LandBridge Company LLC Announces Third Quarter Results and Declares Quarterly Cash Dividend

Delivers revenue growth of

Declared initial quarterly cash dividend of

Initiated FY24 and FY25 outlook

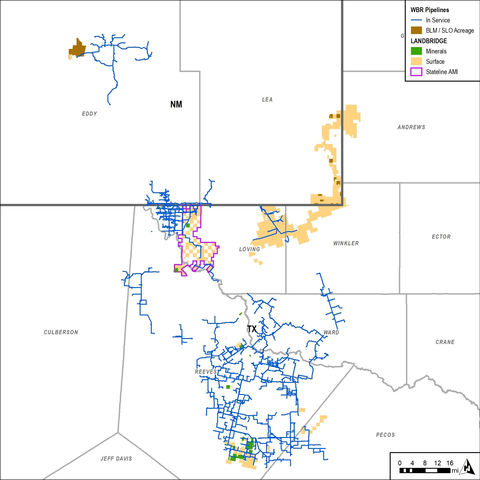

(Graphic: LandBridge)

Third Quarter 2024 Financial Highlights

-

Revenues of

$28.5 million 60% year-over-year -

Net loss of

$2.8 million -

Net loss margin of

10% (1) -

Adjusted EBITDA(2) of

$25.0 million 62% year-over-year -

Adjusted EBITDA Margin(2) of

88% -

Cash flows from operating activities of

$7.5 million -

Free Cash Flow(2,3) of

$7.1 million -

Operating cash flow margin of

26% -

Free Cash Flow Margin(2,3) of

25%

(1) Net loss and net loss margin include a non-cash expense of |

(2) Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow and Free Cash Flow Margin are non-GAAP financial measures. See “Comparison of Non-GAAP Financial Measures” included within the Appendix of this press release for related disclosures and reconciliations to the most directly comparable financial measures calculated and presented in accordance with GAAP. |

(3) Free Cash Flow and Free Cash Flow Margin were impacted by |

Other Recent Events

-

Acquired 1,280 surface acres in

Winkler County, Texas , and executed a purchase agreement for an additional 5,800 acres inLea County, New Mexico that will collectively increase the total surface owned by the Company to approximately 227,000 acres -

Entered into a lease development agreement for the development of a data center and related facilities on approximately 2,000 acres of our land in

Reeves County, Texas - Completed an amendment to the Company’s debt facilities to fund the acquisitions and enhance the Company’s liquidity position

-

Announced initial

$0.10

Jason Long, Chief Executive Officer, stated, “Our active land management strategy continues to deliver strong results with another quarter of double-digit revenue growth year-over-year and industry-leading Adjusted EBITDA margins. We continue to capitalize on activity across the

Scott McNeely, Chief Financial Officer of the Company, said, “Given the significant growth opportunities we see ahead, we continue to pursue opportunities to enhance our financial flexibility and liquidity. Our recent debt facility amendment supports our ability to continue to strategically and opportunistically pursue new land acquisitions. We are also pleased to introduce our inaugural quarterly cash dividend, providing another important means to share our success with shareholders.”

Third Quarter 2024 Consolidated Financial Information

Revenue for the third quarter of 2024 was

Adjusted EBITDA was

Net loss margin was

Diversified Revenue Streams

Surface Use Royalties and Revenue: Generated revenues of

Resources Sales and Royalties: Generated revenues of

Oil and Gas Royalties: Generated revenues of

Free Cash Flow Generation

Cash flow from operations for the third quarter of 2024 was

Net cash used in investing activities during the third quarter of 2024 was

Net cash used in financing activities during the third quarter of 2024 consists of

Strong Balance Sheet with Ample Liquidity

Total cash and cash equivalents were

As of September 30, 2024, the Company had approximately

Total liquidity was

Subsequent to the quarter, the Company amended its debt facilities to increase availability under its revolving credit facility by

Ongoing Commercial Progress

In November 2024, we acquired 1,280 fee surface acres in

In November 2024, we entered into a purchase and sale agreement with a third-party private seller to acquire approximately 5,800 fee surface acres in

In November 2024, we executed a lease development agreement for the development of a data center and related facilities on approximately 2,000 acres of our land in

Outlook

The Company is initiating the following outlook for full-year 2024 and full-year 2025:

For the full-year 2024, the Company expects Adjusted EBITDA to be between

- Higher than expected surface use royalties and revenues subsequent to increased development and higher than anticipated produced water volumes on our surface;

-

Addition of a lease development agreement payment for the development of a data center on approximately 2,000 acres of our land in the southern

Delaware Basin; - Deferral of marketing a 250MW solar project into 2025 to better align with the execution of the lease development agreement in connection with the data center;

- Lower than anticipated resource sales and royalties; and

- Impact of realized commodity prices on our oil and gas royalties.

For the full-year 2025, the Company expects Adjusted EBITDA to be between

- Incremental contribution of our recent acquisitions;

- Initial solar facility contributions to surface use revenues;

- Growth of our surface use royalties through higher produced water volumes on our surface;

- Updates to resources sales and royalties based on current timing and volume expectations; and

- Updates to anticipated commodity pricing based on current regional pricing dynamics

Reconciliations of forward-looking non-GAAP financial measures to comparable GAAP measures are not available due to the challenges and impracticability of estimating certain items, particularly non-recurring gains or losses, unusual or non-recurring items, income tax benefit or expense, or one-time transaction costs and cost of revenue. We are unable to reasonably predict these because they are uncertain and depend on various factors not yet known, which could have a material impact on GAAP results for the guidance period. Because of those challenges, a reconciliation of forward-looking non-GAAP financial measures is not available without unreasonable effort.

Quarterly Report on Form 10-Q

Our financial statements and related footnotes will be available in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which is expected to be filed with the

Conference Call and Webcast Information

The Company will hold a conference call on Thursday, November 7, 2024, at 8:00 a.m. Central Time to discuss third quarter results. A live webcast of the conference call will be available on the Investors section of the Company’s website at https://ir.landbridgeco.com/overview/default.aspx. To listen to the live broadcast, go to the site at least 10-15 minutes prior to the scheduled start time to register and install any necessary audio software.

The conference call can also be accessed by dialing (800) 715-9871 (or (646) 307-1963 for international participants) and providing the Conference ID 4907698. The telephone replay can be accessed by dialing (800) 770-2030 and providing the Conference ID 4907698. The telephone replay will be available starting shortly after the call through November 21, 2024.

About LandBridge

LandBridge owns approximately 221,000 surface acres across

Cautionary Statement Regarding Forward-Looking Statements

This news release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on LandBridge’s beliefs, as well as assumptions made by, and information currently available to, LandBridge, and therefore involve risks and uncertainties that are difficult to predict. Generally, future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” and the words “believe,” “anticipate,” “continue,” “intend,” “expect” and similar expressions identify forward-looking statements. Forward-looking statements include, but are not limited to, strategies, plans, objectives, expectations, intentions, assumptions, future operations and prospects and other statements that are not historical facts, including our estimated future financial performance. You should not place undue reliance on forward-looking statements. Although LandBridge believes that plans, intentions and expectations reflected in or suggested by any forward-looking statements made herein are reasonable, LandBridge may be unable to achieve such plans, intentions or expectations and actual results, and performance or achievements may vary materially and adversely from those envisaged in this news release due to a number of factors including, but not limited to: our customers’ demand for and use of our land and resources; the success of our affiliates, WaterBridge, Desert Environmental and the counterparty to the lease development agreement in executing their business strategies, including their ability to construct infrastructure, attract customers and operate successfully on our land; our customers’ willingness and ability to develop our land or any potential acquired acreage to accommodate any future surface use developments, such as the site under contract for the lease development agreement for the data center; the domestic and foreign supply of, and demand for, energy sources, including the impact of actions relating to oil price and production controls by the members of the Organization of Petroleum Exporting Countries,

The historical financial information presented below reflects only our historical financial results and the historical financial results of our predecessor, DBR Land Holdings LLC, as applicable and does not give pro forma effect to the East Stateline Acquisition, the Credit Agreement Amendment, the Corporate Reorganization or the Offering. Each of the East Stateline Acquisition, the Credit Amendment, the Corporate Reorganization and the Offering is reflected in the historical financial information solely from and after its respective completion.

THIRD QUARTER 2024 RESULTS

CONSOLIDATED STATEMENTS OF OPERATIONS |

||||||||||||||||

|

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Surface use royalties |

|

$ |

4,227 |

|

|

$ |

1,693 |

|

|

$ |

9,129 |

|

|

$ |

5,316 |

|

Surface use royalties - Related party |

|

|

5,627 |

|

|

|

1,500 |

|

|

|

11,902 |

|

|

|

3,274 |

|

Easements and other surface-related revenues |

|

|

5,176 |

|

|

|

2,309 |

|

|

|

15,018 |

|

|

|

5,662 |

|

Easements and other surface-related revenues - Related party |

|

|

1,465 |

|

|

|

7 |

|

|

|

4,224 |

|

|

|

3,864 |

|

Resource sales |

|

|

4,874 |

|

|

|

4,190 |

|

|

|

11,908 |

|

|

|

15,907 |

|

Resource sales - Related party |

|

|

57 |

|

|

|

139 |

|

|

|

329 |

|

|

|

1,627 |

|

Oil and gas royalties |

|

|

2,903 |

|

|

|

6,323 |

|

|

|

11,563 |

|

|

|

14,948 |

|

Resource royalties |

|

|

2,686 |

|

|

|

1,638 |

|

|

|

6,803 |

|

|

|

4,810 |

|

Resource royalties - Related party |

|

|

1,472 |

|

|

|

- |

|

|

|

2,579 |

|

|

|

- |

|

Total revenues |

|

|

28,487 |

|

|

|

17,799 |

|

|

|

73,455 |

|

|

|

55,408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Resource sales-related expense |

|

|

423 |

|

|

|

1,003 |

|

|

|

1,739 |

|

|

|

3,081 |

|

Other operating and maintenance expense |

|

|

708 |

|

|

|

701 |

|

|

|

1,837 |

|

|

|

1,956 |

|

General and administrative expense (income) |

|

|

22,131 |

|

|

|

(5,571 |

) |

|

|

98,114 |

|

|

|

(20,610 |

) |

Depreciation, depletion, amortization and accretion |

|

|

2,038 |

|

|

|

2,562 |

|

|

|

6,294 |

|

|

|

6,396 |

|

Operating income (loss) |

|

|

3,187 |

|

|

|

19,104 |

|

|

|

(34,529 |

) |

|

|

64,585 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest expense, net |

|

|

7,071 |

|

|

|

2,893 |

|

|

|

16,235 |

|

|

|

4,173 |

|

Other income |

|

|

- |

|

|

|

(526 |

) |

|

|

(241 |

) |

|

|

(541 |

) |

(Loss) income from operations before taxes |

|

|

(3,884 |

) |

|

|

16,737 |

|

|

|

(50,523 |

) |

|

|

60,953 |

|

Income tax (benefit) expense |

|

|

(1,128 |

) |

|

|

104 |

|

|

|

(890 |

) |

|

|

303 |

|

Net (loss) income |

|

$ |

(2,756 |

) |

|

$ |

16,633 |

|

|

$ |

(49,633 |

) |

|

$ |

60,650 |

|

Net loss prior to Offering |

|

|

- |

|

|

|

|

|

|

(46,877 |

) |

|

|

|

||

Net loss attributable to noncontrolling interest |

|

|

(5,412 |

) |

|

|

|

|

|

(5,412 |

) |

|

|

|

||

Net income attributable to LandBridge Company LLC |

|

$ |

2,656 |

|

|

|

|

|

$ |

2,656 |

|

|

|

|

||

CONSOLIDATED BALANCE SHEETS |

||||||||

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2024 |

|

|

2023 |

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

14,417 |

|

|

$ |

37,823 |

|

Accounts receivable, net |

|

|

12,757 |

|

|

|

12,383 |

|

Related party receivable |

|

|

2,161 |

|

|

|

1,037 |

|

Prepaid expenses and other current assets |

|

|

2,271 |

|

|

|

1,035 |

|

Total current assets |

|

|

31,606 |

|

|

|

52,278 |

|

|

|

|

|

|

|

|

||

Non-current assets: |

|

|

|

|

|

|

||

Property, plant and equipment, net |

|

|

628,087 |

|

|

|

203,018 |

|

Intangible assets, net |

|

|

27,484 |

|

|

|

28,642 |

|

Other assets |

|

|

2,711 |

|

|

|

5,011 |

|

Total non-current assets |

|

|

658,282 |

|

|

|

236,671 |

|

Total assets |

|

$ |

689,888 |

|

|

$ |

288,949 |

|

|

|

|

|

|

|

|

||

Liabilities and equity |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

182 |

|

|

$ |

200 |

|

Related party payable |

|

|

504 |

|

|

|

453 |

|

Accrued liabilities |

|

|

6,199 |

|

|

|

4,945 |

|

Current portion of long-term debt |

|

|

35,547 |

|

|

|

20,339 |

|

Other current liabilities |

|

|

826 |

|

|

|

1,163 |

|

Total current liabilities |

|

|

43,258 |

|

|

|

27,100 |

|

|

|

|

|

|

|

|

||

Non-current liabilities: |

|

|

|

|

|

|

||

Long-term debt |

|

|

242,430 |

|

|

|

108,343 |

|

Other long-term liabilities |

|

|

183 |

|

|

|

2,759 |

|

Total non-current liabilities |

|

|

242,613 |

|

|

|

111,102 |

|

Total liabilities |

|

|

285,871 |

|

|

|

138,202 |

|

|

|

|

|

|

|

|

||

Commitments and contingencies |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Member's equity |

|

|

- |

|

|

|

150,747 |

|

Class A shares, unlimited shares authorized and 17,425,000 shares issued

|

|

|

94,553 |

|

|

|

- |

|

Class B shares, unlimited shares authorized and 55,726,603 shares issued

|

|

|

- |

|

|

|

- |

|

Retained earnings |

|

|

2,656 |

|

|

|

- |

|

Total shareholders' equity attributable to LandBridge Company LLC |

|

|

97,209 |

|

|

|

- |

|

Noncontrolling interest |

|

|

306,808 |

|

|

|

- |

|

Total shareholders' and member's equity |

|

|

404,017 |

|

|

|

150,747 |

|

Total liabilities and equity |

|

$ |

689,888 |

|

|

$ |

288,949 |

|

|

|

|

|

|

|

|

||

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|||||||||

|

|

Nine Months Ended

|

|

|

|||||

|

|

2024 |

|

|

2023 |

|

|

||

Cash flows from operating activities |

|

|

|

|

|

|

|

||

Net (loss) income |

|

$ |

(49,633 |

) |

|

$ |

60,650 |

|

|

Adjustments to reconcile net (loss) income to net cash provided by operating activities: |

|

|

|

|

|

|

|

||

Depreciation, depletion, amortization and accretion |

|

|

6,294 |

|

|

|

6,396 |

|

|

Amortization of deferred financing fees |

|

|

302 |

|

|

|

65 |

|

|

Amortization of debt issuance costs |

|

|

875 |

|

|

|

129 |

|

|

Share-based compensation |

|

|

84,196 |

|

|

|

(24,434 |

) |

|

Deferred income tax benefit |

|

|

(1,276 |

) |

|

|

- |

|

|

Other |

|

|

- |

|

|

|

(17 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

||

Accounts receivable |

|

|

1,640 |

|

|

|

(2,357 |

) |

|

Related party receivable |

|

|

(1,124 |

) |

|

|

(357 |

) |

|

Prepaid expenses and other assets |

|

|

(341 |

) |

|

|

225 |

|

|

Accounts payable |

|

|

(50 |

) |

|

|

658 |

|

|

Related party payable |

|

|

51 |

|

|

|

(158 |

) |

|

Other current liabilities |

|

|

(226 |

) |

|

|

(241 |

) |

|

Net cash provided by operating activities |

|

|

40,708 |

|

|

|

40,559 |

|

|

|

|

|

|

|

|

|

|

||

Cash flows from investing activities |

|

|

|

|

|

|

|

||

Acquisitions |

|

|

(431,260 |

) |

|

|

- |

|

|

Capital expenditures |

|

|

(761 |

) |

|

|

(2,634 |

) |

|

Proceeds from disposal of assets |

|

|

- |

|

|

|

11 |

|

|

Net cash used in investing activities |

|

|

(432,021 |

) |

|

|

(2,623 |

) |

|

|

|

|

|

|

|

|

|

||

Cash flows from financing activities |

|

|

|

|

|

|

|

||

Proceeds from issuance of Class A shares, net of underwriting discounts and fees |

|

|

278,263 |

|

|

|

- |

|

|

Offering costs |

|

|

(6,997 |

) |

|

|

(116 |

) |

|

Contributions from member |

|

|

120,000 |

|

|

|

- |

|

|

Distributions to member |

|

|

(170,854 |

) |

|

|

(105,165 |

) |

|

Proceeds from term loan |

|

|

265,000 |

|

|

|

100,000 |

|

|

Repayments on term loan |

|

|

(93,750 |

) |

|

|

(62,417 |

) |

|

Proceeds from revolver |

|

|

15,000 |

|

|

|

25,000 |

|

|

Repayments of revolver |

|

|

(35,000 |

) |

|

|

- |

|

|

Debt issuance costs |

|

|

(3,437 |

) |

|

|

(3,104 |

) |

|

Other financing activities, net |

|

|

(318 |

) |

|

|

(193 |

) |

|

Net cash provided by (used in) financing activities |

|

|

367,907 |

|

|

|

(45,995 |

) |

|

Net decrease in cash and cash equivalents |

|

|

(23,406 |

) |

|

|

(8,059 |

) |

|

Cash and cash equivalents - beginning of period |

|

|

37,823 |

|

|

|

25,351 |

|

|

Cash and cash equivalents - end of period |

|

$ |

14,417 |

|

|

$ |

17,292 |

|

|

|

|

|

|

|

|

|

|

||

Comparison of Non-GAAP Financial Measures

Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow and Free Cash Flow Margin are supplemental non-GAAP measures that we use to evaluate current, past and expected future performance. Although these non-GAAP financial measures are important factors in assessing our operating results and cash flows, they should not be considered in isolation or as a substitute for net income or gross margin or any other measures presented under GAAP.

Adjusted EBITDA and Adjusted EBITDA Margin are used to assess the financial performance of our assets over the long term to generate sufficient cash to return capital to equity holders or service indebtedness. We define Adjusted EBITDA as net income (loss) before interest; taxes; depreciation, amortization, depletion and accretion; share-based compensation; non-recurring transaction-related expenses and other non-cash or non-recurring expenses. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by total revenues.

We believe Adjusted EBITDA and Adjusted EBITDA Margin are useful because they allow us to more effectively evaluate our operating performance and compare the results of our operations from period to period, and against our peers, without regard to our financing methods or capital structure. We exclude the items listed above from net income (loss) in arriving at Adjusted EBITDA and Adjusted EBITDA Margin because these amounts can vary substantially from company to company within our industry depending upon accounting methods, book values of assets, capital structures and the method by which the assets were acquired.

The following table sets forth a reconciliation of net income as determined in accordance with GAAP to Adjusted EBITDA and Adjusted EBITDA Margin for the periods indicated.

|

Three Months Ended |

|

|||||||||

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

|||

|

(In thousands) |

|

|||||||||

Net (loss) income |

$ |

(2,756 |

) |

|

$ |

(57,653 |

) |

|

$ |

16,633 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|||

Depreciation, depletion, amortization and accretion |

|

2,038 |

|

|

|

2,112 |

|

|

|

2,562 |

|

Interest expense, net |

|

7,071 |

|

|

|

6,280 |

|

|

|

2,893 |

|

Income tax (benefit) expense |

|

(1,128 |

) |

|

|

137 |

|

|

|

104 |

|

EBITDA |

|

5,225 |

|

|

|

(49,124 |

) |

|

|

22,192 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|||

Share-based compensation - Incentive Units (1) |

|

9,830 |

|

|

|

71,762 |

|

|

|

(6,933 |

) |

Share-based compensation - RSUs |

|

1,794 |

|

|

|

- |

|

|

|

- |

|

Transaction-related expenses (2) |

|

351 |

|

|

|

774 |

|

|

|

141 |

|

Non-recurring (3) |

|

7,825 |

|

|

|

- |

|

|

|

- |

|

Other |

|

(13 |

) |

|

|

- |

|

|

|

- |

|

Adjusted EBITDA |

$ |

25,012 |

|

|

$ |

23,412 |

|

|

$ |

15,400 |

|

Net (loss) income margin |

|

(10 |

%) |

|

|

(222 |

%) |

|

|

93 |

% |

Adjusted EBITDA Margin |

|

88 |

% |

|

|

90 |

% |

|

|

87 |

% |

(1) Share-based compensation – Incentive Units for the three months ended September 30, 2024, consists of |

|||||||||||

| (2) Transaction-related expenses consist of non-capitalizable transaction costs associated with both completed or attempted acquisitions, debt amendments and entity structuring charges. | |||||||||||

(3) Non-recurring expenses consist primarily of |

|||||||||||

Free Cash Flow and Free Cash Flow Margin are used to assess our ability to repay our indebtedness, return capital to our shareholders and fund potential acquisitions without access to external sources of financing for such purposes. We define Free Cash Flow as cash flow from operating activities less investment in capital expenditures. We define Free Cash Flow Margin as Free Cash Flow divided by total revenues.

We believe Free Cash Flow and Free Cash Flow Margin are useful because they allow for an effective evaluation of both our operating and financial performance, as well as the capital intensity of our business, and subsequently the ability of our operations to generate cash flow that is available to distribute to our shareholders, reduce leverage or support acquisition activities.

The following table sets forth a reconciliation of cash flows from operating activities determined in accordance with GAAP to Free Cash Flow and Free Cash Flow Margin, respectively, for the periods indicated.

|

Three Months Ended |

|

|||||||||

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

|||

|

(In thousands) |

|

|||||||||

Net cash provided by operating activities |

$ |

7,450 |

|

|

$ |

16,043 |

|

|

$ |

16,209 |

|

Net cash used in investing activities |

|

(1,053 |

) |

|

|

(375,807 |

) |

|

|

(234 |

) |

Cash provided by (used in) operating and investing activities |

|

6,397 |

|

|

|

(359,764 |

) |

|

|

15,975 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|||

Acquisitions |

|

750 |

|

|

|

375,438 |

|

|

|

- |

|

Proceeds from disposal of assets |

|

- |

|

|

|

- |

|

|

|

- |

|

Free Cash Flow |

$ |

7,147 |

|

|

$ |

15,674 |

|

|

$ |

15,975 |

|

Operating cash flow margin (1) |

|

26 |

% |

|

|

62 |

% |

|

|

91 |

% |

Free Cash Flow Margin |

|

25 |

% |

|

|

60 |

% |

|

|

90 |

% |

(1) Operating cash flow data is calculated by dividing net cash provided by operating activities by total revenue. |

|||||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20241106070670/en/

Media Contact

Daniel Yunger / Nathaniel Shahan

Kekst CNC

kekst-landbridge@kekstcnc.com

Investor Contact

Scott McNeely

Chief Financial Officer

LandBridge Company LLC

832-703-1433

Contact@LandBridgeCo.com

Source: LandBridge Company LLC