IREN achieves 20 EH/s milestone

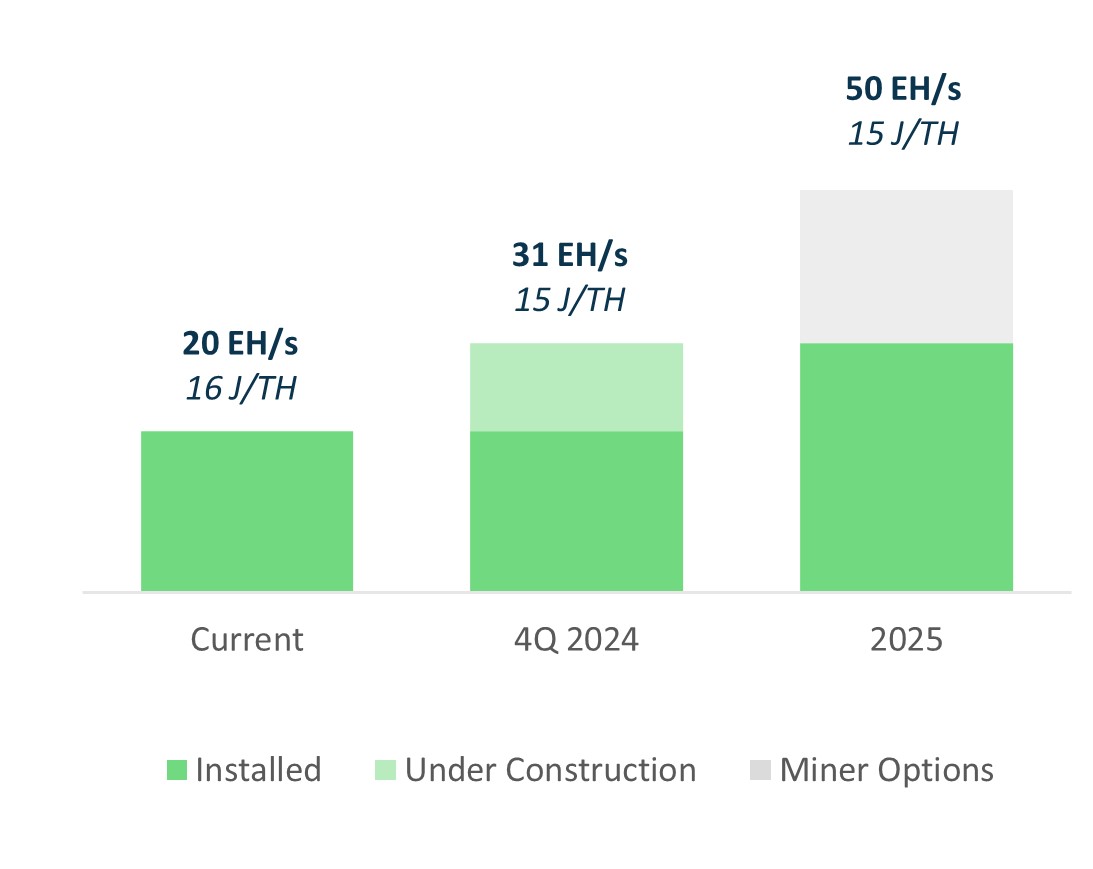

Iris Energy (NASDAQ: IREN) has announced reaching a significant milestone of 20 EH/s installed capacity ahead of schedule. The company expects to further increase this to 21 EH/s in the coming days through optimization of existing data center infrastructure. IREN is on track to achieve 31 EH/s in Q4 2024, with construction of Childress Phase 3 (150MW) well underway and approximately 430 people mobilized on site.

Previously purchased Bitmain S21 XP miners (13.5 J/TH) are scheduled for shipping over the next two months as part of the expansion. At 31 EH/s (15 J/TH efficiency), IREN projects $20k electricity cost and $30k all-in cash cost per Bitcoin mined. The company is progressing towards industry leadership with ongoing construction at Childress Phase 2 and 3.

Iris Energy (NASDAQ: IREN) ha annunciato di aver raggiunto un traguardo significativo di 20 EH/s di capacità installata, anticipando i tempi previsti. L'azienda prevede di aumentare ulteriormente questa capacità a 21 EH/s nei prossimi giorni attraverso l'ottimizzazione dell'infrastruttura esistente del data center. IREN è sulla buona strada per raggiungere 31 EH/s nel quarto trimestre del 2024, con la costruzione della Fase 3 di Childress (150MW) già in corso e circa 430 persone mobilitate sul sito.

I minatori Bitmain S21 XP precedentemente acquistati (13,5 J/TH) sono programmati per la spedizione nei prossimi due mesi come parte dell'espansione. A 31 EH/s (15 J/TH di efficienza), IREN prevede un costo dell'elettricità di 20k dollari e un costo totale in contante di 30k dollari per Bitcoin estratto. L'azienda sta facendo progressi verso la leadership del settore con i lavori in corso per le Fasi 2 e 3 di Childress.

Iris Energy (NASDAQ: IREN) ha anunciado haber alcanzado un hito significativo de 20 EH/s de capacidad instalada, adelantándose al cronograma. La empresa espera aumentar esto a 21 EH/s en los próximos días mediante la optimización de la infraestructura existente del centro de datos. IREN está en camino de alcanzar 31 EH/s en el cuarto trimestre de 2024, con la construcción de la Fase 3 de Childress (150MW) ya en marcha y aproximadamente 430 personas movilizadas en el sitio.

Los mineros Bitmain S21 XP adquiridos previamente (13.5 J/TH) están programados para ser enviados en los próximos dos meses como parte de la expansión. A 31 EH/s (15 J/TH de eficiencia), IREN proyecta un costo de electricidad de 20 mil dólares y un costo total en efectivo de 30 mil dólares por Bitcoin extraído. La empresa avanza hacia el liderazgo en la industria con la construcción en curso de las Fases 2 y 3 de Childress.

아이리스 에너지 (NASDAQ: IREN)는 일정에 앞서 20 EH/s의 설치 용량이라는 중요한 이정표에 도달했다고 발표했습니다. 회사는 기존 데이터 센터 인프라 최적화를 통해 향후 몇 일 내에 이를 21 EH/s로 추가 증가시킬 것으로 예상하고 있습니다. IREN은 2024년 4분기까지 31 EH/s를 달성할 예정이며, 차일드리스 3단계(150MW) 건설이 원활히 진행 중이고 약 430명이 현장에 배치되어 있습니다.

이전에 구매한 비트메인 S21 XP 마이너 (13.5 J/TH)는 확장의 일환으로 향후 두 달간 배송될 예정입니다. 31 EH/s에서 (15 J/TH 효율), IREN은 비트코인 채굴 시 전기 요금 2만 달러 및 총 현금 비용 3만 달러를 예상하고 있습니다. 회사는 차일드리스 2단계와 3단계에서 진행 중인 건설로 산업 리더십을 향해 나아가고 있습니다.

Iris Energy (NASDAQ: IREN) a annoncé avoir atteint un jalon important de 20 EH/s de capacité installée, en avance sur le calendrier. L'entreprise prévoit d'augmenter cette capacité à 21 EH/s dans les prochains jours grâce à l'optimisation de l'infrastructure existante du centre de données. IREN est sur la bonne voie pour atteindre 31 EH/s au quatrième trimestre 2024, avec la construction de la phase 3 de Childress (150 MW) déjà bien avancée et environ 430 personnes mobilisées sur le site.

Les mineurs Bitmain S21 XP achetés précédemment (13,5 J/TH) sont programmés pour être expédiés au cours des deux prochains mois dans le cadre de l'expansion. À 31 EH/s (15 J/TH d'efficacité), IREN projette un coût d'électricité de 20 000 dollars et un coût total en espèces de 30 000 dollars par Bitcoin extrait. L'entreprise progresse vers le leadership du secteur avec la construction en cours des phases 2 et 3 de Childress.

Iris Energy (NASDAQ: IREN) hat bekannt gegeben, dass man einen bedeutenden Meilenstein von 20 EH/s installierter Kapazität vorzeitig erreicht hat. Das Unternehmen erwartet, diese Kapazität in den kommenden Tagen auf 21 EH/s zu erhöhen, indem die bestehende Infrastruktur des Rechenzentrums optimiert wird. IREN ist auf dem besten Weg, im vierten Quartal 2024 31 EH/s zu erreichen, wobei der Bau der Phase 3 von Childress (150MW) bereits im Gang ist und etwa 430 Personen vor Ort mobilisiert sind.

Bereits erworbene Bitmain S21 XP Miner (13,5 J/TH) sind für den Versand in den nächsten zwei Monaten im Rahmen der Expansion geplant. Bei 31 EH/s (15 J/TH Effizienz) rechnet IREN mit 20.000 Dollar Stromkosten und 30.000 Dollar Gesamtkosten pro mined Bitcoin. Das Unternehmen strebt mit dem laufenden Bau der Phasen 2 und 3 von Childress eine Führungsposition in der Branche an.

- Achieved 20 EH/s milestone ahead of schedule

- Expected increase to 21 EH/s in the coming days

- On track for 31 EH/s in Q4 2024

- Childress Phase 3 (150MW) construction well underway

- Projected $20k electricity cost and $30k all-in cash cost per Bitcoin mined at 31 EH/s

- None.

Insights

IREN's achievement of 20 EH/s ahead of schedule represents significant operational execution in the competitive Bitcoin mining landscape. With global Bitcoin hashrate at approximately 662 EH/s, IREN now controls roughly 3% of total network hashrate - a meaningful position that will grow to nearly 4.7% when they reach their targeted 31 EH/s by Q4 2024.

The efficiency metrics are particularly impressive. Their current 16 J/TH efficiency will improve to 15 J/TH as they deploy Bitmain S21 XP miners (13.5 J/TH) over the next two months. This hardware upgrade represents a strategic investment in next-generation equipment that will improve their competitive positioning through both increased hashrate and improved energy efficiency.

The rapid expansion from 20 EH/s to 31 EH/s (a 55% increase) demonstrates strong infrastructure capabilities, especially with the Childress Phase 3 construction advancing with 430 personnel on site. Their ability to optimize existing infrastructure to quickly reach 21 EH/s shows operational excellence in maximizing deployed assets.

Their electricity costs of

IREN's operational milestone translates directly to improved financial metrics. At their projected 31 EH/s capacity, the company estimates

The economics here are compelling. Their expanding scale creates operating leverage, with corporate overheads of approximately

The accelerated timeline for reaching 20 EH/s suggests strong project management capabilities, which increases confidence in their ability to execute the remaining expansion to 31 EH/s on schedule. This execution track record is particularly valuable given the capital-intensive nature of the Bitcoin mining industry.

Their infrastructure investment strategy aligns with long-term value creation. The company is positioning itself as both a Bitcoin mining operation and an AI cloud services provider (noting 1,896 NVIDIA H100 & H200 GPUs), creating business diversification that hedges against Bitcoin-specific risks.

The company's renewable energy focus also provides strategic advantages beyond ESG considerations - it unlocks opportunities for demand response programs and grid services that can generate additional revenue streams, as mentioned in their operations overview.

On track for 31 EH/s

SYDNEY, Australia, Sept. 23, 2024 (GLOBE NEWSWIRE) -- Iris Energy Limited (NASDAQ: IREN) (together with its subsidiaries, “IREN”) today provided a business update.

“We are pleased to announce that we’ve reached our 20 EH/s milestone ahead of schedule. This achievement reflects the hard work of our global team. Thank you for your dedication and efforts in making this happen,” said Daniel Roberts, Co-Founder and Co-CEO of IREN. “We look forward to continuing this momentum as we expand to over 30 EH/s in the next three months.”

IREN achieves 20 EH/s milestone

IREN has increased its installed capacity to 20 EH/s (16 J/TH efficiency).

Through optimization of its existing data center infrastructure, IREN now expects to increase its installed capacity to 21 EH/s in the coming days.

On track for 31 EH/s in 4Q 2024

Childress Phase 3 (150MW) construction is well underway, with approximately 430 people mobilized to site.

As part of the expansion from 21 EH/s to 31 EH/s, previously purchased Bitmain S21 XP miners (13.5 J/TH) are scheduled for shipping over the next 2 months.

Based on 31 EH/s (15 J/TH efficiency):

$20 k electricity cost per Bitcoin mined1$30 k all-in cash cost per Bitcoin mined2

Pathway to industry leadership

Childress Phase 2 and 3 construction

(September 2024)

Assumptions and Notes

- Calculations assume 662 EH/s (global hashrate), 3.125 BTC (block reward), 0.1 BTC (transaction fees),

0.15% (pool fees), 484MW (power consumption),$0.03 8/kWh electricity costs (4.5c/kWh BC, 3.5c/kWh Childress – note August 2024 electricity price at Childress of 3.1c/kWh following transition to spot pricing). - Estimated all-in cash costs per Bitcoin mined at 31 EH/s include electricity costs (as noted above) and indicative all other opex (including all corporate overheads) of ~

$80m per annum.

Forward-Looking Statements

This investor update includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or IREN’s future financial or operating performance. For example, forward-looking statements include but are not limited to IREN’s business strategy, expected operational and financial results, and expected increase in power capacity and hashrate. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “may,” “can,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “target”, “will,” “estimate,” “predict,” “potential,” “continue,” “scheduled” or the negatives of these terms or variations of them or similar terminology, but the absence of these words does not mean that statement is not forward-looking. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking.

These forward-looking statements are based on management’s current expectations and beliefs. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause IREN’s actual results, performance or achievements to be materially different from any future results performance or achievements expressed or implied by the forward looking statements, including, but not limited to: Bitcoin price and foreign currency exchange rate fluctuations; IREN’s ability to obtain additional capital on commercially reasonable terms and in a timely manner to meet its capital needs and facilitate its expansion plans; the terms of any future financing or any refinancing, restructuring or modification to the terms of any future financing, which could require IREN to comply with onerous covenants or restrictions, and its ability to service its debt obligations, any of which could restrict its business operations and adversely impact its financial condition, cash flows and results of operations; IREN’s ability to successfully execute on its growth strategies and operating plans, including its ability to continue to develop its existing data center sites and to diversify and expand into the market for high performance computing (“HPC”) solutions it may offer (including the market for AI Cloud Services); IREN’s limited experience with respect to new markets it has entered or may seek to enter, including the market for HPC solutions (including AI Cloud Services); expectations with respect to the ongoing profitability, viability, operability, security, popularity and public perceptions of the Bitcoin network; expectations with respect to the profitability, viability, operability, security, popularity and public perceptions of any current and future HPC solutions (including AI Cloud Services) that IREN offers; IREN’s ability to secure and retain customers on commercially reasonable terms or at all, particularly as it relates to its strategy to expand into markets for HPC solutions (including AI Cloud Services); IREN’s ability to manage counterparty risk (including credit risk) associated with any current or future customers, including customers of its HPC solutions (including AI Cloud Services) and other counterparties; the risk that any current or future customers, including customers of its HPC solutions (including AI Cloud Services), or other counterparties may terminate, default on or underperform their contractual obligations; Bitcoin global hashrate fluctuations; IREN’s ability to secure renewable energy, renewable energy certificates, power capacity, facilities and sites on commercially reasonable terms or at all; delays associated with, or failure to obtain or complete, permitting approvals, grid connections and other development activities customary for greenfield or brownfield infrastructure projects; IREN’s reliance on power and utilities providers, third party mining pools, exchanges, banks, insurance providers and its ability to maintain relationships with such parties; expectations regarding availability and pricing of electricity; IREN’s participation and ability to successfully participate in demand response products and services and other load management programs run, operated or offered by electricity network operators, regulators or electricity market operators; the availability, reliability and/or cost of electricity supply, hardware and electrical and data center infrastructure, including with respect to any electricity outages and any laws and regulations that may restrict the electricity supply available to IREN; any variance between the actual operating performance of IREN’s miner hardware achieved compared to the nameplate performance including hashrate; IREN’s ability to curtail its electricity consumption and/or monetize electricity depending on market conditions, including changes in Bitcoin mining economics and prevailing electricity prices; actions undertaken by electricity network and market operators, regulators, governments or communities in the regions in which IREN operates; the availability, suitability, reliability and cost of internet connections at IREN’s facilities; IREN’s ability to secure additional hardware, including hardware for Bitcoin mining and any current or future HPC solutions (including AI Cloud Services) it offers, on commercially reasonable terms or at all, and any delays or reductions in the supply of such hardware or increases in the cost of procuring such hardware; expectations with respect to the useful life and obsolescence of hardware (including hardware for Bitcoin mining as well as hardware for other applications, including any current or future HPC solutions (including AI Cloud Services) IREN offers); delays, increases in costs or reductions in the supply of equipment used in IREN’s operations; IREN’s ability to operate in an evolving regulatory environment; IREN’s ability to successfully operate and maintain its property and infrastructure; reliability and performance of IREN’s infrastructure compared to expectations; malicious attacks on IREN’s property, infrastructure or IT systems; IREN’s ability to maintain in good standing the operating and other permits and licenses required for its operations and business; IREN’s ability to obtain, maintain, protect and enforce its intellectual property rights and confidential information; any intellectual property infringement and product liability claims; whether the secular trends IREN expects to drive growth in its business materialize to the degree it expects them to, or at all; any pending or future acquisitions, dispositions, joint ventures or other strategic transactions; the occurrence of any environmental, health and safety incidents at IREN’s sites, and any material costs relating to environmental, health and safety requirements or liabilities; damage to IREN’s property and infrastructure and the risk that any insurance IREN maintains may not fully cover all potential exposures; ongoing proceedings relating to the default by two of IREN’s wholly-owned special purpose vehicles under limited recourse equipment financing facilities; ongoing securities litigation relating in part to the default; and any future litigation, claims and/or regulatory investigations, and the costs, expenses, use of resources, diversion of management time and efforts, liability and damages that may result therefrom; IREN's failure to comply with any laws including the anti-corruption laws of the United States and various international jurisdictions; any failure of IREN's compliance and risk management methods; any laws, regulations and ethical standards that may relate to IREN’s business, including those that relate to Bitcoin and the Bitcoin mining industry and those that relate to any other services it offers, including laws and regulations related to data privacy, cybersecurity, the storage, use or processing of information and consumer laws; IREN’s ability to attract, motivate and retain senior management and qualified employees; increased risks to IREN’s global operations including, but not limited to, political instability, acts of terrorism, theft and vandalism, cyberattacks and other cybersecurity incidents and unexpected regulatory and economic sanctions changes, among other things; climate change, severe weather conditions and natural and man-made disasters that may materially adversely affect IREN’s business, financial condition and results of operations; public health crises, including an outbreak of an infectious disease (such as COVID-19) and any governmental or industry measures taken in response; IREN’s ability to remain competitive in dynamic and rapidly evolving industries; damage to IREN’s brand and reputation; expectations relating to Environmental, Social or Governance issues or reporting; the costs of being a public company; and other important factors discussed under the caption “Risk Factors” in IREN’s annual report on Form 20-F filed with the SEC on August 28, 2024 as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investor Relations section of IREN’s website at https://investors.iren.com.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this investor update. Any forward-looking statement that IREN makes in this investor update speaks only as of the date of such statement. Except as required by law, IREN disclaims any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Non-IFRS Financial Measures

This investor update includes non-IFRS financial measures, including electricity costs (presented on a net basis). We provide these measures in addition to, and not as a substitute for, measures of financial performance prepared in accordance with IFRS. There are a number of limitations related to the use of non-IFRS financial measures. For example, other companies, including companies in our industry, may calculate these measures differently. IREN believes that these measures are important and supplement discussions and analysis of its results of operations and enhances an understanding of its operating performance.

Electricity costs are calculated as our IFRS Electricity charges net of Realized gain/(loss) on financial asset, ERS revenue (included in Other income) and ERS fees (included in Other operating expenses), and excludes the cost of RECs.

About IREN

IREN is a leading data center business powering the future of Bitcoin, AI and beyond utilizing

- Bitcoin Mining: providing security to the Bitcoin network, expanding to 31 EH/s in 2024. Operations since 2019.

- AI Cloud Services: providing cloud compute to AI customers, 1,896 NVIDIA H100 & H200 GPUs. Operations since 2024.

- Next-Generation Data Centers: 345MW of operating data centers, expanding to 510MW in 2024. Specifically designed and purpose-built infrastructure for high-performance and power-dense computing applications.

- Technology: technology stack for performance optimization of AI Cloud Services, Bitcoin Mining and energy trading operations.

- Development Portfolio: 2,310MW of grid-connected power secured across North America, >1,000 acre property portfolio and additional development pipeline.

100% Renewable Energy (from clean or renewable energy sources or through the purchase of RECs): targets sites with low-cost & underutilized renewable energy, and supports electrical grids and local communities.

Contacts

| Media Jon Snowball Domestique +61 477 946 068 Danielle Ghigliera Aircover Communications +1 510 333 2707 | Investors Lincoln Tan IREN +61 407 423 395 lincoln.tan@iren.com |

To keep updated on IREN’s news releases and SEC filings, please subscribe to email alerts at https://iren.com/investor/ir-resources/email-alerts.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/f364061d-d227-47d9-b226-ce0b30a6a15d

https://www.globenewswire.com/NewsRoom/AttachmentNg/f796e473-6215-4d37-91ea-6b5f738b7f4a