IBC Advanced Alloys Reports Financial Results for the Quarter Ended March 31, 2023

Highlights of the Quarter As Compared to the Prior-Year Period

(Unless otherwise noted, all financial amounts in this news release are expressed in U.S. dollars.)

- Consolidated sales of

$7.8 million and$21.2 million in the quarter and year-to-date ("YTD"), respectively, strengthened by23.5% and3.3% . - The Copper Alloy division registered its sixth consecutive quarter of rising sales, with revenue jumping by

78.6% in the quarter and by59.2% YTD. - Engineered Materials ("EM") division sales were off in the quarter and YTD largely due to lower demand for beryllium-aluminum products used in machines that manufacture semiconductor chips as compared to the prior-year periods, when demand was at a historic high.

- Consolidated adjusted earnings before interest, taxes, depreciation, and amortization ("Adjusted EBITDA")1 were

$583,000 and$320,000 in the quarter and YTD, respectively. IBC booked a loss for the quarter of$511,000 ($0.01 / share) and a year-to-date loss of$2.9 million ($0.03) .

FRANKLIN, IN / ACCESSWIRE / May 30, 2023 / IBC Advanced Alloys Corp. ("IBC" or the "Company") (TSXV:IB)(OTCQB:IAALF) announces its financial results for the quarter and nine months ended March 31, 2023.

Consolidated Results

Sales grew in the quarter and year-to-date compared to the comparative periods. The sales and profitability gains in the Copper Alloys division were offset by weaker performance in the EM division:

SELECTED RESULTS: Consolidated Operations (

| Quarter Ended 3-31-2023 | Quarter Ended 3-31-2022 | Nine Months Ended 3-31-2023 | Nine Months Ended 3-31-2022 | |||||||||||||

Revenue | $ | 7,755 | $ | 6,279 | $ | 21,178 | $ | 20,493 | ||||||||

Change | 23.5 | % | 3.3 | % | ||||||||||||

Operating income (loss)1 | $ | 81 | $ | 551 | $ | (1,133 | ) | $ | 919 | |||||||

Adjusted EBITDA1 | $ | 583 | $ | 854 | $ | 320 | $ | 2,157 | ||||||||

Income (loss) for the period | $ | (511 | ) | $ | 287 | $ | (2,914 | ) | $ | 50 | ||||||

Income (loss) per share | (0.01 | ) | 0.00 | (0.03 | ) | 0.00 | ||||||||||

"The Copper Alloys division continues to show strong revenue and performance growth across the board, and our new consolidated and vertically integrated foundry in Indiana has a large and growing order book that they continue to work to fulfill," said Mark A. Smith, Chairman and CEO of IBC. "While it was another challenging quarter for our Engineered Materials division, I am pleased to see progress being made toward improving yield recoveries and expanding sales leads."

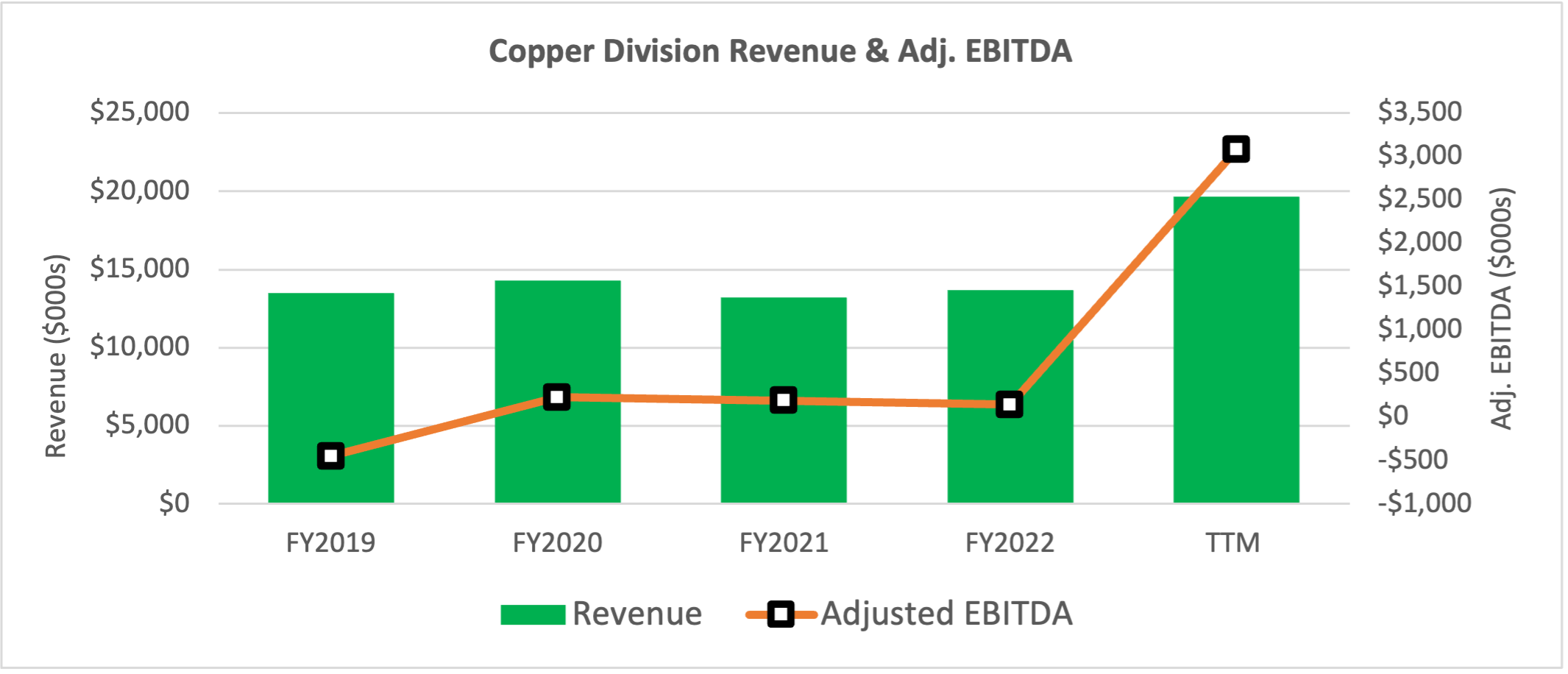

Copper Alloys Division

Copper Alloy division enjoyed its sixth consecutive quarter of rising sales. Operating performance has remained strong as the division takes advantage of its consolidated foundry and forge operations.

SELECTED RESULTS: Copper Alloys Division (

| Quarter Ended 3-31-2023 | Quarter Ended 3-31-2022 | Nine Months Ended 3-31-2023 | Nine Months Ended 3-31-2022 | |||||||||||||

Revenue | $ | 5,925 | $ | 3,317 | $ | 16,035 | $ | 10,074 | ||||||||

Operating income (loss)1 | $ | 1,289 | $ | 89 | $ | 2,237 | $ | (608 | ) | |||||||

Adjusted EBITDA1 | $ | 1,425 | $ | 85 | $ | 2,650 | $ | (286 | ) | |||||||

Income (loss) for the period | $ | 979 | $ | 223 | $ | 1,675 | $ | (278 | ) | |||||||

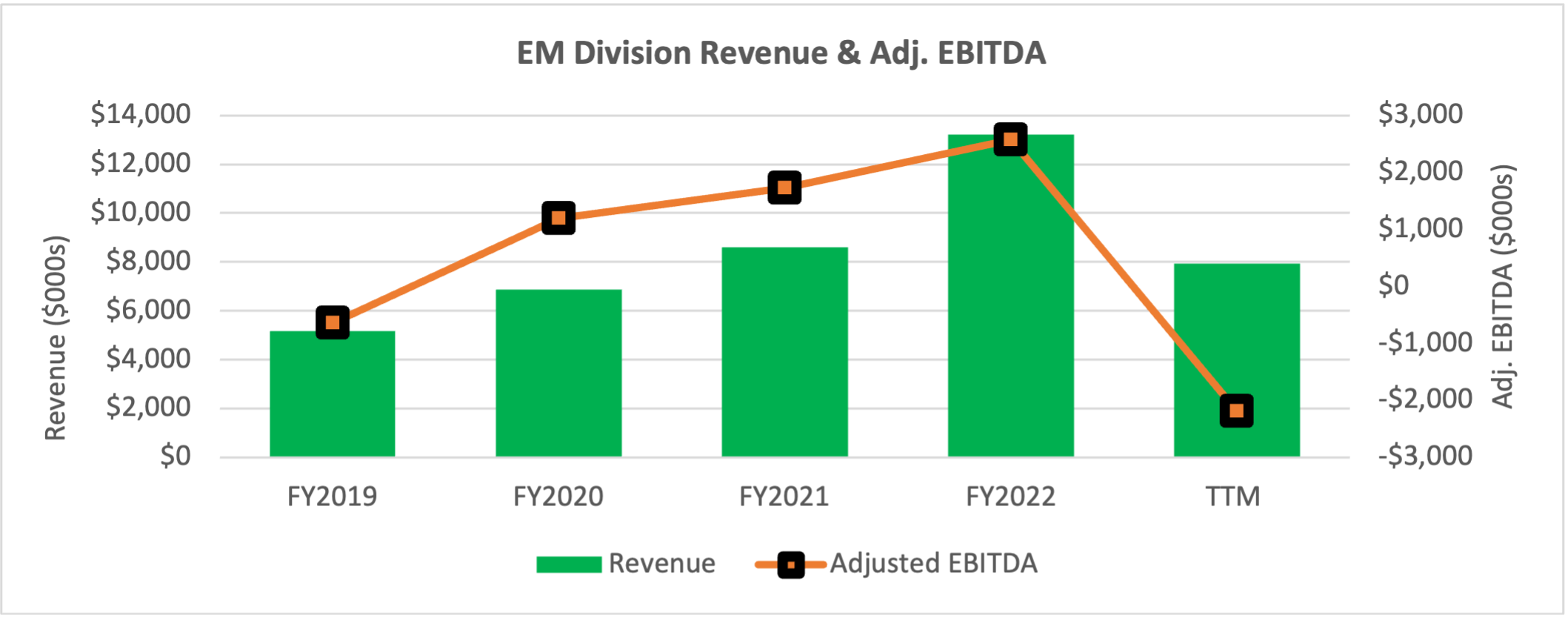

Engineered Materials Division

Engineered Materials has continued to experience lower demand for beryllium-aluminum products used to manufacture semiconductor chips as compared to the prior-year periods when demand was at historic highs. This is reflected in lower sales and current-period operating losses:

SELECTED RESULTS: Engineered Materials Division (

| Quarter Ended 3-31-2023 | Quarter Ended 3-31-2022 | Nine Months Ended 3-31-2023 | Nine Months Ended 3-31-2022 | |||||||||||||

Revenue | $ | 1,830 | $ | 2,962 | $ | 5,143 | $ | 10,419 | ||||||||

Operating income (loss)1 | $ | (884 | ) | $ | 607 | $ | (2,791 | ) | $ | 2,003 | ||||||

Adjusted EBITDA1 | $ | (613 | ) | $ | 867 | $ | (1,976 | ) | $ | 2,785 | ||||||

Income (loss) for the period | $ | (1,005 | ) | $ | 554 | $ | (3,047 | ) | $ | 1,836 | ||||||

Full results can be seen in the Company's financial statements and management's discussion and analysis ("MD&A"), available at Sedar.ca and on the Company's website at https://ibcadvancedalloys.com/investors-center/.

NON-IFRS MEASURES

To supplement its consolidated financial statements, which are prepared and presented in accordance with IFRS, IBC uses "operating income (loss)" and "Adjusted EBITDA", which are non-IFRS financial measures. IBC believes that operating income (loss) helps identify underlying trends in the business that could otherwise be distorted by the effect of certain income or expenses that the Company includes in loss for the period, and provides useful information about core operating results, enhances the overall understanding of past performance and future prospects, and allows for greater visibility with respect to key metrics used by management in financial and operational decision-making. The Company believes that Adjusted EBITDA is a useful indicator for cash flow generated by the business that is independent of IBC's capital structure.

Operating income (loss)and Adjusted EBITDA should not be considered in isolation or construed as an alternative to loss for the period or any other measure of performance or as an indicator of our operating performance. Operating income (loss) and Adjusted EBITDA presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to IBC's data.

OPERATING INCOME (LOSS)

Operating income (loss) represents income or loss for the quarter, excluding foreign exchange loss, interest expense, interest income, other income (expense) and income taxes that the Company does not believe are reflective of its core operating performance during the periods presented. A reconciliation of the quarter and year-to-date loss to operating income (loss) follows:

Three months ended March 31 | 2023 | 2022 | ||||||

| ( | ( | |||||||

Income (loss) for the period | (511 | ) | 287 | |||||

Foreign exchange (gain) loss | (13 | ) | 4 | |||||

Interest expense | 629 | 149 | ||||||

Loss on disposal of assets | - | 129 | ||||||

(Gain) on revaluation of derivative | (11 | ) | - | |||||

Other income | (16 | ) | (19 | ) | ||||

Income tax expense | 3 | 1 | ||||||

Operating income | 81 | 551 | ||||||

Nine months ended March 31 | 2023 | 2022 | ||||||

| ( | ( | |||||||

(Gain) loss for the period | (2,914 | ) | 50 | |||||

Foreign exchange (gain) loss | (5 | ) | 6 | |||||

Interest expense | 1,862 | 747 | ||||||

Loss on disposal of assets | - | 108 | ||||||

(Gain) on revaluation of derivative | (70 | ) | - | |||||

Other income | (12 | ) | (17 | ) | ||||

Income tax expense | 6 | 25 | ||||||

Operating income (loss) | (1,133 | ) | 919 | |||||

ADJUSTED EBITDA

Adjusted EBITDA represents our income (loss) for the period before interest, income taxes, depreciation, amortization, and share-based compensation. A reconciliation of the quarter and year-to-date loss to Adjusted EBITDA follows:

Three months ended March 31 | 2023 | 2022 | ||||||

| ( | ( | |||||||

Income (loss) for the period | (511 | ) | 287 | |||||

Income tax expense | 3 | 1 | ||||||

Interest expense | 629 | 149 | ||||||

(Gain) on revaluation of derivative | (11 | ) | - | |||||

Depreciation, amortization, & impairment | 413 | 359 | ||||||

Stock-based compensation expense (non-cash) | 60 | 58 | ||||||

Adjusted EBITDA | 583 | 854 | ||||||

Nine months ended March 31 | 2023 | 2022 | ||||||

| ( | ( | |||||||

Loss (gain) for the period | (2,914 | ) | 50 | |||||

Income tax expense | 6 | 25 | ||||||

Interest expense | 1,862 | 747 | ||||||

(Gain) on revaluation of derivative | (70 | ) | - | |||||

Depreciation, amortization, & impairment | 1,233 | 1,140 | ||||||

Stock-based compensation expense (non-cash) | 203 | 195 | ||||||

Adjusted EBITDA | 320 | 2,157 | ||||||

For more information on IBC and its innovative alloy products, go here.

On Behalf of the Board of Directors:

"Mark A. Smith"

Mark A. Smith, CEO & Chairman of the Board

# # #

CONTACTS:

Mark A. Smith, Chairman of the Board

Jim Sims, Director of Investor and Public Relations

+1 (303) 503-6203

Email: jim.sims@ibcadvancedalloys.com

Website: www.ibcadvancedalloys.com

@IBCAdvanced $IB $IAALF #copper #beryllium #F35

ABOUT IBC ADVANCED ALLOYS CORP.

IBC is a leading beryllium and copper advanced alloys company serving a variety of industries such as defense, aerospace, automotive, telecommunications, precision manufacturing, and others. IBC's Copper Alloys Division manufactures and distributes a variety of copper alloys as castings and forgings, including beryllium copper, chrome copper, and aluminum bronze. IBC's Engineered Materials Division makes the Beralcast® family of alloys, which can be precision cast and are used in an increasing number of defense, aerospace, and other systems, including the F-35 Joint Strike Fighter. IBC's has production facilities in Indiana and Massachusetts. The Company's common shares are traded on the TSX Venture Exchange under the symbol "IB" and the OTCQB under the symbol "IAALF".

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy of this news release. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain information contained in this news release may be forward-looking information or forward-looking statements as defined under applicable securities laws. Forward-looking information and forward-looking statements are often, but not always identified by the use of words such as "expect", "anticipate", "believe", "foresee", "could", "estimate", "goal", "intend", "plan", "seek", "will", "may" and "should" and similar expressions or words suggesting future outcomes. This news release includes forward-looking information and statements pertaining to, among other things, the Company's expectation of further growth in revenue and market demand, and the ability of the Copper Alloy division to increase its production capacity, reduce unit costs of production, expand its product portfolio and expand into new markets. Forward-looking statements involve substantial known and unknown risks and uncertainties, certain of which are beyond the Company's control including: the impact of general economic conditions in the areas in which the Company or its customers operate, including the semiconductor manufacturing and oil and gas industries, risks associated with manufacturing activities, changes in laws and regulations including the adoption of new environmental laws and regulations and changes in how they are interpreted and enforced, increased competition, the lack of availability of qualified personnel or management, limited availability of raw materials, fluctuations in commodity prices, foreign exchange or interest rates, stock market volatility and obtaining required approvals of regulatory authorities. As a result of these risks and uncertainties, the Company's future results, performance or achievements could differ materially from those expressed in these forward-looking statements. All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are based on assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances.

Please see "Risks Factors" in our Annual Information Form available under the Company's profile at www.sedar.com, for information on the risks and uncertainties associated with our business. Readers should not place undue reliance on forward-looking information and statements, which speak only as of the date made. The forward-looking information and statements contained in this release represent our expectations as of the date of this release. We disclaim any intention or obligation or undertaking to update or revise any forward-looking information or statements whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

SOURCE: IBC Advanced Alloys Corp.

View source version on accesswire.com:

https://www.accesswire.com/758150/IBC-Advanced-Alloys-Reports-Financial-Results-for-the-Quarter-Ended-March-31-2023