INCC May 11, 2021 Shareholder Update

INCC (OTC PINK: INCC) recently provided a shareholder update detailing significant developments from April 2021. The company became compliant with OTC markets, returned 394 million shares to treasury, and reduced its authorized shares from 8.9 billion to 7 billion. A major acquisition of Blue Plant Farms, LLC was executed, focusing on CBD hemp oil products with innovative formulations. The acquisition includes a $5 million deal for Preferred Z shares, capped at 7 billion shares outstanding. INCC aims to implement a national go-to-market strategy targeting 5,000 convenience stores within 24 months.

- INCC became compliant with OTC markets.

- Returned 394 million shares to treasury.

- Reduced authorized shares from 8.9 billion to 7 billion.

- Executed acquisition of Blue Plant Farms, enhancing product offerings.

- Plans to target 5,000 convenience stores in a national market strategy.

- Issued 220,678,371 shares for board member services, increasing outstanding shares.

Insights

Analyzing...

SARASOTA, FL / ACCESSWIRE / May 11, 2021 / INCC (International Consolidated Companies, Inc. (OTC PINK:INCC)) Shareholder Update:

April 2021:

INCC became OTC markets compliant.

INCC returned 394mm shares to treasury.

INCC reduced its Authorized Shares, by 1.9B, from 8.9B to 7B.

INCC added Thomas J. Megale, CPA to its Board of directors.

INCC issued 220,678,371 shares to TJ Megale and CJ Ornburg each respectively for their service on the Board of Directors. As of these two issuances there are now 7B shares issued and outstanding of INCC common stock. The Authorized has been capped at 7B.

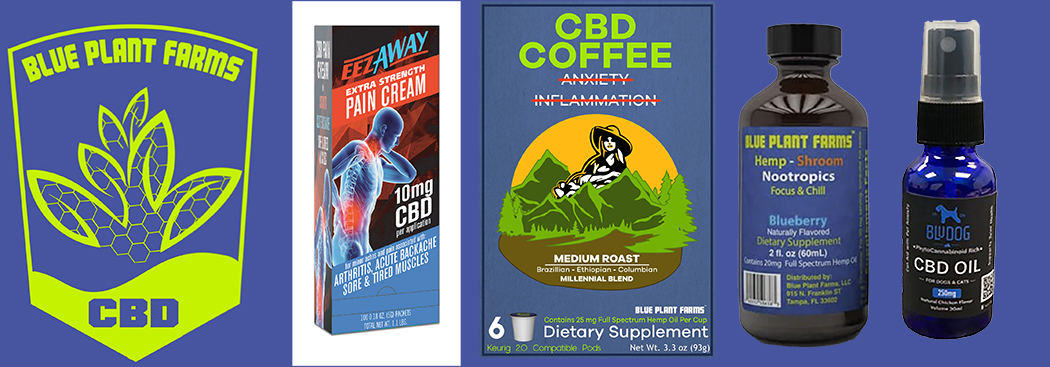

April 30th INCC executed a definitive agreement to acquire Blue Plant Farms, LLC. Blue Plant Farms produces CBD hemp oil products under several brand names offering improved bioavailability through the Company's proprietary water-soluble formulations.

Blue Plant Farms' product suite includes:

- EEZ-AWAY™ OTC Drug Single Application CBD with Emu Oil for topical pain relief

- CBD Millennial Blend™ Coffees w/25gm Full Spectrum Hemp Oil in K-Cup capsules

- NOOTROPIC™ Blueberry Hemp-Shroom Nootropic Shot for well-being.

- BLUDOG™ Phyto-Cannabinoid for Dogs & Cats with 250 mg CBD

EEZ-AWAY™ is the first BPF product to use PureForm CBDTM.

Since PureForm CBDTM is manufactured in their labs, where there are no production capacity constraints due to crop damage or limitations of any kind; No hemp or cannabis-based regulatory constraints; No: Toxic Impurities, Heavy Metals, Pesticides, Neurotoxins, or Mycotoxins. No Variability in Product Quality.

CBD is cannabidiol, one of 140 cannabinoids -naturally occurring compounds found in cannabis plants. CBD is cannabidiol, one of 140 cannabinoids -naturally occurring compounds found in cannabis plants. Generally speaking, Research supports CBD's benefits in a range of conditions.

Terms of the Deal:

Sales Milestones and Bonus Structure

Sales Bonus Shares

Year 1=

Year 2=

Year 3=

Year 4=

INCC anticipates launching the Company's National Go-To-Market strategy on July 1, 2021 through Blue Plant Farms' sales and distribution contract with a 90,000-member convenience store association, with initial goals calling for insertion of products into 5,000 convenience stores over the next 24 months.

Valuation Econometrics was engaged by INCC to value BPF on the merits of its contract for implementation of 5,000 C-stores and only the (1) EEZ-AWAY™ product. This valuation does not include any other products or distribution channels including additional C-stores.

In addition, INCC today announced the addition of Thomas J. Megale, CPA to the Company's board of directors, joining Antonio Uccello - CEO and Chairman of the Board, and Jeffrey Ornburg - Director.

Antonio Uccello - Chief Executive Officer / Chairman of the Board

Mr. Uccello is the founder, President, Chief Executive Officer, Chairman of the Board of Directors and the Chief Financial Officer of the Company. Mr. Uccello attended college at the University of Connecticut and took graduate courses at Hunter College in New York City. Mr. Uccello has been in the securities industry for 13 years. Mr. Uccello has extensive experience in finance and is responsible for the over-all profitability of the Company.

C. Jeffrey Ornburg - Director

Jeffrey Ornburg was the co-founder and Managing Partner of Excelsior Benefits, Excelsior Companies, and Excelsior Endeavors. Excelsior Benefits is a national general agency operating in the small to mid-market employee benefits. Representing United Healthcare, Blue Cross Blue Shield, Principal Financial, TransAmerica, Human. Mr. Ornburg played an integral role in growing the agency to over a

Thomas Megale - Director

Thomas Megale is on the board of Greenrose Acquisition Corp. and Managing Member at T J Megale CPA PLLC. He previously was Partner at Abbate & Megale. Mr. Megale received undergraduate degree from Boston College School of Management 1981.

About International Consolidated Companies, Inc.

International Consolidated Companies (INCC) was founded in 2002. INCC is focused on acquiring and growing businesses that offer innovation, quality, and cost-efficient Cannabis technologies.

Forward-looking disclaimer

This press release may contain certain forward-looking statements and information, as defined within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and is subject to the Safe Harbor created by those sections. This material may contain statements about expected future events and/or financial results that are forward-looking in nature and subject to risk and uncertainties. Such forward-looking statements by definition involve risks, uncertainties and other factors, which may cause the actual results, performance or achievements to be materially different from the statements made herein.

More Information: Antonio Uccello, INCC (949-315-0244) (baltic38dp@me.com),

@baltic38dp

SOURCE: International Consolidated Companies, Inc.

View source version on accesswire.com:

https://www.accesswire.com/646226/INCC-May-11-2021-Shareholder-Update