US Dividends Climb 2.6% to Record High $503.1 Billion in 2020

During the worst crisis since World War II, US dividends proved resilient, increasing

(Graphic: Business Wire)

Globally, dividends fell to

The dividend cuts were most severe in the UK and Europe, which together accounted for more than half the total reduction in payouts globally, mainly owing to the forced curtailment on banking dividends by regulators. In North America, companies were able to conserve cash and protect their dividends by suspending or reducing share buybacks instead, and regulators were more lenient with the banks. In Asia, Australia was worst affected, thanks to its heavy reliance on banking dividends, which were constrained by regulators until December. Elsewhere, China, Hong Kong and Switzerland joined Canada among the best performing nations.

Q4 ended the year with a smaller fall than feared

Globally, Q4 payouts fell

How did Covid-19 affect global dividends?

Although cuts and cancellations globally totalled

Outlook

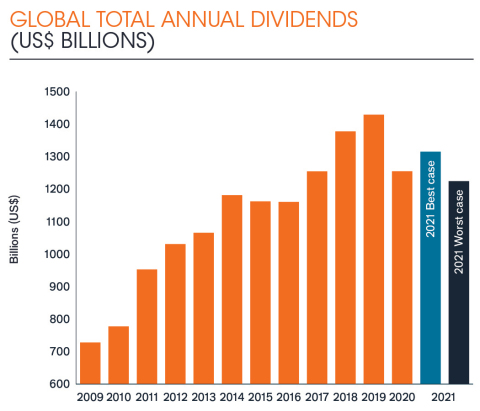

Payouts are expected to fall in Q1 2021, although the decline is likely to be smaller than between Q2 and Q4 2020. The outlook for the full year remains extremely uncertain. The pandemic has intensified in many parts of the world, even as vaccine rollouts provide hope. Importantly, banking dividends will resume in countries where they were curtailed, but they will not come close to 2019 levels in Europe and the UK, and this will limit the potential for growth. Those parts of the world that proved resilient in 2020 look likely to repeat this performance in 2021, but some sectors are likely to continue to struggle until economies can reopen fully.

A slow escape from the pandemic, and the drag caused by the first quarter, suggest that global dividends may fall by

Matt Peron, Director of Research at Janus Henderson said: “Covid-19’s impact on dividends varied significantly across different regions and sectors, which underscores the importance of taking a diversified approach to income investing. With the first set of 2021 dividend announcements in the US looking better than projected, central-bank policy expected to keep interest rates low and economies poised to rebound as vaccine distribution expands, equity income strategies will be increasingly important for many investors.”

Unless otherwise stated all data is sourced by Janus Henderson Investors as of 31 December 2020.

Past performance is no guarantee of future results. International investing involves certain risks and increased volatility not associated with investing solely in the UK. These risks included currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavourable political or legal developments.

Notes to editors

Janus Henderson Group (JHG) is a leading global active asset manager dedicated to helping investors achieve long-term financial goals through a broad range of investment solutions, including equities, fixed income, quantitative equities, multi-asset and alternative asset class strategies.

At 30 September 2020, Janus Henderson had approximately US

Methodology

Each year Janus Henderson analyse dividends paid by the 1,200 largest firms by market capitalisation (as at 31/12 before the start of each year). Dividends are included in the model on the date they are paid. Dividends are calculated gross, using the share count prevailing on the pay date (this is an approximation because companies in practice fix the exchange rate a little before the pay date), and converted to US$ using the prevailing exchange rate. Where a scrip dividend is offered, investors are assumed to opt

This press release is solely for the use of members of the media and should not be relied upon by personal investors, financial advisers or institutional investors. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Capital International Limited (reg no. 3594615), Henderson Global Investors Limited (reg. no. 906355), Henderson Investment Funds Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Henderson Management S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Henderson Secretarial Services Limited (incorporated and registered in England and Wales, registered no. 1471624, registered office 201 Bishopsgate, London EC2M 3AE) is the name under which company secretarial services are provided. All these companies are wholly owned subsidiaries of Janus Henderson Group plc. (incorporated and registered in Jersey, registered no. 101484, with registered office at 47 Esplanade, St Helier, Jersey JE1 0BD).

[Janus Henderson, Janus, Henderson, Perkins, Intech, VelocityShares, Knowledge Shared, Knowledge. Shared and Knowledge Labs] are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210222005102/en/