METALLA REPORTS PORTFOLIO UPDATES

Metalla Royalty & Streaming (NYSE American: MTA) (TSXV: MTA) reports portfolio updates for several projects:

Gosselin (1.35% NSR): Drilling has extended mineralization outside the current resource pit shell, including potential connection between Côté and Gosselin deposits.

Endeavor (4.0% NSR): $20M funding secured for mine restart, with production expected in H1-2025. Recent drilling shows potential for increased ore extraction rates.

La Guitarra (2.0% NSR): Mining ramp-up continues, with commercial production expected before year-end. Current throughput averages 350 tonnes per day.

Joaquin (2.0% NSR): New operator plans comprehensive exploration program to boost resource estimate and publish maiden JORC (2012) MRE in H1-2025.

Metalla Royalty & Streaming (NYSE American: MTA) (TSXV: MTA) riporta aggiornamenti sul portafoglio per diversi progetti:

Gosselin (1.35% NSR): La perforazione ha esteso la mineralizzazione al di fuori dell'attuale confine della risorsa, includendo una potenziale connessione tra i depositi di Côté e Gosselin.

Endeavor (4.0% NSR): Fondi di 20 milioni di dollari assicurati per il riavvio della miniera, con produzione prevista per il primo semestre del 2025. Le recenti perforazioni mostrano un potenziale per aumentare i tassi di estrazione dei minerali.

La Guitarra (2.0% NSR): L'aumento della produzione mineraria continua, con la produzione commerciale prevista prima della fine dell'anno. L'attuale capacità di trattamento è di 350 tonnellate al giorno.

Joaquin (2.0% NSR): Un nuovo operatore prevede un programma di esplorazione completo per aumentare la stima delle risorse e pubblicare la prima Relazione Mineraria JORC (2012) nel primo semestre del 2025.

Metalla Royalty & Streaming (NYSE American: MTA) (TSXV: MTA) informa sobre actualizaciones de cartera para varios proyectos:

Gosselin (1.35% NSR): La perforación ha extendido la mineralización fuera del límite de la recurso actual, incluyendo una posible conexión entre los depósitos de Côté y Gosselin.

Endeavor (4.0% NSR): Se aseguraron 20 millones de dólares en financiamiento para reiniciar la mina, con producción estimada para el primer semestre de 2025. Las perforaciones recientes muestran potencial para aumentar las tasas de extracción de mineral.

La Guitarra (2.0% NSR): La ramp-up de minería continúa, con la producción comercial esperada antes de fin de año. La capacidad de procesamiento actual promedia 350 toneladas por día.

Joaquin (2.0% NSR): Un nuevo operador planea un programa de exploración integral para aumentar la estimación de recursos y publicar la primera MRE JORC (2012) en el primer semestre de 2025.

메탈라 로열티 & 스트리밍 (NYSE American: MTA) (TSXV: MTA)가 여러 프로젝트의 포트폴리오 업데이트를 보고합니다:

고셀린 (1.35% NSR): 현재 자원 갱도 경계 외부에서 광물화가 확장되었으며, 코테와 고셀린 광산 간의 잠재적 연결이 포함됩니다.

엔데버 (4.0% NSR): 2천만 달러의 자금 확보로 광산 재가동이 예정되어 있으며, 2025년 상반기에 생산이 기대됩니다. 최근 시추 결과는 광석 추출률 증가의 가능성을 보여줍니다.

라 기타라 (2.0% NSR): 채굴이 지속적으로 증가하고 있으며, 연말 전에 상업 생산이 예상됩니다. 현재 처리량은 하루 평균 350톤입니다.

호아킨 (2.0% NSR): 새로운 운영자는 자원 추정치를 높이고 2025년 상반기에 최초의 JORC (2012) MRE를 발표하기 위한 종합 탐사 프로그램을 계획하고 있습니다.

Metalla Royalty & Streaming (NYSE American: MTA) (TSXV: MTA) fait rapport sur les mises à jour du portefeuille pour plusieurs projets :

Gosselin (1.35% NSR): Le forage a étendu la minéralisation en dehors de l'actuel contour de ressources, y compris une connexion potentielle entre les dépôts de Côté et Gosselin.

Endeavor (4.0% NSR): Un financement de 20 millions de dollars a été sécurisé pour le redémarrage de la mine, avec une production prévue au premier semestre 2025. Les forages récents montrent un potentiel pour augmenter les taux d'extraction de minerai.

La Guitarra (2.0% NSR): L'augmentation de la production minière se poursuit, avec une production commerciale prévue avant la fin de l'année. Le débit actuel est en moyenne de 350 tonnes par jour.

Joaquin (2.0% NSR): Un nouvel opérateur prévoit un programme d'exploration complet pour augmenter l'estimation des ressources et publier la première MRE JORC (2012) au premier semestre 2025.

Metalla Royalty & Streaming (NYSE American: MTA) (TSXV: MTA) berichtet über Portfolio-Updates für mehrere Projekte:

Gosselin (1.35% NSR): Die Bohrungen haben die Mineralisierung über die aktuelle Ressourcenschicht hinaus erweitert, einschließlich einer potenziellen Verbindung zwischen den Lagerstätten von Côté und Gosselin.

Endeavor (4.0% NSR): 20 Millionen Dollar Finanzierung gesichert für den Neustart der Mine, mit Produktion, die für das erste Halbjahr 2025 erwartet wird. Jüngste Bohrungen zeigen Potenzial für erhöhte Erzabbauquoten.

La Guitarra (2.0% NSR): Der Abbau wird weiterhin hochgefahren, mit kommerzieller Produktion, die vor Jahresende erwartet wird. Derzeit liegt die Durchsatzrate bei durchschnittlich 350 Tonnen pro Tag.

Joaquin (2.0% NSR): Ein neuer Betreiber plant ein umfassendes Erkundungsprogramm, um die Ressourcen-Schätzung zu steigern und die erste JORC (2012) MRE im ersten Halbjahr 2025 zu veröffentlichen.

- Gosselin drilling extended mineralization outside current resource pit shell

- Endeavor secured $20M funding for mine restart

- La Guitarra mining ramp-up on track, generating $2.4M in revenue since commencement

- Joaquin acquisition completed, with plans for comprehensive exploration program

- None.

Insights

This update from Metalla Royalty & Streaming highlights positive developments across several key assets in their portfolio:

- At Gosselin, drilling has extended mineralization beyond the current resource pit, potentially increasing the overall resource. The possibility of connecting Gosselin and Côté zones suggests significant upside potential.

- Endeavor mine restart is fully funded with a

$20M facility and favorable offtake terms. The updated mine plan shows strong economics with a Pre-tax NPV8% ofA$414M and average annual EBITDA of$89M for the first 5 years. - La Guitarra is ramping up production, averaging 350 tpd and generating over

$2.4M in revenue since mining commenced. Commercial production of 500 tpd is expected before year-end. - Joaquin project acquisition is complete, with plans for comprehensive exploration to boost resources and publish a JORC-compliant estimate in H1-2025.

These updates collectively indicate potential for increased future royalty revenues for Metalla, particularly from Endeavor and La Guitarra in the near term, with longer-term upside from Gosselin and Joaquin.

Metalla's portfolio updates present a positive outlook for the company's future cash flows and asset value:

- The Gosselin exploration results could significantly enhance the value of Metalla's

1.35% NSR royalty, especially if the zone connects with Côté. - Endeavor's restart, backed by

$20M in funding, provides near-term revenue visibility. The projectedA$89M annual EBITDA for the first 5 years suggests substantial royalty income for Metalla. - La Guitarra's ramp-up to commercial production by year-end indicates imminent cash flow from this

2% NSR royalty. - Joaquin's exploration potential and historical production of 4.3 Moz AgEq at 410 g/t hint at future value appreciation for Metalla's

2% NSR.

These developments across multiple assets diversify Metalla's revenue streams and growth prospects, potentially leading to improved financial performance and shareholder value in the coming years.

(All dollar amounts are in

- Gosselin (

1.35% NSR) – Drilling has successfully outlined extensions of the Gosselin Zone outside of the current resource pit shell, including mineralization at depth in between Côté and Gosselin deposits. - Endeavor (

4.0% NSR) – Funding & offtake secured to fund Endeavor restart; recent drilling provides upside, reiterated guidance for H1-2025 production. La Guitarra (2.0% NSR) – Mining ramp up rates continue to be met, with commercial production expected before year end.- Joaquin (

2.0% NSR) – New operator outlines comprehensive exploration program to boost resource estimate and publish maiden JORC (2012) MRE.

GOSSELIN (

Metalla holds a

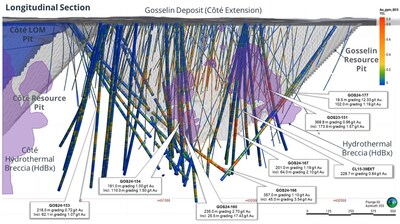

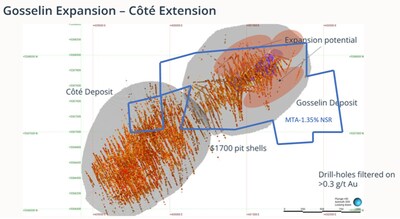

On October 15, 2024, IAMGOLD announced diamond drill results outlining the successful extension of mineralization outside of the Gosselin December 31, 2023 mineral resource pit shell. Key extensions have been intersected south and west of the Gosselin West Breccia, and at depth between the Côté and Gosselin West Breccia in an attempt to connect the two zones. Highlights of the Gosselin drill program include:

- 0.96 g/t gold over 368.8 meters

- 2.7 g/t gold over 235 meters

- 1.1 g/t gold over 357 meters

- 1.19 g/t gold over 201 meters

Renaud Adams, President and Chief Executive Officer of IAMGOLD, commented: "We believe that Côté is just the start of what will be a mining district. The exploration results today from Gosselin continue to demonstrate the potential for the Côté and Gosselin Zones to connect, in addition to highlighting that the overall size and scope of these zones have yet to be defined – as both Côté and Gosselin remain open at depth in all directions."

On February 15, 2024, IAMGOLD announced the updated Gosselin mineral resource estimate of 4.4 M Indicated gold ounces at 0.85 g/t and 3.0 M Inferred gold ounces at 0.75 g/t. Exploration drilling for the remainder of 2024 will continue to target mineralization beneath both Gosselin and Côté.

Figure 1: Long Section of Gosselin Drill Program.

Figure 2: Plan view of Côté & Gosselin drilling. 2

For more information, please view IAMGOLD's October 15, 2024 Press Release, IAMGOLD's October 15 2024 Presentation and IAMGOLD's February 15, 2024 Press Release.

ENDEAVOR (

Metalla holds a

On September 16, 2024, Polymetals announced it had secured a

Polymetals reiterated that the Endeavor mine is on track to be restarted with first cashflows expected in H1-2025. Polymetals announced and updated Endeavor mine plan on August 5, 2024 with a Pre-tax NPV

On October 9, 2024, Polymetals announced the results from recent drilling completed at Endeavor. Key intercepts include 517 g/t silver-equivalent ("AgEq")1 over 67.1 meters and 551 g/t AgEq over 53.8 meters, outlining the potential for increased ore extraction rates from the Upper North Lode at Endeavor.

For more information, please view the Polymetals Resources September 16, 2024 Press Release and Polymetals Resources October 9, 2024 Press Release and Polymetals Resources August 5,2024 Press Release

Metalla holds a

On September 24, 2024, Sierra Madre announced that daily throughput rates of economical interesting silver and gold mineralization have averaged 350 tonnes per day ("tpd") over the past 30 days, generating in excess of

Ken Scott, Chief Financial Officer of Sierra Madre, commented: "The Guitarra team is continuing to do a great job of incrementally increasing the daily production rate. Our next test mining and processing goal is 400 tonnes per day, followed by commercial production of 500 tonnes per day before year end."

For more information, please view Sierra Madre's September 24, 2024 Press Release.

JOAQUIN (

Metalla holds a

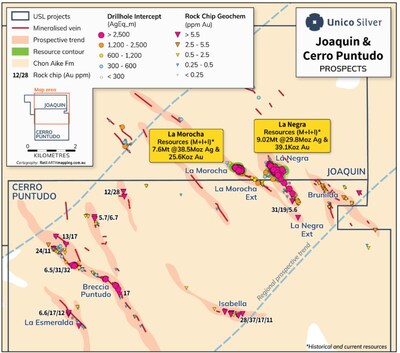

On October 11, 2024, Unico announced the completion of the acquisition of Joaquin from Pan American Silver Corporation (NYSE: PAAS). From 2019-2022, Joaquin produced 4.3 Moz AgEq at 410 g/t with ore trucked 145 kilometres to the Manantial Espejo mine.

Joaquin contains a historical mineral resource estimate in the categories of Measured and Indicated of 70.1 Moz AgEq3 and in the category of Inferred of 3.3 Moz AgEq3 at 136 g/t in the La Negra and La Marocha deposits. Unico is planning a comprehensive exploration program on four advanced prospects, aiming to boost current Foreign Estimates and publish an initial JORC (2012) Mineral Resource Estimate in H1-2025.

Unico outlined there are several historical drill holes that fall outside the historic resource with highlighted intercepts of 1,699 g/t silver & 22 g/t gold over 4.5 meters and 99 g/t silver & 0.4 g/t gold over 8.6 meters.

Figure 3: Joaquin Project Map

For more information, please view Unico's October 11, 2024 Press Release and Unico's August 20, 2024 Press Release and Coeur D'Alene Mines Corporation, Technical Report NI 43-101, February 2013, Joaquin Project, Santa Cruz Argentina. 4

QUALIFIED PERSON

The technical information contained in this alert has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of

ABOUT METALLA

Metalla was created to provide shareholders with leveraged precious and strategic metal exposure by acquiring royalties and streams. Our goal is to increase share value by accumulating a diversified portfolio of royalties and streams with attractive returns. Our strong foundation of current and future cash-generating asset base, combined with an experienced team, gives Metalla a path to become one of the leading royalty companies.

For further information, please visit our website at www.metallaroyalty.com.

ON BEHALF OF METALLA ROYALTY & STREAMING LTD.

(signed) "Brett Heath"

Chief Executive Officer

Website : www.metallaroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accept responsibility for the adequacy or accuracy of this alert.

Technical and Third-Party Information

Notes:

- AgEq is defined by Polymetals in their October 9, 2024 Press Release.

- Figure 2 depicts an area that is larger than the coverage of the Metalla royalty, and is provided for informational purposes.

- AgEq is defined by Unico in their August 20, 2024 Press Release. This Mineral Resource estimate covers an area that is larger than the coverage of the Metalla royalty, and is provided for informational purposes.

- Pan American Silver Corp. prepared a more recent Technical Report and Feasibility Study in January 2018, however, this report was focused on an underground mine at the Moarocha vein, which is not the subject of the Metalla Royalty.

Metalla has limited, if any, access to the properties on which Metalla holds a royalty, stream or other interest. Metalla is dependent on (i) the operators of the mines or properties and their qualified persons to provide technical or other information to Metalla, or (ii) publicly available information to prepare disclosure pertaining to properties and operations on the mines or properties on which Metalla holds a royalty, stream or other interest, and generally has limited or no ability to independently verify such information. Although Metalla does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some information publicly reported by operators may relate to a larger property than the area covered by Metalla's royalty, stream or other interests. Metalla's royalty, stream or other interests can cover less than

Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this alert, including any references to mineral resources or mineral reserves, was prepared in accordance with Canadian NI 43-101, which differs significantly from the requirements of the

"Inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This alert contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable securities legislation. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur, or be achieved. Forward-looking statements in this alert include, but are not limited to, that Côté is the start of a mining district; the potential for the Côté and Gosselin Zones to connect; the exploration drilling at Côté mine for the remainder of 2024; the re-start of the

Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Metalla to control or predict, that may cause Metalla's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: that Côté may not be the start of a mining district; that the Côté and Gosselin Zones may never connect; that further exploration drilling may not take place at Côté in 2024; that the Endeavor mine will not restart; that the cashflow at Endeavor will not start as and when expected; that the rates of ore extraction at Endeavor may not increase; that

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-reports-portfolio-updates-302281430.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-reports-portfolio-updates-302281430.html

SOURCE Metalla Royalty & Streaming Ltd.

FAQ

What are the recent drilling results for Gosselin (MTA's 1.35% NSR)?

When is Endeavor mine (MTA's 4.0% NSR) expected to restart production?

What is the current production status of La Guitarra (MTA's 2.0% NSR)?