Informatica Reports Third Quarter 2023 Financial Results

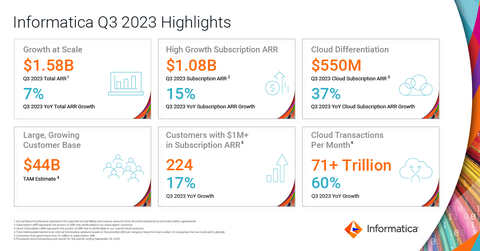

- Subscription ARR increased 15% YoY to $1.08 billion

- Cloud Subscription ARR increased 37% YoY to $550 million

- Exceeded high end of guidance for all Q3 2023 metrics

- Announced restructuring plan to reduce global workforce by 10%

-

Subscription Annual Recurring Revenue (ARR) in the third quarter increased

15% year-over-year to$1.08 billion -

Cloud Subscription ARR in the third quarter increased

37% year-over-year to$550 million - Exceeds high end of guidance across all third quarter 2023 metrics; raises full-year 2023 Non-GAAP Operating Income and Adjusted Unlevered Free Cash Flow (after-tax) guidance

-

Announces restructuring plan to reduce global workforce by

10% ; the plan streamlines the Company’s cost structure as a direct result of its cloud-only, consumption-driven strategy announced in January 2023; the Company expects no impact to full-year 2023 guidance

Informatica Q3 2023 Highlights (Graphic: Business Wire)

"Q3 represented another strong step forward as we accelerate our cloud-only, consumption-driven strategy. Our team delivered another quarter exceeding guidance for the top and bottom line as we help customers increase productivity, drive efficiency, and become AI-led, data-driven companies,” said Amit Walia, Chief Executive Officer at Informatica. “We continue to accelerate our innovation-led cloud transformation to make IDMC, powered by our AI engine CLAIRE, the data management platform of choice for enterprises across the globe as they build their modern data architecture to drive their AI-driven digital transformation.”

Third Quarter 2023 Financial Highlights:

-

GAAP Total Revenues increased

10% year-over-year to$408.6 million $5.0 million -

GAAP Subscription Revenues increased

22% year-over-year to$261.8 million -

Total ARR increased

7% year-over-year to$1.58 billion $1.4 million -

GAAP Operating Income of

$32.1 million $128.1 million -

GAAP Operating Cash Flow of

$58.7 million -

Adjusted Unlevered Free Cash Flow (after-tax) of

$96.1 million $38.0 million

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

Third Quarter 2023 Business Highlights:

-

Processed 71.3 trillion cloud transactions per month for the quarter ended September 30, 2023, compared to 44.5 trillion cloud transactions per month in the same quarter last year, an increase of

60% year-over-year. -

Reported 224 customers that spend more than

$1 million 17% year-over-year. -

Reported 1,978 customers that spend more than

$100,000 7% year-over-year. -

Achieved a Cloud Subscription net retention rate (NRR) of

118% at the end of September 30, 2023.

Product Innovation:

- Announced CLAIRE GPT, a generative AI-powered capability that will deliver the advancements of a natural language-based interface to Informatica’s Intelligent Data Management Cloud (IDMC), is available in private preview.

-

Expanded partnership with Oracle: launched Oracle Cloud (OCI) Point of Delivery (POD) in

North America to scale our market reach; expanded data governance capabilities with native scanners to collect metadata and profile data for insights on Oracle Autonomous Data and Oracle GoldenGate; and named launch partner for Private Offers on Oracle Cloud Marketplace. - Expanded partnership with Google: launched a new solution combining SaaS Master Data Management on Google Cloud with Google Cloud's customer data platform based on Google BiqQuery.

Industry Recognition:

- Named "An Outstanding Customer Service Experience" by J.D. Power for the third consecutive year in Certified Assisted Technical Support Program.

- Named a Winner in the Technology & Services Industry Association® (TSIA) 2023 Innovation in Customer Portals that Improve Digital Customer Experience category.

- Ranked #1 in the Dresner Advisory Services 2023 Master Data Management Market Study.

- Named a Champion in the Bloor Research Market Update for Master Data Management 2023 for the third consecutive year.

- Recognized in Constellation Research ShortList™ for Metadata Management, Data Cataloging and Data Governance for the fourth consecutive year.

Restructuring Plan:

-

Today, the Company announced a plan to reduce its workforce by approximately 545 employees, representing

10% of the Company’s current global workforce, and to reduce its global real estate footprint (the “November Plan”). The November Plan is intended to further streamline the Company’s cost structure as a direct result of its cloud-only, consumption-driven (“CoCd”) strategy announced in January 2023. The increased focus and simplicity of the CoCd strategy enables the Company to deliver continued AI-powered product innovation and strong Cloud Subscription ARR growth with a lower expense base and higher operating margins. The Company estimates that it will incur non-recurring charges of approximately$35 million $45 million $84 million $70 million - Added Walia, "In January, we transitioned to a cloud-only, consumption-driven strategy, which is the final leg of our multi-year plan to drive profitable growth. We’ve already seen significant benefits of these initiatives undertaken throughout this year, including the strong momentum and execution reflected in today’s earnings results. Our next phase of growth allows us to further streamline our global cost structure without reducing our growth expectations. We intend to finish our transition to a cloud-only business model while maintaining sales capacity, best-in-class product innovation and customer satisfaction. We have strong momentum heading into the fourth quarter and look forward to sharing more about our strategy at Investor Day.”

Ithaca L.P. Update:

- As disclosed in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, Ithaca L.P. (“Ithaca”), a limited partnership affiliated with the funds advised by Permira Advisors LLC, had an obligation to distribute its Class A Common Stock to its limited partners as soon as practicable after October 29, 2023, the two-year anniversary of the closing of the Company’s initial public offering. We have been advised that on or about November 3, 2023, Ithaca plans to distribute approximately 8.6 million shares of the Company’s Class A Common Stock to four of its limited partners. Following this distribution, approximately 51.4 million shares of Class A Common Stock will continue to be held in Ithaca for approximately one year, unless otherwise sold by Ithaca or distributed to Ithaca’s limited partners prior to such time. Permira will continue to retain voting and investment power over the shares held by Ithaca. The Company’s Class A Common Stock to be distributed by Ithaca to its limited partners will be available for immediate resale in the public market at the discretion of the applicable limited partner.

Share Repurchase Authorization:

-

On October 31, 2023, the Company's Board of Directors (the "Board") approved a new share repurchase authorization which enables the Company to repurchase up to

$200 million

Upcoming Events:

-

On December 5, 2023, the Company will host its 2023 Investor Day in

San Francisco at 1:00 p.m. PT. A live webcast and replay will be available on the Company's Investor Relations website. - On December 7, 2023, the Company is scheduled to participate in a fireside discussion at the Barclays Global Technology Conference at 2:30 p.m. PT. A live webcast and replay will be available on the Company's Investor Relations website.

Fourth Quarter and Full-Year 2023 Financial Outlook

The Company provides the financial guidance below based on current market conditions and expectations and it is subject to various important cautionary factors described below. Guidance includes the impact from macroeconomic conditions and expected foreign exchange headwinds versus the prior year comparable periods.

Based on information available as of November 1, 2023, guidance for the full-year 2023 is as follows:

Full-Year 2023 Ending December 31, 2023:

-

GAAP Total Revenues are expected to be in the range of

$1,570 million $1,590 million 5% year-over-year growth at the midpoint of the range. -

Total ARR is expected to be in the range of

$1,585 million $1,615 million 5% year-over-year growth at the midpoint of the range. -

Subscription ARR is expected to be in the range of

$1,098 million $1,118 million 11% year-over-year growth at the midpoint of the range. -

Cloud Subscription ARR is expected to be in the range of

$604 million $614 million 35% year-over-year growth at the midpoint of the range. -

Raising Non-GAAP Operating Income from

$420 million $440 million $430 million $450 million 25% year-over-year growth at the midpoint of the range. -

Raising Adjusted Unlevered Free Cash Flow (after-tax) from

$370 million $390 million $410 million $430 million 46% year-over-year growth at the midpoint of the range.

Based on information available as of November 1, 2023, guidance for the fourth quarter 2023 is as follows:

Fourth Quarter 2023 Ending December 31, 2023:

-

GAAP Total Revenues are expected to be in the range of

$420 million $440 million 8% year-over-year growth at the midpoint of the range. -

Subscription ARR is expected to be in the range of

$1,098 million $1,118 million 11% year-over-year growth at the midpoint of the range. -

Cloud Subscription ARR is expected to be in the range of

$604 million $614 million 35% year-over-year growth at the midpoint of the range. -

Non-GAAP Operating Income is expected to be in the range of

$130 million $150 million 23% year-over-year growth at the midpoint of the range.

The Company is assuming constant FX rates for the year based on the rates at the start of the full-year 2023 planning period. For reference purposes, the assumed FX rates for our top four currencies in full-year 2023 are as follows:

Currency |

|

Planned Rate |

EUR/$ |

|

1.07 |

GBP/$ |

|

1.20 |

$/CAD |

|

1.35 |

$/JPY |

|

132 |

Using the foreign exchange rate assumptions noted above, the Company has incorporated the following FX impacts into 2023 guidance:

|

Q4 2023 |

|

Full-Year 2023 |

Total Revenues |

|

|

|

Total ARR |

|

|

|

Subscription ARR |

|

|

|

Cloud Subscription ARR |

|

|

|

In addition to the above guidance, the Company is also providing fourth quarter and full-year 2023 cash paid for interest estimates for modeling purposes. For the fourth quarter 2023, we estimate cash paid for interest to be approximately

In addition to the above guidance, the Company is also providing a fourth quarter and full-year 2023 weighted-average number of basic and diluted share estimates for modeling purposes. For the fourth quarter 2023, we expect basic weighted-average shares outstanding to be approximately 292 million shares and diluted weighted-average shares outstanding to be approximately 297 million shares. For the full-year 2023, we expect basic weighted-average shares outstanding to be approximately 288 million shares and diluted weighted-average shares outstanding to be approximately 293 million shares.

Reconciliation of Non-GAAP Operating Income and Adjusted Unlevered Free Cash Flow after-tax guidance to the most directly comparable GAAP measures is not available without unreasonable effort, as certain items cannot be reasonably predicted because of their high variability, complexity, and low visibility. In particular, the measures and effects of our stock-based compensation expense specific to our equity compensation awards and employer payroll tax-related items on employee stock transactions are directly impacted by the timing of employee stock transactions and unpredictable fluctuations in our stock price, which we expect to have a significant impact on our future GAAP financial results.

Webcast and Conference Call

A conference call to discuss Informatica’s third quarter 2023 financial results and financial outlook for the fourth quarter and full-year 2023 is scheduled for 2:00 p.m. Pacific Time today. To participate, please dial 1-833-470-1428 from the

Forward-Looking Statements

This press release and the related conference call and webcast contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements may relate to, but are not limited to, expectations of future operating results or financial performance, including expectations regarding achieving profitability and our GAAP and non-GAAP guidance for the fourth quarter and 2023 fiscal year, the effect of foreign currency exchange rates, the effect of macroeconomic conditions, management’s plans, priorities, initiatives, and strategies, our efforts to reduce operating expenses and adjust cash flows in light of current business needs and priorities, our expected costs related to restructuring and related charges, including the timing of such charges, the impact of the restructuring and related charges on our business, results of operations and financial condition, plans regarding our stock repurchase authorization, the distribution of Class A common stock by certain of our stockholders and management's estimates and expectations regarding growth of our business, the potential benefits realized by customers from our cloud modernization programs, market, and partnerships. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “toward,” “will,” or “would,” or the negative of these words or other similar terms or expressions. You should not put undue reliance on any forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved, if at all.

Forward-looking statements are based on information available at the time those statements are made and are based on current expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management as of that time with respect to future events. These statements are subject to risks and uncertainties, many of which involve factors or circumstances that are beyond our control, that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this press release may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. These risks, uncertainties, assumptions, and other factors include, but are not limited to, those related to our business and financial performance, the effects of adverse global macroeconomic conditions and geopolitical uncertainty, the effects of public health crises on our business, results of operations, and financial condition, our ability to attract and retain customers, our ability to develop new products and services and enhance existing products and services, our ability to respond rapidly to emerging technology trends, our ability to execute on our business strategy, including our strategy related to the Informatica IDMC platform and key partnerships, our ability to increase and predict customer consumption of our platform, our ability to compete effectively, and our ability to manage growth.

Further information on these and additional risks, uncertainties, and other factors that could cause actual outcomes and results to differ materially from those included in or contemplated by the forward-looking statements contained in this release are included under the caption “Risk Factors” and elsewhere in our Annual Report on Form 10-K that was filed for the fiscal year ended December 31, 2022, and other filings and reports we make with the Securities and Exchange Commission from time to time, including our Quarterly Report on Form 10-Q that will be filed for the third quarter ended September 30, 2023. All forward-looking statements contained herein are based on information available to us as of the date hereof and we do not assume any obligation to update these statements as a result of new information or future events.

Non-GAAP Financial Measures and Key Business Metrics

We review several operating and financial metrics, including the following unaudited non-GAAP financial measures and key business metrics to evaluate our business, measure our performance, identify trends affecting our business, formulate business plans, and make strategic decisions:

Non-GAAP Financial Measures

In addition to our results determined in accordance with

Non-GAAP Income from Operations and Non-GAAP Net Income exclude the effect of stock-based compensation expense-related charges, amortization of acquired intangibles, equity compensation related payments, expenses associated with acquisitions, and strategic investments, and are adjusted for income tax effects. We believe the presentation of operating results that exclude these non-cash or non-recurring items provides useful supplemental information to investors and facilitates the analysis of our operating results and comparison of operating results across reporting periods.

Adjusted EBITDA represents GAAP net loss as adjusted for income tax benefit (expense), interest income, interest expense, loss on debt refinancing, other income (expense), stock-based compensation, amortization of intangibles, equity compensation related payments, restructuring, acquisition costs, and depreciation. Equity compensation-related payments are related to the repurchase of employee stock options. We believe adjusted EBITDA is an important metric for understanding our business to assess our relative profitability adjusted for balance sheet debt levels.

Adjusted Unlevered Free Cash Flow (after-tax) represents operating cash flow less purchases of property and equipment and is adjusted for interest payments, equity compensation payments, restructuring costs (including payments for impaired leases), and executive severance. We believe this measure provides useful supplemental information to investors because it is an indicator of our liquidity over the long term needed to maintain and grow our core business operations. We also provide actual and forecast cash interest expense to aid in the calculation of adjusted free cash flow (after-tax).

Key Business Metrics

Annual Recurring Revenue (ARR) represents the expected annual billing amounts from all active maintenance and subscription agreements. ARR is calculated based on the contract Monthly Recurring Revenue (MRR) multiplied by 12. MRR is calculated based on the accounting adjusted total contract value divided by the number of months of the agreement based on the start and end dates of each contracted line item. The aggregate ARR calculated at the end of each reported period represents the value of all contracts that are active as of the end of the period, including those contracts that have expired but are still under negotiation for renewal. We typically allow for a grace period of up to 6 months past the original contract expiration quarter during which we engage in the renewal process before we report the contract as lost/inactive. This grace-period ARR amount has been less than

Maintenance Annual Recurring Revenue represents the portion of ARR only attributable to our maintenance contracts. We believe that Maintenance ARR is a helpful metric for understanding our business since it represents the approximate annualized cash value collected over a 12-month period for all our maintenance contracts. Maintenance ARR includes maintenance contracts supporting our on-premise perpetual licenses. Maintenance ARR should be viewed independently of maintenance revenue and deferred revenue related to our maintenance contracts and is not intended to be combined with or to replace either of those items.

Subscription Annual Recurring Revenue represents the portion of ARR only attributable to our subscription contracts. We believe that Subscription ARR is a helpful metric for understanding our business since it represents the approximate annualized cash value collected over a 12-month period for all our recurring subscription contracts. Subscription ARR excludes maintenance contracts on our perpetual licenses to provide information regarding the period-to-period performance and overall size and scale of our subscription business as we continue to focus our efforts on subscription-based licensing. Subscription ARR should be viewed independently of subscription revenue and deferred revenue related to our subscription contracts and is not intended to be combined with or to replace either of those items.

Cloud Subscription Annual Recurring Revenue represents the portion of ARR that is attributable to our hosted cloud contracts. We believe that Cloud Subscription ARR is a helpful metric for understanding our business since it represents the approximate annualized cash value collected over a 12-month period for all our recurring Cloud contracts. Cloud Subscription ARR is a subset of our overall Subscription ARR, and by providing this breakdown of Cloud Subscription ARR, it provides visibility on the size and growth rate of our Cloud Subscription ARR within our overall Subscription ARR. Cloud Subscription ARR should be viewed independently of subscription revenue and deferred revenue related to our subscription contracts and is not intended to be combined with or to replace either of those items.

Subscription Net Retention Rate (NRR) compares the contract value for Subscription ARR from the same set of customers at the end of a period compared to the prior year. We treat divisions, segments, or subsidiaries inside companies as separate customers. To calculate our Subscription NRR for a particular period, we first establish the Subscription ARR value at the end of the prior-year period. We subsequently measure the Subscription ARR value at the end of the current period from the same cohort of customers. The net retention rate is then calculated by dividing the aggregate Subscription ARR in the current period by the prior-year period. An increase in the Subscription NRR occurs as a result of price increases on existing contracts, higher consumption of existing products, and sales of additional new subscription products to existing customers exceeding losses from subscription contracts due to cancellations. We believe Subscription NRR is an important metric for understanding our business since it measures the rate at which we are able to sell additional products into our subscription customer base.

Cloud Subscription Net Retention Rate compares the contract value for Cloud Subscription ARR from the same set of customers at the end of a period compared to the prior year. We treat divisions, segments or subsidiaries inside companies as separate customers. To calculate our Cloud Subscription NRR for a particular period, we first establish the Cloud Subscription ARR value at the end of the prior year period. We subsequently measure the Cloud Subscription ARR value at the end of the current period from the same cohort of customers. Cloud Subscription NRR is then calculated by dividing the aggregate Cloud Subscription ARR in the current period by the prior year period. An increase in the Cloud Subscription NRR occurs as a result of price increases on existing contracts, higher consumption of existing products, and sales of additional new subscription products to existing customers exceeding losses from subscription contracts due to price decreases, usage decreases and cancellations. We believe Cloud Subscription NRR is an important metric for understanding our business since it measures the rate at which we are able to sell additional products into our cloud subscription customer base.

About Informatica

Informatica (NYSE: INFA), an Enterprise Cloud Data Management leader, brings data to life by empowering businesses to realize the transformative power of their most critical assets. We have created a new category of software, the Informatica Intelligent Data Management Cloud™ (IDMC). IDMC is an end-to-end data management platform, powered by CLAIRE® AI, that connects, manages and unifies data across any multi-cloud or hybrid system, democratizing data and enabling enterprises to modernize and advance their business strategies. Customers in more than 100 countries, including 85 of the Fortune 100, rely on Informatica to drive data-led digital transformation. Informatica. Where data comes to life.

INFORMATICA INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data) (unaudited) |

|||||||||||||||

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

|

|

|

|

|

|

|

|

||||||||

Revenues: |

|

|

|

|

|

|

|

||||||||

Subscriptions |

$ |

261,828 |

|

|

$ |

214,009 |

|

|

$ |

703,339 |

|

|

$ |

618,799 |

|

Perpetual license |

|

205 |

|

|

|

1,208 |

|

|

|

1,024 |

|

|

|

6,180 |

|

Software revenue |

|

262,033 |

|

|

|

215,217 |

|

|

|

704,363 |

|

|

|

624,979 |

|

Maintenance and professional services |

|

146,530 |

|

|

|

156,734 |

|

|

|

445,619 |

|

|

|

481,358 |

|

Total revenues |

|

408,563 |

|

|

|

371,951 |

|

|

|

1,149,982 |

|

|

|

1,106,337 |

|

Cost of revenues: |

|

|

|

|

|

|

|

||||||||

Subscriptions |

|

39,133 |

|

|

|

27,692 |

|

|

|

113,443 |

|

|

|

77,573 |

|

Perpetual license |

|

162 |

|

|

|

147 |

|

|

|

555 |

|

|

|

476 |

|

Software costs |

|

39,295 |

|

|

|

27,839 |

|

|

|

113,998 |

|

|

|

78,049 |

|

Maintenance and professional services |

|

41,533 |

|

|

|

50,649 |

|

|

|

128,556 |

|

|

|

152,574 |

|

Amortization of acquired technology |

|

3,013 |

|

|

|

8,703 |

|

|

|

8,776 |

|

|

|

26,776 |

|

Total cost of revenues |

|

83,841 |

|

|

|

87,191 |

|

|

|

251,330 |

|

|

|

257,399 |

|

Gross profit |

|

324,722 |

|

|

|

284,760 |

|

|

|

898,652 |

|

|

|

848,938 |

|

Operating expenses: |

|

|

|

|

|

|

|

||||||||

Research and development |

|

85,862 |

|

|

|

80,403 |

|

|

|

255,608 |

|

|

|

239,590 |

|

Sales and marketing |

|

129,997 |

|

|

|

132,282 |

|

|

|

393,035 |

|

|

|

404,831 |

|

General and administrative |

|

41,911 |

|

|

|

31,255 |

|

|

|

122,027 |

|

|

|

92,461 |

|

Amortization of intangible assets |

|

34,481 |

|

|

|

38,231 |

|

|

|

103,120 |

|

|

|

115,351 |

|

Restructuring |

|

407 |

|

|

|

— |

|

|

|

28,131 |

|

|

|

— |

|

Total operating expenses |

|

292,658 |

|

|

|

282,171 |

|

|

|

901,921 |

|

|

|

852,233 |

|

Income (loss) from operations |

|

32,064 |

|

|

|

2,589 |

|

|

|

(3,269 |

) |

|

|

(3,295 |

) |

Interest income |

|

10,447 |

|

|

|

2,813 |

|

|

|

27,950 |

|

|

|

4,308 |

|

Interest expense |

|

(39,327 |

) |

|

|

(22,185 |

) |

|

|

(111,844 |

) |

|

|

(51,570 |

) |

Other income, net |

|

5,519 |

|

|

|

3,963 |

|

|

|

8,680 |

|

|

|

12,020 |

|

Income (loss) before income taxes |

|

8,703 |

|

|

|

(12,820 |

) |

|

|

(78,483 |

) |

|

|

(38,537 |

) |

Income tax (benefit) expense |

|

(70,573 |

) |

|

|

2,782 |

|

|

|

111,061 |

|

|

|

10,757 |

|

Net income (loss) |

$ |

79,276 |

|

|

$ |

(15,602 |

) |

|

$ |

(189,544 |

) |

|

$ |

(49,294 |

) |

Net income (loss) per share attributable to Class A and Class B-1 common stockholders: |

|

|

|

|

|

|

|

||||||||

Basic |

$ |

0.27 |

|

|

$ |

(0.06 |

) |

|

$ |

(0.66 |

) |

|

$ |

(0.18 |

) |

Diluted |

$ |

0.27 |

|

|

$ |

(0.06 |

) |

|

$ |

(0.66 |

) |

|

$ |

(0.18 |

) |

Weighted-average shares used in computing net income (loss) per share: |

|

|

|

|

|

|

|

||||||||

Basic |

|

289,354 |

|

|

|

281,859 |

|

|

|

287,133 |

|

|

|

280,361 |

|

Diluted |

|

296,556 |

|

|

|

281,859 |

|

|

|

287,133 |

|

|

|

280,361 |

|

INFORMATICA INC. CONSOLIDATED BALANCE SHEETS (in thousands, except par value data) |

|||||||

|

September 30, |

|

December 31, |

||||

|

2023 |

|

2022 |

||||

|

(unaudited) |

|

|

||||

Assets |

|

|

|

||||

Current assets: |

|

|

|

||||

Cash and cash equivalents |

$ |

612,107 |

|

|

$ |

497,879 |

|

Short-term investments |

|

256,986 |

|

|

|

218,256 |

|

Accounts receivable, net of allowances of |

|

273,355 |

|

|

|

454,759 |

|

Contract assets, net |

|

89,455 |

|

|

|

95,221 |

|

Prepaid expenses and other current assets |

|

125,053 |

|

|

|

132,638 |

|

Total current assets |

|

1,356,956 |

|

|

|

1,398,753 |

|

Property and equipment, net |

|

152,464 |

|

|

|

160,574 |

|

Operating lease right-of-use-assets |

|

58,055 |

|

|

|

67,735 |

|

Goodwill |

|

2,340,632 |

|

|

|

2,337,036 |

|

Customer relationships intangible asset, net |

|

698,152 |

|

|

|

794,898 |

|

Other intangible assets, net |

|

22,079 |

|

|

|

33,094 |

|

Deferred tax assets |

|

16,428 |

|

|

|

13,076 |

|

Other assets |

|

152,991 |

|

|

|

165,733 |

|

Total assets |

$ |

4,797,757 |

|

|

$ |

4,970,899 |

|

Liabilities and Stockholders’ Equity |

|

|

|

||||

Current liabilities: |

|

|

|

||||

Accounts payable |

$ |

7,956 |

|

|

$ |

38,002 |

|

Accrued liabilities |

|

39,049 |

|

|

|

58,844 |

|

Accrued compensation and related expenses |

|

106,748 |

|

|

|

150,118 |

|

Current operating lease liabilities |

|

16,365 |

|

|

|

17,514 |

|

Current portion of long-term debt |

|

18,750 |

|

|

|

18,750 |

|

Income taxes payable |

|

28,951 |

|

|

|

3,758 |

|

Contract liabilities |

|

599,675 |

|

|

|

676,470 |

|

Total current liabilities |

|

817,494 |

|

|

|

963,456 |

|

Long-term operating lease liabilities |

|

46,279 |

|

|

|

55,178 |

|

Long-term contract liabilities |

|

14,696 |

|

|

|

23,007 |

|

Long-term debt, net |

|

1,809,891 |

|

|

|

1,821,760 |

|

Deferred tax liabilities |

|

27,296 |

|

|

|

18,604 |

|

Long-term income taxes payable |

|

37,810 |

|

|

|

30,601 |

|

Other liabilities |

|

3,778 |

|

|

|

3,932 |

|

Total liabilities |

|

2,757,244 |

|

|

|

2,916,538 |

|

Stockholders’ equity: |

|

|

|

||||

Class A common stock; |

|

2,471 |

|

|

|

2,398 |

|

Class B-1 common stock; |

|

440 |

|

|

|

440 |

|

Class B-2 common stock; |

|

— |

|

|

|

— |

|

Additional paid-in-capital |

|

3,466,037 |

|

|

|

3,282,383 |

|

Accumulated other comprehensive income (loss) |

|

(55,690 |

) |

|

|

(47,671 |

) |

Accumulated deficit |

|

(1,372,745 |

) |

|

|

(1,183,189 |

) |

Total stockholders’ equity |

|

2,040,513 |

|

|

|

2,054,361 |

|

Total liabilities and stockholders’ equity |

$ |

4,797,757 |

|

|

$ |

4,970,899 |

|

INFORMATICA INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) (unaudited) |

||||||||||||||||

|

|

Three Months Ended

|

|

Nine Months Ended

|

||||||||||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

|

|

|

|

|

|

|

|

|

||||||||

Operating activities: |

|

|

|

|

|

|

|

|

||||||||

Net income (loss) |

|

$ |

79,276 |

|

|

$ |

(15,602 |

) |

|

$ |

(189,544 |

) |

|

$ |

(49,294 |

) |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

||||||||

Depreciation and amortization |

|

|

4,203 |

|

|

|

5,091 |

|

|

|

12,674 |

|

|

|

16,461 |

|

Non-cash operating lease costs |

|

|

3,776 |

|

|

|

4,124 |

|

|

|

12,800 |

|

|

|

12,841 |

|

Stock-based compensation |

|

|

56,508 |

|

|

|

34,155 |

|

|

|

162,058 |

|

|

|

97,988 |

|

Deferred income taxes |

|

|

358 |

|

|

|

(27,439 |

) |

|

|

4,356 |

|

|

|

(84,786 |

) |

Amortization of intangible assets and acquired technology |

|

|

37,494 |

|

|

|

46,934 |

|

|

|

111,896 |

|

|

|

142,127 |

|

Amortization of debt issuance costs |

|

|

870 |

|

|

|

898 |

|

|

|

2,574 |

|

|

|

2,735 |

|

Amortization of investment discount, net of premium |

|

|

(1,225 |

) |

|

|

(280 |

) |

|

|

(2,976 |

) |

|

|

(280 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

||||||||

Accounts receivable |

|

|

23,303 |

|

|

|

34,562 |

|

|

|

182,550 |

|

|

|

174,716 |

|

Prepaid expenses and other assets |

|

|

(1,187 |

) |

|

|

6,650 |

|

|

|

25,894 |

|

|

|

10,341 |

|

Accounts payable and accrued liabilities |

|

|

(4,740 |

) |

|

|

(2,742 |

) |

|

|

(108,067 |

) |

|

|

(112,792 |

) |

Income taxes payable |

|

|

(96,176 |

) |

|

|

7,728 |

|

|

|

32,574 |

|

|

|

22,591 |

|

Contract liabilities |

|

|

(43,742 |

) |

|

|

(40,820 |

) |

|

|

(81,484 |

) |

|

|

(93,301 |

) |

Net cash provided by operating activities |

|

|

58,718 |

|

|

|

53,259 |

|

|

|

165,305 |

|

|

|

139,347 |

|

Investing activities: |

|

|

|

|

|

|

|

|

||||||||

Purchases of property and equipment |

|

|

(1,804 |

) |

|

|

(573 |

) |

|

|

(4,919 |

) |

|

|

(1,573 |

) |

Purchases of investments |

|

|

(107,148 |

) |

|

|

(132,577 |

) |

|

|

(255,073 |

) |

|

|

(181,245 |

) |

Maturities of investments |

|

|

28,307 |

|

|

|

20,287 |

|

|

|

180,007 |

|

|

|

67,588 |

|

Sales of investments |

|

|

15,712 |

|

|

|

— |

|

|

|

39,510 |

|

|

|

— |

|

Business acquisition, net of cash acquired |

|

|

(12,476 |

) |

|

|

— |

|

|

|

(12,476 |

) |

|

|

— |

|

Net cash used in investing activities |

|

|

(77,409 |

) |

|

|

(112,863 |

) |

|

|

(52,951 |

) |

|

|

(115,230 |

) |

Financing activities: |

|

|

|

|

|

|

|

|

||||||||

Payment of debt |

|

|

(4,688 |

) |

|

|

(4,688 |

) |

|

|

(14,064 |

) |

|

|

(9,376 |

) |

Proceeds from issuance of common stock under employee stock purchase plan |

|

|

12,098 |

|

|

|

19,146 |

|

|

|

28,229 |

|

|

|

32,790 |

|

Payments of offering costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,085 |

) |

Payments for dividends related to Class B-2 shares |

|

|

— |

|

|

|

— |

|

|

|

(12 |

) |

|

|

(24 |

) |

Payments for taxes related to net share settlement of equity awards |

|

|

(15,152 |

) |

|

|

— |

|

|

|

(26,252 |

) |

|

|

— |

|

Net activity from derivatives with an other-than-insignificant financing element |

|

|

— |

|

|

|

2,283 |

|

|

|

— |

|

|

|

(4,851 |

) |

Proceeds from issuance of shares under equity plans |

|

|

12,039 |

|

|

|

5,063 |

|

|

|

19,692 |

|

|

|

17,537 |

|

Net cash provided by financing activities |

|

|

4,297 |

|

|

|

21,804 |

|

|

|

7,593 |

|

|

|

33,991 |

|

Effect of foreign exchange rate changes on cash and cash equivalents |

|

|

(6,302 |

) |

|

|

(5,538 |

) |

|

|

(5,719 |

) |

|

|

(16,341 |

) |

Net (decrease) / increase in cash and cash equivalents |

|

|

(20,696 |

) |

|

|

(43,338 |

) |

|

|

114,228 |

|

|

|

41,767 |

|

Cash and cash equivalents at beginning of period |

|

|

632,803 |

|

|

|

543,201 |

|

|

|

497,879 |

|

|

|

458,096 |

|

Cash and cash equivalents at end of period |

|

$ |

612,107 |

|

|

$ |

499,863 |

|

|

$ |

612,107 |

|

|

$ |

499,863 |

|

Supplemental disclosures: |

|

|

|

|

|

|

|

|

||||||||

Cash paid for interest |

|

$ |

38,027 |

|

|

$ |

23,753 |

|

|

$ |

109,089 |

|

|

$ |

54,234 |

|

Cash paid for income taxes, net of refunds |

|

$ |

25,224 |

|

|

$ |

22,492 |

|

|

$ |

74,110 |

|

|

$ |

72,951 |

|

INFORMATICA INC. NON-GAAP FINANCIAL MEASURES AND KEY BUSINESS METRICS (in thousands, except per share data) (unaudited) |

|||||||||||||||

| RECONCILIATIONS OF GAAP TO NON-GAAP | |||||||||||||||

Reconciliation of GAAP net income (loss) to Non-GAAP net income |

|||||||||||||||

|

Three Months Ended September

|

|

Nine Months Ended September

|

||||||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

|

|

|

|

|

|

|

|

||||||||

|

(in thousands) |

|

(in thousands) |

||||||||||||

GAAP net income (loss) |

$ |

79,276 |

|

|

$ |

(15,602 |

) |

|

$ |

(189,544 |

) |

|

$ |

(49,294 |

) |

Stock-based compensation |

|

56,508 |

|

|

|

34,155 |

|

|

|

162,058 |

|

|

|

97,988 |

|

Amortization of intangibles |

|

37,494 |

|

|

|

46,934 |

|

|

|

111,896 |

|

|

|

142,127 |

|

Equity compensation |

|

— |

|

|

|

19 |

|

|

|

— |

|

|

|

147 |

|

Restructuring |

|

407 |

|

|

|

— |

|

|

|

28,131 |

|

|

|

— |

|

Acquisition costs |

|

1,584 |

|

|

|

— |

|

|

|

1,584 |

|

|

|

— |

|

Executive severance |

|

— |

|

|

|

33 |

|

|

|

— |

|

|

|

99 |

|

Income tax effect |

|

(94,653 |

) |

|

|

(12,932 |

) |

|

|

59,269 |

|

|

|

(35,662 |

) |

Non-GAAP net income |

$ |

80,616 |

|

|

$ |

52,607 |

|

|

$ |

173,394 |

|

|

$ |

155,405 |

|

|

|

|

|

|

|

|

|

||||||||

Net income (loss) per share: |

|

|

|

|

|

|

|

||||||||

Net income (loss) per share—basic |

$ |

0.27 |

|

|

$ |

(0.06 |

) |

|

$ |

(0.66 |

) |

|

$ |

(0.18 |

) |

Net income (loss) per share—diluted |

$ |

0.27 |

|

|

$ |

(0.06 |

) |

|

$ |

(0.66 |

) |

|

$ |

(0.18 |

) |

Non-GAAP net income per share—basic |

$ |

0.28 |

|

|

$ |

0.19 |

|

|

$ |

0.60 |

|

|

$ |

0.55 |

|

Non-GAAP net income per share—diluted |

$ |

0.27 |

|

|

$ |

0.18 |

|

|

$ |

0.59 |

|

|

$ |

0.54 |

|

|

|

|

|

|

|

|

|

||||||||

Share count (in thousands): |

|

|

|

|

|

|

|

||||||||

Weighted-average shares used in computing Net income (loss) per share—basic |

|

289,354 |

|

|

|

281,859 |

|

|

|

287,133 |

|

|

|

280,361 |

|

Weighted-average shares used in computing Net income (loss) per share—diluted |

|

296,556 |

|

|

|

281,859 |

|

|

|

287,133 |

|

|

|

280,361 |

|

Weighted-average shares used in computing Non-GAAP net income per share—basic |

|

289,354 |

|

|

|

281,859 |

|

|

|

287,133 |

|

|

|

280,361 |

|

Weighted-average shares used in computing Non-GAAP net income per share—diluted |

|

296,556 |

|

|

|

286,794 |

|

|

|

292,072 |

|

|

|

285,163 |

|

Reconciliation of GAAP income (loss) from operations to Non-GAAP income from operations |

|||||||||||||||

|

Three Months Ended September

|

|

Nine Months Ended September

|

||||||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

|

|

|

|

|

|

|

|

||||||||

|

(in thousands) |

|

(in thousands) |

||||||||||||

GAAP income (loss) from operations |

$ |

32,064 |

|

|

$ |

2,589 |

|

|

$ |

(3,269 |

) |

|

$ |

(3,295 |

) |

Stock-based compensation |

|

56,508 |

|

|

34,155 |

|

|

162,058 |

|

|

|

97,988 |

|

||

Amortization of intangibles |

|

37,494 |

|

|

|

46,934 |

|

|

|

111,896 |

|

|

|

142,127 |

|

Equity compensation |

|

— |

|

|

|

19 |

|

|

|

— |

|

|

|

147 |

|

Restructuring |

|

407 |

|

|

|

— |

|

|

|

28,131 |

|

|

|

— |

|

Acquisition costs |

|

1,584 |

|

|

|

— |

|

|

|

1,584 |

|

|

|

— |

|

Non-GAAP income from operations |

$ |

128,057 |

|

|

$ |

83,697 |

|

|

$ |

300,400 |

|

|

$ |

236,967 |

|

INFORMATICA INC. NON-GAAP FINANCIAL MEASURES AND KEY BUSINESS METRICS |

|||||||||||||||||||

Adjusted EBITDA Reconciliation |

|||||||||||||||||||

|

Three Months Ended September

|

|

Nine Months Ended September

|

|

Trailing Twelve

|

||||||||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

(in thousands) |

|

(in thousands) |

|

(in thousands) |

||||||||||||||

GAAP net income (loss) |

$ |

79,276 |

|

|

$ |

(15,602 |

) |

|

$ |

(189,544 |

) |

|

$ |

(49,294 |

) |

|

$ |

(193,925 |

) |

Income tax (benefit) expense |

|

(70,573 |

) |

|

|

2,782 |

|

|

|

111,061 |

|

|

|

10,757 |

|

|

|

119,782 |

|

Interest income |

|

(10,447 |

) |

|

|

(2,813 |

) |

|

|

(27,950 |

) |

|

|

(4,308 |

) |

|

|

(32,866 |

) |

Interest expense |

|

39,327 |

|

|

|

22,185 |

|

|

|

111,844 |

|

|

|

51,570 |

|

|

|

138,294 |

|

Other income, net |

|

(5,519 |

) |

|

|

(3,963 |

) |

|

|

(8,680 |

) |

|

|

(12,020 |

) |

|

|

(5,656 |

) |

Stock-based compensation |

|

56,508 |

|

|

|

34,155 |

|

|

|

162,058 |

|

|

|

97,988 |

|

|

|

199,932 |

|

Amortization of intangibles |

|

37,494 |

|

|

|

46,934 |

|

|

|

111,896 |

|

|

|

142,127 |

|

|

|

158,594 |

|

Equity compensation |

|

— |

|

|

|

19 |

|

|

|

— |

|

|

|

147 |

|

|

|

185 |

|

Restructuring |

|

407 |

|

|

|

— |

|

|

|

28,131 |

|

|

|

— |

|

|

|

28,131 |

|

Acquisition costs |

|

1,584 |

|

|

|

— |

|

|

|

1,584 |

|

|

|

— |

|

|

|

1,584 |

|

Depreciation |

|

4,132 |

|

|

|

5,092 |

|

|

|

12,540 |

|

|

|

16,286 |

|

|

|

17,261 |

|

Adjusted EBITDA |

$ |

132,189 |

|

|

$ |

88,789 |

|

|

$ |

312,940 |

|

|

$ |

253,253 |

|

|

$ |

431,316 |

|

Adjusted Unlevered Free Cash Flows |

|||||||||||||||

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

||||||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

|

(in thousands, except percentages) |

|

(in thousands, except percentages) |

||||||||||||

Total GAAP Revenue |

$ |

408,563 |

|

|

$ |

371,951 |

|

|

$ |

1,149,982 |

|

|

$ |

1,106,337 |

|

Net cash provided by operating activities |

$ |

58,718 |

|

|

$ |

53,259 |

|

|

$ |

165,305 |

|

|

$ |

139,347 |

|

Less: Purchases of property, plant, and equipment |

|

(1,804 |

) |

|

|

(573 |

) |

|

|

(4,919 |

) |

|

|

(1,573 |

) |

Add: Equity compensation payments |

|

47 |

|

|

|

159 |

|

|

|

168 |

|

|

|

504 |

|

Add: Executive severance |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,919 |

|

Add: Restructuring costs |

|

1,144 |

|

|

|

182 |

|

|

|

26,764 |

|

|

|

575 |

|

Adjusted Free Cash Flow (after-tax)(1) |

$ |

58,105 |

|

|

$ |

53,027 |

|

|

$ |

187,318 |

|

|

$ |

142,772 |

|

Add: Cash paid for interest |

|

38,027 |

|

|

|

23,753 |

|

|

|

109,089 |

|

|

|

54,234 |

|

Adjusted Unlevered Free Cash Flows (after-tax)(1) |

$ |

96,132 |

|

|

$ |

76,780 |

|

|

$ |

296,407 |

|

|

$ |

197,006 |

|

|

|

|

|

|

|

|

|

||||||||

Adjusted Free Cash Flow (after-tax) margin(1) |

|

14 |

% |

|

|

14 |

% |

|

|

16 |

% |

|

|

13 |

% |

Adjusted Unlevered Free Cash Flows (after-tax) margin(1) |

|

24 |

% |

|

|

21 |

% |

|

|

26 |

% |

|

|

18 |

% |

(1) Includes cash tax payments of

Key Business Metrics |

|||||||

|

September 30, |

||||||

|

2023 |

|

2022 |

||||

|

|

|

|

||||

|

(in thousands, except percentages) |

||||||

Cloud Subscription Annual Recurring Revenue |

$ |

549,507 |

|

|

$ |

400,271 |

|

Self-managed Subscription Annual Recurring Revenue |

|

527,687 |

|

|

|

536,123 |

|

Subscription Annual Recurring Revenue |

|

1,077,194 |

|

|

|

936,394 |

|

Maintenance Annual Recurring Revenue on Perpetual Licenses |

|

498,697 |

|

|

|

531,357 |

|

Total Annual Recurring Revenue |

$ |

1,575,891 |

|

|

$ |

1,467,751 |

|

|

|

|

|

||||

Subscription Net Retention Rate |

|

106 |

% |

|

|

112 |

% |

Cloud Subscription Net Retention Rate |

|

118 |

% |

|

|

115 |

% |

INFORMATICA INC. SUPPLEMENTAL INFORMATION |

|||||

Additional Business Metrics |

|||||

|

September 30, |

||||

|

2023 |

|

2022 |

||

Maintenance Renewal Rate |

95 |

% |

|

96 |

% |

Subscription Renewal Rate |

94 |

% |

|

94 |

% |

Customers that spend more than |

224 |

|

|

191 |

|

Customers that spend more than |

1,978 |

|

|

1,852 |

|

Cloud transactions processed per month in trillions(3) |

71.3 |

|

|

44.5 |

|

(1) |

Total number of customers that spend more than |

|

(2) |

Total number of customers that spend more than |

|

(3) |

Total number of cloud transactions processed on our platform per month in trillions, which measures data processed. |

Net Debt Reconciliation |

|||||||

|

September 30, |

|

December 31 |

||||

|

2023 |

|

2022 |

||||

|

|

|

|

||||

|

(in millions) |

||||||

Dollar Term Loan |

$ |

1,847 |

|

|

$ |

1,861 |

|

Less: Cash, cash equivalents, and short-term investments |

|

(869 |

) |

|

|

(716 |

) |

Total net debt |

$ |

978 |

|

|

$ |

1,145 |

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20231101362347/en/

Investor Relations:

Victoria Hyde-Dunn

vhydedunn@informatica.com

Public Relations:

prteam@informatica.com

Source: Informatica

FAQ

What is the Subscription Annual Recurring Revenue (ARR) for Informatica in Q3 2023?

What is the Cloud Subscription ARR for Informatica in Q3 2023?

Did Informatica meet its guidance for Q3 2023?

What is the restructuring plan announced by Informatica?