IREN December 2024 Monthly Update

IREN has released its December 2024 monthly update, highlighting significant achievements in Bitcoin mining and AI/HPC operations. The company mined 529 Bitcoin in December, contributing to a total of 3,984 Bitcoin mined in 2024. December's operations generated record revenue of $52.1m and hardware profit of $40m with a 77% profit margin.

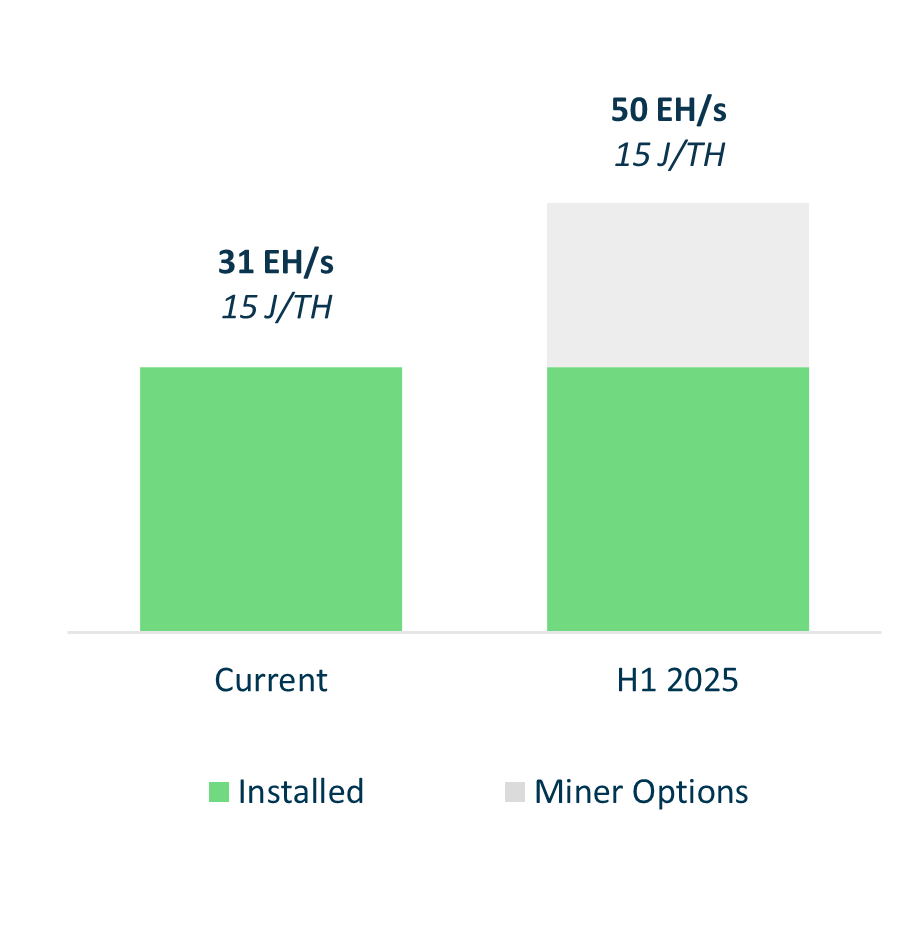

The company achieved its year-end target of 31 EH/s mining capacity, representing a 450% increase from 5.6 EH/s. Operating hashrate averaged 28.1 EH/s in December. Data center capacity reached 510MW at month-end, with plans to expand to 810MW by H1 2025.

In AI/HPC operations, IREN has deployed 1,896 NVIDIA H100 & H200 GPUs and is advancing negotiations for additional AI opportunities. The company's Childress facility expanded to 350MW operating capacity, with construction progressing on Phases 4-5 (+300MW) to support expansion to 50 EH/s in H1 2025.

IREN ha pubblicato il suo aggiornamento mensile di dicembre 2024, evidenziando risultati significativi nel mining di Bitcoin e nelle operazioni di AI/HPC. L'azienda ha estratto 529 Bitcoin a dicembre, contribuendo a un totale di 3.984 Bitcoin estratti nel 2024. Le operazioni di dicembre hanno generato un fatturato record di 52,1 milioni di dollari e un profitto hardware di 40 milioni di dollari con un margine di profitto del 77%.

L'azienda ha raggiunto il suo obiettivo di fine anno di 31 EH/s in capacità di estrazione, rappresentando un aumento del 450% rispetto ai 5,6 EH/s. Il tasso medio di hash operativo è stato di 28,1 EH/s a dicembre. La capacità del data center ha raggiunto 510MW alla fine del mese, con piani di espansione a 810MW entro la prima metà del 2025.

Nelle operazioni di AI/HPC, IREN ha distribuito 1.896 GPU NVIDIA H100 e H200 ed è in fase di avanzamento nelle negoziazioni per ulteriori opportunità nel campo dell'AI. Il centro Childress dell'azienda ha ampliato la propria capacità operativa a 350MW, con la costruzione in corso delle Fasi 4-5 (+300MW) per supportare l'espansione a 50 EH/s nella prima metà del 2025.

IREN ha publicado su actualización mensual de diciembre de 2024, destacando logros significativos en la minería de Bitcoin y operaciones de IA/HPC. La empresa extrajo 529 Bitcoin en diciembre, contribuyendo a un total de 3,984 Bitcoin extraídos en 2024. Las operaciones de diciembre generaron ingresos récord de 52.1 millones de dólares y una ganancia de hardware de 40 millones de dólares con un margen de ganancia del 77%.

La empresa alcanzó su objetivo de fin de año de 31 EH/s en capacidad de minería, lo que representa un aumento del 450% desde los 5.6 EH/s. La tasa de hash operativa promedio fue de 28.1 EH/s en diciembre. La capacidad del centro de datos alcanzó 510MW a fin de mes, con planes de expansión a 810MW para la primera mitad de 2025.

En las operaciones de IA/HPC, IREN ha desplegado 1,896 GPU NVIDIA H100 y H200 y está avanzando en las negociaciones para oportunidades adicionales en IA. La instalación Childress de la empresa se expandió a una capacidad operativa de 350MW, con la construcción en progreso de las Fases 4-5 (+300MW) para apoyar la expansión a 50 EH/s en la primera mitad de 2025.

IREN은 2024년 12월 월간 업데이트를 발표하며 비트코인 채굴과 AI/HPC 운영에서 중요한 성과를 강조했습니다. 이 회사는 12월에 529 비트코인을 채굴하여 2024년에 총 3,984 비트코인을 채굴했습니다. 12월의 운영은 5,210만 달러의 기록적인 수익과 4,000만 달러의 하드웨어 이익을 창출하여 77%의 이익률을 기록했습니다.

회사는 31 EH/s의 채굴 용량 목표를 연말까지 달성했으며, 이는 5.6 EH/s에서 450% 증가한 수치입니다. 12월의 운영 해시레이트는 평균 28.1 EH/s였습니다. 데이터 센터 용량은 월말에 510MW에 도달했으며, 2025년 상반기까지 810MW로 확대할 계획입니다.

AI/HPC 운영에서 IREN은 1,896개의 NVIDIA H100 및 H200 GPU를 배치하였고 추가 AI 기회를 위한 협상이 진행 중입니다. 회사의 칠드레스 시설은 운영 용량을 350MW로 확장하였으며, 2025년 상반기에 50 EH/s로 확장을 지원하기 위해 단계 4-5(+300MW)의 건설이 진행되고 있습니다.

IREN a publié sa mise à jour mensuelle de décembre 2024, mettant en avant des réalisations significatives dans le minage de Bitcoin et les opérations AI/HPC. L'entreprise a extrait 529 Bitcoin en décembre, contribuant à un total de 3.984 Bitcoin extraits en 2024. Les opérations de décembre ont généré des revenus record de 52,1 millions de dollars et un bénéfice matériel de 40 millions de dollars avec une marge bénéficiaire de 77 %.

L'entreprise a atteint son objectif de fin d'année de 31 EH/s en capacité de minage, représentant une augmentation de 450 % par rapport à 5,6 EH/s. Le taux de hachage moyen a été de 28,1 EH/s en décembre. La capacité du data center a atteint 510 MW à la fin du mois, avec des plans d'expansion à 810 MW d'ici la première moitié de 2025.

Dans les opérations AI/HPC, IREN a déployé 1.896 GPU NVIDIA H100 et H200 et avance dans les négociations pour d'autres opportunités en AI. L'installation Childress de l'entreprise a été agrandie à une capacité opérationnelle de 350 MW, avec la construction des Phases 4-5 (+300 MW) en cours, afin de soutenir l'expansion à 50 EH/s au cours de la première moitié de 2025.

IREN hat sein monatliches Update für Dezember 2024 veröffentlicht und erhebliche Erfolge im Bitcoin-Mining und in den AI/HPC-Operationen hervorgehoben. Das Unternehmen hat im Dezember 529 Bitcoin gemined, was zu insgesamt 3.984 Bitcoin im Jahr 2024 beiträgt. Die Dezember-Operationen generierten einen Rekordumsatz von 52,1 Millionen US-Dollar und einen Hardwaregewinn von 40 Millionen US-Dollar mit einer Gewinnmarge von 77 %.

Das Unternehmen erreichte sein Jahresendziel von 31 EH/s Mining-Kapazität, was einem Anstieg von 450 % gegenüber 5,6 EH/s entspricht. Die durchschnittliche Hashrate betrug im Dezember 28,1 EH/s. Die Kapazität des Rechenzentrums erreichte zum Monatsende 510 MW, mit Plänen zur Erweiterung auf 810 MW bis zur ersten Hälfte von 2025.

In den AI/HPC-Operationen hat IREN 1.896 NVIDIA H100- und H200-GPUs bereitgestellt und führt fortschrittliche Verhandlungen über zusätzliche AI-Möglichkeiten. Die Childress-Anlage des Unternehmens wurde auf eine Betriebsleistung von 350 MW erweitert, wobei der Bau der Phasen 4-5 (+300 MW) voranschreitet, um die Erweiterung auf 50 EH/s in der ersten Hälfte von 2025 zu unterstützen.

- Record revenue of $52.1m in December, up 60% from previous month

- Hardware profit of $40m with 77% profit margin in December

- Achieved 31 EH/s mining capacity target (vs original 20 EH/s target)

- 450% increase in mining capacity during 2024 (5.6 EH/s to 31 EH/s)

- Low power costs at Childress facility (3.2 c/kWh in December)

- Successful deployment of 1,896 NVIDIA H100 & H200 GPUs

- AI Cloud Services revenue declined from $1.0m in October to $0.8m in December

Insights

SYDNEY, Jan. 07, 2025 (GLOBE NEWSWIRE) -- IREN Limited (NASDAQ: IREN) (together with its subsidiaries, “IREN” or “the Company”), today published its monthly update for December 2024.

December Highlights

| Bitcoin Mining | AI / HPC |

|

|

| Data Centers | Corporate |

|

|

| Key Metrics | Dec-24 | Nov-24 | Oct-24* |

| Bitcoin Mining2 | |||

| Average operating hashrate | 28.1 EH/s | 19.7 EH/s | 19.9 EH/s |

| Bitcoin mined | 529 BTC | 379 BTC | 439 BTC |

| Revenue (per Bitcoin) | |||

| Electricity cost (per Bitcoin) | ( | ( | ( |

| Mining revenue | |||

| Electricity costs3 | ( | ( | ( |

| Hardware profit | |||

| Hardware profit margin4 | |||

| AI Cloud Services | |||

| AI Cloud Services revenue | |||

| Electricity costs3 | ( | ( | ( |

| Hardware profit | |||

| Hardware profit margin4 |

*Revision of Oct-24 electricity cost per Bitcoin from

2024 Key Achievements

- Substantial hashrate growth:

450% increase in mining capacity from 5.6 EH/s to 31 EH/s - Best-in-class efficiency: 15 J/TH nameplate fleet efficiency

- Data center expansion: 17x expansion at Childress from 20MW to 350MW

- Accelerated 1.4GW Sweetwater site: energization brought forward from October 2026 to April 2026

- Established AI Cloud Services business: 1,896 NVIDIA H100 & H200 GPUs, servicing multiple customers

- Convertible notes: completed

$440m oversubscribed and upsized offering - Transition to spot pricing: 2.8 c/kWh Childress power price since transition to spot pricing3

Bitcoin Mining

Record revenue and hardware profit

- Operating hashrate averaged 28.1 EH/s (expansion to 31 EH/s installed capacity achieved towards end of month)

- Revenue increased by

60% to record$52.1m , driven by ramp-up in operating hashrate and higher Bitcoin prices - Unit economics of

77% hardware profit margin, with hardware profit of$40m 4 - Spot pricing at Childress continued to deliver low power prices (3.2 c/kWh in Dec)3

31 EH/s installed, 50 EH/s in H1 2025

- 500+ team delivering single-site expansion at Childress

- Exercised 19 EH/s of miner purchase options into a combination of S21 Pro and S21 XP miners for expansion to 50 EH/s

AI / HPC

CCO Kent Draper presenting at NeurIPS Conference, Vancouver (Dec-24)

AI Cloud Services

- 1,896 NVIDIA H100 & H200 GPUs installed

- Contracting of H200 cluster ongoing

Other

- Negotiating with parties on additional AI monetization opportunities

- Installing liquid cooling at Childress and Prince George to support NVIDIA Blackwell GPUs

Data Centers

Childress Phases 1 - 3 (Dec-24)

Childress Phases 4 - 5 (Dec-24)

Childress Phase 3 complete (150MW)

- 6 x 25MW data center buildings now complete, energized and hashing

- Childress operating capacity increased to 350MW

Childress Phase 4 & 5 update (+300MW)

- Civil works, data center construction and electrical installation progressing

- Key electrical equipment secured

- Site teams and processes in place to sustain cadence of constructing ~50MW of data centers per month

- Supports expansion to 50 EH/s in H1 2025

1.4GW Sweetwater site

- Procurement underway to support IREN-owned 1.4GW substation energization by April 2026

- Construction planning for multiple pathways

Data Center | Capacity (MW) | Capacity (EH/s)5 | Timing | Status | |

| Canal Flats (BC, Canada) | 30 | 1.6 | Complete | Operating | |

| Mackenzie (BC, Canada) | 80 | 5.2 | Complete | Operating | |

| Prince George (BC, Canada) | 50 | 3.0 | Complete | Operating | |

| Childress (Texas, USA) | 350 | 21.1 | Complete | Operating | |

| Total Operating | 510 | 31 | |||

| Childress Phase 4 - 5 (Texas, USA) | 300 | 19 | H1 2025 | Under construction | |

| Childress Phase 6 (Texas, USA) | 100 | 2025 | Under construction | ||

| Total Operating & Construction | 910 | 50 | |||

| Sweetwater (Texas, USA) | 1,400 | April 2026 | Connection underway | ||

| Additional Pipeline | >1,000 | Development | |||

| Total | >3,000 |

Corporate

NeurIPS Conference, Vancouver (Dec-24)

31 EH/s target achieved

- Installed self-mining capacity increased to 31 EH/s during the month following completion of Childress Phase 3

- Global portfolio now consists of 510MW of operating data centers

- Watch the highlight video here

Upcoming events

- Needham Growth Conference, New York

(Jan 14 - 15, 2025)

Assumptions and Notes

- Hardware profit is calculated as revenue less electricity costs.

- Bitcoin and Bitcoin mined in this investor update are presented in accordance with our revenue recognition policy which is determined on a Bitcoin received basis (post deduction of mining pool fees).

- Electricity costs are presented on a net basis and calculated as IFRS electricity charges, ERS revenue (included in other income) and ERS fees (included in other operating expenses). Childress power price since transition to spot pricing calculated on a monthly average basis. Figures are based on current internal estimates and exclude REC purchases.

- Hardware profit margin for Bitcoin mining and AI Cloud Services is calculated as revenue less electricity costs, divided by revenue (for each respective revenue stream) and excludes all other costs.

- Capacity to be installed comprises Bitmain S21 Pro and S21 XP miners.

| Contacts | |

| Media | Investors |

| Jon Snowball Sodali & Co +61 477 946 068 | Lincoln Tan IREN +61 407 423 395 lincoln.tan@iren.com |

| Megan Boles Aircover Communications +1 562 537 7131 | |

To keep updated on IREN’s news releases and SEC filings, please subscribe to email alerts at https://iren.com/investor/ir-resources/email-alerts.

Forward-Looking Statements

This investor update includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or IREN’s future financial or operating performance. For example, forward-looking statements include but are not limited to the Company’s business strategy, expected operational and financial results, and expected increase in power capacity and hashrate. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “may,” “can,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “target”, “will,” “estimate,” “predict,” “potential,” “continue,” “scheduled” or the negatives of these terms or variations of them or similar terminology, but the absence of these words does not mean that statement is not forward-looking. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking.

These forward-looking statements are based on management’s current expectations and beliefs. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause IREN’s actual results, performance or achievements to be materially different from any future results performance or achievements expressed or implied by the forward looking statements, including, but not limited to: Bitcoin price and foreign currency exchange rate fluctuations; IREN’s ability to obtain additional capital on commercially reasonable terms and in a timely manner to meet its capital needs and facilitate its expansion plans; the terms of any future financing or any refinancing, restructuring or modification to the terms of any future financing, which could require IREN to comply with onerous covenants or restrictions, and its ability to service its debt obligations, any of which could restrict its business operations and adversely impact its financial condition, cash flows and results of operations; IREN’s ability to successfully execute on its growth strategies and operating plans, including its ability to continue to develop its existing data center sites and to diversify and expand into the market for high performance computing (“HPC”) solutions it may offer (including the market for AI Cloud Services); IREN’s limited experience with respect to new markets it has entered or may seek to enter, including the market for HPC solutions (including AI Cloud Services); expectations with respect to the ongoing profitability, viability, operability, security, popularity and public perceptions of the Bitcoin network; expectations with respect to the profitability, viability, operability, security, popularity and public perceptions of any current and future HPC solutions (including AI Cloud Services) that IREN offers; IREN’s ability to secure and retain customers on commercially reasonable terms or at all, particularly as it relates to its strategy to expand into markets for HPC solutions (including AI Cloud Services); IREN’s ability to manage counterparty risk (including credit risk) associated with any current or future customers, including customers of its HPC solutions (including AI Cloud Services) and other counterparties; the risk that any current or future customers, including customers of its HPC solutions (including AI Cloud Services), or other counterparties may terminate, default on or underperform their contractual obligations; Bitcoin global hashrate fluctuations; IREN’s ability to secure renewable energy, renewable energy certificates, power capacity, facilities and sites on commercially reasonable terms or at all; delays associated with, or failure to obtain or complete, permitting approvals, grid connections and other development activities customary for greenfield or brownfield infrastructure projects; IREN’s reliance on power and utilities providers, third party mining pools, exchanges, banks, insurance providers and its ability to maintain relationships with such parties; expectations regarding availability and pricing of electricity; IREN’s participation and ability to successfully participate in demand response products and services and other load management programs run, operated or offered by electricity network operators, regulators or electricity market operators; the availability, reliability and/or cost of electricity supply, hardware and electrical and data center infrastructure, including with respect to any electricity outages and any laws and regulations that may restrict the electricity supply available to IREN; any variance between the actual operating performance of IREN’s miner hardware achieved compared to the nameplate performance including hashrate; IREN’s ability to curtail its electricity consumption and/or monetize electricity depending on market conditions, including changes in Bitcoin mining economics and prevailing electricity prices; actions undertaken by electricity network and market operators, regulators, governments or communities in the regions in which IREN operates; the availability, suitability, reliability and cost of internet connections at IREN’s facilities; IREN’s ability to secure additional hardware, including hardware for Bitcoin mining and any current or future HPC solutions (including AI Cloud Services) it offers, on commercially reasonable terms or at all, and any delays or reductions in the supply of such hardware or increases in the cost of procuring such hardware; expectations with respect to the useful life and obsolescence of hardware (including hardware for Bitcoin mining as well as hardware for other applications, including any current or future HPC solutions (including AI Cloud Services) IREN offers); delays, increases in costs or reductions in the supply of equipment used in IREN’s operations; IREN’s ability to operate in an evolving regulatory environment; IREN’s ability to successfully operate and maintain its property and infrastructure; reliability and performance of IREN’s infrastructure compared to expectations; malicious attacks on IREN’s property, infrastructure or IT systems; IREN’s ability to maintain in good standing the operating and other permits and licenses required for its operations and business; IREN’s ability to obtain, maintain, protect and enforce its intellectual property rights and confidential information; any intellectual property infringement and product liability claims; whether the secular trends IREN expects to drive growth in its business materialize to the degree it expects them to, or at all; any pending or future acquisitions, dispositions, joint ventures or other strategic transactions; the occurrence of any environmental, health and safety incidents at IREN’s sites, and any material costs relating to environmental, health and safety requirements or liabilities; damage to IREN’s property and infrastructure and the risk that any insurance IREN maintains may not fully cover all potential exposures; ongoing proceedings relating to the default by two of IREN’s wholly-owned special purpose vehicles under limited recourse equipment financing facilities; ongoing securities litigation relating in part to the default; and any future litigation, claims and/or regulatory investigations, and the costs, expenses, use of resources, diversion of management time and efforts, liability and damages that may result therefrom; IREN's failure to comply with any laws including the anti-corruption laws of the United States and various international jurisdictions; any failure of IREN's compliance and risk management methods; any laws, regulations and ethical standards that may relate to IREN’s business, including those that relate to Bitcoin and the Bitcoin mining industry and those that relate to any other services it offers, including laws and regulations related to data privacy, cybersecurity and the storage, use or processing of information and consumer laws; IREN’s ability to attract, motivate and retain senior management and qualified employees; increased risks to IREN’s global operations including, but not limited to, political instability, acts of terrorism, theft and vandalism, cyberattacks and other cybersecurity incidents and unexpected regulatory and economic sanctions changes, among other things; climate change, severe weather conditions and natural and man-made disasters that may materially adversely affect IREN’s business, financial condition and results of operations; public health crises, including an outbreak of an infectious disease (such as COVID-19) and any governmental or industry measures taken in response; IREN’s ability to remain competitive in dynamic and rapidly evolving industries; damage to IREN’s brand and reputation; expectations relating to Environmental, Social or Governance issues or reporting; the costs of being a public company; the increased regulatory and compliance costs of IREN ceasing to be a foreign private issuer and an emerging growth company, as a result of which it will be required, among other things, to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC commencing with its next financial year, and it will also be required to prepare its financial statements in accordance with U.S. GAAP rather than IFRS and to modify certain of its policies to comply with corporate governance practices required of a U.S. domestic issuer; and other important factors discussed under the caption “Risk Factors” in IREN’s annual report on Form 20-F filed with the SEC on August 28, 2024 as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investor Relations section of IREN’s website at https://investors.iren.com.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this investor update. Any forward-looking statement that IREN makes in this investor update speaks only as of the date of such statement. Except as required by law, IREN disclaims any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Preliminary Financial Information

The preliminary financial information included in this investor update is not subject to the same closing procedures as our unaudited quarterly financial results and has not been reviewed by our independent registered public accounting firm. The preliminary financial information included in this investor update does not represent a comprehensive statement of our financial results or financial position and should not be viewed as a substitute for unaudited financial statements prepared in accordance with International Financial Reporting Standards. Accordingly, you should not place undue reliance on the preliminary financial information included in this investor update.

Non-IFRS Financial Measures

This investor update includes non-IFRS financial measures, including electricity costs (presented on a net basis) and hardware profit. We provide these measures in addition to, and not as a substitute for, measures of financial performance prepared in accordance with IFRS. There are a number of limitations related to the use of non-IFRS financial measures. For example, other companies, including companies in our industry, may calculate these measures differently. The Company believes that these measures are important and supplement discussions and analysis of its results of operations and enhances an understanding of its operating performance.

Electricity costs are calculated as our IFRS Electricity charges, ERS revenue (included in Other income) and ERS fees (included in Other operating expenses), and excludes the cost of RECs.

Illustrative Annualized Hardware Profit is calculated as illustrative revenue less assumed electricity costs (excludes all other site, overhead and REC costs).

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/1f0f3591-0b8f-4b00-9165-ece3916de129

https://www.globenewswire.com/NewsRoom/AttachmentNg/bee0bcb1-c8d1-4f06-a4ab-a6eb44e68696

https://www.globenewswire.com/NewsRoom/AttachmentNg/a7f6518a-6057-49b9-8175-313744fd0a96

https://www.globenewswire.com/NewsRoom/AttachmentNg/23966215-fc70-457b-8a14-3c1dd890af68

https://www.globenewswire.com/NewsRoom/AttachmentNg/d99097e3-96b3-4af6-be25-26af12bd9c4c