French Business Leaders Remain Focused on Growth Amid Cost and Labor Concerns, Third Annual J.P. Morgan Survey Finds

- None.

- None.

French midsize businesses expect increased revenue and profits over the next 12 months in spite of experiencing rising costs

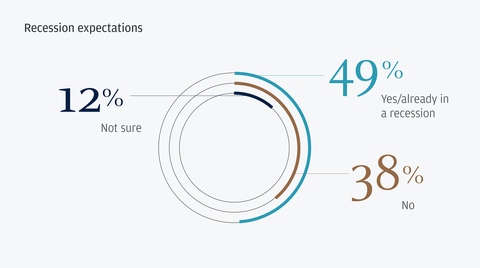

Recession expectations among French midsize business leaders (Graphic: Business Wire)

“The French business community continues to demonstrate a steady and practical mindset when thinking about the future,” said Olivier Simon, Head of Commercial Banking,

In a survey of more than 250 C-suite executives from French midsize businesses, many are eyeing growth in 2024. Nearly eight-in-ten (

“While French business leaders are naturally feeling less optimistic about the year ahead compared to last year, we’re also seeing glimpses of hope among these companies,” said Kyril Courboin, Head of

Preparing for Multiple Possibilities

As French business leaders expect growth in the year ahead, a primary way they’re positioning themselves for this is through several strategic financing options.

-

Bank lines of credit were reported as the most popular type of financing with nearly two-thirds (

62% , up14% from 2023) of businesses currently using these facilities.

-

The next top financing option that leaders are using is equipment financing (

50% ), closely followed by private placement debt or equity (45% ), asset-based financing (44% ) and commercial real estate (43% ). Equipment financing was also cited as the top financing option planned in the year ahead at36% .

Navigating Ongoing Labor Challenges While Aiming for Growth

Amid plans to add headcount, labor shortages were reported as a top external threat French business leaders are bracing for in the year ahead.

-

One-third (

33% ) of French business leaders reported labor as a top challenge, driven by respondents’ concerns around shortages, retention and recruiting needs. For comparison, only24% ofU.K. and27% German business leaders cited labor issues as a concern.

-

Other top challenges include uncertain economic conditions (

30% ), cybersecurity and fraud concerns (26% ) and rising interest rates (26% ).

Finding Ways to Embed AI into Business

Artificial intelligence (AI) tools, such as generative AI and language processing software, remains an opportunity and a priority for French business leaders, with

-

Of those currently using or considering adopting AI, half are already applying AI to their business operations (

51% ) and their internal and external communications needs (50% ).

-

French business leader’s plans for AI are in line with their

U.K. (79% ) and German (82% ) counterparts.

For more information on the 2024 France Business Leaders Outlook survey, visit jpmorgan.com/business-leaders-outlook-FRA.

Survey Methodology

J.P. Morgan’s Business Leaders Outlook survey was conducted online from November 16 – December 13, 2023. In total, 261 business leaders (CEOs, CFOs, heads of finance and owners) from French midsized companies (annual revenues generally ranging from EUR

About JPMorgan Chase

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in

JPMorgan Chase in

As the oldest

© 2024 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. JPMorgan Chase Bank, N.A. is organized under the laws of

View source version on businesswire.com: https://www.businesswire.com/news/home/20240117383547/en/

J.P. Morgan

J.P. Morgan Commercial Banking, Bentley Weisel, bentley.r.weisel@chase.com

Source: JPMorgan Chase & Co.

FAQ

What are French midsize businesses expecting over the next 12 months?

What is the outlook of French business leaders on the global economy?