Samsara Delivers Combination of Growth, Scale, and Profitability in FY25

Shows continued high growth at scale and record profitability metrics

-

$1.46B 33% year-over-year (YoY) on an adjusted basis2 -

2,506 customers with more than

$100 K36% YoY -

$111M 9% adjusted FCF margin -

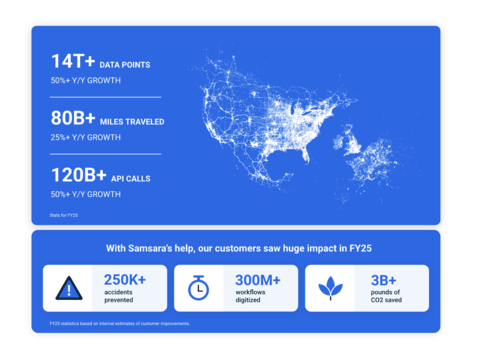

Powers one of the world’s largest operational data sets with 14T+ data points processed, reflecting more than

50% YoY growth

Samsara FY25 stats (Graphic: Business Wire)

-

Achieved

$1.46B $1M + ARR and a quarterly record of 203 customers with$100 K+ ARR. It also landed leading organizations as new customers, including Bimbo Bakeries, the largestU.S. commercial baking company, Swissport, a leading global aviation services provider, and one of the top three global telecommunications companies. -

Empowered Customers with Real-Time Insights: As Samsara expanded its customer base and achieved further multi-product adoption, it led to significant growth of its data set in FY25: 14T+ data points processed, representing more than

50% YoY growth, 80B+ miles traveled, representing more than25% YoY growth, and 120B+ API calls, representing more than50% YoY growth. - Enabled Life-Changing Impact: With Samsara’s support, its customers prevented 250K+ vehicle accidents, digitized 300M+ workflows, and saved 3B+ pounds of CO2 in FY253.

“Our customers partner with us because we provide actionable insights that help them operate smarter,” said Sanjit Biswas, CEO and Co-Founder at Samsara. “Samsara is building one of the world's largest operational data sets and combining it with AI will transform our customers' operations in the next decade.”

Transforming How the World Runs: Factors Driving Samsara’s Strong Momentum

Samsara is driven by its commitment to help customers achieve their ambitious goals. There are several factors contributing to the company’s strong momentum to date, including:

-

Serving the Backbone of the Economy: Samsara is addressing a large market that is in the early stages of digitization. Physical operations represent more than

40% of the global GDP and are the backbone of the economy. - Purpose-Built Platform: Samsara pioneered the Connected Operations Platform, a singular system of record for physical operations, specifically for this market.

- Focus on Building for the Long Term: Samsara’s increasing scale and strong unit economics are delivering operational efficiency.

- Innovation for Impact: Samsara is continuously innovating and expanding its multi-product platform to solve its customers’ most pressing challenges.

With a continued focus on enabling its customers to operate smarter with data, Samsara today announced enhancements to its Smart Trailers solution with features and strategic partnerships designed to help fleets boost efficiency, reduce costs, and improve safety.

Powered by Samsara’s advanced Asset Gateways, these features provide real-time visibility into trailer health, including tire pressure and power status, and detect trailer mispulls—enabling fleets to proactively manage maintenance and minimize costly downtime. Samsara’s expansive ecosystem of 300+ partner integrations now includes partners like Continental’s TPMS for real-time tire pressure and temperature monitoring, and SKF’s wheel-end sensors to detect bearing failures or extreme wheel heat. Customers can access their critical trailer insights across vendors all in the Samsara dashboard, helping to improve maintenance, reduce downtime, and ensure compliance.

To learn more about Samsara’s platform and impact, visit here.

__________________

1Samsara defines ARR as the annualized value of subscription contracts that have commenced revenue recognition as of the measurement date. Figures as of Q4 FY25.

2Adjusted ARR growth is ARR growth adjusted for Constant Currency.

3FY25 statistics based on internal estimates of customer improvements.

About Samsara

Samsara (NYSE: IOT) is the pioneer of the Connected Operations® Platform, which enables organizations that depend on physical operations to harness Internet of Things (IoT) data to develop actionable insights and improve their operations. With tens of thousands of customers across

Samsara is a registered trademark of Samsara Inc. All other brand names, product names or trademarks belong to their respective holders.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250306721163/en/

Stephanie Burke

Samsara

media@samsara.com

Source: Samsara