IonQ Announces Third Quarter 2021 Financial Results

IonQ, a leader in quantum computing, reported third quarter 2021 results, featuring revenue of $223K and total contract value bookings of $15.1 million year-to-date. The company has raised its guidance for 2021 bookings to a midpoint of $15.8 million. IonQ demonstrated superior performance against competitors and achieved an industry-first milestone in fault-tolerant error correction. With $587 million in cash, IonQ is well-capitalized for growth, with expectations of fourth quarter revenue between $1.0 million and $1.2 million.

- Guidance for 2021 total contract value bookings raised to $15.8 million.

- Achieved an industry-first in fault-tolerant error correction technology.

- Strong cash position of $587 million as of September 30, 2021.

- Net loss of $14.8 million for the third quarter.

- Adjusted EBITDA loss of $7.9 million.

TCV Bookings of

Increases guidance for 2021 TCV Bookings from

Industry benchmarks confirm superior performance of

Cloud partnerships and integrations ensure

Commercial and ecosystem partnerships with

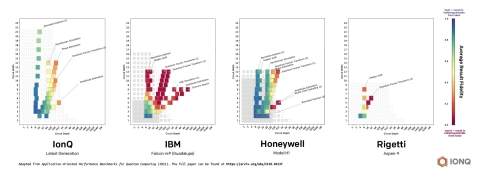

Side-by-side comparison of quantum computers tested from each of four providers included in the paper. IonQ’s latest system outperformed all others evaluated by having higher average result fidelity across a wide set of algorithms with a greater circuit width/depth than any other system. (Photo: Business Wire)

“IonQ delivered a number of significant milestones this quarter, delivering upon our technology roadmap and accelerating the commercialization of our quantum computers,” said

This quarter, the publication of a benchmarking study of all currently available quantum computers by the

In the third quarter,

In early October, researchers from

IonQ’s bookings results demonstrate the Company’s leadership and growing demand for IonQ’s industry-leading trapped-ion hardware.

“We look forward to 2022 with confidence as we continue to build out IonQ’s ecosystem, demonstrate our superior scalability and efficiency, and solve useful problems for our worldwide customer base,” said Chapman.

Third Quarter Financial Highlights

-

Revenue of

$223 thousand $451 thousand -

Year-to-date total contract value (TCV) bookings of

$15.1 million -

Cash and cash equivalents of

$587 million September 30, 2021 . -

Net loss of

$14.8 million -

Adjusted EBITDA was a loss of

$7.9 million

“The completion of our business combination with dMY Technology Group III gave us the capital to fuel additional momentum in our system development and commercialization efforts,” said

“We believe our strong balance sheet with cash and cash equivalents of

* Adjusted EBITDA is a non-GAAP financial measure defined under “Non-GAAP Financial Measures,” and is reconciled to net loss, its closest comparable GAAP measure, at the end of this release.

Third Quarter and Recent Business Highlights

-

Industry benchmarking by the QED-C demonstrated the superior power of

IonQ hardware compared to key competitors. -

First team globally to show fault-tolerant error correction in practice in a peer-reviewed paper published in Nature, alongside researchers from

Duke University , theUniversity of Maryland and theGeorgia Institute of Technology . - Debuted the industry’s first Reconfigurable Multicore Quantum Architecture, creating a path to scale quantum computers with potentially hundreds of qubits on one chip.

-

A partnership with

The University of Maryland to create theNational Quantum Lab atMaryland (Q-Lab ), the nation’s first user facility that enables hands-on access to a commercial-grade quantum computer. -

Announced partnerships and collaborations with leading organizations such as Accenture, Goldman Sachs,

Fidelity Center for Applied Research , andGE Research . -

Closed business combination with dMY

Technology Group, Inc. III onSeptember 30, 2021 , to become the first pure-play publicly traded quantum computing company in the world. -

Continued our hiring of world-class talent with key positions filled by

Tom Jones asChief People Officer (Blue Origin, Microsoft, Honeywell),Ariel Braunstein as Senior Vice President of Product Management (Google ,Lytro , Cisco), andDean Kassmann as Vice President of Research and Development (Blue Origin, Amazon).

Financial Outlook

-

Expected bookings of

$600 thousand $800 thousand $15.7 million $15.9 million -

Expected revenue of

$1.0 million $1.2 million $1.5 million $1.7 million

Third Quarter 2021 Conference Call

Non-GAAP Financial Measures

To supplement IonQ’s condensed financial statements presented in accordance with GAAP, we use non-GAAP measures of certain components of financial performance. Adjusted EBITDA is a financial measure that is not required by or presented in accordance with GAAP. Management believes that this measure provides investors an additional meaningful method to evaluate certain aspects of the company’s results period over period. Adjusted EBITDA is defined as net loss before interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation, remeasurements of liability-classified warrants, and other nonrecurring nonoperating income and expenses. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations. The presentation of non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the financial results prepared in accordance with GAAP, and the Company’s non-GAAP measures may be different from non-GAAP measures used by other companies. For IonQ’s investors to be better able to compare its current results with those of previous periods, the Company has shown a reconciliation of GAAP to non-GAAP financial measures at the end of this release.

About

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Some of the forward-looking statements can be identified by the use of forward-looking words. Statements that are not historical in nature, including the words “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast” and other similar expressions are intended to identify forward-looking statements. These statements include those related to the Company’s ability to further develop and advance its quantum computers and achieve scale; ability to attract personnel; market opportunity, anticipated growth, and future financial performance, including management’s outlook for the fourth quarter and fiscal year 2021. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: market adoption of quantum computing solutions and the Company’s products, services and solutions; the ability of the Company to protect its intellectual property; changes in the competitive industries in which the Company operates; changes in laws and regulations affecting the Company’s business; the Company’s ability to implement its business plans, forecasts and other expectations, and identify and realize additional partnerships and opportunities; and the risk of downturns in the market and the technology industry including, but not limited to, as a result of the COVID-19 pandemic. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the registration statement on Form S-1 and other documents filed by the Company from time to time with the

| Condensed Consolidated Balance Sheets | ||||||

| (unaudited) | ||||||

| (in thousands) | ||||||

|

2021 |

|

|

2020 |

|

|

| Assets | ||||||

| Current assets: | ||||||

| Cash and cash equivalents | $ |

587,294 |

|

$ |

36,120 |

|

| Accounts receivable |

|

4,082 |

|

|

390 |

|

| Prepaid expenses and other current assets |

|

6,478 |

|

|

2,069 |

|

| Total current assets |

|

597,854 |

|

|

38,579 |

|

| Property and equipment, net |

|

16,729 |

|

|

11,988 |

|

| Operating lease right-of-use assets |

|

4,098 |

|

|

4,296 |

|

| Intangible assets, net |

|

5,521 |

|

|

2,687 |

|

| Other noncurrent assets |

|

2,357 |

|

|

2,928 |

|

| Total Assets | $ |

626,559 |

|

$ |

60,478 |

|

| Liabilities and Stockholders' Equity | ||||||

| Current liabilities: | ||||||

| Accounts payable | $ |

1,967 |

|

$ |

538 |

|

| Accrued expenses |

|

3,483 |

|

|

608 |

|

| Current portion of operating lease liabilities |

|

564 |

|

|

495 |

|

| Unearned revenue |

|

3,909 |

|

|

240 |

|

| Current portion of stock option early exercise liabilities |

|

1,153 |

|

|

- |

|

| Total current liabilities |

|

11,076 |

|

|

1,881 |

|

| Operating lease liabilities, net of current portion |

|

3,681 |

|

|

3,776 |

|

| Unearned revenue, net of current portion |

|

1,533 |

|

|

1,118 |

|

| Stock option early exercise liabilities, net of current portion |

|

2,252 |

|

|

- |

|

| Warrant liabilities |

|

50,350 |

|

|

- |

|

| Total liabilities | $ |

68,892 |

|

$ |

6,775 |

|

| Stockholders' Equity: | ||||||

| Common stock |

|

10 |

|

|

3 |

|

| Additional paid-in capital |

|

629,364 |

|

|

93,305 |

|

| Accumulated deficit |

|

(71,707 |

) |

|

(39,605 |

) |

| Total stockholders' equity |

|

557,667 |

|

|

53,703 |

|

| Total Liabilities and Stockholders' Equity | $ |

626,559 |

|

$ |

60,478 |

|

| Condensed Consolidated Statements of Operations and Comprehensive Loss | |||||||||||||

| (unaudited) | |||||||||||||

| (in thousands, except share and per share data) | |||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||

| Revenue | $ |

233 |

|

$ |

- |

|

$ |

451 |

|

$ |

- |

|

|

| Costs and expenses: | |||||||||||||

| Cost of revenue (excluding depreciation and amortization) |

|

234 |

|

|

57 |

|

|

742 |

|

|

57 |

|

|

| Research and development |

|

6,180 |

|

|

2,339 |

|

|

15,311 |

|

|

7,643 |

|

|

| Sales and marketing |

|

1,286 |

|

|

81 |

|

|

2,384 |

|

|

263 |

|

|

| General and administrative |

|

2,461 |

|

|

727 |

|

|

8,321 |

|

|

1,840 |

|

|

| Depreciation and amortization |

|

596 |

|

|

372 |

|

|

1,543 |

|

|

995 |

|

|

| Total operating costs and expenses |

|

10,757 |

|

|

3,576 |

|

|

28,301 |

|

|

10,798 |

|

|

| Loss from operations |

|

(10,524 |

) |

|

(3,576 |

) |

|

(27,850 |

) |

|

(10,798 |

) |

|

| Offering costs associated with warrants |

|

(4,259 |

) |

|

- |

|

|

(4,259 |

) |

|

- |

|

|

| Other income |

|

2 |

|

|

11 |

|

|

7 |

|

|

305 |

|

|

| Loss before benefit for income taxes |

|

(14,781 |

) |

|

(3,565 |

) |

|

(32,102 |

) |

|

(10,493 |

) |

|

| Benefit for income taxes |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

| Net loss and comprehensive loss | $ |

(14,781 |

) |

$ |

(3,565 |

) |

$ |

(32,102 |

) |

$ |

(10,493 |

) |

|

| Net loss per share attributable to common stockholders | |||||||||||||

| Basic and diluted | $ |

(0.12 |

) |

$ |

(0.03 |

) |

$ |

(0.27 |

) |

$ |

(0.09 |

) |

|

| Weighted average shares used in computing net loss per share attributable to common stockholders | |||||||||||||

| Basic and diluted |

|

120,605,457 |

|

|

115,369,517 |

|

|

119,535,167 |

|

|

114,597,135 |

|

|

| Condensed Consolidated Statements of Cash Flows | ||||||

| (unaudited) | ||||||

| (in thousands) | ||||||

| Nine Months Ended |

||||||

|

2021 |

|

|

2020 |

|

|

| Cash flows from operating activities: | ||||||

| Net loss | $ |

(32,102 |

) |

$ |

(10,493 |

) |

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||

| Depreciation and amortization |

|

1,543 |

|

|

995 |

|

| Non-cash research and development arrangements |

|

1,205 |

|

|

- |

|

| Amortization of warrant |

|

219 |

|

|

18 |

|

| Offering costs associated with warrants |

|

4,259 |

|

|

- |

|

| Stock-based compensation expense |

|

5,929 |

|

|

681 |

|

| Non-cash operating lease expense |

|

184 |

|

|

46 |

|

| Changes in operating assets and liabilities: | ||||||

| Accounts receivable |

|

(3,691 |

) |

|

(293 |

) |

| Prepaid expenses and other current assets |

|

(3,950 |

) |

|

(428 |

) |

| Other noncurrent assets |

|

(39 |

) |

|

3 |

|

| Accounts payable |

|

(1,191 |

) |

|

178 |

|

| Accrued expenses |

|

1,714 |

|

|

214 |

|

| Operating lease liabilities |

|

(15 |

) |

|

14 |

|

| Unearned revenue |

|

4,084 |

|

|

743 |

|

| Net cash used in operating activities |

|

(21,851 |

) |

|

(8,322 |

) |

| Cash flows from investing activities: | ||||||

| Purchases of property and equipment |

|

(5,300 |

) |

|

(8,031 |

) |

| Capitalized software development costs |

|

(1,205 |

) |

|

(775 |

) |

| Intangible asset acquisition costs |

|

(414 |

) |

|

(286 |

) |

| Proceeds from disposal of assets |

|

5 |

|

|

1 |

|

| Net cash used in investing activities |

|

(6,914 |

) |

|

(9,091 |

) |

| Cash flows from financing activities: | ||||||

| Proceeds from stock options exercised |

|

5,424 |

|

|

29 |

|

| Repurchase of early exercised stock options |

|

(968 |

) |

|

- |

|

| Proceeds from merger and PIPE transaction, net of transaction costs |

|

575,483 |

|

|

- |

|

| Net cash provided by financing activities |

|

579,939 |

|

|

29 |

|

| Net change in cash and cash equivalents |

|

551,174 |

|

|

(17,384 |

) |

| Cash and cash equivalents at the beginning of the period |

|

36,120 |

|

|

59,527 |

|

| Cash and cash equivalents at the end of the period | $ |

587,294 |

|

$ |

42,143 |

|

| Reconciliation of Net Loss to Adjusted EBITDA | |||||||||||||

| (unaudited) | |||||||||||||

| (in thousands) | |||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||

| Net loss | $ |

(14,781 |

) |

$ |

(3,565 |

) |

$ |

(32,102 |

) |

$ |

(10,493 |

) |

|

| Interest expense |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

| Benefit for income taxes |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

| Depreciation and amortization expense |

|

596 |

|

|

372 |

|

|

1,543 |

|

|

995 |

|

|

| Stock-based compensation |

|

2,055 |

|

|

181 |

|

|

5,929 |

|

|

681 |

|

|

| Change in fair value of assumed warrant liabilities |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

| Offering cost associated with warrants |

|

4,259 |

|

|

- |

|

|

4,259 |

|

|

- |

|

|

| Adjusted EBITDA | $ |

(7,871 |

) |

$ |

(3,012 |

) |

$ |

(20,371 |

) |

$ |

(8,817 |

) |

|

Adjusted EBITDA is a supplemental measure of our performance that is not required by, or presented in accordance with, generally accepted accounting principles in |

|||||||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20211115006227/en/

Media:

ionq@missionnorth.com

Investor:

IonQIR@icrinc.com

Source:

FAQ

What are IonQ's third quarter 2021 financial results?

What is IonQ's guidance for total contract value bookings in 2021?

What milestone did IonQ achieve regarding error correction?

What is IonQ's expected revenue for the fourth quarter of 2021?