Jaguar Announces Positive Metallurgical Testwork at High-Grade Faina Deposit Progresses Conceptual Mine Study and Plan

Jaguar Mining has reported successful metallurgical testwork at its Faina project, achieving over 85% gold recovery through a combination of gravity concentration and flotation. The Faina resource contains 261,000 tonnes at 6.87 g/t Au, totaling 58,000 oz Au, with inferred resources at 1.5 million tonnes at 7.26 g/t Au, totaling 360,000 oz Au. These results support conceptual mining studies aimed at integrating Faina into the nearby Turmalina Mine operations, enhancing production capacity and extending mine life.

- Achieved over 85% gold recovery in metallurgical tests.

- Measured and indicated resources total 261,000 tonnes at 6.87 g/t Au.

- Inferred resources amount to 1.5 million tonnes at 7.26 g/t Au.

- Project integration expected to enhance production at the Turmalina Mine.

- None.

Insights

Analyzing...

- Metallurgical Testwork achieves >

85% gold recovery via a combination of gravity concentration followed by flotation of gravity tails. - Faina Measured and Indicated Mineral Resources total 261,000 t at a grade of 6.87 g/t Au, containing 58,000 oz Au.

- Faina Inferred Mineral Resources total 1.5 million tonnes (Mt) at a grade of 7.26 g/t Au, containing 360,000 oz Au.

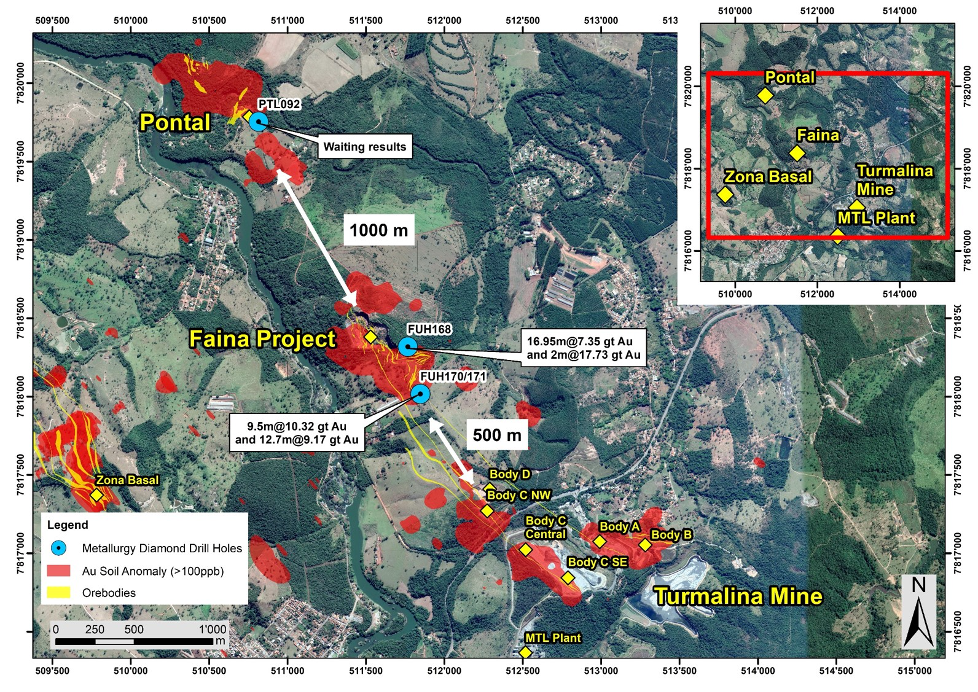

TORONTO, ON / ACCESSWIRE / September 7, 2021 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG) is pleased to announce that it is progressing conceptual mining studies and plans to advance its high-grade Faina mineral resource following positive metallurgical testwork results. The Faina project is located 500m northwest on strike from its operating Turmalina Gold Mine and Mill Complex, in Minas Gerais, Brasil.

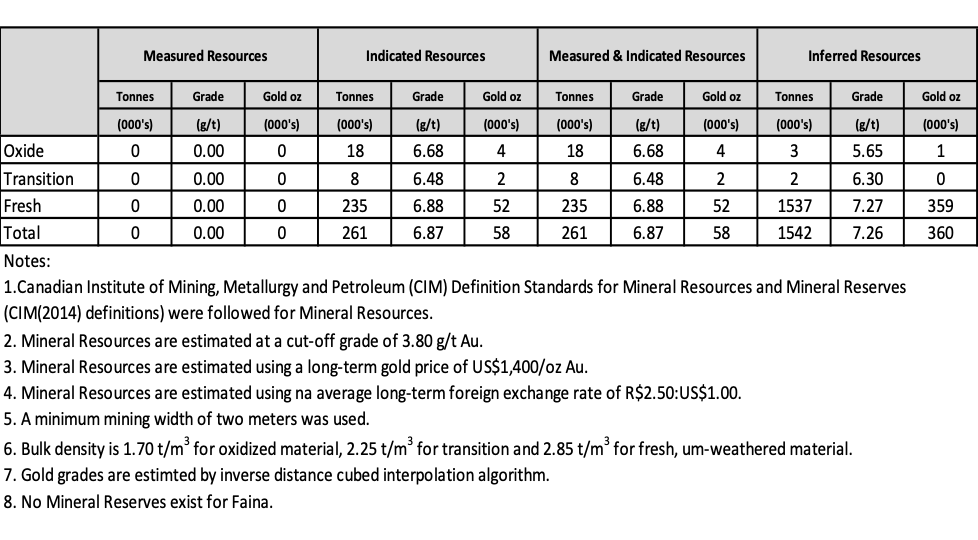

Faina measured and indicated mineral resources ("MRMR") as of December 31, 2019 (refer to press release dated 20th April, 2020), totalled 261,000 tonnes at a grade of 6.87 g/t Au, containing 58,000 oz Au And Inferred Mineral Resources totalled 1.5 million tonnes (Mt) at a grade of 7.26 g/t oz Au, containing 360,000 oz Au*.

* 1. Mineral Resources were estimated at a cut-off grade of 3.8 g/t Au. 2. Mineral Resources are estimated using a long-term gold price of US

The shallow oxide portion of the Faina deposit was previously mined via an open pit from 1992 to 1993 and processed by heap leaching, but due to the refractory nature of the sulphide mineralization beneath the oxides, this portion of the mineralization remains to be exploited. The Faina mineral resource remains open with exploration potential along strike and extending to depth.

Results from recently completed preliminary metallurgical testwork on Faina sulphide samples selected from several large - diameter (PQ) diamond drill holes demonstrated that metallurgical recoveries >

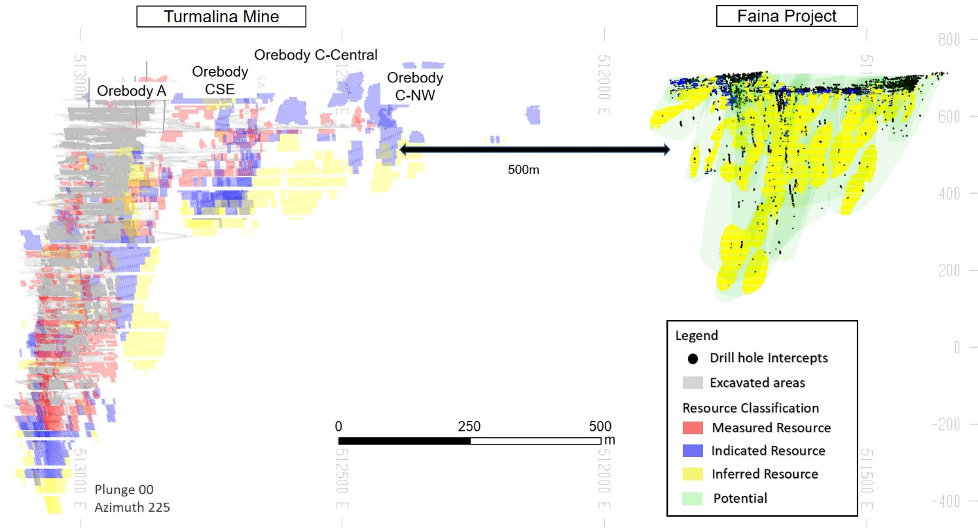

The above results will inform conceptual mine studies and plans supported by modern advances in metallurgical processes for extraction of gold from refractory ores. Importantly, the studies will incorporate the viability of adding to the production profile and life of the nearby Turmalina Mine by accessing the deposit north-west from currently active mining areas and the utilization of available additional crushing and milling capacity.

Simultaneous with the studies, Jaguar is currently engaged in data collection and analysis required for the estimation of mineral reserves for Faina, including resource drilling, geotechnical investigations, analysis of mining scenarios, and more comprehensive metallurgical test work.

Vern Baker, CEO, Jaguar Mining commented: "Faina is the first project moving from our exploration team into a potential growth project. Jaguar is focused on building exceptional value through growth that utilizes our existing capital base, land position, and effective team. There is less than a kilometre between the Faina resource and active workings at Turmalina, allowing the Faina resource to fit perfectly into our growth concept. We expect to be able to leverage our underground infrastructure as well as our under-utilized plant by adding the Faina resource into the Turmalina Mine. Faina will probably be accessed from current development headings being completed to access and expand the CNW resources in the upper levels of Turmalina. We believe we can continue to grow the Faina resource as well as upgrade inferred resources to measured and indicated with additional drilling. Our current conceptual study is targeted at determining our most effective actions to combine Faina resource into the Turmalina Life-of-Mine plan. Faina can contribute to our company very quickly as it is located within our current mining permits and will utilize existing infrastructure."

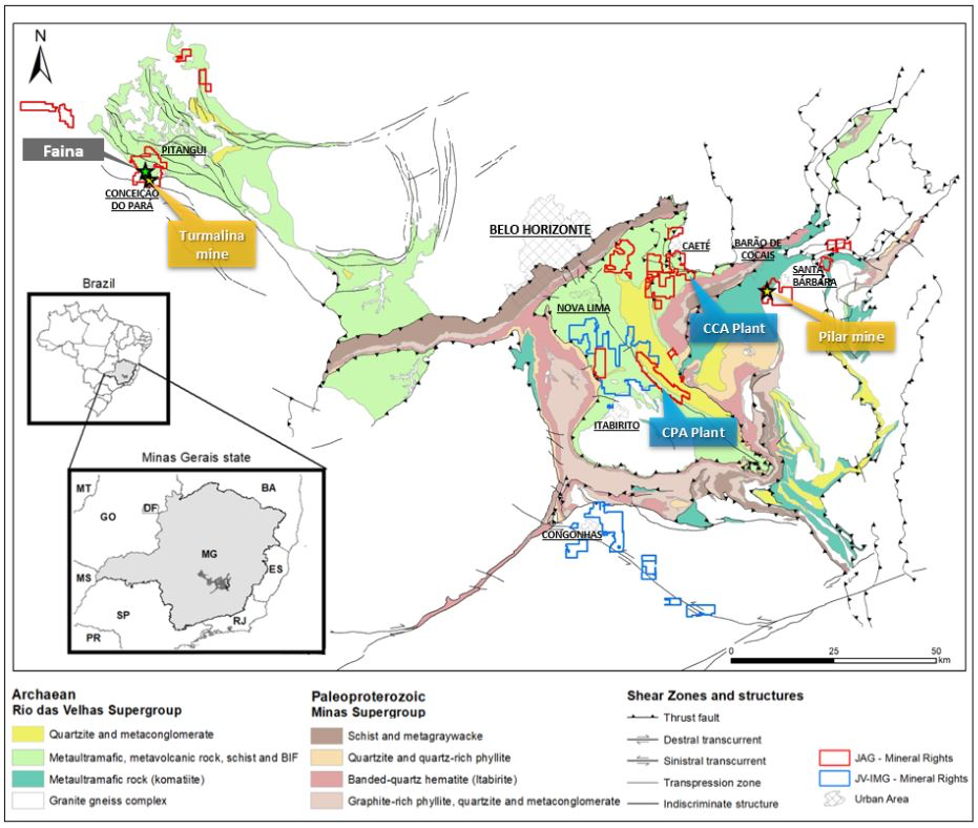

Figure 1. Location map showing the location of the Faina relative to Jaguar's Operations within the Iron Quadrangle, Minas Gerais, Brazil

Key observations from preliminary metallurgical testwork are summarized as follows:

- Two composite samples, SF1 and SF2, selected from diamond drill holes FUH168A and FUH 171 were used for recent preliminary metallurgical test work. (See figure 2 for location of drill holes).

- The estimated gold grade for composite sample SF1 was 6.88 g/t Au and for composite sample SF2 was 9.13 g/t Au.

- The preliminary metallurgical testwork comprised a series of diagnostic tests on composite samples SF1 and SF2 to determine the amenability of gold extraction using the following different techniques.

- Gravity concentration tests using a Knelson MD3 concentrator.

- Bottle roll simulated intensive leaching tests of gravity concentrate.

- Bottle roll cyanide leaching tests of gravity concentrate.

- Bottle roll simulated carbon-in-leach (CIL) tests (cyanide leaching with activated carbon) of gravity concentrate

- Alkaline leaching (NaOH digestion) and cyanide leaching tests on gravity concentrate.

- Flotation tests on the combined gravity and intensive leach tails to produce a rougher concentrate.

- Alkaline leaching and cyanide leaching tests on flotation concentrate.

- Chemical analyses were performed on the two composite samples. The average gold and sulphur grades of sample SF1 were 6.88 g/t Au and

3.21% S, respectively. Sample SF2 was higher in gold and sulphur grades than sample SF1 and averaged 9.13 g/t Au and3.36% S. - The highest gold recovery achieved was from a combination of gravity concentration followed by flotation of gravity tails on sample SF1 (

92.36% overall gold recovery). - The highest gold recoveries on sample SF2 ranged between

86.25% and88.49% from a combination of gravity concentration followed by flotation of gravity tails while this recovery was improved to89.72% with a secondary flotation test conducted using different reagents.

Table 1 Faina Mineral Resources by Category as at December 31st, 2019.

Figure 2. Plan showing location of Faina relative to the Turmalina Mine and Mill Infrastructure and principal mineralized structures. Please note the location of diamond holes FUH168A and FUH171 from which composite sulphide samples SF1 and SF2 were selected for preliminary metallurgical testwork.

Figure 3. Long section showing the location of Faina Project relative to current operational areas 500m along strike at the Turmalina Mine.

Qualified Person

Scientific and technical information contained in this press release has been reviewed and approved by Jonathan Victor Hill, BSc (Hons) (Economic Geology - UCT), FAUSIMM, Vice President Geology and Exploration, who is an employee of Jaguar Mining Inc., and is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the south-eastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar holds the second largest gold land position in the Iron Quadrangle with just over 62,000* hectares (*includes Iamgold JV Agreement Areas).

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex and Caeté Mining Complex (Pilar and Roça Grande Mines, and Caeté Plant). The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. The Roça Grande Mine has been on temporary care and maintenance since April 2019. Additional information is available on the Company's website at www.jaguarmining.com

For further information please contact:

Vernon Baker

Chief Executive Officer

Jaguar Mining Inc.

vernon.baker@jaguarmining.com

416-847-1854

Hashim Ahmed

Chief Financial Officer

Jaguar Mining Inc.

hashim.ahmed@jaguarmining.com

416-847-1854

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, expected sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the estimated timeline for the development of its mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). In addition, the Company's principal operations and mineral properties are located in Brazil and there are additional business and financial risks inherent in doing business in Brazil as compared to the United States or Canada. In Brazil, corruption represents a challenge requiring extra attention by those who conduct business there. Corruption does not only occur with the misuse of public, government or regulatory powers, it also can occur in a business's supplies, inputs and procurement functions (such as illicit rebates, kickbacks and dubious vendor relationships) as well as the inventory and product sales functions (such as inventory shrinkage or skimming). Employees as well as external parties (such as suppliers, distributors and contractors) have opportunities to commit theft, procurement fraud and other wrongs against the Company. While corruption, bribery and fraud and theft risks can never be fully eliminated, the Company reviews and implements controls to reduce the likelihood of these events occurring. The Company's present and future business operations face these risks. Accordingly, for all of the reasons above, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR at www.sedar.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

SOURCE: Jaguar Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/662871/Jaguar-Announces-Positive-Metallurgical-Testwork-at-High-Grade-Faina-Deposit-Progresses-Conceptual-Mine-Study-and-Plan