i-80 Gold Releases Results of a Scoping Study for the Ruby Hill Processing Plant

i-80 Gold Corp. has released a Scoping Study by DRA Americas Inc. evaluating the restart of the Ruby Hill mill and leach circuits. The study estimates US$8.9 million for restarting the oxide processing facilities and US$65.7 million for converting to a flotation plant for lead/silver and zinc concentrates. Increased high-grade oxide mineralization was identified at Granite Creek and Ruby Hill, enhancing the potential for a restart. The completion of this study supports i-80’s aim to boost its operational capabilities in Nevada.

- Estimated restart capital of US$8.9 million for oxide material processing.

- Estimated conversion capital of US$65.7 million for flotation plant.

- Increased high-grade oxide mineralization identified at Granite Creek and Ruby Hill.

- None.

Insights

Analyzing...

RENO, Nev., Nov. 7, 2022 /PRNewswire/ - i-80 GOLD CORP. (TSX: IAU) (NYSE: IAUX) ("i-80", or the "Company") is pleased to announce the results of a Scoping Study completed by DRA Americas Inc. ("DRA") that was commission by the Company to provide preliminary capital and operating cost estimates for the potential restart of the existing Ruby Hill mill and leach circuits to operating status.

The study was completed in two Parts to consider processing of oxide gold and/or base metal mineralization. Part 1 was to provide a preliminary estimate of capital and operating cost required for the potential restart of the existing process facilities at Ruby Hill for the processing of oxide mineralized material. Part 2 was to provide a preliminary estimate of the capital and operating cost required for converting the process plant from a mill/leach facility processing oxide gold mineralized material to a base metal flotation plant producing two concentrates (lead/silver and zinc concentrates). Capital estimates for the possible restart and conversion of the mill facility were developed at AACE Class 5 (Order of Magnitude) level, consistent with industry best practices for scoping studies. The Study was not specifically based on mineralized material from the Company's projects.

- A preliminary estimate of US

$8.9 Million in capital, including contingency, indirects and EPCM costs for the restart to process oxide material - A preliminary estimate of US

$65.7 Million in capital, including contingency, indirects and EPCM costs for the conversion to a floatation plant producing two concentrates (Part 2)

Drilling programs completed at Granite Creek and Ruby Hill have identified more high-grade oxide mineralized material than anticipated. At Granite Creek, drilling and mining of the Ogee Zone has encountered a significant amount of oxide mineralization including high-grade material that is currently being stockpiled on-site. Drilling in the upper portion of the "426 Zone" within the Ruby Deeps deposit has also encountered significant oxide mineralization and the recently discovered "007 Zone" appears to also be oxide. The 426 Zone is being modeled in the ongoing work for an updated resource estimate and is expected be included in the planned Preliminary Economic Assessment for the Ruby Deeps deposit.

"With appreciable oxide mineralization having been identified at both Ruby Hill and Granite Creek, we felt it was prudent to assess the possible restart of the Ruby Hill CIL Plant as a second Company operated processing facility.", stated Matt Gili, President and Chief Operating Officer of i-80. "Owing to the anticipated low capital cost, and accelerated timeline for restart, this plant has the potential to enhance our proposed stand-alone operating capabilities in Nevada. We plan to incorporate the results of this work in our planned upcoming economic studies being completed for Granite Creek and Ruby Hill."

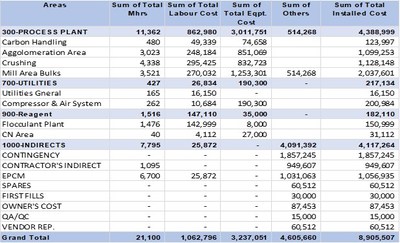

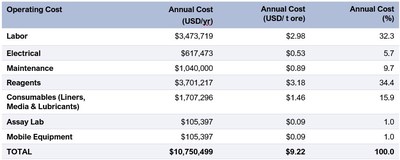

The Study contemplates that Run-of-Mine (ROM) mineralized material would be fed to the existing primary and secondary crushing circuits. A radial stacker conveyor would feed a high-grade stockpile from where slot/tube feeders and a reclaim conveyor located in a reclaim tunnel would feed a tertiary crushing and screening circuit followed by a fine ore silo. The material would then be fed from the fine ore silo to the ball mill and classification circuit located in the mill building. The cyclone overflow would feed a new trash screen installed prior to the thickener. The thickener underflow would feed the leach tank, with leach tailings reporting to belt filters. The filter cake produced will deposit onto a conveyor feeding a new Agglomerator (Part of the Low-Grade Oxide circuit) for placement on the existing leach pad. The thickener overflow and filtrate would be fed to the carbon absorption columns (CIC circuit). Nameplate feed rates for the high grade and low-grade circuits are 298,297 and 867,107 tons per year respectively. According to the study, the preliminary estimate for the capital cost and associated Operating Cost estimates are provided in Tables 1 & 2 below.

The Study contemplates that ROM material would be fed to the existing primary and secondary crushing circuit. A radial stacker conveyor would feed a stockpile in the same location as the High-Grade Oxide Stockpile in the Oxide Circuit. A reclaim tunnel conveyor would feed a tertiary crushing and screening circuit followed by a fine ore silo. The material would then flow from the fine ore silo to the ball mill and classification circuit located in the mill building.

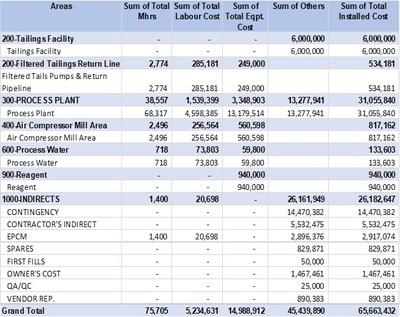

It is contemplated that the flotation area would include sequential lead/silver and zinc flotation circuits, each consisting of a rougher followed by concentrate regrinding and three stages of cleaning. Lead concentrate, zinc concentrate and flotation tailings would each be dewatered and deposited in stockpiles. The tailings would be transported to a filtered tailings storage area (Lined Area) and would have a return pump feeding back captured solution to the flotation process water tank. Nameplate feed rates through the plant is 268,640 tons per annum. According to the study, the preliminary estimate for the capital cost for the conversion to a floatation plant and associated Operating Cost estimates are provided in Tables 3 & 4 below.

Tim George, PE, Mine Operations Manager, reviewed the technical and scientific information contained in this press release and is a Qualified Person within the meaning of NI 43-101.

i-80 Gold Corp. is a well-financed, Nevada-focused, mining company with a goal of achieving mid-tier gold producer status through the development of multiple deposits within the Company's advanced-stage property portfolio with processing at i-80's centralized milling facility that includes an autoclave.

Certain statements in this release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities laws, including but not limited to, the expansion or mineral resources at Ruby Hill and the potential of the Ruby Hill project. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect the Company's current expectations regarding future events, performance and results and speak only as of the date of this release.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: material adverse changes, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

The Scoping Study is not definitive and subject to further study by the Company and not specifically based on material from the Company's Projects but generic in nature.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/i-80-gold-releases-results-of-a-scoping-study-for-the-ruby-hill-processing-plant-301669841.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/i-80-gold-releases-results-of-a-scoping-study-for-the-ruby-hill-processing-plant-301669841.html

SOURCE i-80 Gold Corp