Turning risk to opportunity: rethinking value creation in aging places and spaces

Rhea-AI Summary

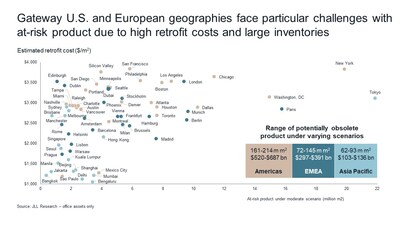

JLL's research reveals that approximately half of global office space (322-425 million square meters) across 66 markets requires substantial investment of $933 billion-$1.2 trillion to remain viable. 78% of office product and 83% of necessary capex is concentrated in the U.S. and Europe. The U.S. accounts for 44% of projected obsolescence, while Europe represents 34%. Five major cities (New York, Washington DC, Paris, Chicago, and London) account for $242-320 billion in necessary capital expenditures.

The study highlights that building retrofits with 40-65% energy use reduction can save $31 per square meter annually, potentially yielding $2.7 billion in annual energy savings for institutional office owners in the eight highest-risk markets.

Positive

- Potential $2.7 billion annual energy savings through building retrofits

- Clear opportunity for value creation through strategic investment in aging properties

- Strong ROI potential from sustainability upgrades

Negative

- $933 billion-$1.2 trillion capital expenditure needed to modernize at-risk office space

- 44% of office space in U.S. faces obsolescence risk

- High concentration of capital needs in five major cities ($242-320 billion)

- Regulatory pressure to meet emissions standards requiring significant investment

News Market Reaction 1 Alert

On the day this news was published, JLL declined 1.51%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

JLL identifies

JLL finds that of the 776 million square meters of existing office space across 66 markets globally, about half of that space, or 322-425 million square meters, is likely to require substantial investment to remain viable in the near term – an investment of approximately

"The commercial real estate landscape is at a turning point as property owners and cities look to establish long-term viability of existing buildings and districts, in the face of evolving experiential and spatial preferences, increasing regulatory pressures, climate risk and changes in real estate demand," said Cynthia Kantor, CEO, Project & Development Services, at JLL. "By proactively assessing and addressing outdated and at-risk buildings, owners can unlock significant value, create a more sustainable, resilient built environment and drive future returns."

"The full potential of existing assets, both those nearing the end and earlier in their lifecycle, can only be realized through collaboration between stakeholders and by considering how various levels of obsolescence interact," said Phil Ryan, Research Director at JLL. "Owners and cities should assess how their portfolios holistically fit into their respective built environments and how a variety of factors contribute to their ability to respond to changing locational preferences and new sustainability and development regulations to create future value."

Considering the risks and opportunities of building age and design

Although there is no one measurement to calculate near-term stranding risk, building age tends to correlate best with the ability to meet tenant, investor and sustainability requirements along with the rate of occupancy and rent growth. In addition to significant capital needs, building age also contributes to an uneven distribution of capital investment required to keep at-risk buildings viable. Forty-four percent of projected obsolescence is likely to be in the

Meeting Sustainability and Regulatory Requirements

The built environment accounts for up to

While sustainability requirements also incur upfront expenses, there is an impressive return on investment over an asset's lifecycle. Whole-building retrofits involving a

Considering the geographic concentration of emissions, the rewards from decarbonization scale rapidly as well. For example, over 52 million square meters of current office assets across

Even with asset classes earlier in their life-cycle journeys, such as data centers, sustainable solutions will be important given the sectors' significantly higher site energy use intensity, as compared to other, potentially older asset classes.

Accounting for Locational Considerations

Along with the asset- and regulation-driven stranding risks, is the growing demand for cohesive, amenitized and balanced spaces that are attractive to all potential stakeholders, from residents to workers and visitors. Local leaders and cities shifting focus to both high-level regeneration and smaller reparative approaches to reflect such spaces are already beginning to see the benefits.

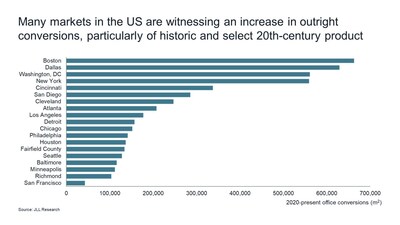

Strategies for repurposing and retrofitting buildings vary widely across markets, with

About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500 company with annual revenue of

Contact: Allison Heraty

Phone: 1 312 228 3128

Email: Allison.Heraty@jll.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/turning-risk-to-opportunity-rethinking-value-creation-in-aging-places-and-spaces-302309970.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/turning-risk-to-opportunity-rethinking-value-creation-in-aging-places-and-spaces-302309970.html

SOURCE JLL