Intrepid Metals Closes MAN Property Acquisition Completing Its Consolidation Work of an Established Copper and Gold Mineralized Trend in Arizona

- Acquisition of MAN Property enhances the Corral Copper Project's mineralized trend and total acreage

- Historical drilling data shows high-grade copper and gold intercepts

- Consolidation of land ownership facilitates district-scale approach to exploration and development

- None.

- MAN Property hosts 80 previous drill holes and 19,449 meters of assay data, within 622 acres of patented mining claims and BLM lode claims

- Several high-grade copper and gold intercepts from historic drilling including:

- 53.03 meters of

1.63% Cu and 1.45 g/t Au in Hole 28_08 - 72.03 meters of

0.75% Cu, 0.34 g/t Au and 14.47 g/t Ag in Hole 28_01

- 53.03 meters of

- With the addition of the MAN Property, the Corral Copper Project now contains a 3 km long mineralized trend and totals over 9,600 acres (15 Square miles), including 1,800 acres of patented mining claims and surface rights

VANCOUVER, BC / ACCESSWIRE / December 12, 2023 / Intrepid Metals Corp. (TSXV:INTR)(OTCQB:IMTCF) ("Intrepid" or the "Company") is pleased to announce that it has closed the previously announced option to acquire a

The terms of the Agreement give Intrepid the option to acquire a

Time Period | Cash Payments | Share Consideration |

Closing | 3,500,000 Shares | |

12 Months | 2,500,000 Shares | |

24 Months | 2,500,000 Shares | |

36 Months | 3,500,000 Shares | |

Totals | 12,000,000 Shares |

In connection with closing, Intrepid has made the initial

"We are very pleased to close this integral acquisition as it completes the consolidation of a 3 km trend of impressive copper and gold mineralization within our larger Corral Copper Project area," said Ken Brophy, CEO of Intrepid. "We are excited to begin to unlock the value within the district as the previous fragmented land ownership has acted as a barrier to a district scale approach to exploration and development. We now control over 9,500 acres, with 1,800 acres made up of patented mining claims and additional surface rights that host the mineralized trend."

Figure 1: Plan Map Showing Historical Copper Values within the 3 km Trend

![]()

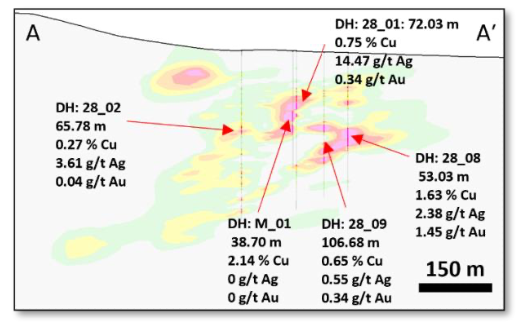

Figure 2: Cross Section through the MAN Property Highlighting Historical Results

Historical Drilling Highlights from MAN

Copper highlights, as well as corresponding gold and silver grades from historical drilling include:

- 53.03m of

1.63% Cu and 1.45 grams per tonne ("g/t") Au (117.35m to 170.38m) in Hole 28_08 - 72.03m of

0.75% Cu, 0.34 g/t Au and 14.47 g/t Ag (57.91m to 129.94m) in Hole 28_01 - 74.98m of

0.73% Cu (74.98m to 149. 96m) in Hole M_35 - 38.70m of

2.14% Cu (98.76m to 137.46m) in Hole M_01 - 106.68m of

0.65% Cu and0.34% Au (109.73m to 216.41m) in Hole 28_09

Note: *Drill intercepts reported from historical drilling. Composite drill intervals where reported were calculated using 3-meter composites, 3 meters of internal dilution with minimum grades of

Additional maps and cross-sections for Corral Copper can be found on our website at: Intrepid Metals Corp - Corral Copper

About Corral Copper

The Corral Copper Project is a district scale advanced exploration and development opportunity in Cochise County, Arizona. Corral Copper is located 15 miles east of the famous mining town of Tombstone and 22 miles north of the historical Bisbee mining camp which has produced more than 8 billion pounds of copper with grades of up to

The district has a mining history dating back to the late 1800s, with several small mines extracting copper from the area in the early 1900s, producing several thousand tons with grades up to

Intrepid is confident that by combining modern exploration techniques with historical data and with a clear focus on responsible development, the Corral Copper Project can quickly become an advanced exploration stage project and move towards feasibility level studies. More details about the Corral Copper Property and the plans for 2023 will be released soon.

Dr. Chris Osterman, P. Geo, a consultant of the Company, is a Qualified Person ("QP") as defined by National Instrument 43-101. Dr. Osterman has reviewed and is responsible for the technical information disclosed in this news release, including the statements with respect to data verification.

About Intrepid Metals Corp.

Intrepid Metals Corp. is a Canadian company focused on exploring for high-grade essential metals such as copper, silver, lead, and zinc mineral projects in proximity to established mining jurisdictions in southeastern Arizona, USA. The Company has acquired or has agreements to acquire several drill ready projects, including the Corral Copper Project (a district scale advanced exploration and development opportunity with significant shallow historical drill results), the Tombstone South Project (within the historical Tombstone mining district with geological similarities to the Taylor Deposit, which was purchased for

INTREPID METALS CORP.

On behalf of the Company

"Ken Brophy"CEO

For further information regarding this news release, please contact:

Ken Brophy

CEO

604-681-8030

info@intrepidmetals.com

Cautionary Note Regarding Forward-Looking Information

Certain statements contained in this release constitute forward-looking information within the meaning of applicable Canadian securities laws. Such forward-looking statements relate to: (i) future exploration plans; (ii) details about potential mineralization; (iii) the exploration potential of the Corral Copper Property; and (iv) potential future production.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the Company can raise additional financing to continue operations; the results of exploration activities, expectations and anticipated impact of the COVID-19 outbreak, commodity prices, the timing and amount of future exploration and development expenditures, the availability of labour and materials, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral deposits, including risks relating to the ability to access infrastructure, risks relating to the failure to access financing, risks relating to changes in commodity prices, risks related to current global financial conditions, risks related to current global financial conditions and the impact of COVID-19 on the Company's business, reliance on key personnel, operational risks inherent in the conduct of exploration and development activities, including the risk of accidents, labour disputes and cave-ins, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) has reviewed or accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Intrepid Metals Corp.

View the original press release on accesswire.com

FAQ

What is the name and ticker symbol of the company that acquired the MAN Property?

What is the total acreage added to the Corral Copper Project through the acquisition of the MAN Property?

How much cash and how many shares were paid to acquire the MAN Property?

What does the acquisition of the MAN Property aim to achieve?

What does the historical drilling data reveal about the MAN Property?