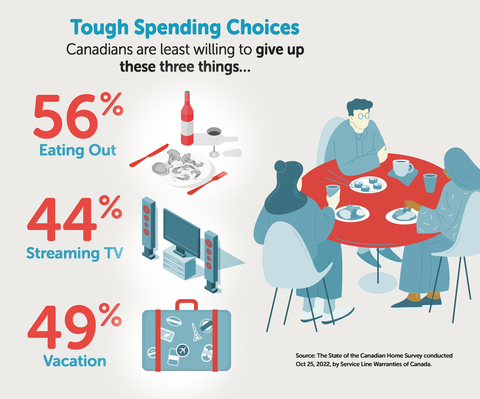

Canadians Unwilling to Give up Dining out, Vacation, and Streaming TV Service Despite Budget Pressures From Inflation

Tough Spending Choices: Canadians are least willing to give up these three things to help balance their budgets. (Graphic: Business Wire)

The survey also looked at what Canadians are most willing to give up – or conversely, least willing – to help balance their budgets. Dining out, vacation, and streaming TV service topped the list of what Canadians are least willing to give up to save money, while regular pet grooming, sports club or pool memberships, and professional lawn care would be the first to go if budgets got tight.

“Inflation is impacting most every facet of our lives right now. The vast majority of Canadians say their budgets have been impacted, so our survey dug into where Canadians are choosing to continue to spend money and in what areas they are willing to cut back,” said

Like SLWC’s 2021 State of the Canadian Home survey, the latest survey examined what types of home emergency repairs are most common and how much money homeowners have set aside in savings for these repairs. Two-thirds (

Unfortunately, the survey also found that many Canadians have no savings set aside to cover an unexpected home repair. Almost

Survey Methodology

This second ever “State of the Canadian Home Survey” was conducted on

***************

Since 2014, 70 Canadian municipalities have launched partnerships with SLWC to give their residents access to affordable service repair plans for common home repair emergencies. These repair plans offer a smart financial tool to prepare for the most common types of home emergencies. SLWC is the trusted source of utility line protection programs in

Homeowners with questions or who wish to receive more information about SLWC or available plans should call toll-free 1-866-922-9004 or visit www.slwof.ca. Local municipalities interested in learning more about the program for their community can visit www.servicelinewarranties.ca.

About Service Line Warranties of

Service Line Warranties of

Through its network of skilled locally based technicians, HomeServe makes a repair or install in a customer’s home every 34 seconds. HomeServe is also a leading provider of residential energy efficiency solutions. Over the past twelve months, HomeServe has installed almost

View source version on businesswire.com: https://www.businesswire.com/news/home/20221115005411/en/

MEDIA:

Service Line Warranties of

Phone: 647-325-7614

Email: mike.vanhorne@homeserve.ca

Hill+Knowlton Strategies for HomeServe

Phone: 703-835-6245

Email: Homeserve@hkstrategies.com

Source: HomeServe