NRSInsights’ June 2025 Retail Same-Store Sales Report

NRSInsights, a subsidiary of IDT Corporation (NYSE: IDT), released its June 2025 retail same-store sales report showing a 3.5% year-over-year increase in same-store sales. The company's network comprises 36,600 active terminals serving approximately 31,700 independent retailers nationwide.

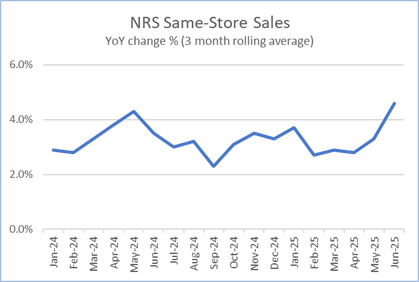

Key metrics include a 3.0% increase in units sold, unchanged basket transactions year-over-year, and a 2.7% increase in average prices for top 500 items. The three-month rolling average showed strong performance with a 4.6% increase in same-store sales. During June 2025, NRS processed $2.1 billion in sales across 140 million transactions, representing a 15% year-over-year growth.

Strong performance was noted in categories including modern oral nicotine, energy drinks, prepared cocktails, and chocolate, while sports drinks, frozen novelties, and bottled water showed monthly growth but yearly declines.

NRSInsights, una controllata di IDT Corporation (NYSE: IDT), ha pubblicato il rapporto sulle vendite al dettaglio a parità di punti vendita di giugno 2025, evidenziando un aumento del 3,5% su base annua nelle vendite a parità di punti vendita. La rete dell'azienda comprende 36.600 terminali attivi che servono circa 31.700 rivenditori indipendenti a livello nazionale.

I principali indicatori includono un aumento del 3,0% nelle unità vendute, transazioni di carrello invariati rispetto all'anno precedente e un aumento del 2,7% nei prezzi medi per i primi 500 articoli. La media mobile su tre mesi ha mostrato una solida performance con un aumento del 4,6% nelle vendite a parità di punti vendita. Nel giugno 2025, NRS ha elaborato 2,1 miliardi di dollari in vendite su 140 milioni di transazioni, rappresentando una crescita del 15% su base annua.

Le categorie con performance positive includono nicotina orale moderna, bevande energetiche, cocktail preparati e cioccolato, mentre bevande sportive, prodotti surgelati e acqua in bottiglia hanno mostrato una crescita mensile ma un calo annuale.

NRSInsights, una subsidiaria de IDT Corporation (NYSE: IDT), publicó su informe de ventas minoristas en tiendas comparables de junio de 2025, mostrando un aumento interanual del 3,5% en ventas en tiendas comparables. La red de la compañía cuenta con 36,600 terminales activos que atienden a aproximadamente 31,700 minoristas independientes a nivel nacional.

Las métricas clave incluyen un aumento del 3,0% en unidades vendidas, transacciones de cesta sin cambios respecto al año anterior y un aumento del 2,7% en los precios promedio de los 500 principales artículos. El promedio móvil de tres meses mostró un sólido desempeño con un aumento del 4,6% en ventas en tiendas comparables. Durante junio de 2025, NRS procesó $2.1 mil millones en ventas a lo largo de 140 millones de transacciones, representando un crecimiento interanual del 15%.

Se observaron buenos resultados en categorías como nicotina oral moderna, bebidas energéticas, cócteles preparados y chocolate, mientras que bebidas deportivas, productos congelados y agua embotellada mostraron crecimiento mensual pero caídas anuales.

NRSInsights는 IDT Corporation (NYSE: IDT)의 자회사로서 2025년 6월 소매 동일 매장 매출 보고서를 발표하며 전년 동기 대비 3.5% 증가를 기록했습니다. 회사의 네트워크는 전국 약 31,700개의 독립 소매업체에 서비스를 제공하는 36,600개의 활성 단말기로 구성되어 있습니다.

주요 지표로는 판매 단위가 3.0% 증가했고, 장바구니 거래 수는 전년과 동일하며, 상위 500개 품목의 평균 가격이 2.7% 상승했습니다. 3개월 이동평균은 4.6% 증가한 강력한 실적을 보였습니다. 2025년 6월 동안 NRS는 1억 4천만 건의 거래를 통해 21억 달러의 매출을 처리하며 전년 대비 15% 성장했습니다.

현대 구강 니코틴, 에너지 음료, 준비된 칵테일, 초콜릿 등 카테고리에서 강한 실적이 나타났으며, 스포츠 음료, 냉동 디저트, 생수는 월간 성장세를 보였으나 연간으로는 감소했습니다.

NRSInsights, une filiale de IDT Corporation (NYSE : IDT), a publié son rapport sur les ventes au détail en magasins comparables pour juin 2025, montrant une augmentation de 3,5 % en glissement annuel des ventes en magasins comparables. Le réseau de l'entreprise comprend 36 600 terminaux actifs desservant environ 31 700 détaillants indépendants à l'échelle nationale.

Les indicateurs clés incluent une augmentation de 3,0 % des unités vendues, des transactions de panier stables par rapport à l'année précédente, et une hausse de 2,7 % des prix moyens pour les 500 principaux articles. La moyenne mobile sur trois mois a montré une solide performance avec une augmentation de 4,6 % des ventes en magasins comparables. En juin 2025, NRS a traité 2,1 milliards de dollars de ventes sur 140 millions de transactions, représentant une croissance annuelle de 15 %.

De solides performances ont été observées dans les catégories telles que la nicotine orale moderne, les boissons énergisantes, les cocktails préparés et le chocolat, tandis que les boissons pour sportifs, les produits surgelés et l'eau en bouteille ont connu une croissance mensuelle mais des baisses annuelles.

NRSInsights, eine Tochtergesellschaft von IDT Corporation (NYSE: IDT), veröffentlichte ihren Bericht zu den Einzelhandelsumsätzen in gleichen Filialen für Juni 2025 und zeigte einen 3,5%igen Anstieg im Jahresvergleich bei den Umsätzen in gleichen Filialen. Das Netzwerk des Unternehmens umfasst 36.600 aktive Terminals, die etwa 31.700 unabhängige Händler landesweit bedienen.

Wichtige Kennzahlen umfassen einen 3,0%igen Anstieg der verkauften Einheiten, unveränderte Warenkorbtransaktionen im Jahresvergleich und einen 2,7%igen Anstieg der Durchschnittspreise für die Top 500 Artikel. Der gleitende Dreimonatsdurchschnitt zeigte mit einem 4,6%igen Anstieg der Umsätze in gleichen Filialen eine starke Leistung. Im Juni 2025 verarbeitete NRS 2,1 Milliarden US-Dollar Umsatz über 140 Millionen Transaktionen, was einem Wachstum von 15% im Jahresvergleich entspricht.

Starke Leistungen wurden in Kategorien wie moderne orale Nikotinprodukte, Energydrinks, fertige Cocktails und Schokolade verzeichnet, während Sportgetränke, gefrorene Neuheiten und Flaschenwasser monatliches Wachstum, aber jährliche Rückgänge zeigten.

- Same-store sales increased 3.5% year-over-year

- Three-month rolling average sales grew 4.6%, highest in 12 months

- Platform processed $2.1 billion in sales, up 15% year-over-year

- Network expanded to 36,600 active terminals nationwide

- Units sold increased 3.0% year-over-year

- Average prices increased 2.7% year-over-year, indicating inflationary pressure

- Basket transactions remained flat year-over-year, showing no growth

- Declining year-over-year performance in seasonal categories (sports drinks, frozen novelties, bottled water)

Insights

NRS shows strong 3.5% same-store sales growth in June, with particularly robust 3-month performance signaling continued retail resilience.

The June 2025 report from NRSInsights reveals a 3.5% year-over-year increase in same-store sales across their network of approximately 36,600 independent retail terminals. While this represents a slight moderation from May's 4.9% growth, the three-month rolling average has actually accelerated to 4.6% - its highest level in the past 12 months.

What's particularly notable is that unit sales increased 3.0% year-over-year, indicating healthy consumer demand rather than growth driven purely by inflation. The average price increase of 2.7% for top items is actually decelerating compared to May's 2.9%, suggesting pricing pressure is gradually easing.

Looking at category performance, we're seeing interesting shifts in consumer behavior. Modern oral nicotine, energy drinks, prepared cocktails, and especially chocolate (with 8% year-over-year growth) are driving the expansion. Meanwhile, traditionally seasonal categories like sports drinks, frozen novelties, and bottled water show sequential growth but year-over-year declines, indicating changing baseline demand patterns.

NRS's transaction volume continues to expand impressively, processing $2.1 billion in sales in June, representing 15% year-over-year growth. This substantially outpaces their same-store metrics, confirming the network's continued expansion is successfully capturing market share in the independent retail sector.

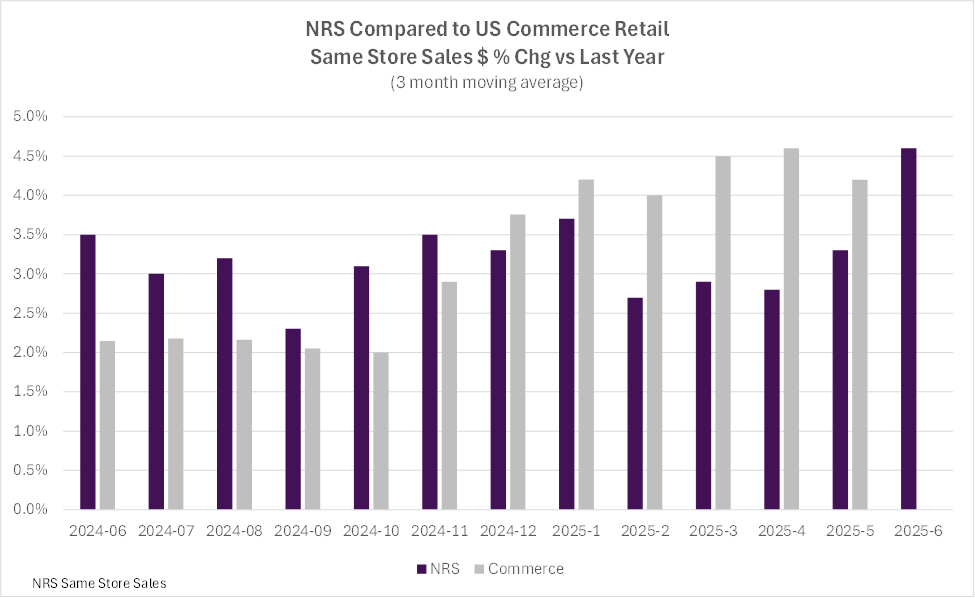

The consistent outperformance against broader retail metrics (with only a 0.1% average gap to Commerce Department data over 12 months) demonstrates that NRS's predominantly urban, multicultural customer base remains resilient despite broader economic pressures.

June same-store sales increased

NEWARK, N.J., July 07, 2025 (GLOBE NEWSWIRE) -- NRSInsights, a provider of sales data and analytics drawn from retail transactions processed through the National Retail Solutions (NRS) point-of-sale (POS) platform, today announced comparative retail same-store sales results for June 2025.

As of June 30, 2025, the NRS retail network comprised approximately 36,600 active terminals nationwide, scanning purchases at approximately 31,700 independent retailers including convenience stores, bodegas, liquor stores, grocers, and tobacco and sundries sellers, predominantly serving urban consumers.

June Highlights*

(*Same-store sales, unit sales, transactions, and average price data refer to June 2025 and are compared to June 2024 unless otherwise noted. All comparisons are provided on a “per calendar day” basis to remove from consideration variability in the number of days per month or three-month period.)

- SALES

-

- Same-store sales increased

3.5% year-over-year. In the previous month (May 2025), same-store sales increased4.9% year-over-year.

- Same-store sales increased

-

- Same-store sales were unchanged compared to the previous month (May 2025). Same-store sales in May 2025 increased

3.8% compared to the previous month (April 2025).

- Same-store sales were unchanged compared to the previous month (May 2025). Same-store sales in May 2025 increased

-

- For the three months ended June 30, 2025, same-store sales increased

4.6% compared to the corresponding three months a year ago.

- For the three months ended June 30, 2025, same-store sales increased

- UNITS SOLD

- Units sold increased

3.0% year-over-year. In the previous month (May 2025), units sold increased3.6% year-over-year. - Units sold increased

0.7% compared to the previous month (May 2025). Units sold in May 2025d increased2.1% compared to the previous month (April 2025).

- Units sold increased

- BASKETS (TRANSACTIONS) PER STORE

- Baskets were unchanged year-over-year. In the previous month (May 2025), baskets increased

0.9% year-over-year. - Baskets increased

0.6% compared to the previous month (May 2025). Baskets in May 2025 increased3.1% compared to the previous month (April 2025).

- Baskets were unchanged year-over-year. In the previous month (May 2025), baskets increased

- AVERAGE PRICES

- A dollar-weighted average of prices for the top 500 items purchased increased

2.7% year-over-year, a lower rate of increase than the2.9% year-over-year increase recorded in May 2025.

- A dollar-weighted average of prices for the top 500 items purchased increased

Retail Trade Comparative Data

The table below provides historical comparative data with the U.S. Commerce Department’s Advance Monthly Retail Trade same-store sales data excluding food service:

Over the past twelve months, the US Commerce Department’s Advance Monthly Retail Trade data, excluding food services, outpaced the NRS network’s three-month moving average same-store sales by

The NRSInsights data in the chart above have not been adjusted to reflect inflation, demographic distributions, seasonal buying patterns, item substitution, days per month, or other factors that may facilitate comparisons to other periods, to other same-store retail sales data, or to the U.S. Commerce Department’s retail data.

Commentary from Brandon Thurber (VP, Data Sales & Client Success at NRS)

"June was another strong month for independent retailers. Same-store dollar sales increased

“Much of June’s increase was generated by categories that have recently shown strength —modern oral nicotine, energy drinks, prepared cocktails, and chocolate, which posted a particularly large

“While sports drinks, frozen novelties, and bottled water all saw growth over the previous month—likely due to early summer heat—each of these categories declined compared to June 2024, reflecting shifts in baseline demand across traditionally seasonal categories.”

NRSInsights Reports

The NRSInsights monthly Same-Store Retail Sales Reports are intended to provide timely topline data reflective of sales at NRS’ network of independent, predominantly urban, retail stores.

Same-store data comparisons of June 2025 with June 2024 are derived from approximately 220 million transactions processed through the approximately 22,600 stores on the NRS network that scanned transactions in both months. Same-store data comparisons of June 2025 with May 2025 are derived from approximately 277 million transactions processed through approximately 30,600 stores.

Same-store data comparisons for the three months ended June 30, 2025 with the year-ago three months are derived from approximately 624 million scanned transactions processed through those stores that scanned transactions in both three-month periods.

NRS POS Platform

The NRS platform predominantly serves small-format, independent, retail stores nationwide including convenience stores, bodegas, liquor stores, grocers, and tobacco and sundries sellers. These independent retailers operate in all 50 states as well as the District of Columbia, and in 205 of the 210 designated market areas (DMAs) in the United States. During June 2025, NRS’ POS terminals processed

About National Retail Solutions (NRS):

National Retail Solutions operates the largest point-of-sale (POS) terminal-based platform and digital payment processing service for independent retailers nationwide. Retailers utilize NRS offerings to process transactions and effectively manage their businesses. Consumer packaged goods (CPG) suppliers, brokers, analytics firms, and advertisers access the terminal’s digital display network to reach these retailers’ predominantly urban, multi-cultural shopper base, and to harness transaction data-based learnings to identify growth opportunities and measure execution and returns on marketing investment. NRS is a subsidiary of IDT Corporation (NYSE: IDT).

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words “believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,” “target” and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

NRSInsights Contact:

Brandon Thurber

VP, Data Sales & Client Success at NRS

National Retail Solutions

Brandon.Thurber@nrsplus.com

IDT Corporation Contact:

Bill Ulrey

william.ulrey@idt.net

# # #