Ivanhoe Electric Announces Completion of Earn-In to Acquire a 60% Interest in the Samapleu-Grata Nickel-Copper Project in the Ivory Coast

- Positive: Ivanhoe Electric secures 60% interest in the Samapleu-Grata Nickel-Copper Project.

- Positive: The 2024 PEA reveals a pre-tax NPV of US$463M and a pre-tax IRR of 28.2%.

- Positive: The project aims for a 16-year mine life producing copper and nickel concentrates with associated by-products.

- Negative: The 2024 PEA includes inferred mineral resources, requiring further exploration for economic viability.

- Negative: The results of the 2024 PEA are preliminary and may not be realized.

- Negative: The project covers only 3% of the total project area, indicating exploration upside and expansion opportunities.

- None.

Insights

The recent preliminary economic assessment (PEA) for the Samapleu-Grata Nickel-Copper Project reveals several key financial metrics that are essential for investors to consider. The projected pre-tax NPV8 of US$463 million and IRR of 28.2% are indicative of a robust project with a strong potential return on investment. These figures are particularly significant when compared to industry benchmarks, as they suggest that the project could yield higher returns than average for similar mining ventures.

Furthermore, the estimated initial capital cost of US$338 million is relatively modest for a project of this scale, which is expected to have a 16-year mine life. The production of a high-quality 26% copper concentrate and a 13% nickel concentrate, along with valuable by-products such as platinum, palladium and cobalt, enhances the project's appeal, as these metals are in high demand for various industrial applications, including electric vehicle batteries and renewable energy technologies.

However, investors should exercise caution given that the PEA is based on inferred resources, which are considered speculative. The transition from inferred to indicated or measured resources will require further exploration and validation, which could impact the project's economics. Additionally, the reliance on long-term price assumptions for nickel and copper adds an element of risk, as commodity prices are subject to volatility.

The inclusion of inferred mineral resources in the 2024 PEA for the Samapleu-Grata Nickel-Copper Project suggests that there is significant potential for resource expansion. However, it is important to highlight that inferred resources carry a higher degree of uncertainty than indicated or measured resources. The requirement for additional trenching and drilling to upgrade these resources means that there is both an opportunity for upside potential and a risk of additional capital requirements.

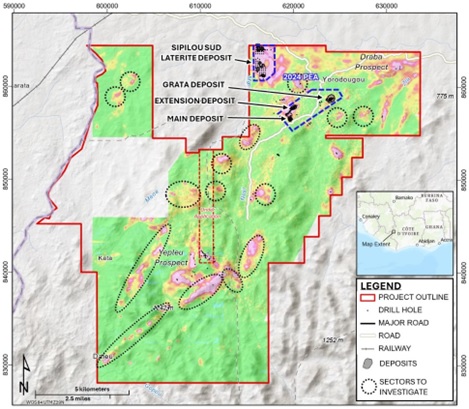

Moreover, the fact that the proposed mine infrastructure covers only approximately 3% of the 835 km2 project area presents substantial exploration upside. The potential for discovering additional mineralized zones within the remaining 97% of the land package could lead to an extension of the mine's life or an increase in annual production, both of which could positively impact the project's valuation.

It is also worth noting the strategic importance of the by-products associated with the nickel and copper concentrates, such as cobalt, platinum and palladium. These metals are critical for various technologies and their market values could significantly contribute to the project's revenue stream, beyond the primary nickel and copper production.

The development of the Samapleu-Grata Nickel-Copper Project within the Ivory Coast brings to the forefront considerations related to environmental and social governance (ESG). The project's potential impact on local communities, ecosystems and the broader environment must be assessed and managed carefully. Responsible mining practices are increasingly important to investors, as they can influence the social license to operate and the long-term sustainability of the project.

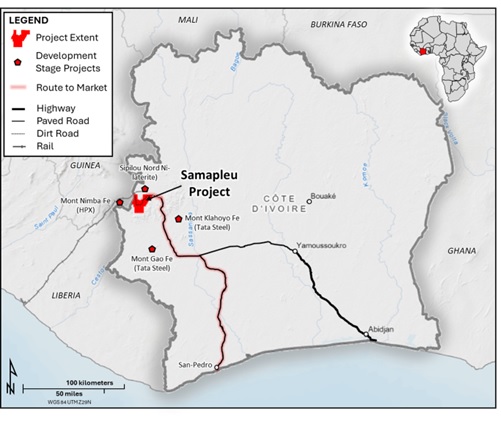

Given the project's location approximately 600 km from the capital Abidjan, infrastructure development for transportation and logistics will be critical. This presents an opportunity for positive economic impact on local communities through job creation and infrastructure improvements. However, it also poses challenges such as potential displacement of communities, environmental degradation and the need for effective waste management strategies.

Investors are paying closer attention to ESG factors and projects that demonstrate a commitment to high ESG standards may attract more investment and potentially enjoy a premium in valuation. Therefore, the project's adherence to environmental regulations, its approach to community engagement and the management of its ESG risks will be critical factors in its long-term success and attractiveness to socially conscious investors.

Joint Venture Partner Sama Resources Announced a New Preliminary Economic Assessment for the Project Delivering a Pre-tax NPV8 of US

The Project has the Potential for a 16-Year Mine Life Producing a Conventional

PHOENIX, AZ / ACCESSWIRE / March 25, 2024 / Ivanhoe Electric Inc. ("Ivanhoe Electric") (NYSE American:IE);(TSX:IE) Executive Chairman, Robert Friedland and President and Chief Executive Officer, Taylor Melvin are pleased to announce today that Ivanhoe Electric has completed its earn-in to acquire a

The Samapleu-Grata Nickel-Copper Project is now a 60/40 joint venture between Ivanhoe Electric and Sama. In addition to a

Mr. Taylor Melvin, President and CEO of Ivanhoe Electric commented: "We are pleased to have completed our earn-in to

A full copy of Sama's press release for the 2024 PEA can be found here.

The Samapleu-Grata Nickel-Copper Project

The Samapleu-Grata Nickel-Copper Project is located in western Ivory Coast approximately 600 km from the capital Abidjan. The total area of the Project is approximately 835 km2.

Ivanhoe Electric entered into a binding term sheet for an earn-in and joint venture agreement with Sama which was subsequently formalized in March 2021. Ivanhoe Electric satisfied the terms of its

Figure 1: Samapleu-Grata Nickel-Copper Project Location in Côte d'Ivoire

Highlights of the 2024 Preliminary Economic Assessment Announced by Sama Resources

The 2024 PEA outlines the potential for a conventional open pit mining operation supporting 86.5 million tonnes of modelled mill feed together with 1.62 million tonnes of direct shipped laterite material entirely from the Grata, Main and Extension deposits and the Sipilou Sud Laterite deposit.

Over the life of mine, the Samapleu-Grata Nickel-Copper Project would produce an annual average of 38,627 tonnes of a

Highlights from the 2024 PEA announced by Sama Resources include:

- Average annual production of approximately 38,627 tonnes of

26% copper concentrate and 55,119 tonnes of13% nickel concentrate - Average annual nickel metal in concentrate of approximately 7,165 tonnes per year and copper metal in concentrate of approximately 10,043 tonnes per year

- 16 year-life of mine

- Pre-tax Net Present Value ("NPV") at an

8% discount rate of US$463M and internal rate of return ("IRR") of28.2% - Post-tax NPV8 of US

$257M and post-tax IRR of22.3% - Initial capital costs of US

$338M including a contingency of US$61M - Post-tax payback period of 3.8 years

The 2024 PEA is based on a long-term nickel price of US

The 2024 PEA is preliminary in nature and includes inferred mineral resources, considered too speculative in nature to be categorized as mineral reserves. Mineral resources that are not mineral reserves have not demonstrated economic viability. Additional trenching and/or drilling will be required to convert inferred mineral resources to indicated or measured mineral resources. There is no certainty that the results of the 2024 PEA will be realized.

The 2024 PEA includes only the Grata, Main and Extension deposits and the Sipilou Sud Laterite Deposit, which together with the proposed mine infrastructure, covers only approximately

Figure 2: Samapleu-Grata Nickel-Copper Project Highlighting Areas Included in the 2024 PEA and Known Prospective Sectors for Further Exploration

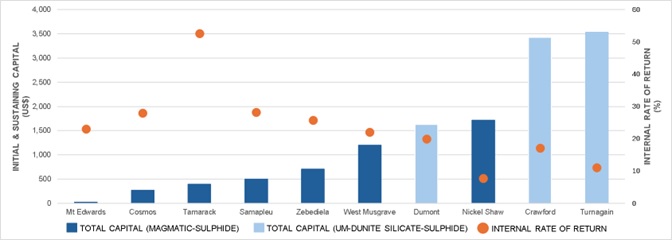

The Samapleu-Grata Nickel-Copper Project is a potentially commercially profitable operating open-pit operation consisting of magmatic polymetallic sulfide mineralization with by-product metals, including copper, gold, cobalt, platinum, and palladium. The Project has a comparatively small capital cost and favorable internal rate of return while producing competitive nickel and copper concentrates.

Figure 3 compares the Project's total estimated capital and pre-tax IRR against other pre-production nickel assets, including primary magmatic sulfide deposits like Tamarack, as well as the bulk-tonnage low-sulfur, ultramafic-hosted deposits like Dumont and Crawford. Based on the 2024 PEA, the Samapleu-Grata Nickel-Copper Project has one of the lowest total capital costs while producing a pre-tax IRR that is second only to the Tamarack deposit in the United States providing the opportunity to construct a relatively small, but comparably profitable polymetallic mining operation.

Figure 3. Total Capital and Pre-Tax IRR for Selected Pre-Production Nickel Deposits

Source: S&P Capital IQ database; company reports and presentations.

Finally, the polymetallic nature of the Samapleu-Grata Nickel Copper Project means that it has the potential to produce not only a nickel concentrate, but a high quality

Qualified Persons

Disclosures of a scientific or technical nature included in this news release, including the information regarding the 2024 PEA have been reviewed, verified and approved by

by Mark Gibson, P.Geo. and Mr. Glen Kuntz, P.Geo. Each is a Qualified Person for the purpose of National Instrument 43-101 and Regulation S-K, Subpart 1300 promulgated by the U.S. Securities and Exchange Commission. Mr. Gibson is the Chief Geophysics Officer for Ivanhoe Electric and Mr. Kuntz is the Senior Vice-President, Mine Development for Ivanhoe Electric. Neither Mr. Gibson nor Mr. Kuntz is considered independent.

About Ivanhoe Electric

We are a U.S. company that combines advanced mineral exploration technologies with electric metals exploration projects predominantly located in the United States. We use our accurate and powerful Typhoon™ geophysical surveying system, together with advanced data analytics provided by our subsidiary, Computational Geosciences Inc., to accelerate and de-risk the mineral exploration process as we seek to discover new deposits of critical metals that may otherwise be undetectable by traditional exploration technologies. We believe the United States is significantly underexplored and has the potential to yield major new discoveries of critical metals. Our mineral exploration efforts focus on copper as well as other metals including nickel, vanadium, cobalt, platinum group elements, gold and silver. Through the advancement of our portfolio of electric metals exploration projects, headlined by the Santa Cruz Copper Project in Arizona and the Tintic Copper-Gold Project in Utah, as well as other exploration projects in the United States, we intend to support United States supply chain independence by finding and delivering the critical metals necessary for the electrification of the economy. We also operate a 50/50 joint venture with Saudi Arabian Mining Company Ma'aden to explore for minerals on ~48,500 km2 of underexplored Arabian Shield in the Kingdom of Saudi Arabia. Website: www.ivanhoeelectric.com.

About Sama Resources

Sama Resources is a Canadian-based, growth-oriented resource company focused on exploring the Samapleu-Grata Nickel-Copper Project in Côte d'Ivoire, West Africa. The Company is managed by experienced industry professionals with a strong track record of discovery. Sama's projects are located approximately 600 km northwest of Abidjan in Côte d'Ivoire and are flanked to the west by the Ivorian and Guinean borders. Sama's projects are located adjacent to the large world-class nickel-cobalt laterite deposits of Sipilou and Foungouesso, forming a 125 km-long new base metal camp in West Africa. Sama owns

Contact Information

Investors: (480) 656-5821 or info@ivanhoeelectric.com

Follow us on Twitter

Ivanhoe Electric's Executive Chairman Robert Friedland: @robert_ivanhoe

Ivanhoe Electric: @ivanhoeelectric

Ivanhoe Electric's investor relations website located at www.ivanhoeelectric.com should be considered Ivanhoe Electric's recognized distribution channel for purposes of the Securities and Exchange Commission's Regulation FD.

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable US and Canadian securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Ivanhoe Electric, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect the Ivanhoe Electric's current expectations regarding future events, performance and results and speak only as of the date of this news release.

Such statements in this news release include, without limitation, all of the results of the 2024 PEA announced by Sama and include future estimates of internal rates of return, net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, and estimates of capital and operating costs as well as statements regarding exploration upside and expansion opportunities at the Project.

Forward-looking statements are based on management's beliefs and assumptions and on information currently available to management. Such statements are subject to significant risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including changes in the prices of copper or other metals Ivanhoe Electric is exploring for; the results of exploration and drilling activities and/or the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations; the final assessment of exploration results and information that is preliminary; the significant risk and hazards associated with any future mining operations, extensive regulation by the US government as well as local governments; changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with Ivanhoe Electric to perform as agreed; and the impact of political, economic and other uncertainties associated with operating in foreign countries, and the impact of the COVID-19 pandemic and the global economy. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and risk factors described in Ivanhoe Electric's Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission.

No assurance can be given that such future results will be achieved. Forward-looking statements speak only as of the date of this news release. Ivanhoe Electric cautions you not to place undue reliance on these forward-looking statements. Subject to applicable securities laws, Ivanhoe Electric does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release, and Ivanhoe Electric expressly disclaims any requirement to do so. No assurance can be given that such future results will be achieved. Forward-looking statements speak only as of the date of this news release. Ivanhoe Electric cautions you not to place undue reliance on these forward-looking statements. Subject to applicable securities laws, Ivanhoe Electric does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release, and Ivanhoe Electric expressly disclaims any requirement to do so.

SOURCE: Ivanhoe Electric Inc.

View the original press release on accesswire.com