J.P. Morgan Asset Management Survey Unveils Growing Demand for Improved Retirement Income Support Among Plan Participants

J.P. Morgan Asset Management's 2024 Defined Contribution (DC) Plan Participant Survey reveals growing demand for improved retirement income support among plan participants. Key findings include:

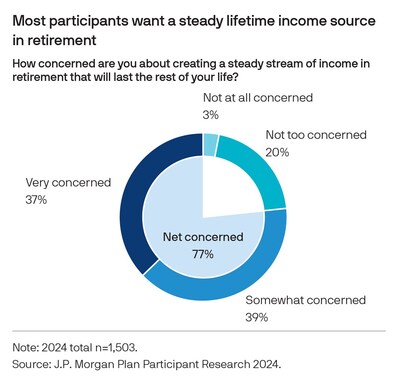

- Nearly 80% worry about securing lifetime retirement income

- 90% find financial wellness programs valuable

- 39% lack basic emergency savings, up from 27% in 2021

- 75% desire professional advice on investment decisions

- 63% acknowledge not saving enough for retirement

- 90% express interest in in-plan solutions providing guaranteed income

The survey highlights generational differences and explores views on savings, advice, plan design, and retirement income. SECURE 2.0 provisions, such as employer-sponsored emergency savings and student loan matching, are appealing to participants. Plan sponsors are encouraged to consider offering financial wellness support, professional guidance, and retirement income solutions to enhance participant experiences and outcomes.

Il sondaggio del 2024 sui partecipanti al Piano di Contributo Definito (DC) di J.P. Morgan Asset Management rivela una crescente domanda di supporto per un reddito pensionistico migliorato tra i partecipanti al piano. I risultati chiave includono:

- Quasi il 80% è preoccupato di garantire un reddito pensionistico a vita

- Il 90% considera i programmi di benessere finanziario di grande valore

- Il 39% non ha risparmi di emergenza di base, in aumento rispetto al 27% nel 2021

- Il 75% desidera consigli professionali sulle decisioni di investimento

- Il 63% riconosce di non risparmiare abbastanza per la pensione

- Il 90% esprime interesse per soluzioni all'interno del piano che offrono reddito garantito

Il sondaggio evidenzia differenze generazionali e esplora le opinioni su risparmi, consigli, design del piano e reddito pensionistico. Le disposizioni SECURE 2.0, come il risparmio d'emergenza sponsorizzato dal datore di lavoro e il matching dei prestiti studenteschi, sono attraenti per i partecipanti. Si invita gli sponsor del piano a considerare l'offerta di supporto per il benessere finanziario, guida professionale e soluzioni per il reddito pensionistico al fine di migliorare le esperienze e i risultati dei partecipanti.

La Encuesta del Participante del Plan de Contribución Definida (DC) 2024 de J.P. Morgan Asset Management revela una creciente demanda de un mejor apoyo para ingresos de jubilación entre los participantes del plan. Los hallazgos clave incluyen:

- Casi el 80% está preocupado por asegurar un ingreso de jubilación de por vida

- El 90% considera valiosos los programas de bienestar financiero

- El 39% carece de ahorros de emergencia básicos, un aumento del 27% en 2021

- El 75% desea asesoramiento profesional sobre decisiones de inversión

- El 63% reconoce que no ahorra lo suficiente para la jubilación

- El 90% expresa interés en soluciones dentro del plan que proporcionen ingresos garantizados

La encuesta destaca diferencias generacionales y explora opiniones sobre ahorros, asesoramientos, diseño del plan e ingresos de jubilación. Las disposiciones SECURE 2.0, como el ahorro de emergencia patrocinado por el empleador y el emparejamiento de préstamos estudiantiles, son atractivas para los participantes. Se alienta a los patrocinadores del plan a considerar ofrecer apoyo al bienestar financiero, orientación profesional y soluciones de ingresos para mejorar las experiencias y los resultados de los participantes.

J.P. Morgan Asset Management의 2024년 확정기여(DC) 플랜 참여자 조사에서는 향상된 퇴직 연금 지원에 대한 수요가 증가하고 있다는 사실이 드러났습니다. 주요 발견 내용은 다음과 같습니다:

- 거의 80%가 평생 퇴직 소득 보장에 대해 걱정하고 있다

- 90%는 재무 웰니스 프로그램이 가치 있다고 생각한다

- 39%는 기본적인 비상 저축이 부족하며, 이는 2021년 27%에서 증가한 수치이다

- 75%는 투자 결정에 대한 전문가의 조언을 원한다

- 63%는 퇴직을 위해 충분히 저축하지 않았음을 인정한다

- 90%는 보장된 소득을 제공하는 플랜 내 솔루션에 관심을 보인다

이 조사는 세대 간 차이를 강조하고 저축, 조언, 플랜 설계 및 퇴직 소득에 대한 의견을 탐구합니다. 고용주가 후원하는 비상 저축 및 학생 대출 매칭과 같은 SECURE 2.0 규정은 참가자들에게 매력적입니다. 플랜 스폰서들은 참가자의 경험과 결과를 향상시키기 위해 재무 웰니스 지원, 전문적인 조언 및 퇴직 소득 솔루션 제공을 고려할 것을 권장합니다.

L'enquête de 2024 sur les participants au Plan de Contribution Définie (DC) de J.P. Morgan Asset Management révèle une demande croissante de soutien pour un revenu de retraite amélioré parmi les participants au plan. Les principales conclusions incluent :

- Près de 80% s'inquiètent de la sécurisation d'un revenu de retraite à vie

- 90% trouvent les programmes de bien-être financier précieux

- 39% manquent d'économies d'urgence de base, en hausse par rapport à 27% en 2021

- 75% désirent des conseils professionnels sur les décisions d'investissement

- 63% reconnaissent ne pas épargner suffisamment pour la retraite

- 90% expriment de l'intérêt pour des solutions en plan offrant un revenu garanti

L'enquête met en lumière des différences générationnelles et explore les opinions sur les économies, les conseils, la conception des plans et le revenu de retraite. Les dispositions de SECURE 2.0, telles que les économies d'urgence parrainées par l'employeur et le jumelage des prêts étudiants, séduisent les participants. Les sponsors de plan sont encouragés à envisager d'offrir un soutien en matière de bien-être financier, des conseils professionnels et des solutions de revenu de retraite afin d'améliorer les expériences et les résultats des participants.

Die Umfrage zur Teilnehmer am 2024 Defined Contribution (DC) Plan von J.P. Morgan Asset Management zeigt eine zunehmende Nachfrage nach verbesserter Altersvorsorge unter den Planteilnehmern. Die wichtigsten Ergebnisse sind:

- Fast 80% sind besorgt darüber, ein lebenslanges Pensionseinkommen zu sichern

- 90% finden Programme zur finanziellen Gesundheit wertvoll

- 39% haben keine grundlegenden Notfallersparnisse, ein Anstieg von 27% im Jahr 2021

- 75% wünschen sich professionelle Beratung zu Investitionsentscheidungen

- 63% erkennen an, dass sie nicht genug für die Altersvorsorge sparen

- 90% zeigen Interesse an Lösungen innerhalb des Plans, die garantierte Einkommen bieten

Die Umfrage hebt generationalen Unterschiede hervor und untersucht Auffassungen zu Sparen, Beratung, Planungsdesign und Alterseinkommen. Die Bestimmungen von SECURE 2.0, wie vom Arbeitgeber geförderte Notfallersparnisse und das Matching von Studienkrediten, sind für die Teilnehmer attraktiv. Plan-Sponsoren werden ermutigt, finanzielle Wellness-Unterstützung, professionelle Beratung und Lösungen für das Alterseinkommen anzubieten, um die Erfahrungen und Ergebnisse der Teilnehmer zu verbessern.

- None.

- None.

Nearly

"While it's no surprise that participants seek retirement income support, it's particularly noteworthy that guaranteed income options are highly attractive and can even motivate increased savings," said Alexandra Nobile, Retirement Strategist at J.P. Morgan Asset Management. "Retirement plans continue to be a top priority for employees when evaluating employer benefits. It's encouraging to see that SECURE 2.0 provisions, including emergency savings and student loan matching, are resonating strongly with plan participants."

The results from the this year's DC Plan Participant Survey of 1,503 participants explored views in four main areas: general savings and employer-sponsored benefits, advice, plan design and retirement income.

1. Broadening the savings scope:

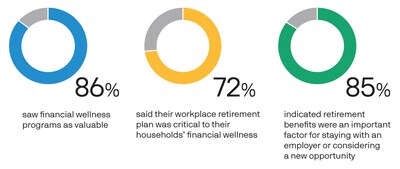

- Nine in 10 found financial wellness programs to be valuable, while

39% lack basic emergency savings, up from27% in 2021. - The majority of participants found key SECURE 2.0 provisions, such as employer-sponsored emergency savings and student loan matching, to be appealing (

69% and66% , respectively). - Plan sponsor implications: Consider offering employees financial wellness support, like emergency savings, student loan debt matching, and financial education.

2. The need for professional guidance:

- Three out of four participants express a desire for professional advice on investment decisions, yet only half currently receive such guidance.

- Six out of 10 participants wish for an easy button where they can completely hand over retirement planning and investing to a professional.

- Plan sponsor implications: educate participants about the value of professional guidance and offer it to plan participants.

3. The power of proactive plan design:

63% of participants acknowledge they are not saving enough for a financially secure retirement.- High favorability towards automatic enrollment and contribution escalation, with nearly nine out of 10 participants supporting these features.

- Strong interest in target date funds, with

89% of participants finding them appealing. - Plan sponsor implications: utilize automatic features to increase participation and contribution rates and given the strong interest, consider defaulting into target date funds.

4. Insights into retirement income:

- The average expected retirement age is 65, though industry research indicates that many may retire earlier due to unforeseen circumstances.

77% of participants are concerned about creating a steady retirement income stream, yet less than half have calculated their savings needs.- Nine in 10 express interest for in-plan solutions that provide guaranteed income in retirement. Guaranteed income was also a top motivator for participants to contribute more to their retirement plans.

- Plan sponsor implications: explore retirement income offerings and consider offering in plan.

"The DC Plan Participant Survey highlights the critical need for proactive plan design, professional guidance, and innovative retirement income solutions," said Alyson Frost, Head of Retirement Insights at J.P. Morgan Asset Management. "As participants face a volatile economic landscape, these insights are invaluable for plan sponsors and financial professionals aiming to enhance participant experiences and achieve stronger retirement outcomes," said Frost.

For more information about the survey findings, please visit the DC Plan Participant Survey dedicated website.

Methodology

In January 2024, we partnered with Greenwald Research, a market research firm based in

Survey results have been weighted by age, gender and household income to reflect the overall makeup of the general population of 401(k) plan participants. In a similarly sized, random sample survey of general population respondents, the margin of error (at the

About J.P. Morgan Asset Management

J.P. Morgan Asset Management, with assets under management of

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jp-morgan-asset-management-survey-unveils-growing-demand-for-improved-retirement-income-support-among-plan-participants-302205433.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jp-morgan-asset-management-survey-unveils-growing-demand-for-improved-retirement-income-support-among-plan-participants-302205433.html

SOURCE J.P. Morgan Asset Management