1812 Brewing Company Addresses Outstanding Convertible Debentures

WATERTOWN, NY / ACCESSWIRE / January 5, 2023 / 1812 Brewing Company (OTC PINK:KEGS) announced a share exchange by CEO Tom Scozzafava, returning 3.4 billion shares to treasury and reducing outstanding shares by 167 million over 2022. This move aims to enhance the company's credibility and stock value for future acquisitions. Additionally, management is negotiating terms to extinguish $13.6 million in convertible debentures, with debt holders agreeing to pause interest accumulation until the company's market value exceeds $100 million.

- Reduction of outstanding shares by approximately 167 million, improving share value.

- Debt holders agreed to waive interest accrual and abstain from conversions until market value exceeds $100 million.

- Uncertainty surrounding the consummation of a previously brokered deal for $13.6 million in convertible debentures.

Insights

Analyzing...

Share appreciation is key to Company's operational and financial goals

WATERTOWN, NY / ACCESSWIRE / January 5, 2023 / 1812 BREWING COMPANY, INC. (OTC PINK:KEGS) (the "Company" or "KEGS") recently announced that its Chairman and CEO Tom Scozzafava had exchanged his shares of common stock for a Company note, and 3.4 billion shares of common stock were returned to the transfer agent and taken back into the Company's treasury resulting in a net decrease of outstanding shares by approximately 167 million shares over the 12 months in 2022.

Chairman and CEO Thomas Scozzafava expounded on the rationale for the share retirement: "To achieve the Company's overarching goals in the long term, it is imperative that the Company gain credibility with vendors, creditors, investors and with its peers in the industry. In particular," Mr. Scozzafava continued, "a strong and generally upwardly trending share price makes the Company a far more attractive partner for an investment into or acquisition of another brewery. The stronger the stock, the stronger it is as potential currency for acquisition purposes, which we have outlined many times is a crucial part of KEGS growth strategy."

Mr. Scozzafava stated, "Similar to the share retirement, it is in this context, and it is with this intent and purpose that the Company is seeking a mutually beneficial resolution to extinguish the

Finally, Mr. Scozzafava concluded, "it is not in the Company's current best interest to issue additional shares at today's share prices and market value. Ideally, the Company will reserve any issuances for mainly acquisitions and do so at valuations that are well above today's.

I look forward to updating you in 2023 as 1812 Brewing Company moves ahead."

About 1812 Brewing Company ("KEGS or the "Company"):

KEGS is an operator of and investor in companies in the craft beer industry. The Company seeks to build a nation-wide network of craft breweries to develop and foster respective brand growth at the local, regional, and national level. KEGS looks to build a network wherein certain economies of scale can be shared across it such as production, distribution footprint expansion, inter-member contract brewing, new product development, sharing of best brewery practices and scale logistics and transportation. The network is to be built through investment by 1812 Brewing Company while maintaining the members' respective local and regional uniqueness, brand autonomy and direct involvement with its consumers. The Company seeks to be an "incubator" of growth for its holdings in the industry.

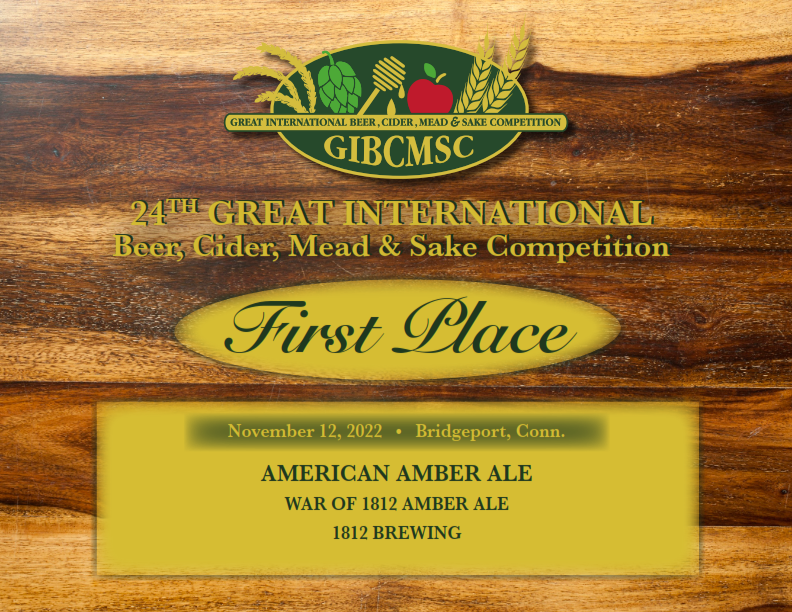

The Company's current holding, 1812 Brewing Co., produces award-winning beers such as War of 1812 Amber Ale ("1812 Amber Ale"), 1812 Light, Hazy Oasis Pale Ale, Thousand Islands IPA, Malicious Intent XX IPA, Route 11 Lager, Railroad Red Ale, Helles Bells Pilsner, St. Stephens Stout, Third Rail Porter, Featherhammer Maibock.

For more updates follow us on our Website, Facebook, Twitter, Instagram and Linkedin.

https://www.1812ale.com/

https://www.facebook.com/1812brewingcompany/

https://www.instagram.com/1812brewingcompany/

https://twitter.com/1812Brewing

https://www.linkedin.com/company/1812brewingcompany/

Contact Name: Tom Scozzafava

Contact Phone Number: 315-788-1812

Contact Email Address: contact@1812ale.com

Safe Harbor: This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 27E of the Securities Act of 1934. Statements contained in this release that are not historical facts may be deemed to be forward-looking statements. Investors are cautioned that forward-looking statements are inherently uncertain. Actual performance and results may differ materially from that projected or suggested herein due to certain risks and uncertainties including, without limitation, ability to obtain financing and regulatory and shareholder approval for anticipated actions.

SOURCE: 1812 Brewing Company Inc.

View source version on accesswire.com:

https://www.accesswire.com/734089/1812-Brewing-Company-Addresses-Outstanding-Convertible-Debentures