Ivanhoe Electric Announces Significant Resource Upgrade at the Santa Cruz Copper Project in Arizona, Including Resource Additions at the East Ridge and Texaco Deposits

Ivanhoe Electric announced a significant update to the Mineral Resource Estimate for the Santa Cruz Copper Project, revealing a 65% increase in tonnage and an 82% increase in total contained copper in indicated resources. The overall project-wide contained copper in indicated resources rose by 11%, with the copper cut-off grade nearly doubling to 0.70%. Initial estimates from the adjacent East Ridge and Texaco deposits confirm expansion potential. Recent metallurgical tests indicate a recovery rate of up to 94% total copper with improved leach processes. An investor call is scheduled for February 14, 2023.

- 65% increase in tonnage and 82% increase in contained copper.

- 11% increase in total contained copper across all deposits.

- Initial resource estimates from East Ridge and Texaco confirm expansion potential.

- Metallurgical testwork indicates up to 94% total copper recovery.

- None.

Insights

Analyzing...

65% Increase in Tonnage and82% Increase in Total Contained Copper in Indicated Resources Across Exotic, Oxide and Enriched Domains at Santa Cruz Deposit- Total Contained Copper in Indicated Resources Across all Deposits and Domains Increases by

11% , with a Near-Doubling of the Copper Cut-Off Grade to a Minimum of0.70% - Initial Mineral Resource Declarations at East Ridge and Texaco Deposits Confirm Expansion Potential of the Project Resource Base

- Increased Resource Base Will Form the Foundation of Initial Assessment Expected by the End of Q3 2023

- Recent Metallurgical Testwork Confirms up to

94% Total Copper Recovery with a Leach-Float Circuit is Achievable at the Santa Cruz Deposit - Ivanhoe Electric to Host Investor Conference Call Today at 12pm ET

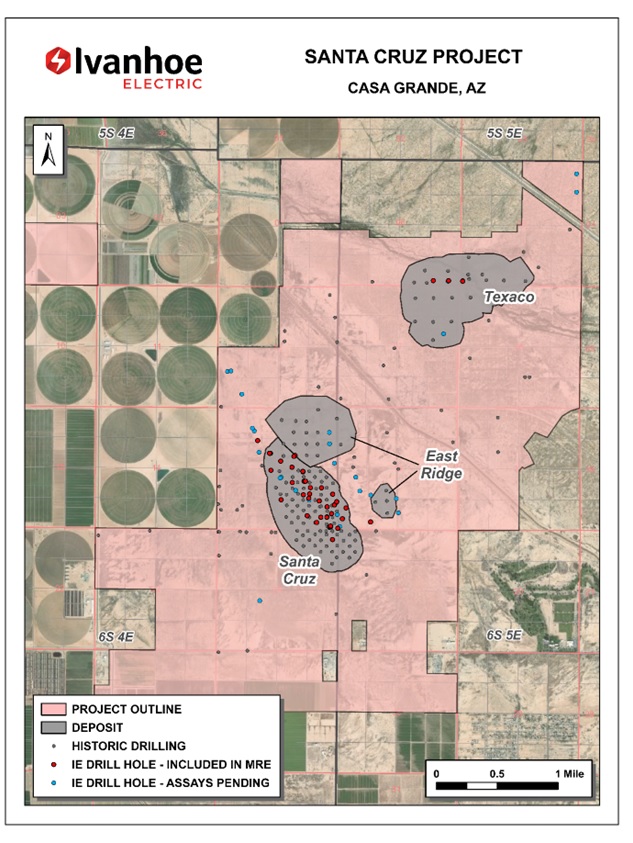

PHOENIX, AZ / ACCESSWIRE / February 14, 2023 / Ivanhoe Electric (NYSE American:IE)(TSX:IE) Executive Chairman, Robert Friedland and President and Chief Executive Officer, Taylor Melvin are pleased to provide an updated Mineral Resource Estimate for the Santa Cruz Copper Project ("Project") located west of Casa Grande, Arizona.

The updated Mineral Resource Estimate now includes the first Mineral Resources declared at the East Ridge Deposit directly adjacent to the Santa Cruz Deposit and at the Texaco Deposit approximately one mile to the northeast.

The updated Mineral Resource Estimate utilizes higher cut-off grades than the

The resource at the Santa Cruz Deposit reflects a

Mr. Friedland commented: "We are making great strides towards our ambitious goal of constructing a low-carbon footprint, underground copper mine with minimal surface disturbance in Arizona. The maiden resource estimates for the East Ridge and Texaco Deposits were founded on the knowledge gained from our 26.5 km2 (6,500-acre) proprietary Typhoon™ 3D induced polarization and resistivity geophysical survey conducted in 2022 and build on the success we have achieved at the Santa Cruz Deposit. Today's announcement is an important milestone that underpins the future development potential of the Santa Cruz Copper Project."

Mr. Melvin commented: "This resource update is the culmination of a tremendous effort by our team at Santa Cruz. The drilling to date increases our confidence in the high copper grades at the Santa Cruz Deposit and confirms the growth potential at the nearby East Ridge and Texaco Deposits. The updated resource provides an excellent foundation for our initial economic assessment, which we expect before the end of Q3 2023."

Highlights of the Updated Santa Cruz Project Mineral Resource Estimate

Using a

Click to View Mineral Resource Video (https://vimeo.com/798541269/87ddccde9a)

Table 1: Updated Mineral Resource Estimate including the Santa Cruz, East Ridge and Texaco Deposits, using a

Category | Tonnage | Total Copper Grade | Total | Total Contained Copper | Total Contained Soluble Copper |

All Deposits: Indicated | 226.7 | 2.8 | 1.9 | ||

All Deposits: Inferred | 149.0 | 1.8 | 1.2 |

Refer to Notes on Mineral Resources following Table 5.

The Santa Cruz Deposit remains the largest deposit at the Santa Cruz Project with Indicated Mineral Resources totaling 223.2 million tonnes grading

Importantly, the Santa Cruz Deposit now includes

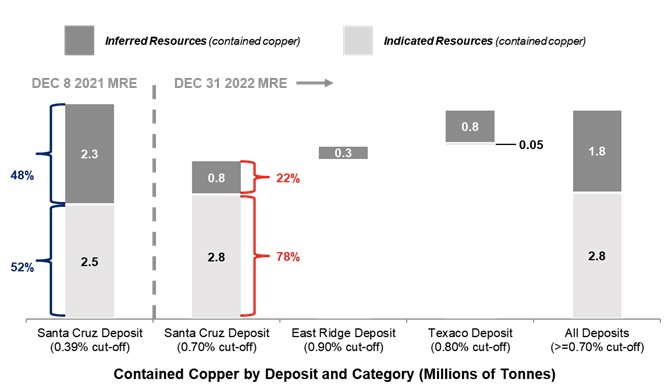

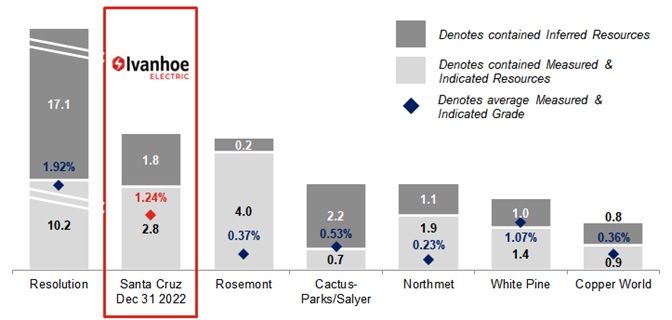

Figure 1: Santa Cruz Project Updated Mineral Resource Estimate (December 31, 2022 Mineral Resource Estimate)

The initial East Ridge and Texaco Mineral Resource Estimates reflect limited portions of the historically defined areas of mineralization and represent what Ivanhoe Electric has delineated within the past six months. Both East Ridge and Texaco Deposits exhibit significant potential for high-grade copper additions within the structural corridors that control the mineralization. Project-wide, Ivanhoe Electric currently has six diamond drill rigs active on site.

Table 2: Initial Mineral Resource Estimates for the East Ridge and Texaco Deposits (December 31, 2022 Mineral Resource Estimate).

Category | Deposit | Tonnage | Total Copper Grade | Total | Total Contained Copper | Total Contained Soluble Copper |

Indicated | Texaco1 | 3.6 | 1.33 | 0.97 | 0.05 | 0.03 |

Inferred | Texaco1 | 62.3 | 1.21 | 0.56 | 0.8 | 0.3 |

East Ridge2 | 24.0 | 1.36 | 1.26 | 0.3 | 0.3 |

- Texaco Deposit cut-off grade is

0.80% total copper. - East Ridge Deposit cut-off grade is

0.90% total copper.

Refer to Notes on Mineral Resources following Table 5.

The Updated Santa Cruz Project Mineral Resource Estimate is the Result of a Highly Successful Drill Program

The primary focus of the ongoing drilling program at each of the Santa Cruz, East Ridge and Texaco Deposits was to:

- Target the higher-grade areas (greater than

1.2% copper) to confirm if the December 8, 2021 Mineral Resource Estimate grade was as outlined in the estimate. - Expand the higher-grade copper areas with a strong focus on the Exotic, Oxide and Chalcocite domains.

- Target the structural controls that influence the higher-grade copper domains.

- Complete various "twin holes" in proximity to historical drilling which can be compared (geologically, structurally, geochemically, etc.) to each other to determine if significant geological and sampling bias exists.

- Upgrade high-grade Inferred Mineral Resources into the Indicated category.

- At East Ridge and Texaco, confirm the higher-grade historical intercepts and determine if the higher-grade areas could be expanded.

Collectively, the Santa Cruz drill program delivered on all six of these points.

Ivanhoe Electric's Infill Drill Program at the Santa Cruz Deposit Successfully Expands the Higher-Grade and Leachable Exotic, Oxide and Enriched Domains

With a specific focus on expanding the higher-grade areas of the Santa Cruz Deposit (greater than

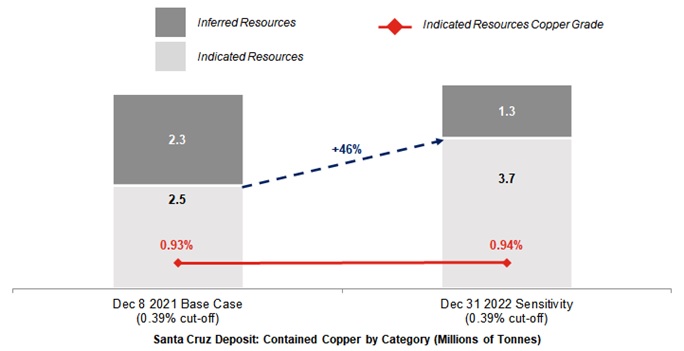

Figure 2: Santa Cruz Deposit Indicated Mineral Resource Estimate Comparison between December 8, 2021 and December 31, 2022 within the Exotic, Oxide, and Chalcocite Enriched Domains.

Comparison to the December 8, 2021 Santa Cruz Deposit Mineral Resource Estimate

The updated Mineral Resource Estimate includes a higher copper cut-off grade of

When the updated Mineral Resource sensitivity is compared to the December 8, 2021 Mineral Resource Estimate using the same

Figure 3: Comparison between the December 8, 2021 and December 31, 2022 Mineral Resource Estimates for the Santa Cruz Deposit using the 2021 Cut-Off Grade of

Table 3: The December 8, 2021 Mineral Resource Estimate for the Santa Cruz Deposit Compared to the December 31, 2022 Mineral Resource: Sensitivity at a

December 8, 2021 | December 31, 2022 | |||||

Category | Tonnage | Total Copper Grade | Total Contained Copper | Tonnage | Total Copper Grade | Total Contained Copper |

Santa Cruz Deposit: Indicated | 274.0 | 2.5 | 392.5 | 3.7 | ||

Santa Cruz Deposit: Inferred | 248.8 | 2.3 | 179.6 | 1.3 | ||

Refer to Notes on Mineral Resources following Table 5.

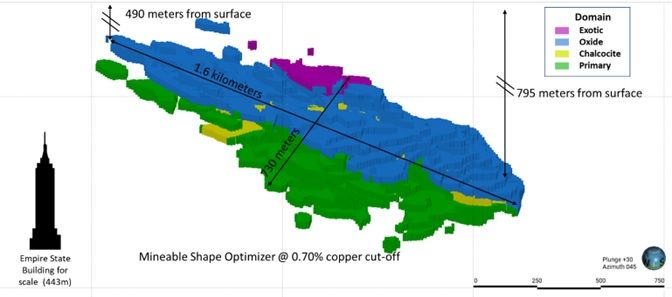

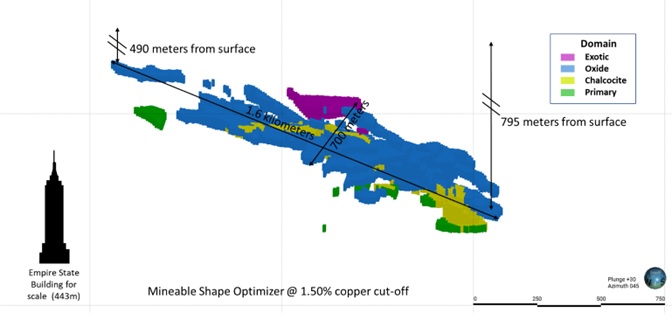

Increased Understanding of Distinct Mineralized Domains at Santa Cruz is Critical to Unlocking the Deposit

- Exotic oxide mineralization (Exotic) is of more limited known occurrence and tends to form very high-grade mineralization in paleo-valleys at the contact of the mineralized bedrock and the overlying gravel cover. This mineralization formed in basal gravels through the precipitation of copper that was transported in solution by migrating groundwater. These zones have shown to contain spectacularly high-grade copper.

- Supergene oxide mineralization (Oxide) forms the uppermost zone of mineralization and is dominated by chrysocolla (a copper oxide that is

34% copper by weight) and atacamite (a copper chloride that is60% copper by weight). - Supergene sulfide mineralization (Chalcocite Enriched) underlies the supergene oxide zone and is comprised primarily of enriched chalcocite (a copper sulfide that is

80% copper by weight), with accessory chalcopyrite and pyrite that is partially or completely replaced by chalcocite. - Hypogene sulfide mineralization (Primary) underlies the supergene sulfide zone and consists of chalcopyrite (a copper sulfide that is

35% copper by weight), pyrite, molybdenite, and minor bornite and covellite, hosted within porphyry-style phyllic alteration. Intensity of mineralization is highest around Laramide-age dyke intrusions that cut the mineralized Proterozoic-age Oracle Granite country rock.

Figure 4: Santa Cruz Deposit Mineralized Domains Shown at

Cut-Off Grade.

Figure 5: Santa Cruz Deposit Mineralized Domains Shown at

Cut-Off Grade.

Figure 6: The Santa Cruz Deposit Compares Favorably to Other Undeveloped United States Copper Projects (Contained Copper in Millions of Tonnes).

Table 4. The December 31, 2022 Mineral Resource Estimate Incorporates both Historical and Ivanhoe Electric Drilling.

Total Drilling | Ivanhoe Electric Drilling | |||||

Deposit | Number of Drill Holes | Meters | Meters Intersecting | Number of Drill Holes | Meters | Meters Intersecting |

Santa Cruz | 129 | 116,388 | 57,326 | 41 | 34,769 | 14,172 |

East Ridge | 18 | 15,448 | 1,501 | 0 | 0 | 0 |

Texaco | 23 | 21,289 | 2,661 | 3 | 3,286 | 685 |

Total | 170 | 153,125 | 61,488 | 44 | 38,055 | 14,857 |

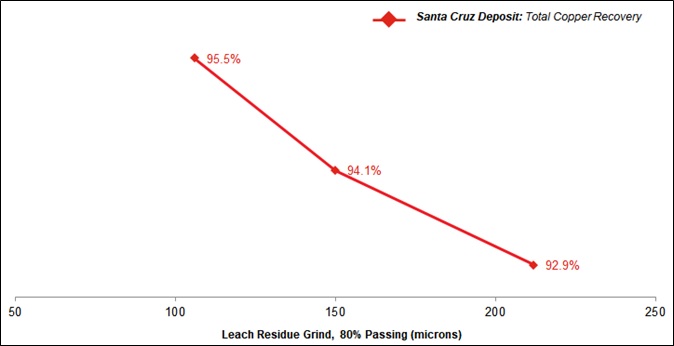

Recent Metallurgical Test Results Indicate Potential for High Copper Recovery Rates of up to

The Santa Cruz Deposit has a high copper grade averaging

Ivanhoe Electric believes that the preferred mineral processing method for the higher-grade mineralization will be a combination of agitation leaching and copper sulfide flotation that will recover most of the soluble copper in the Exotic, Oxide and Chalcocite Enriched Domains.

Agitation leach tests undertaken in mid-2022 verified historical test results and after adjusting the particle size distribution, acid-soluble copper recovery of

Ivanhoe Electric subsequently conducted a leach-float test program in which the same mill composite sample used in prior testing was subjected to the standard leach procedure developed earlier in the year. Three standard leach tests were conducted, followed by flotation of the leach residue at different grind sizes. Ivanhoe Electric successfully confirmed that up to

Figure 7. Total Copper Recovery, Before Processing Losses, for Combined Agitation Leach Followed by Flotation.

Ivanhoe Electric will host a conference call to discuss the Santa Cruz Project Mineral Resource Update

The Company will hold an investor conference call to discuss the Mineral Resource Update on Tuesday, February 14th, at 12:00 pm Eastern. The North American toll-free dial-in number is 888-664-6383; International callers, please dial: 416-764-8650 Confirmation number is 72608350.

Link to join the live audio webcast: https://app.webinar.net/aL8w53Vmn6l

Qualified Persons

The December 31, 2022 Mineral Resource Estimate and other scientific and technical information in this news release related thereto has been prepared and approved by Christian Ballard, P.Geo. Nordmin Engineering Ltd. and James J. Moore (P.E.)., Met Engineering, LLC. Both individuals are Qualified Persons within the meaning of National Instrument 43-101 ("NI 43-101") and Regulation S-K, subpart 1300 promulgated by the U.S. Securities Exchange Commission ("Reg S-K"). Both are considered independent under both standards.

Glen Kuntz, P.Geo, Senior Vice President of Mine Development of Ivanhoe Electric has reviewed and approved other scientific and technical information contained in this news release. Mr. Kuntz is a Qualified Person under both NI 43-101 and S-K 1300. Mr. Kuntz is not independent of Ivanhoe Electric as he is an employee of the corporation.

Ivanhoe Electric has prepared an independent technical report summary for the Santa Cruz Project prepared under Reg S-K titled Mineral Resource Estimate Update and S-K 1300 Technical Report Summary for the Santa Cruz, Texaco, and East Ridge Deposits, Arizona, USA. Current to December 31, 2022 and dated February 14th. The report is authored by Nordmin Engineering Ltd. and Met Engineering LLC.

Ivanhoe Electric will have prepared and filed an updated NI 43-101 technical report for the Santa Cruz Project including the December 31, 2022 Mineral Resource Estimate within 45 days of this press release. The existing NI 43-101 technical report for the Santa Cruz Project titled "NI 43-101 Technical Report and Mineral Resource Estimate for the Santa Cruz Project, Arizona, USA" prepared by Nordmin with an effective date of June 7, 2022 is available on the company's website, on EDGAR and on the company's SEDAR profile.

The existing technical report includes relevant information regarding the assumptions, parameters and methods of the December 8, 2021 mineral resource estimates on the Santa Cruz Project cited in this news release, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release.

About Ivanhoe Electric

Ivanhoe Electric is an American technology and mineral exploration company that is re-inventing mining for the electrification of everything by combining advanced mineral exploration technologies, renewable energy storage solutions and electric metals projects predominantly located in the United States. Ivanhoe Electric uses its Typhoon™ transmitter, an accurate and powerful geophysical survey system, together with advanced data analytics provided by its subsidiary, Computational Geosciences, to accelerate and de-risk the mineral exploration process as well as to potentially discover deposits of critical metals that may otherwise be undetectable by traditional exploration technologies. Through its controlling interest in VRB Energy, Ivanhoe Electric also develops and manufactures advanced grid-scale vanadium redox battery storage systems. Finally, through advancing its portfolio of electric metals projects located primarily in the United States, headlined by the Santa Cruz Copper Project in Arizona and the Tintic Copper-Gold Project in Utah, as well as projects in Montana, Oregon and North Carolina, Ivanhoe Electric is also well positioned to support American supply chain independence by delivering the critical metals necessary for electrification of the economy.

Contact Information

Valerie Kimball, Director, Investor Relations

720-933-1150

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable U.S. and Canadian securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect the company's current expectations regarding future events, performance and results and speak only as of the date of this news release.

Such statements include without limitation statements regarding: (i) that the Santa Cruz PEA is expected to be completed by the end of Q3 2023; and (ii) the potential for copper recoveries of

This news release also contains references to estimates of Mineral Resources. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral Resource estimates may have to be re-estimated based on: (i) fluctuations in copper, gold or other metal prices; (ii) results of drilling and other exploration activities; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation and re-evaluation of mine plans subsequent to the date of any estimates and/or changes in mine plans; (vi) the possible failure to receive required permits, approvals and licenses; and (vii) changes in law or regulation.

Forward-looking statements are based on management's beliefs and assumptions and on information currently available to management. Such statements are subject to significant risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including changes in the prices of copper or other metals Ivanhoe Electric is exploring for; the results of exploration and drilling activities and/or the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations; the final assessment of exploration results and information that is preliminary; the significant risk and hazards associated with any future mining operations, extensive regulation by the U.S. government as well as local governments; changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; and the impact of political, economic and other uncertainties associated with operating in foreign countries, and the impact of the COVID-19 pandemic and the global economy. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements described in Ivanhoe Electric's registration statement on Form S-1, as amended, filed with the U.S. Securities and Exchange Commission and base PREP prospectus filed with Canadian securities commissions.

No assurance can be given that such future results will be achieved. Forward-looking statements speak only as of the date of this news release. Ivanhoe Electric cautions you not to place undue reliance on these forward-looking statements. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release, and Ivanhoe Electric expressly disclaims any requirement to do so.

Appendix

Table 5: Updated Mineral Resource Estimate by Deposit (All Domains, December 31, 2022).

Category | Deposit | Tonnage | Total Copper Grade | Total | Total Contained Copper | Total Contained Soluble Copper |

Indicated | Santa Cruz | 223.2 | 1.24 | 0.82 | 2.8 | 1.8 |

Texaco | 3.6 | 1.33 | 0.97 | 0.05 | 0.03 | |

Inferred | Santa Cruz | 62.7 | 1.23 | 0.92 | 0.8 | 0.6 |

Texaco | 62.3 | 1.21 | 0.56 | 0.8 | 0.3 | |

East Ridge | 24.0 | 1.36 | 1.26 | 0.3 | 0.3 | |

TOTAL | ||||||

Indicated | All Deposits | 226.7 | 1.24 | 0.82 | 2.8 | 1.9 |

Inferred | All Deposits | 149.0 | 1.24 | 0.82 | 1.8 | 1.2 |

TOTAL LESS PRIMARY | ||||||

Indicated | All Exclude Primary | 149.7 | 1.42 | 1.24 | 2.1 | 1.9 |

Inferred | All Exclude Primary | 106.0 | 1.32 | 1.16 | 1.4 | 1.2 |

Notes on Mineral Resources

- The Mineral Resources in this Estimate were independently prepared, including estimation and classification, by Nordmin Engineering Ltd. and in accordance with the definitions for Mineral Resources in S-K 1300.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. This estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Verification included multiple site visits to inspect drilling, logging, density measurement procedures and sampling procedures, and a review of the control sample results used to assess laboratory assay quality. In addition, a random selection of the drill hole database results was compared with the original records.

- The Mineral Resources in this estimate for the Santa Cruz, East Ridge, and Texaco Deposits used Datamine Studio RMTM software to create the block models.

- The Mineral Resources are current to December 31, 2022.

- Underground-constrained Mineral Resources for the Santa Cruz Deposit are reported at a cut-off grade of

0.70% total copper, Texaco Deposit are reported at a cut-off grade of0.80% total copper and East Ridge Deposit are reported at a cut-off grade of0.90% total copper. The cut-off grade reflects total operating costs to define reasonable prospects for eventual economic extracted by conventional underground mining methods with a maximum production rate of 15,000 tonnes/day. All material within mineable shape-optimized wireframes has been included in the Mineral Resource. - Underground mineable shape optimization parameters include a long term copper price of

$3.70 /lb, process recovery of94% , direct mining costs between$24.50 -$40.00 /processed tonne reflecting various mining method costs (long hole or room and pillar), mining general and administration cost of$4.00 /tonne processed, onsite processing and SX/EW costs between$13.40 -$14.47 /tonne processed, offsite costs between$3.29 -$4.67 /tonne processed, along with variable royalties between 5.00-6.96% NSR and a mining recovery of100% . - Specific Gravity was applied using weighted averages by Deposit Sub-Domain.

- All figures are rounded to reflect the relative accuracy of the estimates, and totals may not add correctly.

- Excludes unclassified mineralization located along edges of the Santa Cruz, East Ridge, and Texaco Deposits where drill density is poor.

- Report from within a mineralization envelope accounting for mineral continuity.

- Total soluble copper means the addition of sequential acid soluble copper and sequential cyanide soluble copper assays. Total soluble copper is not reported for the Primary Domain.

Table 6: Updated Mineral Resource Estimate by Domain Type (All Deposits, December 31, 2022).

Category | Domain | Tonnage | Total Copper Grade | Total | Total Contained Copper | Total Contained Soluble Copper |

Indicated | Exotic | 5.0 | 1.79 | 1.59 | 0.1 | 0.1 |

Oxide | 97.5 | 1.43 | 1.28 | 1.4 | 1.3 | |

Chalcocite Enriched | 47.2 | 1.35 | 1.12 | 0.6 | 0.5 | |

Primary | 77.0 | 0.89 | N/A | 0.7 | N/A | |

Inferred | Exotic | 5.7 | 1.61 | 1.28 | 0.1 | 0.1 |

Oxide | 74.8 | 1.27 | 1.12 | 1.0 | 0.8 | |

Chalcocite Enriched | 25.5 | 1.40 | 1.24 | 0.4 | 0.3 | |

Primary | 43.0 | 1.04 | N/A | 0.4 | N/A | |

TOTAL | ||||||

Indicated | All Domains | 226.7 | 1.24 | 0.82 | 2.8 | 1.9 |

Inferred | All Domains | 149.0 | 1.24 | 0.82 | 1.8 | 1.2 |

TOTAL LESS PRIMARY | ||||||

Indicated | All Domains | 149.7 | 1.42 | 1.24 | 2.1 | 1.9 |

Inferred | All Domains | 106.0 | 1.32 | 1.16 | 1.4 | 1.2 |

Refer to Notes on Mineral Resources following Table 5.

Table 7: Updated Mineral Resource Estimate Sensitivity to Cut-Off Grade (Santa Cruz Deposit Only, All Domains, December 31, 2022).

Category | Cut-Off | Tonnage | Total Copper Grade | Total | Total Contained Copper | Total Contained Soluble Copper |

Indicated | 438.4 | 0.88 | 0.48 | 3.9 | 2.1 | |

Inferred | 277.1 | 0.60 | 0.28 | 1.7 | 0.8 | |

Indicated | 387.9 | 0.95 | 0.53 | 3.7 | 2.0 | |

Inferred | 169.5 | 0.76 | 0.42 | 1.3 | 0.7 | |

Indicated | 338.9 | 1.02 | 0.59 | 3.5 | 2.0 | |

Inferred | 104.7 | 0.96 | 0.64 | 1.0 | 0.7 | |

Indicated | 279.6 | 1.12 | 0.68 | 3.1 | 1.9 | |

Inferred | 78.0 | 1.11 | 0.80 | 0.9 | 0.6 | |

Indicated | 223.2 | 1.24 | 0.82 | 2.8 | 1.8 | |

Inferred | 62.7 | 1.23 | 0.92 | 0.8 | 0.6 | |

Indicated | 179.9 | 1.35 | 0.96 | 2.4 | 1.7 | |

Inferred | 51.8 | 1.33 | 1.02 | 0.7 | 0.5 | |

Indicated | 144.1 | 1.48 | 1.11 | 2.1 | 1.6 | |

Inferred | 42.8 | 1.43 | 1.11 | 0.6 | 0.5 | |

Indicated | 119.3 | 1.59 | 1.25 | 1.9 | 1.5 | |

Inferred | 36.9 | 1.52 | 1.18 | 0.6 | 0.4 | |

Indicated | 83.8 | 1.79 | 1.51 | 1.5 | 1.3 | |

Inferred | 26.1 | 1.70 | 1.34 | 0.4 | 0.3 | |

Indicated | 53.2 | 2.05 | 1.78 | 1.1 | 0.9 | |

Inferred | 14.9 | 1.99 | 1.59 | 0.3 | 0.2 | |

Indicated | 21.7 | 2.51 | 2.18 | 0.5 | 0.5 | |

Inferred | 5.9 | 2.43 | 1.97 | 0.1 | 0.1 |

Refer to Notes on Mineral Resources following Table 5.

Figure 8. Santa Cruz, East Ridge and Texaco Mineral Resources with Ivanhoe Electric and Historic Drill Collars Identified.

SOURCE: Ivanhoe Electric Inc.

View source version on accesswire.com:

https://www.accesswire.com/739243/Ivanhoe-Electric-Announces-Significant-Resource-Upgrade-at-the-Santa-Cruz-Copper-Project-in-Arizona-Including-Resource-Additions-at-the-East-Ridge-and-Texaco-Deposits