IREN January 2025 Monthly Update

IREN has released its January 2025 monthly update, highlighting strong performance in Bitcoin mining operations. The company achieved an average operating hashrate of 29.0 EH/s, mining 1,521 BTC with revenue per Bitcoin of $99,789. Total revenue reached $52.0m with electricity costs of $12.9m, maintaining a robust hardware profit margin of 75%.

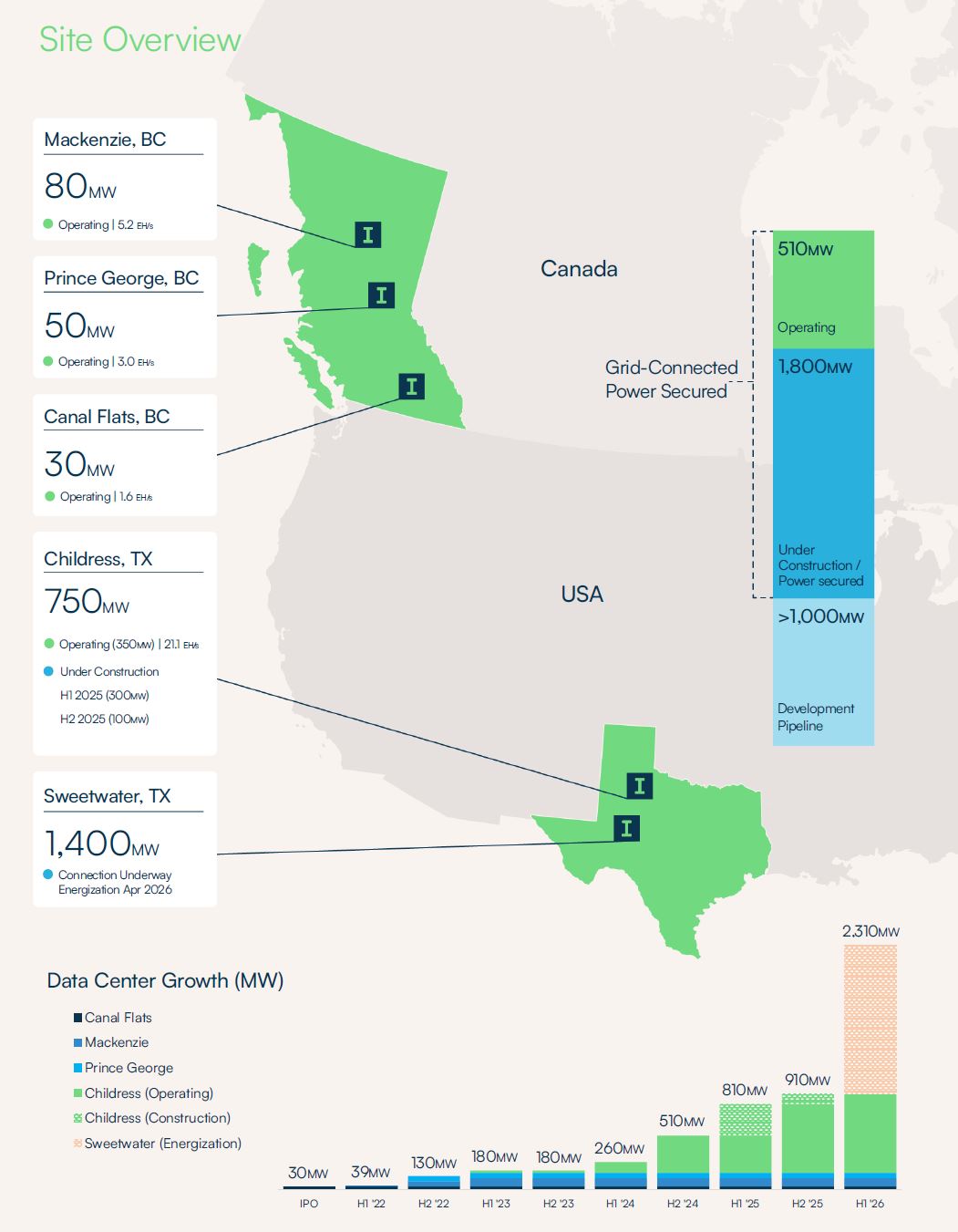

The company's AI Cloud Services generated revenue of $0.8m with a 96% hardware profit margin. IREN is progressing with significant infrastructure projects, including the 750MW Childress Project expansion and the 1.4GW Sweetwater Project, where construction of the substation is set to commence in early 2025. The company is on track to achieve 50 EH/s in 5 months and is implementing direct-to-chip liquid cooling for AI/HPC operations.

IREN ha pubblicato il suo aggiornamento mensile di gennaio 2025, evidenziando un'ottima performance nelle operazioni di mining di Bitcoin. L'azienda ha raggiunto un hashrate operativo medio di 29.0 EH/s, estraendo 1.521 BTC con entrate per Bitcoin di $99.789. Il fatturato totale ha raggiunto $52.0 milioni, con costi elettrici di $12.9 milioni, mantenendo un robusto margine di profitto hardware del 75%.

I servizi AI Cloud dell'azienda hanno generato entrate di $0.8 milioni con un margine di profitto hardware del 96%. IREN sta progredendo con importanti progetti infrastrutturali, inclusa l'espansione del progetto Childress da 750MW e il progetto Sweetwater da 1.4GW, dove la costruzione della sottostazione è prevista per cominciare all'inizio del 2025. L'azienda è sulla buona strada per raggiungere 50 EH/s in 5 mesi e sta implementando un raffreddamento a liquido diretto ai chip per le operazioni AI/HPC.

IREN ha publicado su actualización mensual de enero de 2025, destacando un fuerte desempeño en las operaciones de minería de Bitcoin. La compañía logró un hashrate operativo promedio de 29.0 EH/s, extrayendo 1,521 BTC con ingresos por Bitcoin de $99,789. Los ingresos totales alcanzaron $52.0 millones con costos de electricidad de $12.9 millones, manteniendo un robusto margen de ganancia de hardware del 75%.

Los servicios de AI Cloud de la compañía generaron ingresos de $0.8 millones con un margen de ganancia de hardware del 96%. IREN está avanzando en proyectos de infraestructura significativos, incluyendo la expansión del Proyecto Childress de 750MW y el Proyecto Sweetwater de 1.4GW, donde la construcción de la subestación comenzará a principios de 2025. La empresa está en camino de alcanzar 50 EH/s en 5 meses y está implementando refrigeración por líquido directo al chip para operaciones de AI/HPC.

IREN은 2025년 1월 월간 업데이트를 발표하며 비트코인 채굴 운영에서 강력한 성과를 강조했습니다. 이 회사는 29.0 EH/s의 평균 운영 해시레이트를 기록하며 1,521 BTC를 채굴하고 비트코인당 수익을 $99,789 달성했습니다. 총 수익은 $52.0백만에 달하고 전기 비용은 $12.9백만으로 하드웨어 이익률 75%를 유지하고 있습니다.

회사의 AI 클라우드 서비스는 $0.8백만의 수익을 올렸고 하드웨어 이익률은 96%입니다. IREN은 750MW의 칠드레스 프로젝트 확장과 1.4GW의 스위트워터 프로젝트를 포함한 중요한 인프라 프로젝트를 진행하고 있으며, 2025년 초에 변전소 건설이 시작될 예정입니다. 회사는 5개월 이내에 50 EH/s를 달성할 예정이며 AI/HPC 작업을 위한 칩 직접 액체 냉각을 구현하고 있습니다.

IREN a publié sa mise à jour mensuelle de janvier 2025, mettant en avant une forte performance dans les opérations de minage de Bitcoin. La société a atteint une hashrate opérationnelle moyenne de 29,0 EH/s, minant 1.521 BTC avec un revenu par Bitcoin de 99.789 $. Le revenu total a atteint 52,0 millions de dollars avec des coûts d'électricité de 12,9 millions de dollars, maintenant une robuste marge bénéficiaire matériel de 75 %.

Les services Cloud AI de l'entreprise ont généré un revenu de 0,8 million de dollars avec une marge bénéficiaire matériel de 96 %. IREN progresse dans d'importants projets d'infrastructure, y compris l'extension du projet Childress de 750 MW et le projet Sweetwater de 1,4 GW, où la construction de la sous-station devrait commencer début 2025. L'entreprise est en bonne voie pour atteindre 50 EH/s en 5 mois et met en œuvre un refroidissement liquide direct au chip pour les opérations AI/HPC.

IREN hat sein monatliches Update für Januar 2025 veröffentlicht und hebt dabei die starke Leistung im Bitcoin-Mining hervor. Das Unternehmen erzielte eine durchschnittliche Betriebs-Hashrate von 29.0 EH/s, indem es 1.521 BTC mit einem Umsatz pro Bitcoin von 99.789 $ minte. Der Gesamtumsatz erreichte 52,0 Millionen Dollar bei Stromkosten von 12,9 Millionen Dollar und hält eine robuste Hardware-Gewinnmarge von 75 % bei.

Die AI-Cloud-Dienste des Unternehmens erzielten Einnahmen von 0,8 Millionen Dollar mit einer Gewinnmarge von 96 % auf Hardware. IREN macht Fortschritte bei bedeutenden Infrastrukturprojekten, einschließlich der Erweiterung des Childress-Projekts mit 750 MW und des Sweetwater-Projekts mit 1,4 GW, für das der Bau des Umspannwerks Anfang 2025 beginnen soll. Das Unternehmen ist auf Kurs, in 5 Monaten 50 EH/s zu erreichen und implementiert eine direkte Chip-Flüssigkeitskühlung für AI/HPC-Betrieb.

- Strong Bitcoin mining performance with 1,521 BTC mined in January

- Healthy hardware profit margin of 75% in Bitcoin mining operations

- High AI Cloud Services profit margin of 96%

- Significant infrastructure expansion with 750MW Childress and 1.4GW Sweetwater projects

- Operating hashrate increased to 29.0 EH/s from 28.1 EH/s in December

- Slight decrease in hardware profit margin from 77% to 75% month-over-month

- Increased electricity costs from $12.1m to $12.9m

- AI Cloud Services revenue remained flat at $0.8m compared to December

Insights

IREN's January performance demonstrates exceptional operational execution and strategic positioning in both Bitcoin mining and AI infrastructure. The 29 EH/s average operating hashrate represents a remarkable 47.2% increase from November 2024, showcasing aggressive scaling capabilities despite voluntary curtailment at Childress.

The economics are particularly compelling:

Strategic developments deserve attention:

- The advancement of the 1.4GW Sweetwater Project, with EPC contractor engagement and imminent construction start, positions IREN for significant scaling potential

- The AI Cloud Services segment, though currently modest at

$0.8 million revenue, maintains industry-leading96% margins and shows promising growth with new NVIDIA H200 contracts - The 2,310 MW grid-connected power portfolio represents a strategic asset amid increasing demand for cloud and colocation services

The company's dual focus on Bitcoin mining efficiency and AI infrastructure development creates a resilient business model. The strategic timing of the ATM facility announcement provides financial flexibility for growth initiatives while maintaining a strong balance sheet position.

SYDNEY, Feb. 06, 2025 (GLOBE NEWSWIRE) -- IREN Limited (NASDAQ: IREN) (together with its subsidiaries, “IREN” or “the Company”), today published its monthly update for January 2025.

January Highlights

- On-track for 50 EH/s in 5 months

- Installing direct-to-chip liquid cooling for AI / HPC

- Advancing construction at 1.4GW Sweetwater Project

- Progressing multi-GW development pipeline

| Key Metrics | Jan 25 | Dec 24 | Nov 24 | |||||

| Bitcoin Mining | ||||||||

| Average operating hashrate | 29.0 EH/s | 28.1 EH/s | 19.7 EH/s | |||||

| Bitcoin mined1 | 521 BTC | 529 BTC | 379 BTC | |||||

| Revenue (per Bitcoin) | $99,789 | $98,524 | $86,065 | |||||

| Electricity cost (per Bitcoin)2 | ($24,683) | ($22,799) | ($22,575) | |||||

| Revenue | ||||||||

| Electricity costs2 | ( | ( | ( | |||||

| Hardware profit3 | ||||||||

| Hardware profit margin4 | | | | |||||

| AI Cloud Services | ||||||||

| Revenue | ||||||||

| Electricity costs2 | ( | ( | ( | |||||

| Hardware profit3 | ||||||||

| Hardware profit margin4 | | | | |||||

Management Commentary

“In January, our Bitcoin mining business continued to deliver strong hardware profits. We also announced a new at-the-market facility that provides flexibility to fund accretive investments across the business and continue to explore alternative funding options to accelerate our growth,” said Daniel Roberts, IREN Co-Founder and Co-CEO.

“Recent announcements regarding Stargate highlight the strategic value of IREN’s 2,310 MW grid-connected power portfolio, with an increase in observed demand for our cloud and colocation services since the start of this year, and following the DeepSeek release. We look forward to addressing the market and sharing additional detail on our financial performance, strategic priorities and growth outlook at our upcoming Q2 FY25 earnings.”

Technical Commentary

- Operating hashrate averaged 29 EH/s, driven by voluntary price curtailment at Childress and de-racking of certain miners to facilitate S21 XP miner upgrades

- Mining unit economics remained robust with hardware profit margin of

75% achieved and average revenue per Bitcoin of$99,789 - Childress power price of 3.6 c/kWh (3.0 c/kWh since transition to spot pricing)5

- AI Cloud Services revenue increased

6% , new NVIDIA H200 contracts closed post month-end. Slightly higher electricity costs were attributable to NVIDIA H200 commissioning and customer testing activities

Upcoming Events

|

Glenn Harrison, VP Operations – Panel Session on Liquid Cooling Solutions (PTC Conference, Jan 25)

Project Update

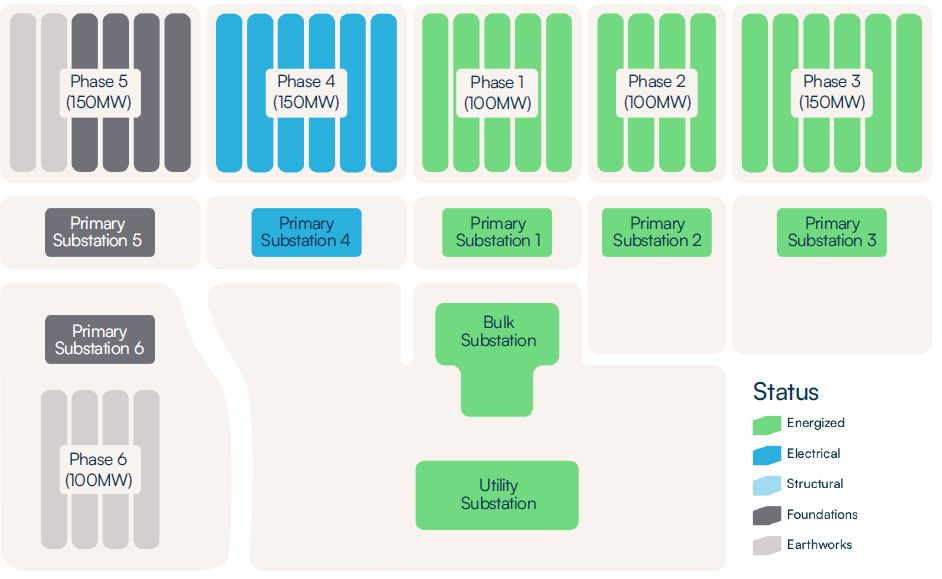

750MW Childress Project

- Expanding to 750MW: construction of final 400MW underway (Phase 4 - 6)

1.4GW Sweetwater Project

- Engaged leading EPC contractor: construction of 1.4GW substation commencing in early 2025

- General site-works: commencing in coming weeks, including construction and installation of site access points, interior roads, office, warehousing, lay-down areas and security

Multi-GW development pipeline

- Internal development team: progressing new grid-interconnection agreements with focus on large power capacity sites

Childress Construction (Feb 2025)

Sweetwater Utility Substation

Childress Project Status

Site Overview

Assumptions and Notes

- Bitcoin and Bitcoin mined in this investor update are presented in accordance with our revenue recognition policy which is determined on a Bitcoin received basis (post deduction of mining pool fees).

- Electricity costs are presented on a net basis and calculated as IFRS electricity charges, ERS revenue (included in other income) and ERS fees (included in other operating expenses). Figures are based on current internal estimates and exclude REC purchases.

- Hardware profit is calculated as revenue less electricity costs. Hardware profit is a non-IFRS financial measure and is provided in addition to, and not as a substitute for, measures of financial performance prepared in accordance with IFRS. Refer to the Forward-Looking Statements disclaimer.

- Hardware profit margin for Bitcoin Mining and AI Cloud Services is calculated as revenue less electricity costs, divided by revenue (for each respective revenue stream) and excludes all other costs.

- Childress power price since transition to spot pricing calculated on a monthly average basis for the period from August 2024 to January 2025.

Contacts

| Media Jon Snowball Sodali & Co +61 477 946 068 +61 423 136 761 Gillian Roberts Aircover Communications +1 818 395 2948 gillian.roberts@aircoverpr.com | Investors Lincoln Tan IREN +61 407 423 395 lincoln.tan@iren.com |

To keep updated on IREN’s news releases and SEC filings, please subscribe to email alerts at

https://iren.com/investor/ir-resources/email-alerts.

Forward-Looking Statements

This investor update includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or IREN’s future financial or operating performance. For example, forward-looking statements include but are not limited to the Company’s business strategy, expected operational and financial results, and expected increase in power capacity and hashrate. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “may,” “can,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “target”, “will,” “estimate,” “predict,” “potential,” “continue,” “scheduled” or the negatives of these terms or variations of them or similar terminology, but the absence of these words does not mean that statement is not forward-looking. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking.

These forward-looking statements are based on management’s current expectations and beliefs. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause IREN’s actual results, performance or achievements to be materially different from any future results performance or achievements expressed or implied by the forward looking statements, including, but not limited to: Bitcoin price and foreign currency exchange rate fluctuations; IREN’s ability to obtain additional capital on commercially reasonable terms and in a timely manner to meet its capital needs and facilitate its expansion plans; the terms of any future financing or any refinancing, restructuring or modification to the terms of any future financing, which could require IREN to comply with onerous covenants or restrictions, and its ability to service its debt obligations, any of which could restrict its business operations and adversely impact its financial condition, cash flows and results of operations; IREN’s ability to successfully execute on its growth strategies and operating plans, including its ability to continue to develop its existing data center sites and to diversify and expand into the market for high performance computing (“HPC”) solutions it may offer (including the market for AI Cloud Services); IREN’s limited experience with respect to new markets it has entered or may seek to enter, including the market for HPC solutions (including AI Cloud Services); expectations with respect to the ongoing profitability, viability, operability, security, popularity and public perceptions of the Bitcoin network; expectations with respect to the profitability, viability, operability, security, popularity and public perceptions of any current and future HPC solutions (including AI Cloud Services) that IREN offers; IREN’s ability to secure and retain customers on commercially reasonable terms or at all, particularly as it relates to its strategy to expand into markets for HPC solutions (including AI Cloud Services); IREN’s ability to manage counterparty risk (including credit risk) associated with any current or future customers, including customers of its HPC solutions (including AI Cloud Services) and other counterparties; the risk that any current or future customers, including customers of its HPC solutions (including AI Cloud Services), or other counterparties may terminate, default on or underperform their contractual obligations; Bitcoin global hashrate fluctuations; IREN’s ability to secure renewable energy, renewable energy certificates, power capacity, facilities and sites on commercially reasonable terms or at all; delays associated with, or failure to obtain or complete, permitting approvals, grid connections and other development activities customary for greenfield or brownfield infrastructure projects; IREN’s reliance on power and utilities providers, third party mining pools, exchanges, banks, insurance providers and its ability to maintain relationships with such parties; expectations regarding availability and pricing of electricity; IREN’s participation and ability to successfully participate in demand response products and services and other load management programs run, operated or offered by electricity network operators, regulators or electricity market operators; the availability, reliability and/or cost of electricity supply, hardware and electrical and data center infrastructure, including with respect to any electricity outages and any laws and regulations that may restrict the electricity supply available to IREN; any variance between the actual operating performance of IREN’s miner hardware achieved compared to the nameplate performance including hashrate; IREN’s ability to curtail its electricity consumption and/or monetize electricity depending on market conditions, including changes in Bitcoin mining economics and prevailing electricity prices; actions undertaken by electricity network and market operators, regulators, governments or communities in the regions in which IREN operates; the availability, suitability, reliability and cost of internet connections at IREN’s facilities; IREN’s ability to secure additional hardware, including hardware for Bitcoin mining and any current or future HPC solutions (including AI Cloud Services) it offers, on commercially reasonable terms or at all, and any delays or reductions in the supply of such hardware or increases in the cost of procuring such hardware; expectations with respect to the useful life and obsolescence of hardware (including hardware for Bitcoin mining as well as hardware for other applications, including any current or future HPC solutions (including AI Cloud Services) IREN offers); delays, increases in costs or reductions in the supply of equipment used in IREN’s operations; IREN’s ability to operate in an evolving regulatory environment; IREN’s ability to successfully operate and maintain its property and infrastructure; reliability and performance of IREN’s infrastructure compared to expectations; malicious attacks on IREN’s property, infrastructure or IT systems; IREN’s ability to maintain in good standing the operating and other permits and licenses required for its operations and business; IREN’s ability to obtain, maintain, protect and enforce its intellectual property rights and confidential information; any intellectual property infringement and product liability claims; whether the secular trends IREN expects to drive growth in its business materialize to the degree it expects them to, or at all; any pending or future acquisitions, dispositions, joint ventures or other strategic transactions; the occurrence of any environmental, health and safety incidents at IREN’s sites, and any material costs relating to environmental, health and safety requirements or liabilities; damage to IREN’s property and infrastructure and the risk that any insurance IREN maintains may not fully cover all potential exposures; ongoing proceedings relating to the default by two of IREN’s wholly-owned special purpose vehicles under limited recourse equipment financing facilities; ongoing securities litigation relating in part to the default; and any future litigation, claims and/or regulatory investigations, and the costs, expenses, use of resources, diversion of management time and efforts, liability and damages that may result therefrom; IREN's failure to comply with any laws including the anti-corruption laws of the United States and various international jurisdictions; any failure of IREN's compliance and risk management methods; any laws, regulations and ethical standards that may relate to IREN’s business, including those that relate to Bitcoin and the Bitcoin mining industry and those that relate to any other services it offers, including laws and regulations related to data privacy, cybersecurity and the storage, use or processing of information and consumer laws; IREN’s ability to attract, motivate and retain senior management and qualified employees; increased risks to IREN’s global operations including, but not limited to, political instability, acts of terrorism, theft and vandalism, cyberattacks and other cybersecurity incidents and unexpected regulatory and economic sanctions changes, among other things; climate change, severe weather conditions and natural and man-made disasters that may materially adversely affect IREN’s business, financial condition and results of operations; public health crises, including an outbreak of an infectious disease and any governmental or industry measures taken in response; IREN’s ability to remain competitive in dynamic and rapidly evolving industries; damage to IREN’s brand and reputation; expectations relating to Environmental, Social or Governance issues or reporting; the costs of being a public company; the increased regulatory and compliance costs of IREN ceasing to be a foreign private issuer and an emerging growth company, as a result of which it will be required, among other things, to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC commencing with its next financial year, and it will also be required to prepare its financial statements in accordance with U.S. GAAP rather than IFRS and to modify certain of its policies to comply with corporate governance practices required of a U.S. domestic issuer; and other important factors discussed under the caption “Risk Factors” in IREN’s annual report on Form 20-F filed with the SEC on August 28, 2024 as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investor Relations section of IREN’s website at https://investors.iren.com.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this investor update. Any forward-looking statement that IREN makes in this investor update speaks only as of the date of such statement. Except as required by law, IREN disclaims any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Preliminary Financial Information

The financial information presented in this investor update is not subject to the same closing procedures as our unaudited quarterly financial results and our audited annual financial results, and has not been reviewed or audited by our independent registered public accounting firm. The preliminary financial information included in this investor update does not represent a comprehensive statement of our financial results or financial position and should not be viewed as a substitute for unaudited financial statements prepared in accordance with International Financial Reporting Standards. Accordingly, you should not place undue reliance on the preliminary financial information included in this investor update.

Non-IFRS Financial Measures

This investor update includes non-IFRS financial measures, including electricity costs (presented on a net basis) and hardware profit. We provide these measures in addition to, and not as a substitute for, measures of financial performance prepared in accordance with IFRS. There are a number of limitations related to the use of non-IFRS financial measures. For example, other companies, including companies in our industry, may calculate these measures differently. The Company believes that these measures are important and supplement discussions and analysis of its results of operations and enhances an understanding of its operating performance.

Electricity costs are calculated as our IFRS Electricity charges, ERS revenue (included in Other income) and ERS fees (included in Other operating expenses), and excludes the cost of RECs.

Hardware Profit is calculated as revenue less electricity costs (excludes all other site, overhead and REC costs).

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/bdf96bfc-e243-4b33-8dff-1f750d982ad1

https://www.globenewswire.com/NewsRoom/AttachmentNg/2e8e57d7-f056-463d-877a-35e04e52d448

https://www.globenewswire.com/NewsRoom/AttachmentNg/31eb1c42-1974-4828-8520-654d517bd436

https://www.globenewswire.com/NewsRoom/AttachmentNg/269f1dae-b1ed-40e0-a97e-bb05aa571dd8

https://www.globenewswire.com/NewsRoom/AttachmentNg/9691a596-630d-481b-bf7f-71b7b0732447

https://www.globenewswire.com/NewsRoom/AttachmentNg/f31b7897-a31c-4352-b191-cd57f5547e6c