Avolon Forecasts Global Passenger Fleet to Almost Double By 2042

-

- Over

- Long-term demand to travel to see friends, family and do business undiminished by pandemic

(Graphic: Business Wire)

Avolon estimates that over

Passenger demand will continue to rise by c.

Aviation is confronting the challenge of decoupling growth from environmental impact. Trillions of dollars of new investment will be required to fund the required transition to new-technology lower emissions aircraft, to ramp up the supply of sustainable aviation fuel, and to explore new designs that pioneer alternative energy sources. Aircraft lessors will play a key role in accelerating fleet renewal, and a growing industry will attract the capital required to hit aviation’s net zero target by 2050.

Avolon’s World Fleet Forecast is available here, and the key takeaways include:

-

The regions showing the biggest increase in travel out to 2042 will be

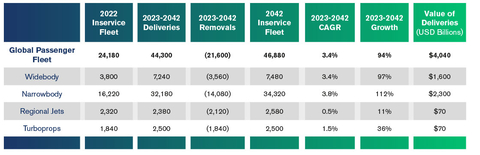

India (4.4% ),China (3.7% ),Asia (5.0% ) andLatin America (4.9% ). Mature markets such asNorth America (2.0% ) andEurope (3.1% ) will continue to grow, although at a more moderate rate. - 44,300 new aircraft will be delivered over the period and 21,600 aircraft will exit the passenger fleet through decommissioning at the end of their economic life or freighter conversion.

-

Growth of the narrowbody fleet (

112% ) will outpace widebody fleet growth (97% ) as single-aisle aircraft are able to accommodate more passengers and trans-continental flight distances. Regional Jet (11% ) and Turboprop (36% ) growth will be more modest. -

The global fleet will have transitioned to largely (

95% ) new-technology fuel-efficient aircraft by the end of the forecast period -

Airbus is set to maintain its strong market position in the narrowbody segment accounting for

58% of the global narrowbody fleet in 2042, compared to53% currently. -

Boeing will maintain its

59% share leadership of the widebody segment, with the resumption of 787 deliveries a key driver. - Supply constraints currently being experienced will continue into the second half of the decade, increasing the value of booked production slots and aircraft that have already been delivered. Those airlines that have not secured sufficient capacity will rely on lessors for new and used aircraft.

Andy Cronin, CEO of Avolon, said:

“The human desire to connect with friends and family, and to do business remains undiminished, as shown by the post-pandemic recovery in air travel. Emerging markets and their growing middle class underpin our forecast for continued expansion of the global fleet. Near-term production constraints will remain a feature and will reward those who have secured their orderbook pipeline. The resilience aviation has shown, and its anticipated long-term growth trend, reaffirms the investment case for aircraft as an asset class.”

Jim Morrison, Chief Risk Officer of Avolon and co-author of the report, said:

“Whilst the pace of growth in demand for travel will moderate, increasing GDP per capita will drive the global fleet to nearly double by 2042. Delivering on sustainability commitments is an imperative to secure aviation’s continued growth. Fleet renewal, scaling sustainable aviation fuel production, and the development of transformational new aircraft designs will be capital intensive. Lessors will play a critical role in the industry’s future success and net zero transition.”

About Avolon

Headquartered in

Disclaimer

This document – the Fleet Forecast - and any other materials contained in or accompanying it (collectively, the “Materials”) are provided for general information purposes only. The Materials are provided without any guarantee, condition, representation or warranty (express or implied) as to their adequacy, correctness or completeness. Any opinions, estimates, commentary or conclusions contained in the Materials represent the judgement of Avolon as at the date of the Materials and are subject to change without notice. The Materials are not intended to amount to advice on which any reliance should be placed and Avolon disclaims all liability and responsibility arising from any reliance placed on the Materials.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230613029173/en/

David Breen / Joe Brennan

Avolon Investor Relations

ir@avolon.aero

T: +353 1 231 5800

Douglas Keatinge

Avolon Head of Communications

dkeatinge@avolon.aero

T: +353 86 037 4163

Source: Avolon