2024 Mid-Year Letter from the CEO: Focusing on Profitable Growth

Kingstone Companies (KINS) reports significant growth opportunities in the New York property market due to competitors exiting the state. The company expects 21% to 30% Core business direct written premium growth in 2024, up from previous guidance of 16% to 20%. Key highlights:

- Third consecutive quarter of profitability expected

- Q2 2024 estimated direct written premium growth: +21.5% overall, +24.3% in Core Personal Lines

- Surge in new business quoting (2X), policies (3X), and premium (9X) in July compared to last year

- Every $10 million in new Personal Lines premium could add approximately $0.10 to earnings per share

- Market changes present the greatest profitable growth opportunity in Kingstone's history

Kingstone Companies (KINS) riporta significative opportunità di crescita nel mercato immobiliare di New York a causa dell'uscita dei concorrenti dallo stato. L'azienda prevede una crescita del 21% al 30% dei premi diretti scritti nel core business per il 2024, in aumento rispetto alle precedenti previsioni del 16% al 20%. Ecco i punti salienti:

- Si attende un terzo trimestre consecutivo di redditività

- Stima di crescita dei premi diretti scritti nel secondo trimestre del 2024: +21,5% complessivo, +24,3% nelle linee personali core

- Aumento delle nuove quotazioni commerciali (2X), delle polizze (3X) e dei premi (9X) a luglio rispetto all'anno scorso

- Ogni $10 milioni di nuovi premi nelle linee personali potrebbe aggiungere circa $0,10 agli utili per azione

- I cambiamenti di mercato presentano la più grande opportunità di crescita redditizia nella storia di Kingstone

Kingstone Companies (KINS) informa sobre oportunidades de crecimiento significativas en el mercado inmobiliario de Nueva York debido a la salida de competidores del estado. La compañía espera un crecimiento del 21% al 30% en la prima directa escrita del negocio principal en 2024, un aumento con respecto a la orientación previa del 16% al 20%. Puntos destacados:

- Se espera un tercer trimestre consecutivo de rentabilidad

- Estimación de crecimiento de prima directa escrita para el segundo trimestre de 2024: +21.5% en general, +24.3% en Líneas Personales Principales

- Aumento en las cotizaciones de nuevos negocios (2X), pólizas (3X) y primas (9X) en julio en comparación con el año pasado

- Cada $10 millones en nuevas primas de Líneas Personales podría agregar aproximadamente $0.10 a las ganancias por acción

- Los cambios en el mercado presentan la mayor oportunidad de crecimiento rentable en la historia de Kingstone

Kingstone Companies (KINS)는 경쟁업체들이 주를 떠나면서 뉴욕 부동산 시장에서 상당한 성장 기회가 있음을 보고합니다. 회사는 2024년 코어 비즈니스의 직접 서면 보험료가 21%에서 30% 성장할 것으로 예상하며, 이는 이전 지침인 16%에서 20%에서 증가한 수치입니다. 주요 내용:

- 세 번째 연속 분기의 수익성이 예상됨

- 2024년 2분기 직접 서면 보험료 성장 추정치: 전체 +21.5%, 코어 개인 보험 +24.3%

- 지난해 대비 7월에 새로운 사업 견적(2배), 정책(3배), 보험료(9배)가 급증함

- 신규 개인 보험료의 매출 1억 달러당 약 $0.10이 주당 순이익에 추가될 수 있음

- 시장 변화가 Kingstone 역사상 가장 큰 수익성 있는 성장 기회를 제공함

Kingstone Companies (KINS) fait état d'opportunités de croissance significatives sur le marché immobilier de New York en raison du départ de concurrents de l'État. La société prévoit une croissance de 21% à 30% des primes brutes écrites dans son activité principale en 2024, en hausse par rapport aux prévisions précédentes de 16% à 20%. Points clés :

- Troisième trimestre consécutif de rentabilité attendu

- Croissance estimée des primes brutes écrites au T2 2024 : +21,5% au total, +24,3% dans les lignes personnelles principales

- Explosion des nouveaux devis commerciaux (2X), des polices (3X), et des primes (9X) en juillet par rapport à l'année dernière

- Chaque $10 millions de nouvelles primes dans les lignes personnelles pourrait ajouter environ $0,10 aux bénéfices par action

- Les changements de marché offrent la plus grande opportunité de croissance rentable dans l'histoire de Kingstone

Kingstone Companies (KINS) berichtet von erheblichen Wachstumschancen auf dem Immobilienmarkt in New York, da Wettbewerber den Staat verlassen. Das Unternehmen erwartet ein Wachstum der direkt geschriebenen Prämien im Kerngeschäft von 21% bis 30% im Jahr 2024, ein Anstieg gegenüber der vorherigen Prognose von 16% bis 20%. Wichtige Highlights:

- Drittes aufeinanderfolgendes Quartal mit erwarteter Rentabilität

- Geschätztes Wachstum der direkt geschriebenen Prämien im 2. Quartal 2024: +21,5% insgesamt, +24,3% in den Kern-Personenlinien

- Anstieg neuer Geschäftsangebote (2X), Policen (3X) und Prämien (9X) im Juli im Vergleich zum Vorjahr

- Jeder $10 Millionen an neuen Prämien in den Personenlinien könnte etwa $0.10 zu den Erträgen pro Aktie hinzufügen

- Marktveränderungen bieten die größte profitable Wachstumschance in der Geschichte von Kingstone

- Third consecutive quarter of profitability expected

- Q2 2024 estimated direct written premium growth of 21.5% overall and 24.3% in Core Personal Lines

- Increased guidance for 2024 Core business direct written premium growth to 21%-30% from 16%-20%

- Surge in new business quoting (2X), policies (3X), and premium (9X) in July compared to last year

- Potential for significant earnings growth with every $10 million in new Personal Lines premium adding approximately $0.10 to EPS

- None.

Insights

Kingstone's mid-year letter provides a clear signal of its financial health and strategic foresight. Reporting three consecutive quarters of profitability indicates a strong turnaround. The company's focus on the New York market is proving fruitful, as evidenced by their impressive growth metrics.

Analyzing the direct written premium growth figures—

For a retail investor, the key takeaway is the potential for enhanced earnings per share (EPS). Every

The significant shifts in the New York property insurance market present a unique growth opportunity for Kingstone. With competitors exiting, Kingstone can capture a larger market share. This market dynamic is reminiscent of past events where such disruptions led to substantial growth for quick-acting insurers.

Kingstone's ability to adapt and capitalize on these changes is critical. The increased guidance for 2024 Core business direct written premium growth from

Retail investors should consider the broader market implications. With the exit of major players, Kingstone’s ability to absorb the displaced policies efficiently is paramount. The company's historical performance during similar market shifts suggests that they are well-positioned to manage and benefit from this influx of new business.

Kingstone's approach to pricing, risk management and maintaining a lean expense structure is commendable. These are fundamental principles in the insurance industry, particularly in a volatile market environment. By insuring properties at their current replacement cost and aligning rates with risks, Kingstone minimizes exposure to adverse selection and underpricing issues.

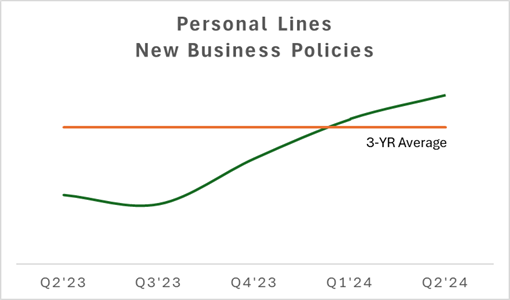

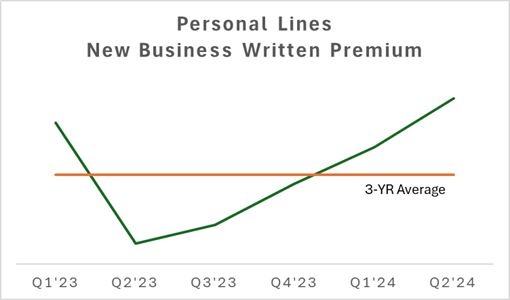

The mention of a threefold increase in new business policies and a ninefold increase in new business premium is noteworthy. Such growth indicates that Kingstone's products are resonating well with the market. Additionally, building long-term relationships with producers adds a layer of stability and reliability to their growth strategy.

For investors, understanding these industry practices provides insight into why Kingstone is thriving. Their disciplined approach to underwriting and risk management is a key driver of their profitability and growth. The current market dynamics offer a perfect storm for Kingstone to expand its footprint significantly.

KINGSTON, NY / ACCESSWIRE / July 22, 2024 / Kingstone Companies, Inc. (Nasdaq:KINS) (the "Company" or "Kingstone"), a Northeast regional property and casualty insurance holding company, today issued the following open letter to stockholders regarding changes in its market opportunity:

Dear Shareholders,

As we enter the second half of the year, I want to update you on our progress and alert you to material changes in the competitive landscape of the New York property market which represents a previously unforeseen and highly significant opportunity for our company to grow and prosper.

Our strategy to focus on our Core state of New York is well understood. To again deliver Kingstone's historic level of profitability required us to:

Price right;

Properly match rate to risk;

Insure all properties at their current replacement cost;

Follow effective risk management protocols; and

Operate at a highly efficient expense structure.

These strategies are all in place and are being reflected in our financial results. We will soon be reporting our third consecutive quarter of profitability in our incredible turn-around journey.

The phenomenal improvement in our profit margin is only half the story. Today, I want to share our prospects for significant growth within our Core Business.

Kingstone acted with swift decisive measures to address the difficult macroeconomic environment and other industry specific issues to return the Company to profitability. Other carriers have succumbed to these problems and have either stopped or restricted writing policies. As such, our personal lines (PL) new business has been growing quite significantly since last year, as indicated in the charts below.

|  |

For the second quarter of 2024, estimated direct written premium growth across all lines of business within our Core NY business was +

Market dynamics have changed profoundly in the last few weeks. Competing carriers, representing >

This situation is reminiscent of the surge in growth we experienced almost twenty years ago, following the three major Gulf Coast hurricanes where carriers responded by greatly restricting or stopping their coastal writings. This is when our prior long-term growth path began.

I believe the current market changes present us with the greatest profitable growth opportunity that Kingstone has ever experienced!

We have the strongest management team in our history. We have built long-term relationships with our extensive group of producers. We have a highly segmented and proven product that effectively matches rate to risk. With confidence in our operations, this incredible growth opportunity could not have come at a better time. I will continue to keep you appraised of this development as accelerating new business comes our way.

While it is impossible to gauge the size of this opportunity for Kingstone right now, I can share that every incremental

Core direct written premium growth in the first half of the year was

Best regards,

Meryl

Meryl Golden

President & Chief Executive Officer

About Kingstone Companies, Inc.

Kingstone is a northeast regional property and casualty insurance holding company whose principal operating subsidiary is Kingstone Insurance Company ("KICO"). KICO is a New York domiciled carrier writing business through retail and wholesale agents and brokers. KICO is actively writing personal lines and commercial auto insurance in New York, and in 2023 was the 15th largest writer of homeowners insurance in New York. KICO is also licensed in New Jersey, Rhode Island, Massachusetts, Connecticut, Pennsylvania, New Hampshire, and Maine.

Disclaimer and Forward-Looking Statements

The estimated, unaudited financial results indicated above are based on information available as of July 22, 2024, remain subject to change based on management's ongoing review of the Company's second quarter results and are forward-looking statements (see below). The actual results may be materially different and are affected by the risk factors and uncertainties identified in Kingstone's annual and quarterly filings with the Securities and Exchange Commission.

This press release may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, may be forward-looking statements. These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. These statements involve risks and uncertainties that could cause actual results to differ materially from those included in forward-looking statements due to a variety of factors. For more details on factors that could affect expectations, see Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023.

The risks and uncertainties include, without limitation, the following:

the risk of significant losses from catastrophes and severe weather events;

risks related to the lack of a financial strength rating from A.M. Best;

risks related to our indebtedness due on December 30, 2024, including due to the need to comply with certain financial covenants and limitations on the ability of our insurance subsidiary to pay dividends to us;

adverse capital, credit and financial market conditions;

the unavailability of reinsurance at current levels and prices;

the exposure to greater net insurance losses in the event of reduced reliance on reinsurance;

the credit risk of our reinsurers;

the inability to maintain the requisite amount of risk-based capital needed to grow our business;

the effects of climate change on the frequency or severity of weather events and wildfires;

risks related to the limited market area of our business;

risks related to a concentration of business in a limited number of producers;

legislative and regulatory changes, including changes in insurance laws and regulations and their application by our regulators;

limitations with regard to our ability to pay dividends;

the effects of competition in our market areas;

our reliance on certain key personnel;

risks related to security breaches or other attacks involving our computer systems or those of our vendors; and

our reliance on information technology and information systems.

Kingstone undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Investor Relations Contact:

Karin Daly

Vice President

The Equity Group Inc.

kdaly@equityny.com

SOURCE: Kingstone Companies, Inc

View the original press release on accesswire.com

FAQ

What is Kingstone Companies' (KINS) revised growth guidance for 2024?

How much did Kingstone's (KINS) direct written premium grow in Q2 2024?

What market opportunity has emerged for Kingstone Companies (KINS) in New York?