New Study Shows Financial Imposter Syndrome Fuels Consumer Anxieties

KeyBank's annual Financial Mobility Survey reveals significant insights about Americans' financial health and anxiety. While 50% of Americans report financial stress, 45% could access $2,000 for emergencies within a month. The survey found that 33% feel stressed about debt, yet 37% need less than $5,000 to relieve this stress.

Key findings show that 70% are confident in paying monthly credit card bills, and 87% can meet mortgage/rent payments. Notably, 44% report having no credit card debt. While 68% say they need more money to live comfortably, 45% are less than $2,500 per month away from their comfort goal. However, homeownership remains challenging, with 46% of non-homeowners viewing it as unattainable, up from 39% last year.

The survey, conducted in September 2024, included 1,000 Americans aged 18-70 who have banking accounts and household financial responsibilities.

Il sondaggio annuale sulla Mobilità Finanziaria di KeyBank rivela importanti informazioni sulla salute finanziaria e l'ansia degli americani. Mentre il 50% degli americani riporta stress finanziario, il 45% potrebbe accedere a $2,000 per emergenze entro un mese. Il sondaggio ha rivelato che il 33% si sente stressato per i debiti, eppure il 37% ha bisogno di meno di $5,000 per alleviare questo stress.

I risultati chiave mostrano che il 70% è fiducioso di poter pagare le bollette mensili delle carte di credito, e l'87% è in grado di far fronte ai pagamenti del mutuo/affitto. Notably, il 44% riporta di non avere debiti su carte di credito. Anche se il 68% afferma di aver bisogno di più soldi per vivere comodamente, il 45% è a meno di $2,500 al mese dal loro obiettivo di comfort. Tuttavia, la proprietà di una casa rimane una sfida, con il 46% dei non proprietari che la vede come inaccessibile, in aumento rispetto al 39% dell'anno scorso.

Il sondaggio, condotto a settembre 2024, ha coinvolto 1,000 americani di età compresa tra i 18 e i 70 anni che hanno conti bancari e responsabilità finanziarie familiari.

La encuesta anual de Movilidad Financiera de KeyBank revela importantes perspectivas sobre la salud financiera y la ansiedad de los estadounidenses. Mientras que el 50% de los estadounidenses informa estrés financiero, el 45% podría acceder a $2,000 para emergencias en un mes. La encuesta encontró que el 33% se siente estresado por la deuda, sin embargo, el 37% necesita menos de $5,000 para aliviar este estrés.

Los hallazgos clave muestran que el 70% está seguro de poder pagar las facturas mensuales de tarjetas de crédito, y el 87% puede cumplir con los pagos de hipoteca/alquiler. Notablemente, el 44% informa no tener deudas de tarjetas de crédito. Aunque el 68% dice que necesita más dinero para vivir cómodamente, el 45% está a menos de $2,500 al mes de su objetivo de confort. Sin embargo, la propiedad de una vivienda sigue siendo un desafío, con el 46% de los no propietarios viéndola como inalcanzable, un aumento respecto al 39% del año pasado.

La encuesta, realizada en septiembre de 2024, incluyó a 1,000 estadounidenses de entre 18 y 70 años que tienen cuentas bancarias y responsabilidades financieras en el hogar.

KeyBank의 연례 재무 이동성 조사는 미국인의 재정 건강과 불안에 대한 중요한 통찰을 제공합니다. 50%의 미국인이 재정적 스트레스를 보고하는 반면, 45%는 한 달 이내에 긴급 상황을 위해 $2,000를 접근할 수 있다고 합니다. 이 조사에서 33%는 부채에 대해 스트레스를 느낀다고 하였으며, 그러나 37%는 이 스트레스를 완화하기 위해 $5,000 미만이 필요하다고 응답했습니다.

주요 결과는 70%가 월간 신용 카드 청구서를 지불할 수 있다고 확신하며, 87%는 주택 담보 대출/임대료 지급이 가능하다고 합니다. 특히, 44%는 신용 카드 빚이 없다고 보고했습니다. 68%는 편안하게 살기 위해 더 많은 돈이 필요하다고 말하지만, 45%는 편안한 목표에서 월 $2,500 미만의 거리에 있습니다. 그러나 주택 소유는 여전히 도전 과제로 남아 있으며, 비소유자의 46%가 주택 소유를 비현실적이라고 간주하고 있으며, 이는 지난해 39%에서 증가한 수치입니다.

이 조사는 2024년 9월에 실시되었으며, 은행 계좌가 있으며 가정의 재정 책임이 있는 18세에서 70세 사이의 1,000명의 미국인을 포함했습니다.

Le sondage annuel sur la Mobilité Financière de KeyBank révèle des informations significatives sur la santé financière et l'anxiété des Américains. Bien que 50 % des Américains signalent un stress financier, 45 % pourraient accéder à 2 000 $ pour des urgences dans le mois. Le sondage a révélé que 33 % se sentent stressés par leurs dettes, néanmoins, 37 % ont besoin de moins de 5 000 $ pour soulager ce stress.

Les résultats clés montrent que 70 % sont confiants quant à leur capacité à payer leurs factures mensuelles de carte de crédit, et 87 % peuvent faire face aux paiements hypothécaires/loyers. Notamment, 44 % déclarent n'avoir aucune dette de carte de crédit. Bien que 68 % affirment avoir besoin de plus d'argent pour vivre confortablement, 45 % sont à moins de 2 500 $ par mois de leur objectif de confort. Cependant, la propriété d'un logement reste difficile, avec 46 % des non-propriétaires la considérant comme inaccessibile, en hausse par rapport à 39 % l'année dernière.

Le sondage, réalisé en septembre 2024, a inclus 1 000 Américains âgés de 18 à 70 ans ayant des comptes bancaires et des responsabilités financières au sein de leur foyer.

Die jährliche Finanzmobilitätsumfrage von KeyBank liefert bedeutende Erkenntnisse über die finanzielle Gesundheit und die Ängste der Amerikaner. Während 50 % der Amerikaner finanziellen Stress berichten, könnten 45 % innerhalb eines Monats auf 2.000 $ für Notfälle zugreifen. Die Umfrage ergab, dass 33 % sich aufgrund von Schulden gestresst fühlen, doch 37 % benötigen weniger als 5.000 $, um diesen Stress zu lindern.

Wesentliche Ergebnisse zeigen, dass 70 % Vertrauen in die Bezahlung ihrer monatlichen Kreditkartenabrechnungen haben und 87 % in der Lage sind, Hypotheken-/Mietzahlungen zu leisten. Bemerkenswerterweise berichten 44 %, keine Kreditkartenschulden zu haben. Während 68 % sagen, dass sie mehr Geld benötigen, um komfortabel zu leben, sind 45 % weniger als 2.500 $ pro Monat von ihrem Komfortziel entfernt. Die Eigentumswohnung bleibt jedoch eine Herausforderung, da 46 % der Nicht-Eigentümer sie als unerreichbar ansehen, ein Anstieg von 39 % im Vergleich zum Vorjahr.

Die Umfrage, die im September 2024 durchgeführt wurde, umfasste 1.000 Amerikaner im Alter von 18 bis 70 Jahren, die Bankkonten und finanzielle Verantwortung im Haushalt haben.

- 70% of respondents confident in monthly credit card payments

- 87% confident in meeting monthly housing payments

- 44% report no credit card debt

- 54% moving closer to financial comfort goals

- 33% experience frequent stress/anxiety about debt

- 46% view homeownership as unattainable, up from 39% previous year

- 63% not confident in ability to take on mortgage

- 54% not confident in ability to increase retirement contributions

Insights

This survey reveals critical insights about consumer financial behavior and sentiment that could impact KEY's retail banking performance. The data shows a complex financial landscape where 70% of consumers can manage monthly credit card payments and 87% meet housing payments, indicating relative stability in KEY's loan portfolio quality.

The finding that 45% of respondents need less than $2,500 monthly to reach their financial comfort goals presents a significant opportunity for KeyBank's retail banking and wealth management services. However, concerning signals emerge from the 63% lacking confidence in mortgage readiness and 54% uncertain about retirement contributions, potentially challenging KEY's mortgage lending and investment services growth.

From a competitive standpoint, KEY's focus on financial wellness tools and educational resources positions them well to capture market share in an environment where consumer financial anxiety is high but actual financial health may be better than perceived. The 33% reporting debt-related stress despite manageable debt levels suggests opportunities for debt consolidation and financial advisory services.

This market research carries strategic implications for KEY's business model and revenue streams. The disconnect between perceived and actual financial health among consumers could affect deposit stability and loan demand. The data showing 44% of respondents without credit card debt suggests a conservative consumer base, which could impact KEY's fee income from credit products.

The rising unattainability of homeownership, increasing to 46% from 39% last year, signals potential headwinds for KEY's mortgage lending division. However, the 23% interest in special purpose credit programs presents an opportunity to differentiate their mortgage products and capture market share in an increasingly challenging housing market.

The generational insight about Gen Z's financial confidence (73% moving toward comfort despite 63% feeling stressed) is particularly relevant for KEY's digital banking strategy and long-term customer acquisition efforts. This demographic's paradoxical financial outlook could influence product development and marketing strategies.

One-third of Americans feel daily anxiety due to debt, but are closer to their money goals than financial stress indicates

KeyBank found that, though many Americans are feeling anxious that they're falling financially behind, they do have solid plans for their finances and are making the right money moves. While half (

The survey polled more than 1,000 Americans to gain insight into respondents' spending and savings habits, levels of financial confidence, stress, resiliency, economic sentiment, and the impacts of debt.

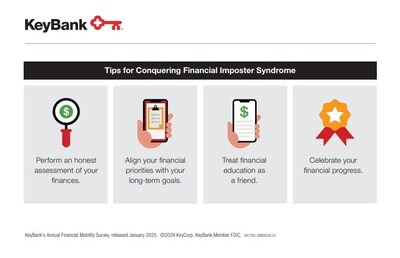

Financial imposter syndrome survey highlights include:

- Americans are stressed about debt:

33% say they often feel stressed or anxious about their debt situation. Yet, 2 in 5 (37% ) say they need to pay down less than$5,000 34% of Americans say they are confident they could come up with$5,000 - Despite stress, most Americans are meeting their monthly payments:

70% are confident they can pay off their credit card every month and87% are confident in meeting monthly rent or mortgage payments. Moreover,44% of Americans say they do not have credit card debt. - Gen Z grows confident: Even though

63% of Gen Z respondents feel financially stressed, nearly three in four (73% ) report they're moving closer to having enough to live comfortably. - Homeownership continues to feel unattainable for most:

46% of respondents who do not own a home say that homeownership is not attainable for their families, up from39% last year. However, to help combat that,23% of survey respondents say understanding special purpose credit programs would increase their confidence in homebuying.

"Despite having solid strategies in place and the economy showing signs of recovery, Americans still feel a pervasive sense of scarcity and insecurity when it comes to their financial well-being," said Daniel Brown, EVP & Director, Consumer Product Management at KeyBank. "This mindset often doesn't align with their actual financial health, which is stronger than they perceive it to be. As a financial partner, we empower our clients to help them bridge this gap, see their true financial potential, make decisions with confidence, not fear, and take pride in the steps they have taken along their journeys."

Americans Seek Money Breaks to Meet Financial Goals

While many are managing their day-to-day finances effectively, Americans are seeking those "big money breaks" that could shift their financial mindset and unlock long-term goals. More than half (

"For many families,

Despite this, many Americans still struggle with long-term goals - and homeownership is at the top of the list.

As Americans increasingly aim to strike a balance between personal fulfillment and overall financial well-being, consumers can access KeyBank's online resources designed to enhance financial confidence and savvy, including the Financial Wellness Center's Banking 101 curriculum, or meet with a local banker to complete a Key Financial Wellness Review to better understand their financial situation, chart the best path forward and conquer any financial imposter syndrome they may be experiencing.

To learn more about the survey's findings, visit the KeyBank 2025 Financial Mobility Survey Executive Summary here:

Methodology

This survey was conducted online by Schmidt Market Research, including1,000 Americans, ages 18-70, with sole or shared responsibility for household financial decisions, who own a checking or savings account, who completed the survey in September 2024. The survey asked respondents about their financial attitudes, understanding, awareness and actions over the prior year.

About KeyCorp

KeyCorp's (NYSE: KEY) roots trace back nearly 200 years to

CFMA #241209-2914631

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/new-study-shows-financial-imposter-syndrome-fuels-consumer-anxieties-302349735.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-study-shows-financial-imposter-syndrome-fuels-consumer-anxieties-302349735.html

SOURCE KeyBank