Jaguar Mining Provides Update on Faina Access and Intersects High Grades in Development and Diamond Drill Holes

Jaguar Mining has announced significant progress in its Faina Project, part of the MTL Mining Complex in Minas Gerais, Brazil. Recent diamond drilling and channel sampling have intersected high-grade gold mineralization. Key drilling results include 20.17 g/t Au over 6.62m and 8.54 g/t Au over 4.72m in the J lens, and 14.42 g/t Au over 6.75m and 13.31 g/t Au over 6.40m in the H lens. The company plans further development and production ramp-up through 2024, aiming for production by 2025. Jaguar has invested $15 million in Faina since 2022. As of the latest update, Faina has Probable Mineral Reserves of 132 koz, Measured and Indicated Mineral Resources of 233 koz, and Inferred Mineral Resources of 232 koz. The ongoing exploration aims to expand resources and upgrade classifications, with mined material to be processed at the MTL mill.

- High-grade gold intersections: 20.17 g/t Au over 6.62m and 8.54 g/t Au over 4.72m in J lens.

- Significant channel sampling results: 14.42 g/t Au over 6.75m and 13.31 g/t Au over 6.40m in H lens.

- Planned production ramp-up by 2025.

- Investment of $15 million in Faina development since 2022.

- Probable Mineral Reserves: 132 koz.

- Measured and Indicated Mineral Resources: 233 koz.

- Inferred Mineral Resources: 232 koz.

- Ongoing exploration to expand and upgrade resource classifications.

- Additional 1,700m of development required, including 560m of secondary development.

- Significant capital investment still needed to achieve production targets.

DEVELOPMENT CHANNEL SAMPLES - H LENS

- 14.42 g/t Au over an estimated true channel width of 6.75m

- 13.31 g/t Au over an estimated true channel width of 6.40m

DIAMOND DRILLING - J LENS

- 20.17 g/t Au over an estimated true width of 6.62m in hole FAI0018

- 8.54 g/t Au over an estimated true width of 4.72m in hole FAI0020

- 6.46 g/t Au over an estimated true width of 9.66m in hole FAI0024

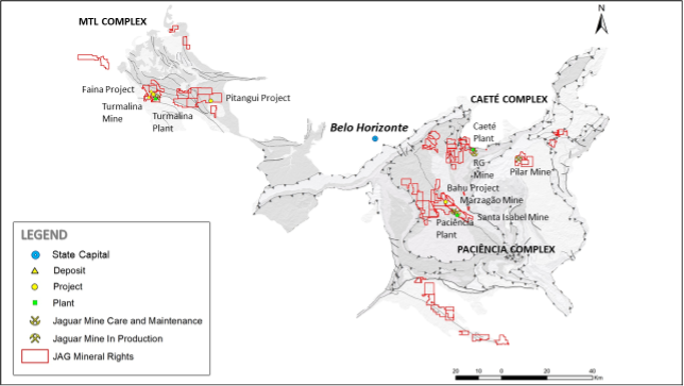

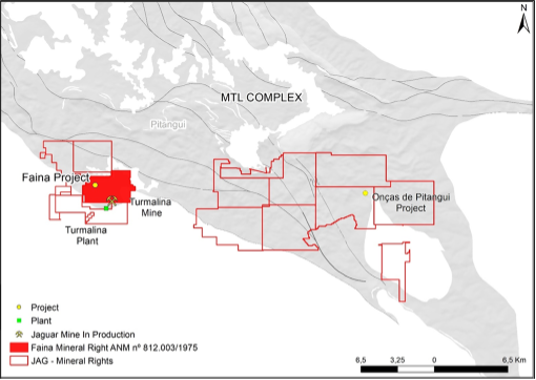

TORONTO, ON / ACCESSWIRE / May 21, 2024 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) is pleased to provide an update and announce that access development and concomitant mineral resource delineation diamond drilling has intersected high-grade mineralization at its Faina Project ("Faina"). Faina is part of the Company's MTL Mining Complex which also includes its Turmalina Mine, and is located in the state of Minas Gerais, Brazil, approximately 130 kilometers northwest of the city of Belo Horizonte.

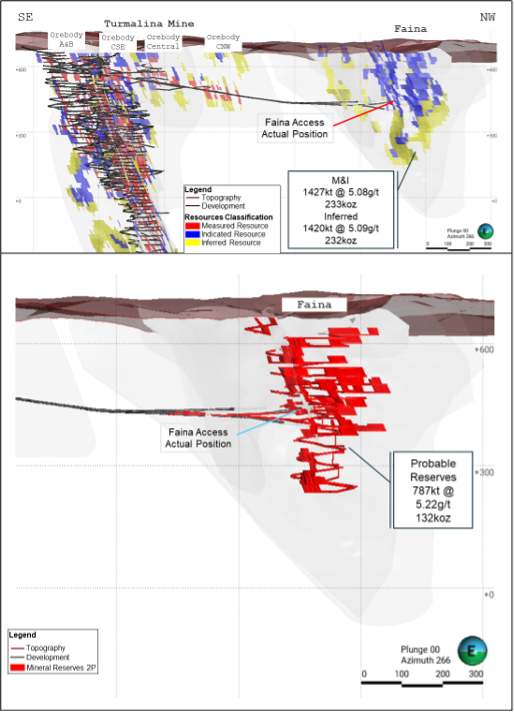

In December 2023, the Company released an NI 43-101 Technical Report (see Press Release dated December 18, 2023) announcing Probable Mineral Reserves for Faina of 132 koz (787 kt @ 5.22 g/t Au), Measured and Indicated Mineral Resources of 233 koz (1,427 kt @ 5.08 g/t Au) and Inferred Mineral Resources of 232 koz (1,420 kt @ 5.09 g/t Au).

Since development of the project commenced in 2022, approximately 3,760m of primary access development from the Turmalina Mine to Faina has been achieved, and a further 1,700m of development is planned for 2024, including approximately 560m of secondary productive development. To date, the Company has invested approximately US

Vern Baker, President, and CEO of Jaguar Mining stated: "We are delighted to have reached high grade mineralization in Faina access development and definition diamond drilling. Primary access development and infill diamond drilling will continue to open and better define the mineralized areas through 2024 as the project ramps up to planned production levels in 2025. Our initial plan is to feed mined material through our MTL mill while continuing with focused metallurgical testwork which will inform longer term processing options. Going forward exploration will focus on expanding the Mineral Resources inventory at Faina as well as conversion of Inferred Mineral Resources to higher classification categories."

Figure 1. Location of the MTL Mining Complex, Turmalina Mine and Faina Project relative to Jaguar's other operational areas in Minas Gerais, Brazil

Figure 2. Location of the Faina Project relative to Jaguar´s MTL Mining Complex and Turmalina Mine

Figure 3. Long Section showing the location of access development from Turmalina Mine to Faina

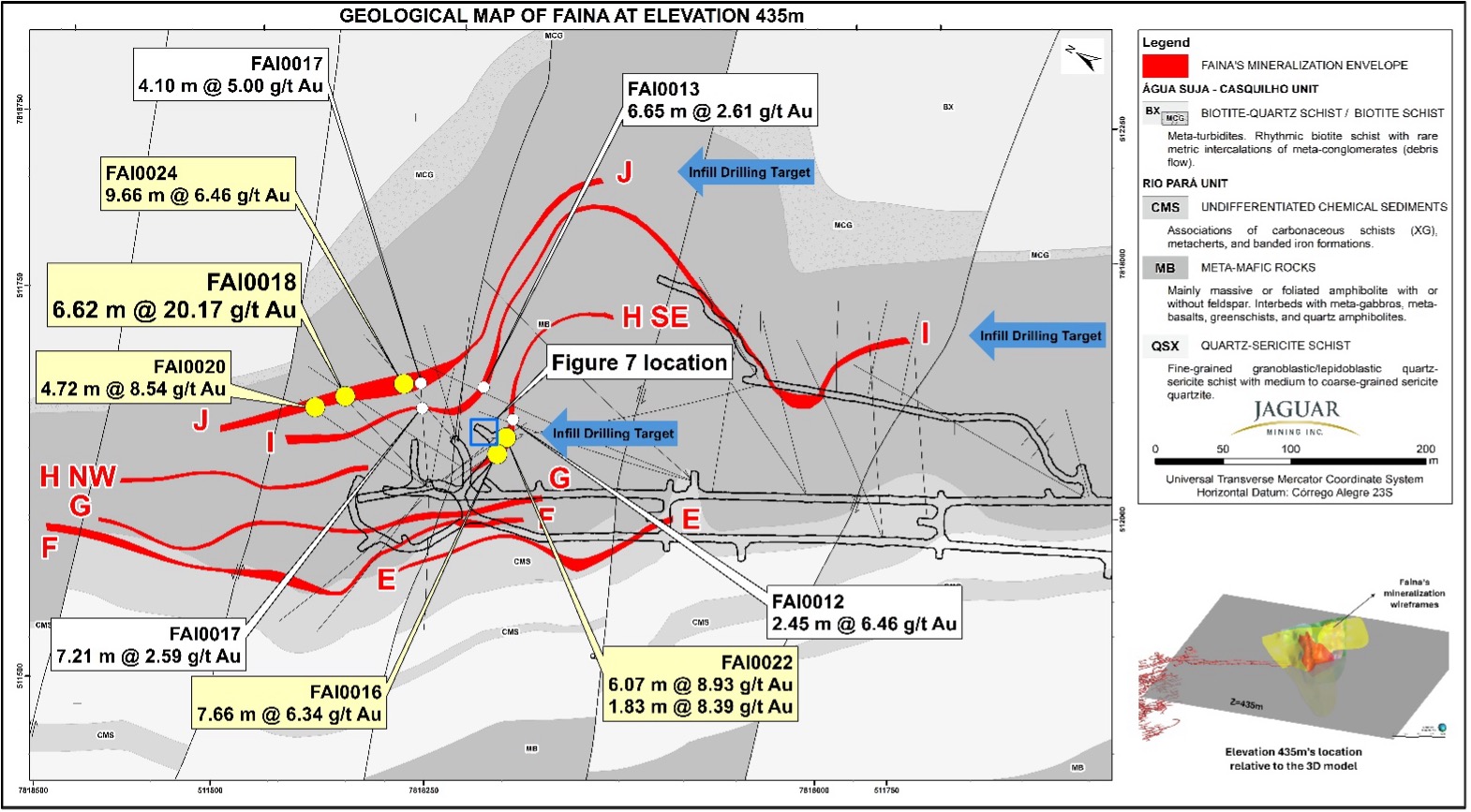

Faina Mineralization

Gold mineralization is hosted within a series of six separate structurally and stratigraphically controlled mineralized lenses defined as lens E (undifferentiated chemical sediments), and lens F to lens J (meta-mafic rocks). These mineralized lenses occur over several stratigraphic intervals within a mafic volcanic package (amphibolite facies) and are characterized by very fine to fine grained massive to disseminated sulfide rich zones which are both conformable and unconformable with bedding, often accompanied by quartz veinlets and stringers. Sulfides are generally 5

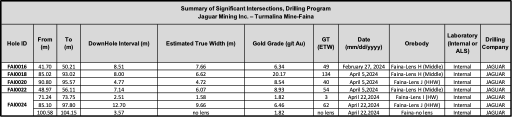

Faina Diamond Drilling and Channel Sampling Results

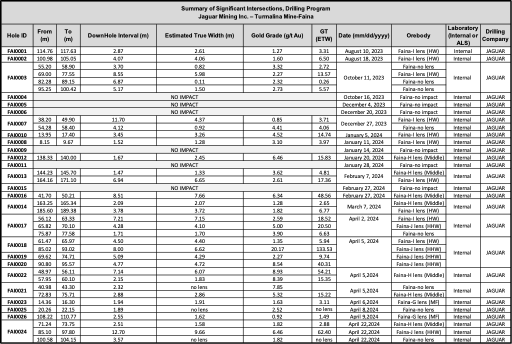

Resource definition diamond drilling successfully intersected the J lens, I lens and H lens as modelled. High grade intercepts with grade x thickness (GT) values greater than 25 (GT) are tabulated below in Table 1. A plan view showing the location of the target lens and diamond drill impact results is presented below in Figure 4.

Figure 4. Plan view showing the location of access development from Turmalina Mine to Faina and diamond drilling intersections. Note that high grade mineralization has been intersected in preliminary development on the H lens, see Figure 7 for detail.

Table 1. Significant diamond drilling impacts with grade x thickness (GT) > 25

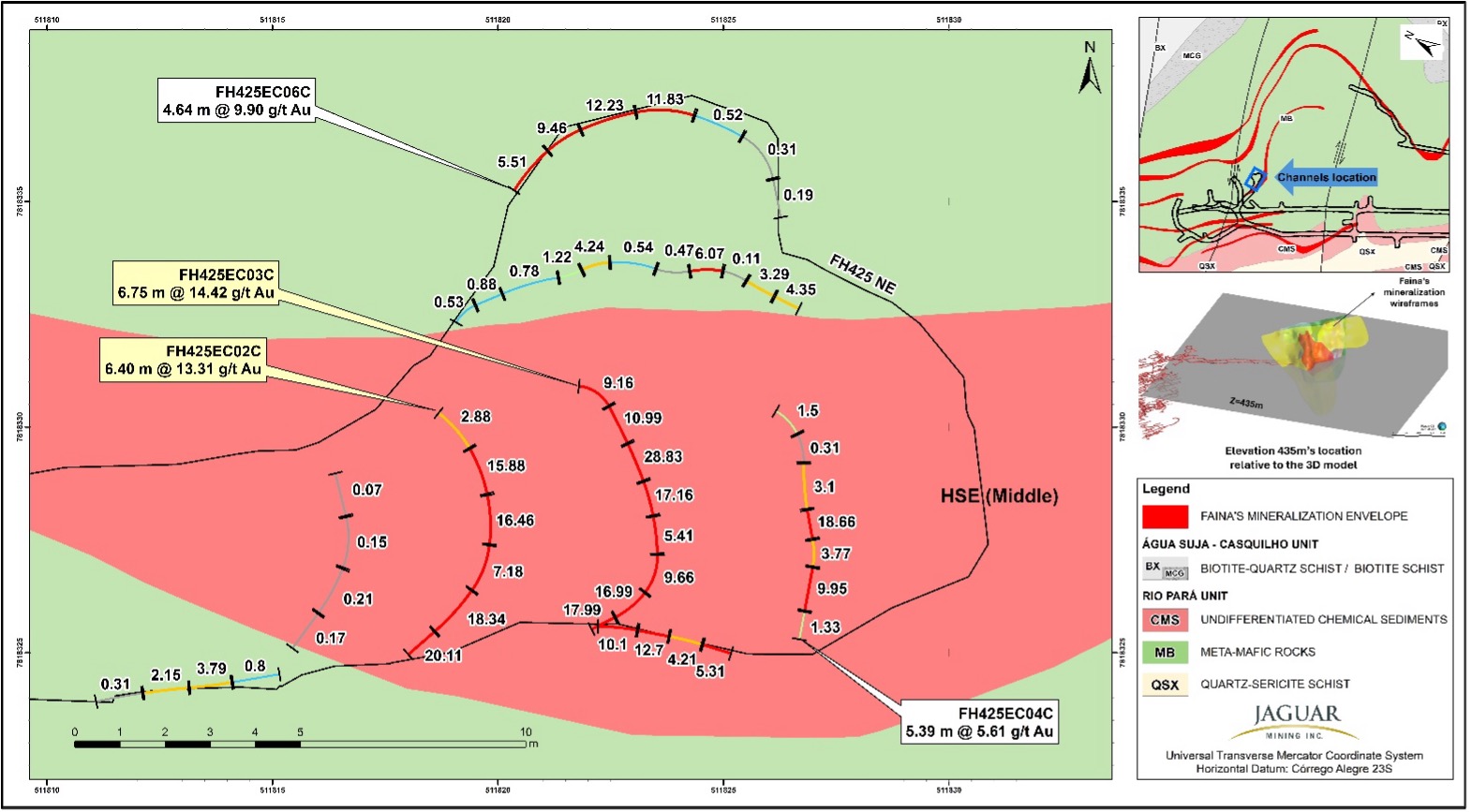

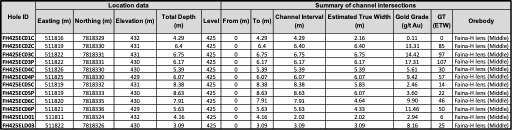

Faina Lens H Development Channel Sample Results

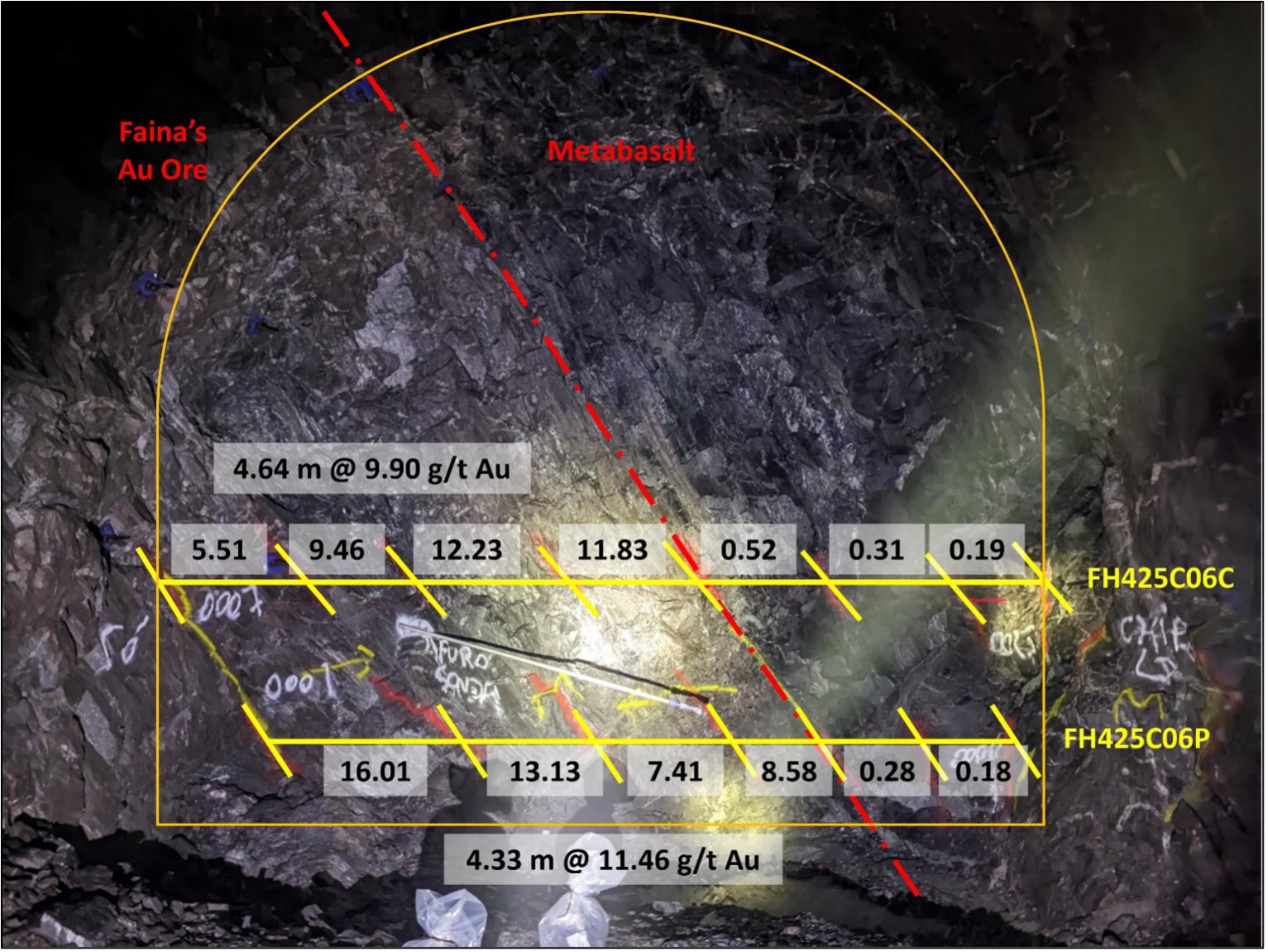

Positive channel sampling results have been intersected in initial mineralized development on Lens H. The individual sample results and composites are presented in Figure 7 below and tabulated in Appendix 2, Table 4.

Figure 5. Faina Lens H development. Plan showing the location and results of development face channel sampling

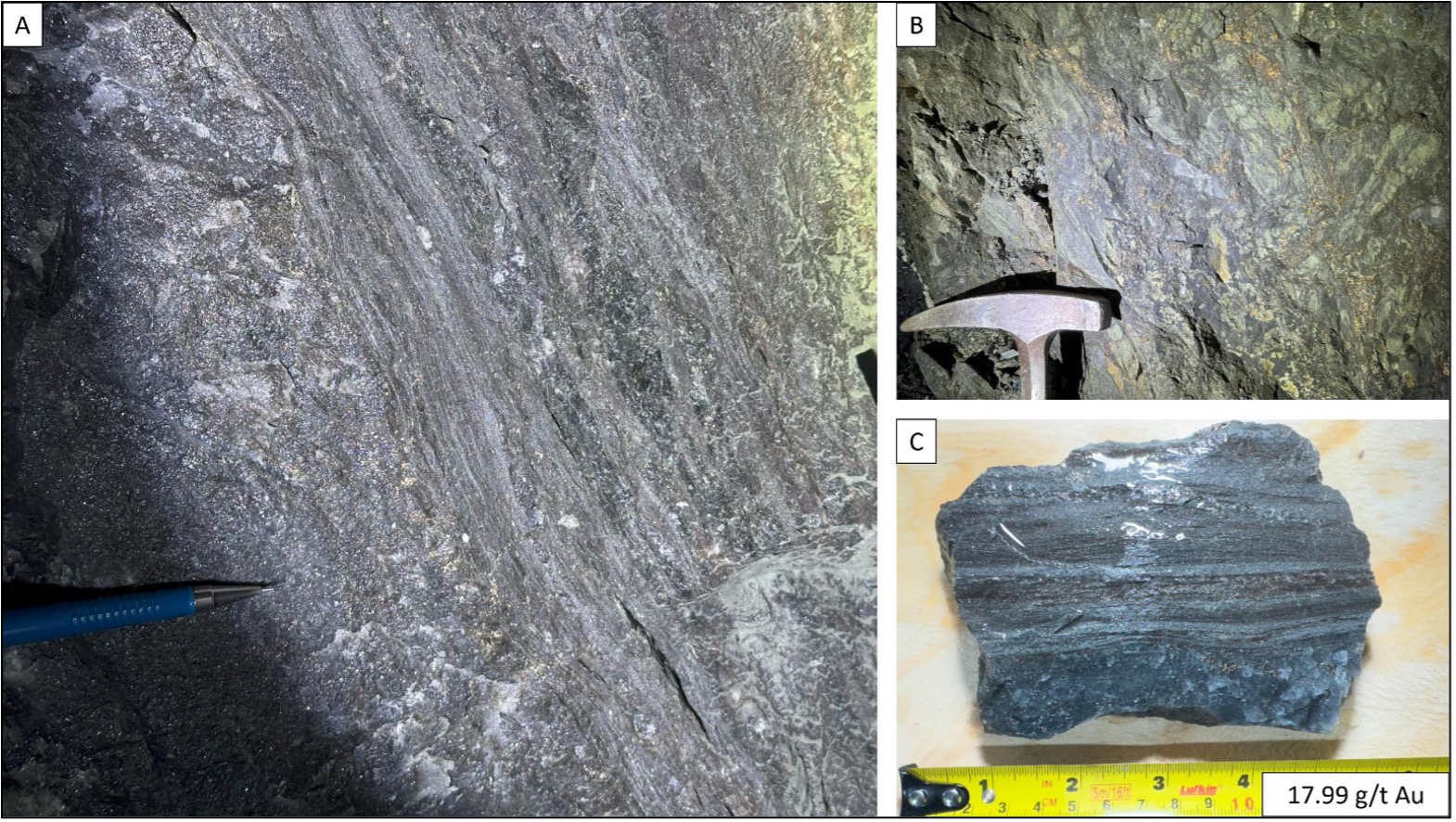

Figure 6. Lens H development. A = Faina's sulphide-rich hydrothermalite Au ore exposed in gallery FH435. Note multiple laminae of tiny arsenopyrite crystals aggregate. B = Faina's footwall style of mineralization: sulphide (pyrrhotite-rich) metachert. C = Faina rock chip sample from lens H with a grade of 17.99 g/t Au.

Figure 7. Faina development gallery (intersecting H lens), showing the channels with individual sample gold assay results. Detailed location, grade and sample data are presented in Appendix 2, Table 4.

Qualified Person

Scientific and technical information contained in this press release has been reviewed and approved by Jonathan Victor Hill, BSc (Hons) (Economic Geology - UCT), FAUSIMM, Advisor Exploration and Geology to Jaguar Mining Inc., and is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the MTL Mining Complex (Turmalina Mine and Plant) and Caeté Mining Complex (Pilar and Roça Grande Mines, and Caeté Plant). The Company also owns the Paciência Mining Complex, which has been on care and maintenance since 2012. The Roça Grande Mine has been on temporary care and maintenance since April 2019. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

Vernon Baker

Chief Executive Officer

Jaguar Mining Inc.

vernon.baker@jaguarmining.com

416-847-1854

Alfred Colas

Chief Financial Officer

Jaguar Mining Inc.

alfred.colas@jaguarmining.com

416-847-1854

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, the duration of the temporary suspension of the Company's 2023 production guidance in ounces and costs, the expected future release of new guidance for 2023, the anticipated impact of planned changes in mining systems and cost cutting initiatives on the Company's future performance and production results, information related to expected sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the estimated timeline for the development of its mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR+ at www.sedarplus.ca. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

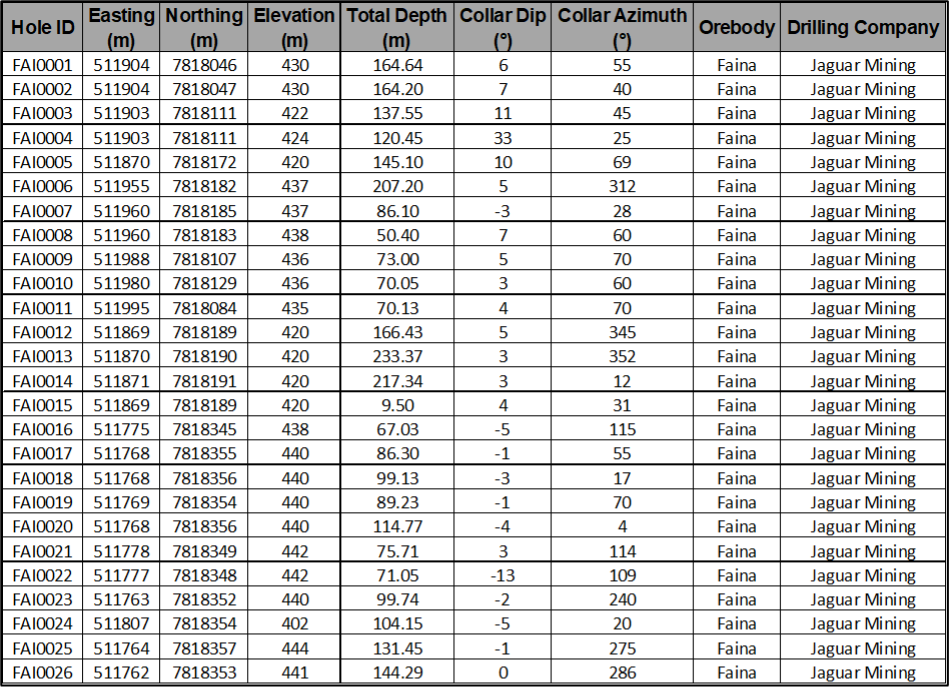

APPENDIX 1

Table 2. Faina Diamond Drilling Results

Table 3. Faina Diamond Drilling Location Data

APPENDIX 2

Table 4. Faina Development Sampling Location Data and Results Lense H (Middle)

SOURCE: Jaguar Mining Inc.

View the original press release on accesswire.com