K92 Mining Announces Q3 Production Results - Record Quarterly Production of 44,304 oz AuEq, Significantly Exceeding Budget

K92 Mining announced record Q3 2024 production results for its Kainantu Gold Mine in Papua New Guinea. Highlights include:

- Record quarterly production of 44,304 ounces gold equivalent (AuEq) or 41,702 oz gold, 1,278,492 lbs copper, and 37,613 oz silver

- Record quarterly sales of 45,248 oz gold, 1,615,185 lbs copper, and 46,062 oz silver

- Record metallurgical recoveries: 95.3% for gold and 95.1% for copper

- Ore processed: 104,992 tonnes with head grade of 13.8 g/t AuEq

- Ore mined: 112,333 tonnes with total mine development of 2,190 metres

The company is well-positioned to meet its 2024 operational guidance of 120,000-140,000 ounces AuEq, having delivered over 80% of the lower end of annual guidance in the first 9 months.

K92 Mining ha annunciato risultati record di produzione per il terzo trimestre del 2024 per la sua Kainantu Gold Mine in Papua Nuova Guinea. I punti salienti includono:

- Produzione trimestrale record di 44.304 once equivale oro (AuEq) o 41.702 once d'oro, 1.278.492 lbs di rame e 37.613 once d'argento

- Vendite trimestrali record di 45.248 once d'oro, 1.615.185 lbs di rame e 46.062 once d'argento

- Recuperi metallurgici record: 95,3% per l'oro e 95,1% per il rame

- Minerale processato: 104.992 tonnellate con grado media di 13,8 g/t AuEq

- Minerale estratto: 112.333 tonnellate con uno sviluppo minerario totale di 2.190 metri

L'azienda è ben posizionata per soddisfare la sua guida operativa per il 2024 di 120.000-140.000 once AuEq, avendo consegnato oltre l'80% del limite inferiore della guida annuale nei primi 9 mesi.

K92 Mining anunció resultados de producción récord para el tercer trimestre de 2024 en su Kainantu Gold Mine en Papúa Nueva Guinea. Los aspectos más destacados incluyen:

- Producción trimestral récord de 44,304 onzas equivalentes de oro (AuEq) o 41,702 oz de oro, 1,278,492 lbs de cobre y 37,613 oz de plata

- Ventas trimestrales récord de 45,248 oz de oro, 1,615,185 lbs de cobre y 46,062 oz de plata

- Recuperaciones metalúrgicas récord: 95.3% para el oro y 95.1% para el cobre

- Mineral procesado: 104,992 toneladas con un grado promedio de 13.8 g/t AuEq

- Mineral extraído: 112,333 toneladas con un desarrollo minero total de 2,190 metros

La empresa está bien posicionada para cumplir con su orientación operativa de 2024 de 120,000-140,000 onzas AuEq, habiendo entregado más del 80% del límite inferior de la guía anual en los primeros 9 meses.

K92 Mining은 파푸아뉴기니에 있는 Kainantu Gold Mine의 2024년 3분기 생산 결과를 발표했습니다. 주요 내용은 다음과 같습니다:

- 분기별 기록 생산량: 44,304 온스 금의 등가 (AuEq) 또는 41,702 온스 금, 1,278,492 lbs 구리, 37,613 온스 은

- 분기별 판매 기록: 45,248 온스 금, 1,615,185 lbs 구리, 46,062 온스 은

- 금과 구리의 금속 회수율 기록: 금 95.3%, 구리 95.1%

- 처리된 광석: 104,992 톤, 평균 등급 13.8 g/t AuEq

- 채굴된 광석: 112,333 톤, 총 광산 개발 2,190 미터

회사는 2024년 운영 지침인 120,000-140,000 온스 AuEq를 충족할 수 있는 좋은 위치에 있으며, 첫 9개월 동안 연간 지침의 하한의 80% 이상을 달성했습니다.

K92 Mining a annoncé des résultats de production record pour le troisième trimestre 2024 de sa Kainantu Gold Mine en Papouasie-Nouvelle-Guinée. Les points marquants comprennent :

- Production trimestrielle record de 44 304 onces équivalentes d'or (AuEq) ou 41 702 oz d’or, 1 278 492 lbs de cuivre et 37 613 oz d’argent

- Ventes trimestrielles record de 45 248 oz d’or, 1 615 185 lbs de cuivre et 46 062 oz d’argent

- Récupérations métallurgiques record : 95,3 % pour l'or et 95,1 % pour le cuivre

- Minerai traité : 104 992 tonnes avec un grade moyen de 13,8 g/t AuEq

- Minerai extrait : 112 333 tonnes avec un développement minier total de 2 190 mètres

L'entreprise est bien positionnée pour atteindre son guide opérationnel 2024 de 120 000 à 140 000 onces AuEq, ayant livré plus de 80 % de la partie inférieure de l'orientation annuelle au cours des neuf premiers mois.

K92 Mining hat Rekordproduktionszahlen für das dritte Quartal 2024 dieser Kainantu Gold Mine in Papua-Neuguinea veröffentlicht. Die Höhepunkte sind:

- Rekordproduktion im Quartal von 44.304 Unzen Goldäquivalent (AuEq) oder 41.702 Unzen Gold, 1.278.492 lbs Kupfer und 37.613 Unzen Silber

- Rekordverkäufe im Quartal von 45.248 Unzen Gold, 1.615.185 lbs Kupfer und 46.062 Unzen Silber

- Rekordmetallurgische Rückgewinnungen: 95,3% für Gold und 95,1% für Kupfer

- Verarbeitetes Erz: 104.992 Tonnen mit einem Gehalt von 13,8 g/t AuEq

- Abgebautes Erz: 112.333 Tonnen mit einer gesamten Entwicklungsstrecke von 2.190 Metern

Das Unternehmen ist gut positioniert, um die Betriebsführung 2024 von 120.000-140.000 Unzen AuEq zu erfüllen, nachdem es in den ersten 9 Monaten über 80% des unteren Endes der Jahresprognose geliefert hat.

- Record quarterly production of 44,304 ounces AuEq, significantly exceeding budget

- Record quarterly sales of 45,248 oz gold, 1,615,185 lbs copper, and 46,062 oz silver

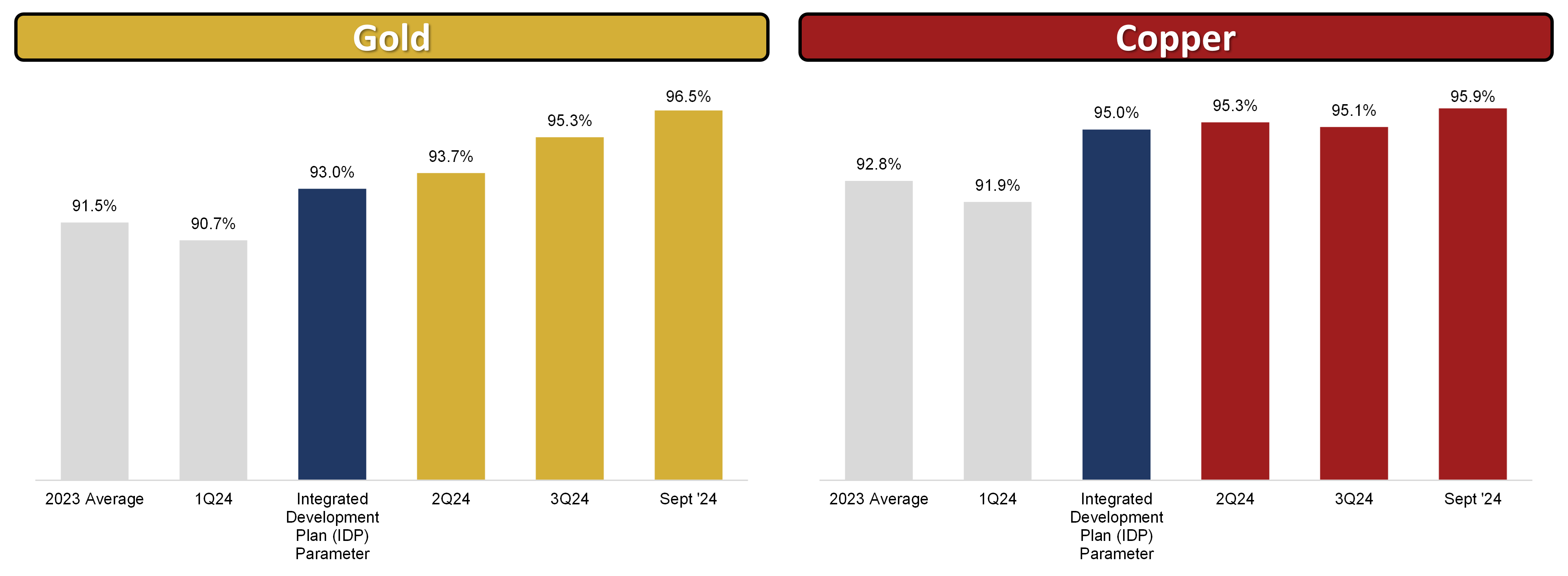

- Record metallurgical recoveries of 95.3% for gold and 95.1% for copper, exceeding IDP parameters

- AuEq head grade of 13.8 g/t, the highest since Q4 2020 and above budget

- Over 80% of AuEq production for the lower end of annual guidance delivered in first 9 months

- Well-positioned to meet 2024 operational guidance of 120,000-140,000 ounces AuEq

- Throughput was deliberately reduced to maximize recoveries at the higher feed grade

- Development rates are planned to notably increase over the next three quarters, indicating current rates may be below target

- Record quarterly production of 44,304 ounces gold equivalent (“AuEq”)(1) or 41,702 oz gold, 1,278,492 lbs copper and 37,613 oz silver, and record quarterly sales of 45,248 oz gold, 1,615,185 lbs copper and 46,062 oz silver. With over

80% of AuEq production for the lower end of annual guidance delivered in the first 9 months of the year, the Company is well positioned to meet its 2024 operational guidance.

- Record metallurgical recoveries in Q3 of

95.3% for gold and near-record recoveries of95.1% for copper, with September achieving record monthly gold recoveries of96.5% and copper recoveries of95.9% , both exceeding the recovery parameters from the Integrated Development Plan, of93.0% and95.0% , respectively (January 2022 effective date)(2).

- Quarterly ore processed of 104,992 tonnes with a head grade of 13.8 grams per tonne (“g/t”) AuEq, or 13.0 g/t gold,

0.58% copper and 13.0 g/t silver. AuEq head grade in Q3 was the highest since Q4 2020 and above budget, benefiting from higher grade stopes in Q2 reporting to Q3, in addition to a moderate positive gold grade reconciliation versus the latest Independent Mineral Resource (effective date of September 12, 2023 for Kora and Judd) for both gold and copper. Throughput was deliberately reduced to maximize recoveries at the higher feed grade.

- Ore mined of 112,333 tonnes, with long hole open stoping performing to design, and total mine development of 2,190 metres. Development rates are planned to notably increase over the next three quarters driven by the completion of multiple infrastructure projects, a major increase to available headings from the opening of two new mining fronts, the progressive introduction of additional equipment already on site as available headings increase, and the execution of various identified productivity initiatives.

- During the quarter, the 221.4-metre-long raise bore for the interim ventilation upgrade was completed from the twin incline to the main mine, plus multiple smaller raises. To date, both raise bore piloting and reaming advance rates have notably exceeded budget.

Note (1): Gold equivalent for Q3 2024 is calculated based on: gold

Note (2): Refer to Integrated Development Plan (IDP) DFS Case and PEA Case. IDP effective date is January 1, 2022. IDP has not been updated to reflect the updated Kora and Judd resource (effective date September 12, 2023); however, the Company does not expect the design parameters and conclusions to materially change. The Company expects the potential mine life to be extended for both cases.

John Lewins, K92 Chief Executive Officer and Director, stated, “As we guided to at the beginning of the year, 2H was expected to be the strongest, and it has certainly delivered thus far, with record ounces produced and sold, and record recoveries while benefiting from record gold prices in Q3. Importantly, the results have well positioned the Company to meet its 2024 Operational Guidance, while also delivering a notable strengthening to the Company’s financial position during the Stage 3 Expansion construction, which is very encouraging.

In less than 9 months from now, the new Stage 3 Expansion Standalone Plant is scheduled to commence commissioning, marking a major milestone for K92 that has taken multiple years to reach, and it effectively represents the beginning of the Company becoming a Tier 1 Mid-Tier Producer. We are also excited to host an analyst and investor tour later this month, highlighting our progress across multiple areas, including current operations, the Stage 3 and 4 Expansions and exploration, while also showcasing the advantages of operating in the mining friendly jurisdiction of Papua New Guinea.”

VANCOUVER, British Columbia, Oct. 09, 2024 (GLOBE NEWSWIRE) -- K92 Mining Inc. (“K92” or the “Company”) (TSX: KNT; OTCQX: KNTNF) is pleased to announce record quarterly production results for the third quarter (“Q3”) of 2024 at its Kainantu Gold Mine in Papua New Guinea, of 44,304 ounces AuEq or 41,702 oz gold, 1,278,492 lbs copper and 37,613 oz silver. Sales during the quarter were 45,248 oz gold, 1,615,185 lbs copper and 46,062 oz silver. With over

During the third quarter, the process plant processed 104,992 tonnes, with a head grade averaging 13.8 g/t AuEq or 13.0 g/t gold,

Strong metallurgical recoveries were also achieved, with record recoveries for gold, averaging

In the third quarter, the mine delivered 112,333 tonnes of ore mined, with 9 levels mined, including the 1225, 1285, 1305, 1325, and 1345 levels at Kora, and the twin incline level, 950, 1170, 1185, 1205, and 1305 levels at Judd. Long hole open stoping performed to design. Overall mine development achieved a total of 2,190 metres. Development rates are expected to significantly increase near-term driven by: the sequential completion of multiple infrastructure projects over the next 3 quarters (interim ventilation upgrade operational – Q4 2024, Puma ventilation drive for life of mine with two x 2 MW fans operational – Q2 2025, first ore pass/waste pass – early 2025); significant increase to available headings and advance productivities as two mining fronts are opened up (twin incline and front below the main mine); progressive introduction of multiple jumbos and equipment that are already on site as available headings increase, and; the execution of various identified productivity initiatives.

During the quarter, the 5-metre diameter, 221.4-metre-long raise bore for the interim ventilation upgrade was completed. Multiple smaller raises were also completed. Raise bore piloting and reaming advance rates have notably exceeded budget to date.

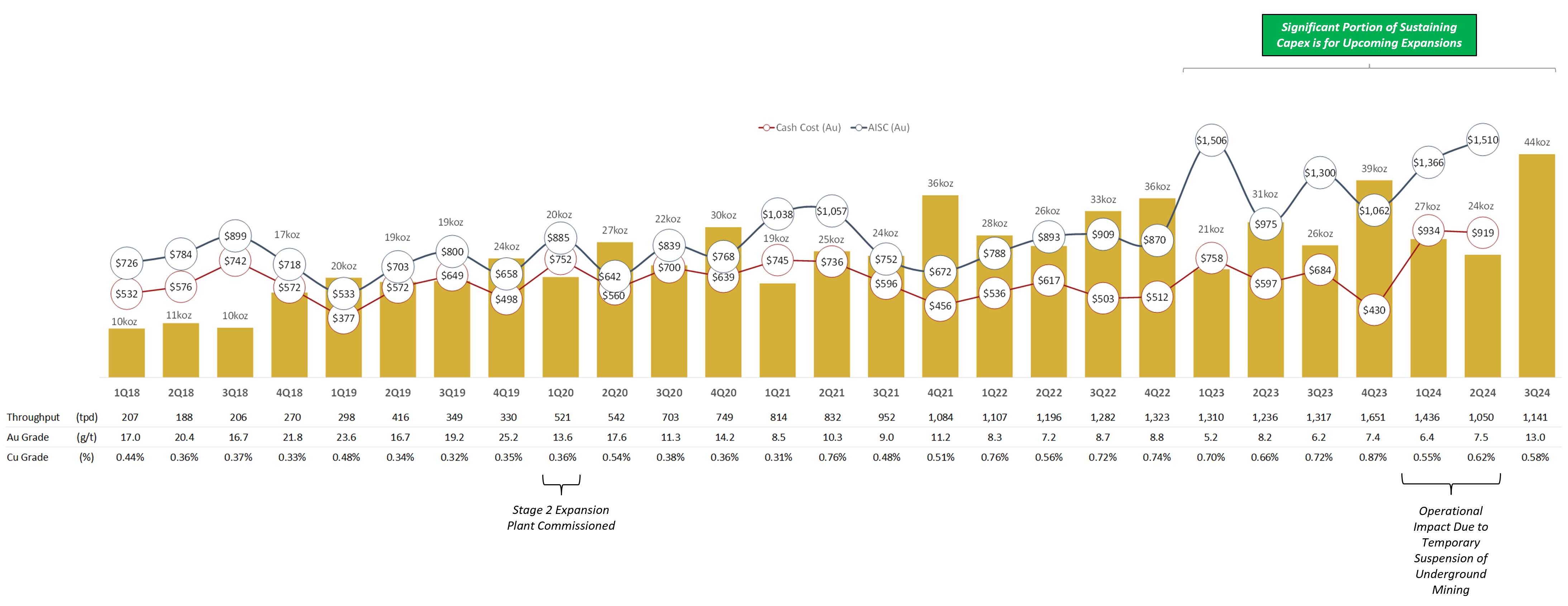

See Figure 1: Quarterly Production, Cash Cost and AISC Chart

See Figure 2: Gold and Copper Recoveries Chart

Table 1 – 2024 & 2023 Annual Production Data

| Q3 2023 | Q4 2023 | 2023 | Q1 2024 | Q2 2024 | Q3 2024 | ||

| Tonnes Processed | T | 121,201 | 151,908 | 503,484 | 130,632 | 95,582 | 104,992 |

| Feed Grade Au | g/t | 6.2 | 7.4 | 6.8 | 6.4 | 7.5 | 13.0 |

| Feed Grade Cu | % | 0.75% | |||||

| Recovery (%) Au | % | 91.5% | |||||

| Recovery (%) Cu | % | 92.8% | |||||

| Metal in Conc & Doré Prod Au | oz | 22,227 | 33,309 | 100,533 | 24,389 | 21,661 | 41,702 |

| Metal in Conc Prod Cu | T | 809 | 1,238 | 3,488 | 655 | 565 | 580 |

| Metal in Conc & Doré Prod Ag | oz | 40,233 | 56,502 | 160,628 | 35,650 | 26,754 | 37,613 |

| Gold Equivalent Production | oz | 26,225 | 39,101 | 117,607 | 27,462 | 24,347 | 44,304 |

Notes – Gold equivalent for Q3 2024 is calculated based on:

gold

Gold equivalent for Q2 2024 is calculated based on:

gold

Gold equivalent for Q1 2024 is calculated based on:

gold

Gold equivalent for Q4 2023 is calculated based on:

gold

Gold equivalent for Q3 2023 is calculated based on:

gold

Qualified Person

K92 Mine Geology Manager and Mine Exploration Manager, Andrew Kohler, PGeo, a qualified person under the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and is responsible for the technical content of this news release. Data verification by Mr. Kohler includes significant time onsite reviewing drill core, face sampling, underground workings, and discussing work programs and results with geology and mining personnel.

Technical Report

The Integrated Development Plan (“IDP”) for the Kainantu Gold Mine Project in Papua New Guinea that contains information on the Definitive Feasibility Study and Preliminary Economic Assessment is included in a technical report, titled, “Independent Technical Report, Kainantu Gold Mine Integrated Development Plan, Kainantu Project, Papua New Guinea” dated October 26, 2022, with an effective date of January 1, 2022.

About K92

K92 Mining Inc. is engaged in the production of gold, copper and silver at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018 and is in a strong financial position. A maiden resource estimate on the Blue Lake copper-gold porphyry project was completed in August 2022. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and Director

For further information, please contact David Medilek, P.Eng., CFA, President and Chief Operating Officer at +1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Such forward-looking statements include, without limitation: (i) the results of the Kainantu Mine Definitive Feasibility Study, and the Kainantu 2022 Preliminary Economic Assessment, including the Stage 3 Expansion, a new standalone 1.2 mtpa process plant and supporting infrastructure; (ii) statements regarding the expansion of the mine and development of any of the deposits; (iii) the Kainantu Stage 4 Expansion, operating two standalone process plants, larger surface infrastructure and mining throughputs; and (iv) the potential extended life of the Kainantu Mine.

All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, without limitation, Public Health Crises, including the COVID-19 virus; changes in the price of gold, silver, copper and other metals in the world markets; fluctuations in the price and availability of infrastructure and energy and other commodities; fluctuations in foreign currency exchange rates; volatility in price of our common shares; inherent risks associated with the mining industry, including problems related to weather and climate in remote areas in which certain of the Company’s operations are located; failure to achieve production, cost and other estimates; risks and uncertainties associated with exploration and development; uncertainties relating to estimates of mineral resources including uncertainty that mineral resources may never be converted into mineral reserves; the Company’s ability to carry on current and future operations, including development and exploration activities at the Arakompa, Kora, Judd and other projects; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the availability and costs of achieving the Stage 3 Expansion or the Stage 4 Expansion; the ability of the Company to achieve the inputs the price and market for outputs, including gold, silver and copper; failures of information systems or information security threats; political, economic and other risks associated with the Company’s foreign operations; geopolitical events and other uncertainties, such as the conflicts in Ukraine, Israel and Palestine; compliance with various laws and regulatory requirements to which the Company is subject to, including taxation; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions, including relationship with the communities in Papua New Guinea and other jurisdictions it operates; other assumptions and factors generally associated with the mining industry; and the risks, uncertainties and other factors referred to in the Company’s Annual Information Form under the heading “Risk Factors”.

Estimates of mineral resources are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production. The estimation of mineral resources and mineral reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, Forward-looking statements are not a guarantee of future performance, and actual results and future events could materially differ from those anticipated in such statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those that are anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Figure 1: Quarterly Production, Cash Cost and AISC Chart

Figure 2: Gold and Copper Recoveries Chart

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/6f384933-6b28-4ab0-bef9-edb6f266fff9

https://www.globenewswire.com/NewsRoom/AttachmentNg/928ed0ba-a4b5-4640-b425-90d20c9e7789