Indie Distributor Hannover House Bets Big on MyFlix Streaming Service

Hannover House (OTC PINK:HHSE) CEO Eric Parkinson is unveiling the MyFlix streaming service, a revolutionary platform set to change the digital entertainment landscape. MyFlix aims to combine transaction-based and subscription models with a vast library of over 15,000 titles, targeting the growing demand for home streaming. The company plans to raise $8 million to support MyFlix's development and marketing. Parkinson believes that MyFlix could significantly boost HHSE’s stock performance, despite ongoing legal challenges.

- MyFlix service aims to offer over 15,000 titles from more than 40 suppliers, enhancing content variety for consumers.

- The upcoming stock offering aims to raise $8 million for MyFlix's development, indicating a strong financial commitment to the project.

- CEO Eric Parkinson anticipates increased interest in HHSE shares following MyFlix's launch.

- Hannover House is facing several disputes and lawsuits, which could pose challenges to the company.

- The stock price has remained under two cents for most of the past year, indicating a lack of investor confidence.

Insights

Analyzing...

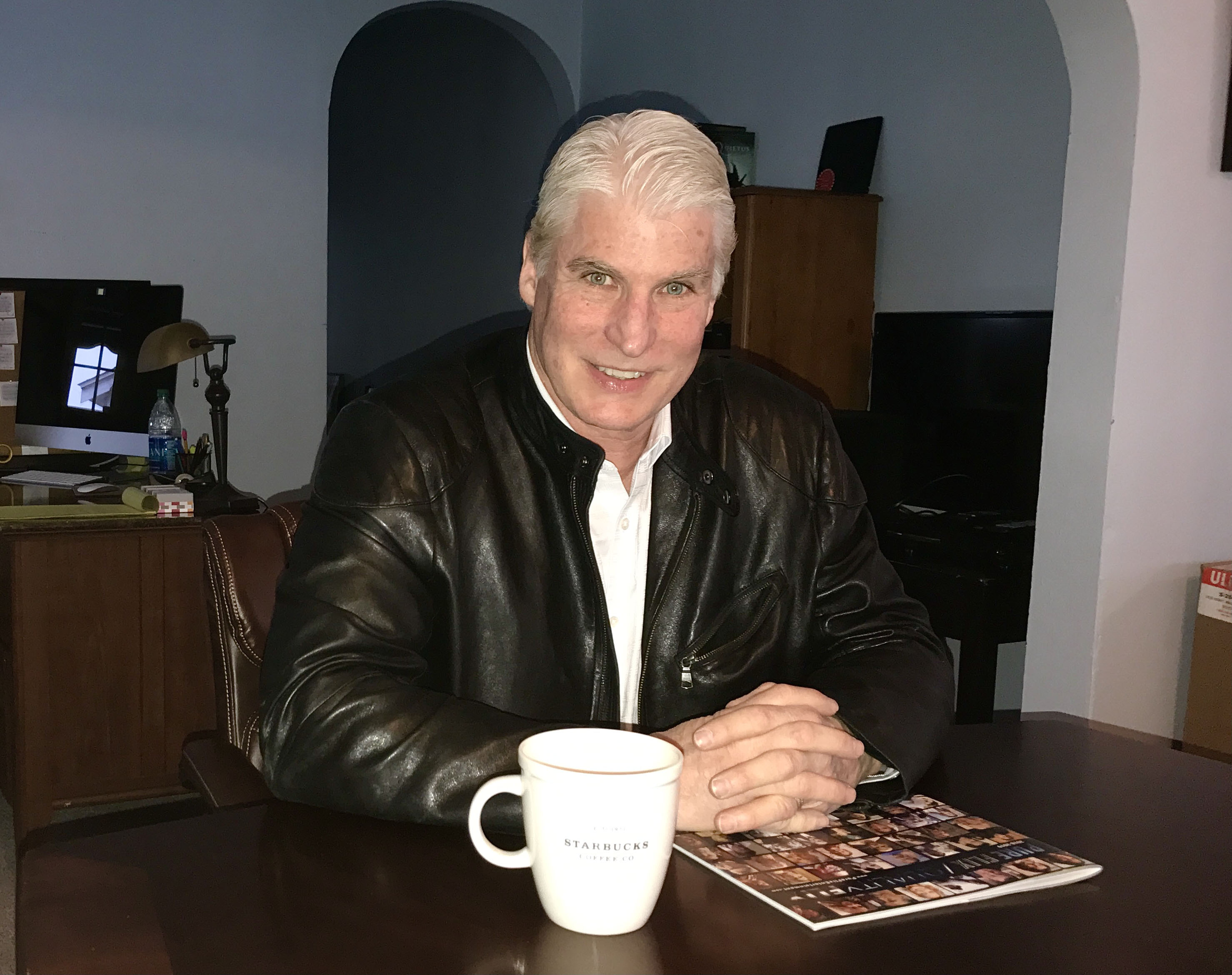

FAYETTEVILLE, AR / ACCESSWIRE / May 12, 2021 / From a modest office in a small, university town, an award-winning film distributor is launching a very big vision that he believes could change the way consumers view movies. Hannover House (OTC PINK:HHSE) CEO Eric Parkinson is applying some cutting-edge ideas to the world of digital-entertainment streaming that could make the company's MyFlix service into a major brand name.

"This is the right business model at the right time," said Parkinson, whose prior work history includes the CEO role at Hemdale Communications, the indie studio behind over 100 commercial hits including Terminator, Hoosiers and Best Picture Oscar Winners Platoon and The Last Emperor.

"Consumers have been migrating towards home streaming for several years now," he explained. "But the COVID-19 crisis and various lock-downs and stay-at-home orders only accelerated this evolution. Streaming services are the new networks for this generation, and we see MyFlix as the first entertainment Superstore."

The MyFlix business model that Parkinson is implementing has been described as a hybrid between Amazon Prime and Netflix. The service will have thousands of movies available on a "per-transaction" basis, such as with Amazon. MyFlix will also offer a monthly subscription option of unlimited views, much as the Netflix and SVOD business models.

But the key element that will differentiate MyFlix from other streaming services is what Parkinson calls the "superstore" concept.

"As an avid movie-viewer, I completely understand the concept of ‘Netflix fatigue,' where consumers tire quickly of the limited selection, which often includes films they had previously seen at the theatres," said Parkinson. "The MyFlix programming model is unique in that we will be offering more than 15,000 titles from over 40 supplier studios, primarily the top indie film suppliers. These are titles that in many cases will be de facto exclusives for MyFlix, along with over 100 bona-fide exclusive and premiere offerings. It will be very difficult for a viewer to reach a ‘MyFlix' fatigue with this many titles," he continued.

The MyFlix product pages have been designed to mirror existing streaming platforms for consumer ease. (Sample movies shown here are not necessarily MyFlix titles.)

Subscription pricing is not yet set, said Parkinson. But titles on a transactional basis will range from

"Both Disney and Warner/HBO have shown that consumers are willing to pay a premium for same-day home streaming of current theatrical hits," he noted. "This is an option we plan to explore. But we feel that the vast majority of MyFlix revenues will be from the monthly subscription users."

In addition to passive viewing, Parkinson sees the MyFlix site as ultimately reaching new audiences through an interactive educational programming portal, as well as multi-party live games. Lastly, he sees a service opportunity under the MyFlix program that would enable consumers to upload and share their own videos, much as with Google's YouTube service.

"We are in a media-delivery revolution at the moment," said Parkinson. "Digital streaming is taking over how consumers receive their entertainment and information. We think that MyFlix can combine the best elements of many of the key services to become a prominent player as the one-stop entertainment superstore."

Hannover House, Inc. will be implementing a stock offering to raise up to eight-million-dollars this summer, with

"We feel like we are on the last mile of a five-year marathon and the finish line is finally in sight," said Parkinson. "We are raising money to help support the consumer launch of MyFlix so that we can reach a critical-mass of awareness quickly. We think a lot of buzz will be generated once we launch the actual site by film aficionados and high-volume consumers. These market segments should deliver a solid kick-start to the MyFlix service. But, we will need high-visibility ads, promotions and publicity to reach the largest of the audience groups, and this will require money."

Hannover House has been operating as a media distributor since 1993, and moved into a DVD business model in 2002. By 2010, the company's focus had evolved into theatrical releasing of independent films, which until recent years, had been a reliable strategy for building DVD sales and streaming demand. But, as streaming services grew into greater prominence, the "bloom" of licensing titles simply due to their stature as a recent theatrical release came off, and sites such as Netflix began focusing on titles with major stars and major box office success. The era of winning a big Netflix license simply due to a film's theatrical launch went away during the same three-year cycle in which consumers also cut their DVD and BluRay purchases by

"The changing marketplace was already evident before COVID," said Parkinson. "Many consumers now have huge flat screen TVs, surround-sound audio and near-theatre quality screening set-ups. For many, going to the theatres was already limited to mega-budget event titles. But, COVID made the transition happen more quickly. As for DVD and BluRay, these remain as significant product lines, but not at the level where a company like Hannover House would want to pursue it as a primary focus. The MyFlix streaming service is a natural step for us to pursue, and combining the best elements from a variety of services gives us a great advantage to grow into consumer favor," he concluded.

MyFlix was the brainchild of Hannover House CEO Eric Parkinson

Hannover House, Inc. stock shares are currently traded on the OTC markets under ticker symbol HHSE. The current pricing has been "under two cents for most of the past year," said Parkinson. "But with a successful MyFlix launch, HHSE could become one of those oft-talked-about legendary stock performances. We certainly believe that this will be the case due to MyFlix, and we look forward to an exciting summer."

Parkinson noted that Hannover House is not without its challenges. The company is dealing with several disputes and lawsuits arising from the changing marketplace - and other media distributors are contemplating their opportunities in the new streaming world.

"There have always been hiccups and problems occurring as a result of the evolving media platforms," said Parkinson. "Years ago, everyone thought that television would kill the radio market. They thought that home video would destroy television and that home theatres would kill the movie chains. Time has proven that if a film or television program is good, it will ultimately find success, despite the evolution of delivery platforms. We have a smart, hard-working and experienced team at Hannover House, and we believe that the MyFlix business model is a winner," he concluded.

CONTACT:

Eric Parkinson, CEO

(818) 481-5277

eric@hannoverhouse.com

SOURCE: Hannover House, Inc.

View source version on accesswire.com:

https://www.accesswire.com/646683/Indie-Distributor-Hannover-House-Bets-Big-on-MyFlix-Streaming-Service