JLL Reports Financial Results for First-Quarter 2022 with New Reporting Segments

Jones Lang LaSalle reported a robust first quarter of 2022 with diluted earnings per share rising to $2.86, up from $1.97 the previous year. The company achieved a 21% increase in revenue to $4.8 billion and a 36% jump in fee revenue to $1.9 billion, driven by strong performance in Capital Markets and Markets Advisory segments. Adjusted EBITDA grew to $273.6 million, with a margin increase to 14.4%. The company repurchased $150 million in shares, reflecting strong capital management amidst economic uncertainties.

- Diluted EPS rose 45% to $2.86.

- Revenue increased 21% to $4.8 billion.

- Fee revenue surged 36% to $1.9 billion.

- Capital Markets fee revenue grew 54%.

- Adjusted EBITDA margin expanded to 14.4%.

- Free cash flow outflow increased to $763 million.

- Net debt increased to $1.33 billion.

- Equity earnings from investments fell by 62%.

Insights

Analyzing...

Diluted earnings per share of

CHICAGO, May 9, 2022 /PRNewswire/ -- Jones Lang LaSalle Incorporated (NYSE: JLL) today reported operating performance for the first quarter of 2022. The company's reporting segments changed, effective this quarter, from geographic-centric Real Estate Services segments to global business line segments.

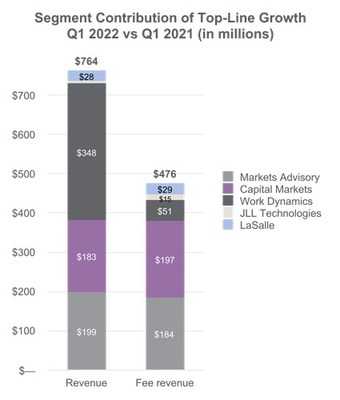

- Revenue up

21% to$4.8 billion and fee revenue up36% to$1.9 billion ; all segments achieved double-digit top-line growth - Higher transaction activity across the globe drove

54% increase in Capital Markets fee revenue - Strong leasing performance across asset classes led

36% growth in Markets Advisory fee revenue - Advisory and Transaction fees contributed to

36% growth in LaSalle fee revenue - Margin expansion reflected higher transaction-based revenue which more than offset incremental expenditures to drive future growth

- Continued return of capital to shareholders with

$150 million of share repurchases this quarter

"JLL again delivered strong financial results this quarter. Robust performance in our Capital Markets and Markets Advisory businesses drove a healthy expansion in our Adjusted EBITDA margin," said Christian Ulbrich, JLL CEO. "Our 'One JLL' philosophy, diversified service offering and integrated technology platform, have allowed us to seamlessly support clients across business lines and geographies. During the first quarter, we generated significant top-line growth across all of our business lines while inflation, supply chain challenges and the war in Ukraine continue to cloud the economic backdrop. We are well positioned to help our clients navigate a more uncertain macro environment and our strong capital position allows us to take advantage of opportunities in the marketplace. Our thoughts and sympathies remain with everyone in Ukraine and elsewhere whose livelihoods are being impacted by this terrible conflict."

Summary Financial Results | Three Months Ended March 31, | ||||

2022 | 2021 | % Change in | % Change in | ||

Revenue | $ 4,801.4 | $ 4,037.1 | 19 % | 21 % | |

Fee revenue1 | 1,900.5 | 1,424.5 | 33 | 36 | |

Net income attributable to common shareholders | $ 145.6 | $ 103.0 | 41 % | 45 % | |

Adjusted net income attributable to common shareholders1 | 176.8 | 109.7 | 61 | 65 | |

Diluted earnings per share | $ 2.86 | $ 1.97 | 45 % | 48 % | |

Adjusted diluted earnings per share1 | 3.47 | 2.10 | 65 | 69 | |

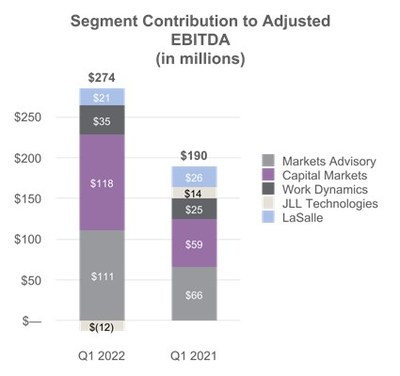

Adjusted EBITDA1 | $ 273.6 | $ 190.1 | 44 % | 47 % | |

Free Cash Flow6 | $ (763.0) | $ (496.4) | (54) % | n/a | |

Note: | For discussion of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. |

Consolidated

| Three Months Ended March 31, | % Change in | % Change in | ||||

2022 | 2021 | ||||||

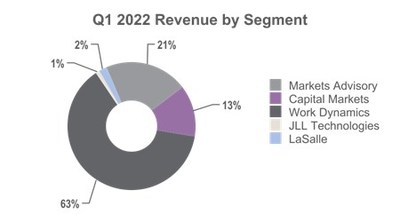

Markets Advisory | $ 999.5 | $ 792.7 | 26 % | 28 % | |||

Capital Markets | 600.6 | 411.7 | 46 | 49 | |||

Work Dynamics | 3,033.6 | 2,698.1 | 12 | 14 | |||

JLL Technologies | 49.4 | 43.4 | 14 | 14 | |||

LaSalle | 118.3 | 91.2 | 30 | 34 | |||

Total revenue | $ 4,801.4 | $ 4,037.1 | 19 % | 21 % | |||

Gross contract costs1 | (2,904.5) | (2,602.9) | 12 | 13 | |||

Net non-cash MSR and mortgage banking derivative activity | 3.6 | (9.7) | (137) | (137) | |||

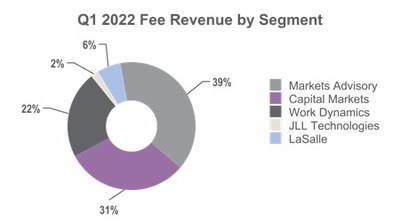

Total fee revenue1 | $ 1,900.5 | $ 1,424.5 | 33 % | 36 % | |||

Markets Advisory | 741.2 | 552.6 | 34 | 36 | |||

Capital Markets | 591.5 | 393.2 | 50 | 54 | |||

Work Dynamics | 410.5 | 363.5 | 13 | 15 | |||

JLL Technologies | 45.3 | 29.9 | 52 | 52 | |||

LaSalle | 112.0 | 85.3 | 31 | 36 | |||

Operating income | $ 175.7 | $ 80.7 | 118 % | 122 % | |||

Equity earnings | $ 18.5 | $ 48.5 | (62) % | (62) % | |||

Adjusted EBITDA1 | $ 273.6 | $ 190.1 | 44 % | 47 % | |||

Note: For discussion of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Consolidated Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||

The company achieved revenue and fee revenue increases of

Refer to segment performance highlights for additional detail.

Net income attributable to common shareholders for the first quarter was

Diluted earnings per share for the first quarter were

Adjusted EBITDA margin for the quarter, calculated on a fee-revenue basis, was

- The meaningful increase in fee revenue, especially from higher margin transaction-based businesses, and

- The timing of incentive compensation accruals reflecting changes in annual incentive compensation plans from 2021 to 2022, which resulted in a lower percentage of expected full-year incentive compensation accrued this quarter compared with the prior year,

- Partially offset by lower equity earnings and incremental expenditures to drive future growth, primarily compensation, T&E and marketing, as business operations continue to trend toward pre-pandemic levels.

Total net debt was

The company's Net Leverage Ratio was 0.8x as of March 31, 2022, up from 0.2x as of December 31, 2021, and up from 0.7x as of March 31, 2021.

Corporate Liquidity as of March 31, 2022, was

Free Cash Flow6 was an outflow of

In the first quarter of 2022, the company repurchased 615,331 shares for

As part of the last phase of our Beyond transformation, effective January 1, 2022, the company changed from its geographic-centric Real Estate Services segments of Americas, EMEA and Asia Pacific to global business line segments of Markets Advisory, Capital Markets, Work Dynamics and JLL Technologies. Our real estate investment management business, LaSalle, continues as a reporting segment.

As the company's segment financial results are presented on this basis, the comparable period has been recast to align with the new reporting structure.

Markets Advisory

| Three Months Ended March 31, | % Change in | % Change in | ||||

2022 | 2021 | ||||||

Revenue | $ 999.5 | $ 792.7 | 26 % | 28 % | |||

Gross contract costs1 | (258.3) | (240.1) | 8 | 9 | |||

Fee revenue1 | $ 741.2 | $ 552.6 | 34 % | 36 % | |||

Leasing | 596.9 | 412.2 | 45 | 46 | |||

Property Management | 118.6 | 114.3 | 4 | 6 | |||

Advisory, Consulting and Other | 25.7 | 26.1 | (2) | 1 | |||

Segment operating income | $ 91.4 | $ 50.2 | 82 % | 83 % | |||

Adjusted EBITDA1 | $ 111.2 | $ 66.0 | 68 % | 70 % | |||

Note: For discussion of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Markets Advisory Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||

Markets Advisory fee revenue grew

Adjusted EBITDA margin for the quarter, calculated on a fee-revenue basis, was

Capital Markets

| Three Months Ended March 31, | % Change in | % Change in | ||||

2022 | 2021 | ||||||

Revenue | $ 600.6 | $ 411.7 | 46 % | 49 % | |||

Gross contract costs1 | (12.7) | (8.8) | 44 | 52 | |||

Net non-cash MSR and mortgage banking derivative activity | 3.6 | (9.7) | (137) | (137) | |||

Fee revenue1 | $ 591.5 | $ 393.2 | 50 % | 54 % | |||

Investment Sales, Debt/Equity Advisory and Other | 468.5 | 286.0 | 64 | 67 | |||

Valuation Advisory | 83.1 | 77.2 | 8 | 12 | |||

Loan Servicing | 39.9 | 30.0 | 33 | 33 | |||

Segment operating income | $ 98.2 | $ 51.4 | 91 % | 96 % | |||

Adjusted EBITDA1 | $ 118.2 | $ 59.1 | 100 % | 104 % | |||

Note: For discussion of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Capital Markets Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||

Capital Markets fee revenue increased

Adjusted EBITDA margin for the quarter, calculated on a fee-revenue basis, was

Work Dynamics

| Three Months Ended March 31, | % Change in | % Change in | ||||

2022 | 2021 | ||||||

Revenue | $ 3,033.6 | $ 2,698.1 | 12 % | 14 % | |||

Gross contract costs1 | (2,623.1) | (2,334.6) | 12 | 14 | |||

Fee revenue1 | $ 410.5 | $ 363.5 | 13 % | 15 % | |||

Workplace Management | 182.0 | 153.4 | 19 | 20 | |||

Project Management | 175.7 | 163.2 | 8 | 11 | |||

Portfolio Services and Other | 52.8 | 46.9 | 13 | 14 | |||

Segment operating income | $ 18.4 | $ 8.6 | 114 % | 101 % | |||

Adjusted EBITDA1 | $ 35.2 | $ 24.9 | 41 % | 38 % | |||

"Workplace Management" was previously called Integrated Facilities Management (IFM). "Project Management" was previously called Project & Development Services. | |||||||

Note: For discussion of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Work Dynamics Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||

The increases in Work Dynamics revenue and fee revenue were led by Workplace Management, primarily from new client wins but also expansions of existing client relationships, particularly in the technology and public institutions sectors in the United States. Project Management growth was driven by the return to office movement and fewer pandemic restrictions in several geographies across the globe, which drove increased project demand.

Adjusted EBITDA margin for the quarter, calculated on a fee-revenue basis, was

JLL Technologies

| Three Months Ended March 31, | % Change in | % Change in | ||||

2022 | 2021 | ||||||

Revenue | $ 49.4 | $ 43.4 | 14 % | 14 % | |||

Gross contract costs1 | (4.1) | (13.5) | (70) | (70) | |||

Fee revenue1 | $ 45.3 | $ 29.9 | 52 % | 52 % | |||

Segment operating loss | $ (34.9) | $ (23.5) | (49) % | (46) % | |||

Equity earnings | $ 18.8 | $ 34.6 | (46) % | (46) % | |||

Adjusted EBITDA1 | $ (12.3) | $ 14.0 | (188) % | (184) % | |||

Note: For discussion of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the JLL Technologies Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||

JLL Technologies top-line growth included

Equity earnings in both years were due to valuation increases to JLL Technologies' investments in proptech funds and early to mid-stage proptech companies, primarily reflecting subsequent financing rounds at increased per-share values.

Adjusted EBITDA margin for the quarter, calculated on a fee-revenue basis, was a negative

LaSalle

| Three Months Ended March 31, | % Change in | % Change in | ||||

2022 | 2021 | ||||||

Revenue | $ 118.3 | $ 91.2 | 30 % | 34 % | |||

Gross contract costs1 | (6.3) | (5.9) | 7 | 7 | |||

Fee revenue1 | $ 112.0 | $ 85.3 | 31 % | 36 % | |||

Advisory fees | 90.7 | 79.3 | 14 | 18 | |||

Transaction fees and other | 17.1 | 6.0 | 185 | 203 | |||

Incentive fees | 4.2 | — | n.m. | n.m. | |||

Segment operating income | $ 22.1 | $ 11.2 | 97 % | 114 % | |||

Equity (losses) earnings | $ (1.9) | $ 13.0 | (115) % | (114) % | |||

Adjusted EBITDA1 | $ 21.3 | $ 26.1 | (18) % | (11) % | |||

n.m.: "not meaningful", represented by a percentage change of greater than 1, | |||||||

Note: For discussion of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the LaSalle Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||

LaSalle advisory fee growth was driven by strong capital raising over the trailing twelve months as well as valuation increases in assets under management. The increase in transaction fees was primarily due to a higher volume of asset acquisitions in Asia and Europe.

Equity losses in the current quarter included a

Adjusted EBITDA margin for the quarter, calculated on a fee-revenue basis, was

JLL (NYSE: JLL) is a leading professional services firm that specializes in real estate and investment management. JLL shapes the future of real estate for a better world by using the most advanced technology to create rewarding opportunities, amazing spaces and sustainable real estate solutions for our clients, our people and our communities. JLL is a Fortune 500 company with annual revenue of

Connect with us

https://www.linkedin.com/company/jll

https://www.facebook.com/jll

https://twitter.com/jll

https://www.instagram.com/jll

Live Webcast | Conference Call | ||

Management will offer a live webcast for shareholders, analysts and investment professionals on Monday, May 9, 2022, at 9:00 a.m. Eastern. Following the live broadcast, an audio replay will be available for download or stream. The link to the live webcast and audio replay can be accessed at the Investor Relations website: ir.jll.com. | Refer to ir.jll.com for a registration link to receive unique credentials to access the presentation of earnings via phone. | ||

Supplemental Information | Contact | ||

Supplemental information regarding the first quarter 2022 earnings call has been posted to the Investor Relations section of JLL's website: ir.jll.com. | If you have any questions, please contact Scott Einberger, Investor Relations Officer. | ||

Phone: | +1 312 252 8943 | ||

Email: | |||

Statements in this news release regarding, among other things, future financial results and performance, achievements, plans, objectives and shares repurchases may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties, and other factors, the occurrence of which are outside JLL's control, including but not limited to, the impact of the COVID-19 pandemic on JLL's business, which may cause JLL's actual results, performance, achievements, plans, and objectives to be materially different from those expressed or implied by such forward-looking statements. For additional information concerning risks, uncertainties, and other factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and risks to JLL's business in general, please refer to those factors discussed under "Risk Factors," "Business," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Quantitative and Qualitative Disclosures about Market Risk," and elsewhere in JLL's filed Annual Report on Form 10-K for the year ended December 31, 2021, soon to be filed Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, and other reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this release, and except to the extent required by applicable securities laws, JLL expressly disclaims any obligation or undertaking to publicly update or revise any forward-looking statements contained herein to reflect any change in expectations or results, or any change in events.

JONES LANG LASALLE INCORPORATED | |||

Consolidated Statements of Operations (Unaudited) | |||

Three Months Ended March 31, | |||

(in millions, except share and per share data) | 2022 | 2021 | |

Revenue | $ 4,801.4 | $ 4,037.1 | |

Operating expenses: | |||

Compensation and benefits | $ 2,410.8 | $ 1,989.0 | |

Operating, administrative and other | 2,141.0 | 1,897.2 | |

Depreciation and amortization | 54.4 | 53.0 | |

Restructuring and acquisition charges3 | 19.5 | 17.2 | |

Total operating expenses | 4,625.7 | 3,956.4 | |

Operating income | 175.7 | 80.7 | |

Interest expense, net of interest income | 10.2 | 10.4 | |

Equity earnings | 18.5 | 48.5 | |

Other income | 0.2 | 11.8 | |

Income before income taxes and noncontrolling interest | 184.2 | 130.6 | |

Income tax provision | 40.3 | 28.2 | |

Net income | 143.9 | 102.4 | |

Net loss attributable to noncontrolling interest | (1.7) | (0.6) | |

Net income attributable to common shareholders | $ 145.6 | $ 103.0 | |

Basic earnings per common share | $ 2.92 | $ 2.01 | |

Basic weighted average shares outstanding (in 000's) | 49,781 | 51,173 | |

Diluted earnings per common share | $ 2.86 | $ 1.97 | |

Diluted weighted average shares outstanding (in 000's) | 50,957 | 52,175 | |

Please reference accompanying financial statement notes. | |||

JONES LANG LASALLE INCORPORATED | |||

Selected Segment Financial Data (Unaudited) | |||

Three Months Ended March 31, | |||

(in millions) | 2022 | 2021 | |

MARKETS ADVISORY | |||

Compensation, operating and administrative expenses | $ 891.0 | $ 726.6 | |

Depreciation and amortization | 17.1 | 15.9 | |

Total segment operating expenses | 908.1 | 742.5 | |

Gross contract costs1 | (258.3) | (240.1) | |

Total fee-based segment operating expenses | $ 649.8 | $ 502.4 | |

Segment operating income | $ 91.4 | $ 50.2 | |

Add: | |||

Equity earnings | 0.5 | 0.4 | |

Depreciation and amortization | 17.1 | 15.9 | |

Other income (expense) | 0.2 | (1.1) | |

Net loss attributable to noncontrolling interest | 2.0 | 0.6 | |

Adjusted EBITDA1 | $ 111.2 | $ 66.0 | |

CAPITAL MARKETS | |||

Compensation, operating and administrative expenses | $ 486.8 | $ 344.4 | |

Depreciation and amortization | 15.6 | 15.9 | |

Total segment operating expenses | 502.4 | 360.3 | |

Gross contract costs1 | (12.7) | (8.8) | |

Total fee-based segment operating expenses | $ 489.7 | $ 351.5 | |

Segment operating income | $ 98.2 | $ 51.4 | |

Add: | |||

Equity earnings | 0.8 | 0.4 | |

Depreciation and amortization | 15.6 | 15.9 | |

Other income | — | 1.1 | |

Adjustments: | |||

Net non-cash MSR and mortgage banking derivative activity | 3.6 | (9.7) | |

Adjusted EBITDA1 | $ 118.2 | $ 59.1 | |

JONES LANG LASALLE INCORPORATED | ||||

Selected Segment Financial Data (Unaudited) Continued | ||||

Three Months Ended March 31, | ||||

(in millions) | 2022 | 2021 | ||

WORK DYNAMICS | ||||

Compensation, operating and administrative expenses | $ 2,998.7 | $ 2,673.3 | ||

Depreciation and amortization | 16.5 | 16.2 | ||

Total segment operating expenses | 3,015.2 | 2,689.5 | ||

Gross contract costs1 | (2,623.1) | (2,334.6) | ||

Total fee-based segment operating expenses | $ 392.1 | $ 354.9 | ||

Segment operating income | $ 18.4 | $ 8.6 | ||

Add: | ||||

Equity earnings | 0.3 | 0.1 | ||

Depreciation and amortization | 16.5 | 16.2 | ||

Adjusted EBITDA1 | $ 35.2 | $ 24.9 | ||

JLL TECHNOLOGIES | ||||

Compensation, operating and administrative expenses (a) | $ 80.5 | $ 64.0 | ||

Depreciation and amortization | 3.8 | 2.9 | ||

Total segment operating expenses | 84.3 | 66.9 | ||

Gross contract costs1 | (4.1) | (13.5) | ||

Total fee-based segment operating expenses | $ 80.2 | $ 53.4 | ||

Segment operating loss | $ (34.9) | $ (23.5) | ||

Add: | ||||

Equity earnings | 18.8 | 34.6 | ||

Depreciation and amortization | 3.8 | 2.9 | ||

Other income | — | 12.0 | ||

Adjustments: | ||||

Gain on disposition | — | (12.0) | ||

Adjusted EBITDA1 | $ (12.3) | $ 14.0 | ||

(a) Included in Compensation, operating and administrative expenses for JLL Technologies is carried interest expense of | ||||

JONES LANG LASALLE INCORPORATED | ||||

Selected Segment Financial Data (Unaudited) Continued | ||||

Three Months Ended March 31, | ||||

(in millions) | 2022 | 2021 | ||

LASALLE | ||||

Compensation, operating and administrative expenses | $ 94.8 | $ 77.9 | ||

Depreciation and amortization | 1.4 | 2.1 | ||

Total segment operating expenses | 96.2 | 80.0 | ||

Gross contract costs1 | (6.3) | (5.9) | ||

Total fee-based segment operating expenses | $ 89.9 | $ 74.1 | ||

Segment operating income | $ 22.1 | $ 11.2 | ||

Add: | ||||

Equity (losses) earnings | (1.9) | 13.0 | ||

Depreciation and amortization | 1.4 | 2.1 | ||

Other expense | — | (0.2) | ||

Net income attributable to noncontrolling interest | (0.3) | — | ||

Adjusted EBITDA1 | $ 21.3 | $ 26.1 | ||

JONES LANG LASALLE INCORPORATED | |||

Summarized Consolidated Statements of Cash Flows4 (Unaudited) | |||

Three Months Ended March 31, | |||

(in millions) | 2022 | 2021 | |

Net cash used in operating activities | $ (716.4) | $ (461.8) | |

Net cash used in investing activities | (94.0) | (97.8) | |

Net cash provided by financing activities | 806.5 | 376.7 | |

Effect of currency exchange rate changes on cash, cash equivalents and restricted cash | (6.7) | (12.4) | |

Net change in cash, cash equivalents and restricted cash | $ (10.6) | $ (195.3) | |

Cash, cash equivalents and restricted cash, beginning of year | 841.6 | 839.8 | |

Cash, cash equivalents and restricted cash, end of period | $ 831.0 | $ 644.5 | |

Reconciliation to Free Cash Flow | |||

Three Months Ended March 31, | |||

(in millions) | 2022 | 2021 | |

Net cash used in operating activities | $ (716.4) | $ (461.8) | |

Net capital additions - property and equipment | (46.6) | (34.6) | |

Free Cash Flow6 | $ (763.0) | $ (496.4) | |

Please reference accompanying financial statement notes. | |||

JONES LANG LASALLE INCORPORATED | ||||||||||||

Consolidated Balance Sheets | ||||||||||||

March 31, | December 31, | March 31, | December 31, | |||||||||

(in millions, except share and per share data) | 2022 | 2021 | 2022 | 2021 | ||||||||

ASSETS | (Unaudited) | LIABILITIES AND EQUITY | (Unaudited) | |||||||||

Current assets: | Current liabilities: | |||||||||||

Cash and cash equivalents | $ 575.8 | $ 593.7 | Accounts payable and accrued liabilities | $ 1,059.4 | $ 1,262.8 | |||||||

Trade receivables, net of allowance | 1,894.5 | 2,004.1 | Reimbursable payables | 1,219.2 | 1,350.0 | |||||||

Notes and other receivables | 396.4 | 389.3 | Accrued compensation and benefits | 1,333.5 | 2,029.5 | |||||||

Reimbursable receivables | 1,691.8 | 1,734.5 | Short-term borrowings | 118.2 | 147.9 | |||||||

Warehouse receivables | 701.7 | 822.3 | Current maturities of long-term debt, net | 274.7 | 274.7 | |||||||

Short-term contract assets, net of allowance | 338.5 | 343.1 | Short-term contract liability and deferred income | 211.3 | 208.2 | |||||||

Prepaid and other | 566.7 | 500.7 | Short-term acquisition-related obligations | 51.2 | 45.8 | |||||||

Total current assets | 6,165.4 | 6,387.7 | Warehouse facilities | 705.3 | 795.7 | |||||||

Property and equipment, net of accumulated depreciation | 749.1 | 740.0 | Short-term operating lease liability | 155.8 | 153.8 | |||||||

Operating lease right-of-use asset | 769.2 | 723.4 | Other | 274.4 | 218.1 | |||||||

Goodwill | 4,597.9 | 4,611.6 | Total current liabilities | 5,403.0 | 6,486.5 | |||||||

Identified intangibles, net of accumulated amortization | 879.5 | 887.0 | Noncurrent liabilities: | |||||||||

Investments | 785.3 | 745.7 | Credit facility, net of debt issuance costs | 1,113.7 | 138.2 | |||||||

Long-term receivables | 327.5 | 316.4 | Long-term debt, net of debt issuance costs | 387.8 | 395.6 | |||||||

Deferred tax assets, net | 313.2 | 330.8 | Long-term deferred tax liabilities, net | 196.5 | 179.7 | |||||||

Deferred compensation plans | 558.3 | 528.8 | Deferred compensation | 500.0 | 525.4 | |||||||

Other | 247.2 | 233.6 | Long-term acquisition-related obligations | 55.4 | 66.3 | |||||||

Total assets | $ 15,392.6 | $ 15,505.0 | Long-term operating lease liability | 765.2 | 714.4 | |||||||

Other | 548.3 | 577.7 | ||||||||||

Total liabilities | $ 8,969.9 | $ 9,083.8 | ||||||||||

Redeemable noncontrolling interest | $ 7.5 | $ 7.8 | ||||||||||

Company shareholders' equity | ||||||||||||

Common stock | 0.5 | 0.5 | ||||||||||

Additional paid-in capital | 2,066.8 | 2,053.7 | ||||||||||

Retained earnings | 5,083.2 | 4,937.6 | ||||||||||

Treasury stock | (552.7) | (406.3) | ||||||||||

Shares held in trust | (5.1) | (5.2) | ||||||||||

Accumulated other comprehensive loss | (419.5) | (395.4) | ||||||||||

Total company shareholders' equity | 6,173.2 | 6,184.9 | ||||||||||

Noncontrolling interest | 242.0 | 228.5 | ||||||||||

Total equity | 6,415.2 | 6,413.4 | ||||||||||

Total liabilities and equity | $ 15,392.6 | $ 15,505.0 | ||||||||||

. | ||||||||||||

Financial Statement Notes

1. Management uses certain non-GAAP financial measures to develop budgets and forecasts, measure and reward performance against those budgets and forecasts, and enhance comparability to prior periods. These measures are believed to be useful to investors and other external stakeholders as supplemental measures of core operating performance and include the following:

(i) Fee revenue and Fee-based operating expenses,

(ii) Adjusted EBITDA attributable to common shareholders ("Adjusted EBITDA") and Adjusted EBITDA margin,

(iii) Adjusted net income attributable to common shareholders and Adjusted diluted earnings per share,

(iv) Percentage changes against prior periods, presented on a local currency basis, and

(v) Free Cash Flow.

However, non-GAAP financial measures should not be considered alternatives to measures determined in accordance with U.S. generally accepted accounting principles ("GAAP"). Any measure that eliminates components of a company's capital structure, cost of operations or investments, or other results has limitations as a performance measure. In light of these limitations, management also considers GAAP financial measures and does not rely solely on non-GAAP financial measures. Because the company's non-GAAP financial measures are not calculated in accordance with GAAP, they may not be comparable to similarly titled measures used by other companies.

Adjustments to GAAP Financial Measures Used to Calculate non-GAAP Financial Measures

Gross Contract Costs represent certain costs associated with client-dedicated employees and third-party vendors and subcontractors and are directly or indirectly reimbursed through the fees we receive. These costs are presented on a gross basis in Operating expenses with the equal amount of corresponding fees in Revenue. Excluding gross contract costs from both Fee revenue and Fee-based operating expenses more accurately reflects how the company manages its expense base and operating margins and also enables a more consistent performance assessment across a portfolio of contracts with varying payment terms and structures.

Net Non-Cash Mortgage Servicing Rights ("MSR") and Mortgage Banking Derivative Activity consists of the balances presented within Revenue composed of (i) derivative gains/losses resulting from mortgage banking loan commitment and warehousing activity and (ii) gains recognized from the retention of MSR upon origination and sale of mortgage loans, offset by (iii) amortization of MSR intangible assets over the period that net servicing income is projected to be received. Non-cash derivative gains/losses resulting from mortgage banking loan commitment and warehousing activity are calculated as the estimated fair value of loan commitments and subsequent changes thereof, primarily represented by the estimated net cash flows associated with future servicing rights. MSR gains and corresponding MSR intangible assets are calculated as the present value of estimated cash flows over the estimated mortgage servicing periods. The above activity is reported entirely within Revenue of the Capital Markets segment. Excluding net non-cash MSR and mortgage banking derivative activity reflects how the company manages and evaluates performance because the excluded activity is non-cash in nature.

Restructuring and Acquisition Charges primarily consist of: (i) severance and employment-related charges, including those related to external service providers, incurred in conjunction with a structural business shift, which can be represented by a notable change in headcount, change in leadership or transformation of business processes; (ii) acquisition, transaction and integration-related charges, including fair value adjustments, which are generally non-cash in the periods such adjustments are made, to assets and liabilities recorded in purchase accounting such as earn-out liabilities and intangible assets; and (iii) lease exit charges. Such activity is excluded as the amounts are generally either non-cash in nature or the anticipated benefits from the expenditures would not likely be fully realized until future periods. Restructuring and acquisition charges are excluded from segment operating results and therefore not a line item in the segments' reconciliation to Adjusted EBITDA.

Amortization of Acquisition-Related Intangibles, primarily composed of the estimated fair value ascribed at closing of an acquisition to assets such as acquired management contracts, customer backlog and relationships, and trade name, is more notable following the company's increase in acquisition activity in recent years. Such non-cash activity is excluded as the change in period-over-period activity is generally the result of longer-term strategic decisions and therefore not necessarily indicative of core operating results.

Gain on Disposition reflects the gain recognized on the sale of businesses. Given the low frequency of business disposals by the company historically, the gain directly associated with such activity is excluded as it is not considered indicative of core operating performance. In 2021, the

Reconciliation of Non-GAAP Financial Measures

Below are reconciliations of (i) Revenue to Fee revenue and (ii) Operating expenses to Fee-based operating expenses:

Three months Ended March 31, | |||

($ in millions) | 2022 | 2021 | |

Revenue | $ 4,801.4 | $ 4,037.1 | |

Gross contract costs1 | (2,904.5) | (2,602.9) | |

Net non-cash MSR and mortgage banking derivative activity | 3.6 | (9.7) | |

Fee revenue | $ 1,900.5 | $ 1,424.5 | |

Operating expenses | $ 4,625.7 | $ 3,956.4 | |

Gross contract costs1 | (2,904.5) | (2,602.9) | |

Fee-based operating expenses | $ 1,721.2 | $ 1,353.5 | |

Below is (i) a reconciliation of Net income attributable to common shareholders to EBITDA and Adjusted EBITDA, (ii) the Net income margin attributable to common shareholders (against Revenue), and (iii) the Adjusted EBITDA margin (presented on a local currency and on a fee-revenue basis). Following this is the (i) reconciliation to adjusted net income and (ii) components of adjusted diluted earnings per share.

Three months Ended March 31, | |||

($ in millions) | 2022 | 2021 | |

Net income attributable to common shareholders | $ 145.6 | $ 103.0 | |

Add: | |||

Interest expense, net of interest income | 10.2 | 10.4 | |

Provision for income taxes | 40.3 | 28.2 | |

Depreciation and amortization | 54.4 | 53.0 | |

EBITDA | $ 250.5 | $ 194.6 | |

Adjustments: | |||

Restructuring and acquisition charges3 | 19.5 | 17.2 | |

Gain on disposition | — | (12.0) | |

Net non-cash MSR and mortgage banking derivative activity | 3.6 | (9.7) | |

Adjusted EBITDA | $ 273.6 | $ 190.1 | |

Net income margin attributable to common shareholders | 3.0 % | 2.6 % | |

Adjusted EBITDA margin | 14.4 % | 13.3 % | |

Three months Ended March 31, | |||

(In millions, except share and per share data) | 2022 | 2021 | |

Net income attributable to common shareholders | $ 145.6 | $ 103.0 | |

Diluted shares (in thousands) | 50,957 | 52,175 | |

Diluted earnings per share | $ 2.86 | $ 1.97 | |

Net income attributable to common shareholders | $ 145.6 | $ 103.0 | |

Adjustments: | |||

Restructuring and acquisition charges3 | 19.5 | 17.2 | |

Net non-cash MSR and mortgage banking derivative activity | 3.6 | (9.7) | |

Amortization of acquisition-related intangibles | 16.8 | 13.0 | |

Gain on disposition | — | (12.0) | |

Tax impact of adjusted items(a) | (8.7) | (1.8) | |

Adjusted net income attributable to common shareholders | $ 176.8 | $ 109.7 | |

Diluted shares (in thousands) | 50,957 | 52,175 | |

Adjusted diluted earnings per share | $ 3.47 | $ 2.10 | |

(a) | For the first quarter of both 2022 and 2021, the tax impact of adjusted items was calculated using the consolidated effective tax rate as this was deemed to approximate the tax impact of adjusted items calculated using applicable statutory tax rates. |

Operating Results - Local Currency

In discussing operating results, the company reports Adjusted EBITDA margins and refers to percentage changes in local currency, unless otherwise noted. Amounts presented on a local currency basis are calculated by translating the current period results of foreign operations to U.S. dollars using the foreign currency exchange rates from the comparative period. Management believes this methodology provides a framework for assessing performance and operations excluding the effect of foreign currency fluctuations.

The following table reflects the reconciliation to local currency amounts for consolidated (i) revenue, (ii) fee revenue, (iii) operating income and (iv) Adjusted EBITDA.

Three Months Ended March 31, | |||

($ in millions) | 2022 | % Change | |

Revenue: | |||

At current period exchange rates | $ 4,801.4 | 19 % | |

Impact of change in exchange rates | 77.8 | n/a | |

At comparative period exchange rates | $ 4,879.2 | 21 % | |

Fee revenue: | |||

At current period exchange rates | $ 1,900.5 | 33 % | |

Impact of change in exchange rates | 32.6 | n/a | |

At comparative period exchange rates | $ 1,933.1 | 36 % | |

Operating income: | |||

At current period exchange rates | $ 175.7 | 118 % | |

Impact of change in exchange rates | 3.2 | n/a | |

At comparative period exchange rates | $ 178.9 | 122 % | |

Adjusted EBITDA: | |||

At current period exchange rates | $ 273.6 | 44 % | |

Impact of change in exchange rates | 5.0 | n/a | |

At comparative period exchange rates | $ 278.6 | 47 % | |

2. As part of the last phase of our Beyond transformation, effective January 1, 2022, the company changed from its geographic-centric Real Estate Services segments of Americas, EMEA and Asia Pacific to global business line segments of Markets Advisory, Capital Markets, Work Dynamics and JLL Technologies. Our real estate investment management business, LaSalle, continues as a reporting segment. Beginning with the first quarter of 2022, the company's financial results are presented on this basis. Comparable periods in 2021 have been recast to align with the new reporting structure.

3. Restructuring and acquisition charges are excluded from the company's measure of segment operating results, although they are included within consolidated Operating income calculated in accordance with GAAP. For purposes of segment operating results, the allocation of restructuring and acquisition charges to the segments is not a component of management's assessment of segment performance. The table below shows restructuring and acquisition charges.

Three Months Ended March 31, | |||

(in millions) | 2022 | 2021 | |

Severance and other employment-related charges | $ 3.3 | $ 1.8 | |

Restructuring, pre-acquisition and post-acquisition charges | 16.9 | 15.5 | |

Fair value adjustments that resulted in a net decrease to earn-out liabilities from prior-period acquisition activity | (0.7) | (0.1) | |

Total restructuring and acquisition charges | $ 19.5 | $ 17.2 | |

4. The consolidated statements of cash flows are presented in summarized form. For complete consolidated statements of cash flows, please refer to the company's Form 10-Q for the three months ended March 31, 2022, to be filed with the SEC in the near future.

5. As of March 31, 2022, LaSalle had

AUM increased

Assets under management data for separate accounts and fund management amounts are reported on a one-quarter lag. In addition, LaSalle raised

6. "Net Debt" is defined as the sum of the (i) Credit facility, (ii) Long-term debt and (iii) Short-term borrowings liability balances less Cash and cash equivalents.

"Net Leverage Ratio" is defined as Net Debt divided by the trailing-twelve-month adjusted EBITDA.

"Corporate Liquidity" is defined as the unused portion of the company's Credit Facility plus cash and cash equivalents.

"Free Cash Flow" is defined as cash provided by operating activities less net capital additions - property and equipment.

7. n.m.: "not meaningful", represented by a percentage change of greater than 1,

Appendix: Revenue and Fee Revenue Segment Detail

Three months ended March 31, 2022 | |||||||||||||||||||||||

(in millions) | Markets Advisory | Capital Markets | Work Dynamics | ||||||||||||||||||||

Leasing | Property Mgmt | Advisory, Consulting and Other | Total Markets Advisory | Invt Sales, Debt/Equity Advisory and Other | Valuation Advisory | Loan Servicing | Total Capital Markets | Workplace Mgmt | Project Mgmt | Portfolio Services and Other | Total Work Dynamics | JLLT | LaSalle | Total | |||||||||

Revenue | $ 600.9 | 370.5 | 28.1 | $ 999.5 | $ 476.1 | 84.6 | 39.9 | $ 600.6 | $ 2,320.4 | 612.3 | 100.9 | $ 3,033.6 | $ 49.4 | $ 118.3 | $ 4,801.4 | ||||||||

Gross contract costs1 | (4.0) | (251.9) | (2.4) | — | (258.3) | (11.2) | (1.5) | — | — | (12.7) | (2,138.4) | (436.6) | (48.1) | (2,623.1) | (4.1) | (6.3) | (2,904.5) | ||||||

Net non-cash MSR and mortgage banking derivative activity | — | — | — | — | — | 3.6 | — | — | 3.6 | — | — | — | — | — | — | 3.6 | |||||||

Fee revenue | $ 596.9 | 118.6 | 25.7 | $ 741.2 | $ 468.5 | 83.1 | 39.9 | $ 591.5 | $ 182.0 | 175.7 | 52.8 | $ 410.5 | $ 45.3 | $ 112.0 | $ 1,900.5 | ||||||||

Three months ended March 31, 2021 | |||||||||||||||||||||||

(in millions) | Markets Advisory | Capital Markets | Work Dynamics | ||||||||||||||||||||

Leasing | Property Mgmt | Advisory, Consulting and Other | Total Markets Advisory | Invt Sales, Debt/Equity Advisory and Other | Valuation Advisory | Loan Servicing | Total Capital Markets | Workplace Mgmt | Project Mgmt | Portfolio Services and Other | Total Work Dynamics | JLLT | LaSalle | Total | |||||||||

Revenue | $ 416.6 | 347.6 | 28.5 | $ 792.7 | $ 302.0 | 79.7 | 30.0 | $ 411.7 | $ 2,048.4 | 551.8 | 97.9 | $ 2,698.1 | $ 43.4 | $ 91.2 | $ 4,037.1 | ||||||||

Gross contract costs1 | (4.4) | (233.3) | (2.4) | — | (240.1) | (6.3) | (2.5) | — | (8.8) | (1,895.0) | (388.6) | (51.0) | (2,334.6) | (13.5) | (5.9) | (2,602.9) | |||||||

Net non-cash MSR and mortgage banking derivative activity | — | — | — | — | — | (9.7) | — | — | (9.7) | — | — | — | — | — | — | (9.7) | |||||||

Fee revenue | $ 412.2 | 114.3 | 26.1 | $ 552.6 | $ 286.0 | 77.2 | 30.0 | $ 393.2 | $ 153.4 | 163.2 | 46.9 | $ 363.5 | $ 29.9 | $ 85.3 | $ 1,424.5 | ||||||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-reports-financial-results-for-first-quarter-2022-with-new-reporting-segments-301542051.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-reports-financial-results-for-first-quarter-2022-with-new-reporting-segments-301542051.html

SOURCE JLL-IR