HighGold Expands Resource Potential With 100-Meter Down-Plunge Base Metal Rich Step-Outs and New Footwall Copper-Silver Zone at Johnson Tract Project, Alaska, USA

HighGold Mining Inc. (TSX-V:HIGH, OTCQX:HGGOF) has announced significant assay results from its 2020 drilling program at the Johnson Tract polymetallic Gold Project in Alaska. Notable findings include:

- 11.0 meters at 8.6% Zn, 0.4% Cu, and 5.9 g/t AuEq in hole JT20-120.

- 18.3 meters at 5.9% Zn and 64 g/t Ag in hole JT20-121.

- 12 meters at 2.8% Cu and 51 g/t Ag in hole JT20-110.

With C$18 million in treasury, the company is well-positioned for further exploration in 2021, targeting both existing and new mineralization zones.

- Drill results indicate substantial expansion of the JT Deposit footprint.

- Discovery of the Footwall Copper-Silver Zone with positive mineralization results.

- Company has C$18 million in treasury, fully funding further exploration.

- None.

HighGold Mining Inc. (TSX-V:HIGH, OTCQX:HGGOF) (“HighGold” or the “Company”) is pleased to announce new assay results from the 2020 exploration drilling program at its flagship Johnson Tract polymetallic Gold Project (“Johnson Tract” or the “Project”) in Southcentral Alaska, USA. Results reported today include drill intersections that continue to expand the down-plunge and up-plunge extents of the JT Deposit (“JT”) and also demonstrate the continuity of the deeper Footwall Copper-Silver Zone (“FCZ”).

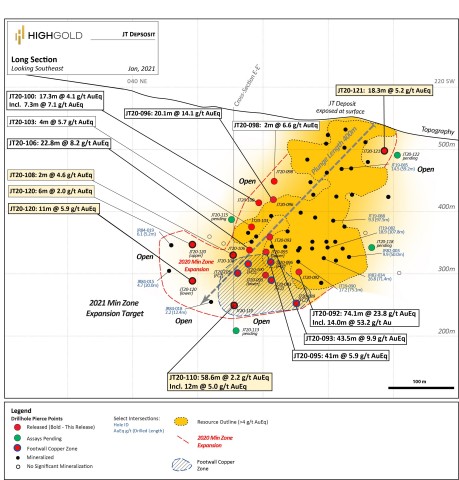

Figure 1. JT Deposit Longitudinal Section with drill hole pierce points (Graphic: Business Wire)

Drill Highlights

-

JT Expansion Down-Plunge - 11.0 meters at

8.6% Zn,0.4% Cu (5.9 g/t AuEq), including 5.0 meters at12.0% Zn,0.3% Cu (7.9 g/t AuEq) in hole JT20-120 -

JT Expansion Up-Plunge - 18.3 meters at

5.9% Zn, 64 g/t Ag,0.1% Cu, (5.2 g/t AuEq), including 4.0 meters at9.5% Zn, 278 g/t Ag,0.2% Cu (10.0 g/t AuEq) in hole JT20-121 -

Footwall Copper-Silver Zone Expansion – 12 meters at

2.8% Cu, 51 g/t Ag (5.0 g/t Au/Eq), within 58.6 meters at1.0% Cu, 21 g/t Ag (2.2 g/t AuEq) in hole JT20-110

“We continue to be encouraged by the continuation and strength of the JT Deposit mineral system at depth and by the emergence of the Footwall Copper-Silver Zone, a new area of copper-silver rich mineralization with resource potential that contributes to the overall metal endowment at Johnson,” commented President and CEO Darwin Green. “The current batch of drill results are base-metal dominant and highlight the presence of copper and zinc-rich domains within the polymetallic gold-rich JT Deposit.

“Drilling in 2020 significantly expanded the JT Deposit footprint with step-outs from the Indicated Mineral Resource of 750k oz AuEq (417k oz Au plus Zn, Cu, Pb, Ag) at a grade of 10.9 g/t AuEq (6.1 g/t Au) over true thickness of 20 to 50m (see Longitudinal Section, Figure 1). As new data is received, HighGold’s geological and structural model continues to evolve. Based on the new data, it appears that a significant portion of the mineral system is open to expansion down-plunge and is not cut-off at depth as interpreted by previous operators. With approximately C

For an video interview with CEO Darwin Green discussing these results, please click HERE.

Drill Program Discussion

The 2020 Drill Program (the “Program”) totaled 16,418 meters in 32 completed drill holes. Assays remain outstanding for 12 drill holes and will be released in batches as they are received and evaluated. The Au-Cu-Zn-Ag-Pb mineralization associated with the JT Deposit has now been intersected over a strike length of 325 meters and a down-plunge distance of 400 meters and remains open for expansion along strike to the northeast and southwest, and at depth. A complete list of significant assays is presented in Table 1 with drill hole intersections presented on a longitudinal section in Figure 1 and on a cross section in Figure 2.

JT Deposit Targets

Drill holes JT20-108 and JT20-110 were drilled on the same cross-section, approximately 100 meters apart, to test the area 25 meters to 50 meters along strike from previously released step-out drill holes along the northeast, down-plunge edge of the JT Deposit. The results from hole JT20-110 were particularly encouraging with a broad 58.3-meter intersection of copper-silver dominant mineralization representing the Footwall Copper Zone. The FCZ is a newly defined subzone of the JT Deposit and has now been intersected in six (6) holes (See Figure 1 and Table 2). Holes JT20-115 and JT20-113, drilled as 50-meter step-outs above and below these two (2) holes, are still pending receipt of assays.

Drill hole JT20-120 was a farther 75-meter step-out to the northeast from the JT20-108/JT20-110 cross-section and intersected an upper 6-meter gold-zinc zone and lower 11-meter zinc-copper zone corresponding to the JT Deposit. Hole JT20-120 has now extended the limit of mineralization 100 meters beyond the modeled resource outline and the zone remains open along strike to the northeast and down-plunge.

Drill hole JT20-121 was designed to test the shallow southwest strike extension of the JT Deposit, 25 meters outside the defined mineral resource and within 50 meters of surface. The hole intersected 18.3 meters of encouraging zinc-gold-silver mineralization and the zone remains open in this direction. Assays for hole JT20-122, a further 25-meter step-out to the southwest, are pending.

The potential to continue expanding the mineralized zones at the JT deposit is considered excellent.

Table 1. Johnson Tract Project – Significant new JT Deposit area drill intersections

Drill

|

From

|

To

|

Length

|

Zone |

Au

|

Ag

|

Cu

|

Pb

|

Zn

|

AuEq

|

JT20-108 |

237.6 |

239.6 |

2.0 |

JT |

0.74 |

94.4 |

1.58 |

0.14 |

0.63 |

4.6 |

Including |

237.6 |

238.1 |

0.5 |

JT |

0.72 |

246.0 |

4.10 |

0.25 |

1.75 |

10.7 |

JT20-110 |

305.6 |

313.0 |

7.4 |

JT/FCZ |

0.05 |

18.5 |

1.29 |

0.12 |

0.09 |

2.2 |

And |

334.9 |

393.5 |

58.6 |

JT/FCZ |

0.22 |

20.6 |

1.04 |

0.09 |

0.39 |

2.2 |

Including |

334.9 |

336.2 |

1.3 |

JT/FCZ |

2.02 |

44.0 |

3.14 |

0.12 |

6.32 |

10.9 |

And |

351.9 |

363.9 |

12.0 |

JT/FCZ |

0.17 |

50.5 |

2.83 |

0.09 |

0.21 |

5.0 |

And |

359.4 |

363.9 |

4.5 |

JT/FCZ |

0.18 |

88.4 |

4.75 |

0.17 |

0.21 |

8.2 |

And |

389.4 |

390.9 |

1.5 |

JT/FCZ |

0.04 |

83.8 |

3.96 |

0.30 |

0.25 |

7.0 |

JT20-120 |

237.6 |

243.6 |

6.0 |

JT |

1.07 |

7.7 |

0.10 |

0.37 |

0.88 |

2.0 |

Including |

237.6 |

238.6 |

1.0 |

JT |

6.13 |

30.3 |

0.32 |

0.99 |

1.04 |

8.1 |

And |

306.0 |

317.0 |

11.0 |

JT |

0.17 |

2.0 |

0.35 |

0.04 |

8.59 |

5.9 |

Including |

312.0 |

317.0 |

5.0 |

JT |

0.11 |

1.6 |

0.31 |

0.08 |

12.01 |

7.9 |

JT20-121 |

98.7 |

117.0 |

18.3 |

JT |

0.56 |

63.5 |

0.11 |

0.12 |

5.92 |

5.2 |

Including |

111.0 |

115.0 |

4.0 |

JT |

0.56 |

278.0 |

0.24 |

0.02 |

9.50 |

10.0 |

Notes: JT = JT Deposit expansion target, FCZ = Footwall Copper Zone target. Bold denotes intervals of greater than 50 g x m AuEq. Yellow intervals appear on the JT Deposit Longitudinal Section. Estimated true thickness is from

Table 2. Compilation of Significant Footwall Copper-Silver Zone intersections drilled to date

Drill |

From |

To |

Length |

Cu |

Ag |

Au |

Pb |

Zn |

CuEq |

AuEq |

Hole |

(meters) |

(meters) |

(meters) |

(%) |

(g/t) |

(g/t) |

(%) |

(%) |

(g/t) |

(g/t) |

JT19-089 |

355.2 |

389.1 |

33.9 |

1.59 |

21.6 |

0.14 |

0.14 |

3.44 |

3.4 |

4.8 |

Including |

364 |

384.7 |

20.7 |

2.38 |

31.9 |

0.18 |

0.10 |

4.86 |

4.9 |

7.0 |

Including |

366 |

373 |

7.0 |

4.67 |

66.3 |

0.08 |

0.08 |

9.69 |

9.5 |

13.5 |

JT20-096 |

311.1 |

350.2 |

39.1 |

1.64 |

26.3 |

0.19 |

0.15 |

0.69 |

2.3 |

3.3 |

Including |

311.1 |

323 |

11.9 |

1.79 |

38.3 |

0.31 |

0.36 |

0.9 |

2.8 |

4.0 |

And |

329.1 |

343.3 |

14.2 |

2.66 |

34.2 |

0.14 |

0.11 |

1.01 |

3.5 |

5.0 |

Including |

335.2 |

342.3 |

7.1 |

4.42 |

58.8 |

0.17 |

0.22 |

1.92 |

5.9 |

8.4 |

JT20-098 |

391.6 |

395.4 |

3.8 |

2.05 |

41.6 |

0.06 |

0 |

0.02 |

2.5 |

3.5 |

Including |

391.6 |

392.7 |

1.1 |

5.44 |

110.0 |

0.08 |

0.01 |

0.02 |

6.4 |

9.1 |

JT20-100 |

285.5 |

294.5 |

9.0 |

1.44 |

6.9 |

0.1 |

0.16 |

2.77 |

2.8 |

4.0 |

Including |

285.5 |

287.5 |

2.0 |

3.37 |

11.3 |

0.08 |

0.56 |

4.92 |

5.8 |

8.3 |

JT20-103 |

298 |

304 |

6.0 |

0.94 |

22.9 |

0.07 |

0.04 |

4.47 |

3.1 |

4.4 |

Including |

301 |

302 |

1.0 |

2.28 |

67.4 |

0.06 |

0.01 |

18.55 |

10.8 |

15.4 |

And |

341.8 |

348 |

6.2 |

1.13 |

14.7 |

0.76 |

0.01 |

0.62 |

2.1 |

2.9 |

JT20-110 |

305.6 |

313 |

7.4 |

1.29 |

18.5 |

0.05 |

0.12 |

0.09 |

1.5 |

2.2 |

And |

334.9 |

393.5 |

58.6 |

1.04 |

20.6 |

0.22 |

0.09 |

0.39 |

1.5 |

2.2 |

Including |

334.9 |

336.2 |

1.3 |

3.14 |

44.0 |

2.02 |

0.12 |

6.32 |

7.7 |

10.9 |

And |

351.9 |

363.9 |

12.0 |

2.83 |

50.5 |

0.17 |

0.09 |

0.21 |

3.5 |

5.0 |

And |

359.4 |

363.9 |

4.5 |

4.75 |

88.4 |

0.18 |

0.17 |

0.21 |

5.8 |

8.2 |

And |

389.4 |

390.9 |

1.5 |

3.96 |

83.8 |

0.04 |

0.3 |

0.25 |

4.9 |

7.0 |

Notes: Bold denotes intervals of greater than 50 g x m AuEq. Estimated true thickness unknown for FCZ intersections. Length-weighted intervals are uncapped. Copper equivalent (“CuEq”) and Gold equivalent (“AuEq”) is calculated by the same formula and assumptions used to report the JT Deposit NI43-101 Resource (effective date April 29, 2020) with metal prices of

Other Targets

Assay results for an additional three (3) drill holes, JT20-097, JT20-101 and JT20-105, have been received for the Northeast Offset Target (“NEO”), located 500 to 800 meters northeast of the JT Deposit. Significant results include 0.7 meters at

The narrow intercepts reported to date for NEO are interpreted as distal-type mineralization similar to that found peripheral to the main JT Deposit. Taken together with historic results and geological observations of the nine (9) holes completed this year at NEO, the Company currently interprets less offset along the Dacite Fault than was originally estimated. Large gaps in drilling exist between the JT Deposit and the NEO Target and these areas will be a focus for drill planning in 2021 to target fault displaced extensions of the JT Deposit.

At the North Trend target, results have been received for three (3) drill holes, JT20-099, JT20-104, and JT20-107. Anomalous gold values were intersected in JT20-099, including 6.0 meters at 0.7 g/t Au, 8 g/t Ag,

About the Johnson Tract Gold Project

Johnson Tract is a poly-metallic (gold, copper, zinc, silver, lead) project located near tidewater, 125 miles (200 kilometers) southwest of Anchorage, Alaska, USA. The 21,000-acre property includes the high-grade Johnson Tract Deposit (“JT Deposit”) and at least nine (9) other mineral prospects over a 12-kilometer strike length. HighGold acquired the Project through a lease agreement with Cook Inlet Region, Inc. (“CIRI”), one of 12 land-based Alaska Native regional corporations created by the Alaska Native Claims Settlement Act of 1971. CIRI is owned by more than 9,100 shareholders who are primarily of Alaska Native descent.

Mineralization at Johnson Tract occurs in Jurassic-age intermediate volcaniclastic rocks and is characterized as epithermal-type with submarine volcanogenic attributes. The JT Deposit is a thick, steeply dipping silicified body (20m to 50m average true thickness) that contains a stockwork of quartz-sulphide veinlets and brecciation, cutting through and surrounded by a widespread zone of anhydrite alteration. The Footwall Copper Zone is located structurally and stratigraphically below JT Deposit and is characterized by copper-silver rich mineralization.

The JT Deposit hosts an Indicated Resource of 2.14 Mt grading 10.93 g/t gold equivalent (“AuEq”) comprised of 6.07 g/t Au, 5.8 g/t Ag,

Prior to HighGold, the Project was last explored in the mid-1990s by a mid-tier mining company that evaluated direct shipping material from Johnson to the Premier Mill near Stewart, British Columbia.

About HighGold

HighGold is a mineral exploration company focused on high-grade gold projects located in North America. HighGold’s flagship asset is the high-grade Johnson Tract Gold (Zn-Cu) Project located in accessible Southcentral Alaska, USA. The Company also controls a portfolio of quality gold projects in the greater Timmins gold camp, Ontario, Canada that includes the Munro-Croesus Gold property, which is renowned for its high-grade mineralization, and the large Golden Mile and Golden Perimeter properties. HighGold’s experienced Board and senior management team, are committed to creating shareholder value through the discovery process, careful allocation of capital, and environmentally/socially responsible mineral exploration.

Ian Cunningham-Dunlop, P.Eng., VP Exploration for HighGold Mining Inc. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

On Behalf of HighGold Mining Inc.

“Darwin Green”

President & CEO

For further information, please visit the HighGold Mining Inc. website at www.highgoldmining.com.

Additional notes:

Starting azimuth and dip for drill holes JT19-108, 110, 120, and 121 are 130/-53, 120/-58, 130/-61, 310/-45 degrees respectively. Samples of drill core were cut by a diamond blade rock saw, with half of the cut core placed in individual sealed polyurethane bags and half placed back in the original core box for permanent storage. Sample lengths typically vary from a minimum 0.5 meter interval to a maximum 2.0 meter interval, with an average 1.0 to 1.5 meter sample length. Drill core samples are shipped by air and transport truck in sealed woven plastic bags to ALS Minerals sample preparation facility in Fairbanks, Alaska for sample preparation and from there by air to ALS Minerals laboratory facility in North Vancouver, BC for analysis. ALS Minerals operate according to the guidelines set out in ISO/IEC Guide 25. Gold is determined by fire-assay fusion of a 50 g sub-sample with atomic absorption spectroscopy (AAS). Samples that return values >100 ppm gold from fire assay and AAS are determined by using fire assay and a gravimetric finish. Various metals including silver, gold, copper, lead and zinc are analyzed by inductively-coupled plasma (ICP) atomic emission spectroscopy, following multi-acid digestion. The elements copper, lead and zinc are determined by ore grade assay for samples that return values >10,000 ppm by ICP analysis. Silver is determined by ore grade assay for samples that return >100 ppm.

The Company has a robust QAQC program that includes the insertion of blanks, standards and duplicates.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward looking statements: This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively “forward looking statements”). Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company’s currently ongoing drill program and pending assays are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company’s expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210121005237/en/

FAQ

What are the recent assay results from HighGold Mining at the Johnson Tract Project?

What is the Financial status of HighGold Mining as of 2021?

Which new mineralization zones have been identified at HighGold Mining's Johnson Tract?

What are the exploration targets for HighGold Mining in 2021?