HighGold Reports 1.05 Moz AuEq at 9.39 g/t AuEq Indicated in Updated Mineral Resource Estimate, Johnson Tract Project, Alaska

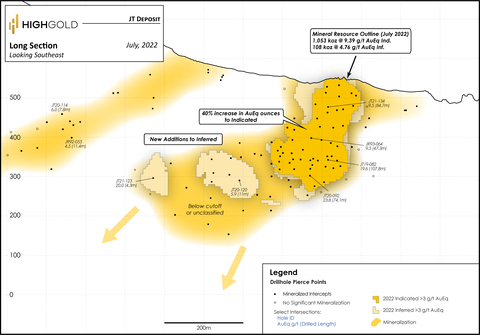

HighGold Mining Inc. (TSX-V:HIGH, OTCQX:HGGOF) reported a 40% increase in Indicated gold equivalent (AuEq) ounces at its Johnson Tract Deposit in Alaska. The updated mineral resource estimate shows 1,053,000 oz AuEq from 3.49 million tonnes at a grade of 9.39 g/t AuEq. The increased resource indicates high confidence, with 91% in the Indicated category and potential for low-cost underground mining. An ongoing exploration program aims to expand these resources, and a full NI 43-101 report will be released by August 2022.

- 40% increase in Indicated AuEq ounces to 1,053,000 oz.

- High confidence with 91% of AuEq ounces in Indicated resource category.

- Potential for low-cost underground mining due to the deposit's geometry and thickness.

- Ongoing exploration program with 13,000m of diamond drilling planned.

- None.

Figure 1. JT Deposit Long Section,

JT Deposit Mineral Resource Highlights

- Updated Indicated Resource – 3.49 million tonnes (“Mt”) grading 9.39 g/t gold equivalent (“AuEq”) for 1,053,000 oz AuEq

- Updated Inferred Resource – 0.71 Mt grading 4.76 g/t AuEq for 108,000 oz AuEq

-

Growth –

40% increase in Indicated AuEq ounces and54% increase in total tonnes (+60% Ind and -19% Inf) over the 2020 MRE (See Company news release datedApril 29, 2020 ) -

High Confidence –

91% of the total AuEq ounces in the Indicated Resource Category - Peer-Leading Thickness – Indicated resource averages 40-meter horizontal width, roughly 10 times the mineable width of most high-grade (+5 g/t) underground gold deposits

- Ideal Geometry for Low-Cost Methods of Underground Mining – thick, subvertical deposit with potential for lateral development from the valley floor to access the deepest and highest-grade portions of the deposit first and for gravity-assisted, bottom-up mining

-

Excellent Metallurgy – high metal recoveries, including global gold recovery up to

97% , utilizing conventional processing at a coarse grind size (See Company news release datedJune 22 , 2022) -

Expansion Potential – open to expansion along strike/down-dip/down-plunge with numerous high-priority property-wide targets including the

Difficult Creek (“DC”) and Milkbone prospects

“We are delighted to establish a high-grade Indicated Resource of more than 1 million ounces gold equivalent at Johnson Tract,” commented CEO

Table 1. JT Deposit Mineral Estimate at 3.0 g/t AuEq Cut-off

(Effective date

Category |

Tonnes |

Au |

Ag |

Cu |

Pb |

Zn |

AuEq |

|||||||

(000s) |

(g/t) |

(g/t) |

(%) |

(%) |

(%) |

(g/t) |

||||||||

Indicated |

3,489 |

5.33 |

6.0 |

0.56 |

0.67 |

5.21 |

9.39 |

|||||||

Inferred |

706 |

1.36 |

9.1 |

0.59 |

0.30 |

4.18 |

4.76 |

|||||||

Contained Metal |

||||||||||||||

Category |

|

Au |

Ag |

Cu |

Pb |

Zn |

AuEq |

|||||||

|

(k oz) |

(k oz) |

(M lb) |

(M lb) |

(M lb) |

(k oz) |

||||||||

Indicated |

598 |

673 |

43.1 |

51.5 |

400.8 |

1,053 |

||||||||

Inferred |

|

31 |

207 |

9.2 |

4.7 |

65.1 |

108 |

|||||||

Notes

-

Includes all drill holes completed at JT Deposit, with drilling completed between 1982 and as recently as

October 2021 -

Assumed metal prices are

US /oz for gold (Au),$165 0US /oz for silver (Ag),$20 US /lb copper (Cu),$3.50 US /lb lead (Pb), and$1 US /lb for zinc (Zn)$1.50 -

Gold Equivalent (“AuEq”) is based on assumed metal prices and payable metal recoveries of

97% for Au,85% for Ag,85% Cu,72% Pb and92% Zn from metallurgical testwork completed in 2022 - AuEq equals = Au g/t + Ag g/t × 0.01 + Cu% × 1.27 + Pb% × 0.31 + Zn% × 0.59

- Average bulk density value of 2.84 used as determined by conventional analytical methods for assay samples

-

Capping was applied to assays to restrict the impact of high-grade outliers, resulting in the removal of

8.4% Au,10.1% Ag,2.8% Cu,6.2% Pb, and1.3% Pb from the resource block model as compared to an uncapped version -

The economic underground mining cut-off is estimated to be 2.5 g/t AuEq derived from assumed operating cost of

$65 $35 $20 - Preliminary underground constraints were applied, including the elimination of isolated or scattered blocks above cut-off grade to define the “reasonable prospects of eventual economic extraction” for the Mineral Resource Estimate

- Mineral resources as reported are undiluted

- Mineral resource tonnages have been rounded to reflect the precision of the estimate

- Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability

JT Deposit Geological Model

Mineralization at the JT Deposit forms a roughly tabular silicified body that contains a stockwork of quartz-sulphide veins and breccia surrounded by a widespread zone of anhydrite alteration. The JT Deposit is hosted by andesite to dacite volcaniclastic rocks. A robust geological model has been developed for the JT Deposit based on 120 drill holes, detailed surface mapping, a well archived and high-quality database, extensive re-logging and re-sampling of historic drill core, and drilling by HighGold since 2019. A total of 57 holes (26,364 meters) were completed in the JT Deposit environment by HighGold since the resource was reported in the second quarter of 2020, including 35 holes (15,128 meters) within the MRE.

The mineral resource block model is constrained by three dimensional (3D) geologic wireframes, constructed by

The southeastern margin of the JT Deposit is constrained by the steeply southeast-dipping Dacite Fault zone. Where not constrained by drilling or faulting, domains were extended approximately 25 meters from a drill hole, except where geology supports extension between holes in the trend of mineralization.

JT Deposit Resource Model Estimate Background

The mineral resource estimate, prepared by

Indicated Resources include the core of the JT Deposit, where drill density and confidence in the geological model are highest. Blocks were initially classified as Inferred Mineral Resource where drill spacing was to a maximum of 100 meters or where within 30 meters of the closest sample. Indicated Resource blocks meet the criteria of being drilled at a maximum hole spacing of 40 meters. All indicated blocks have three holes within a maximum distance of 50 meters;

The complete NI 43-101 Technical Report will be released within 45 days of this news release.

Qualified Persons

Next Steps at Johnson Tract

The Company recently commenced a

In addition to drilling, the Company plans to conduct preliminary engineering and environmental baseline studies to support Project planning and future economic evaluation work.

About the

Johnson Tract is a poly-metallic (gold, copper, zinc, silver, lead) project located near tidewater, 125 miles (200 kilometers) southwest of

Mineralization at Johnson Tract occurs in Jurassic-age intermediate volcaniclastic rocks and is characterized as epithermal-type with submarine volcanogenic attributes. The JT Deposit is a thick, steeply dipping silicified body (20m to 50m average true thickness) that contains a stockwork of quartz-sulphide veinlets and brecciation, cutting through and surrounded by a widespread zone of anhydrite alteration.

Prior to HighGold, the Project was last explored in the mid-1990s by a mid-tier mining company that evaluated direct shipping material from Johnson to the

About HighGold

HighGold is a well-funded mineral exploration company focused on high-grade gold projects located in

Qualified Person and Quality Assurance

On Behalf of

“

President & CEO

Neither

Forward looking statements: This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively “forward looking statements”). Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company’s 2022 exploration plans and potential future engineering and economic studies are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company’s expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220712005547/en/

For further information, please visit the

Phone: 1-604-629-1165 or North American toll-free 1-855-629-1165

Email: information@highgoldmining.com.

Website: www.highgoldmining.com

Twitter: @HighgoldMining

Source:

FAQ

What is the latest gold equivalent resource estimate for HighGold Mining's Johnson Tract Deposit?

How much has the gold equivalent resource increased at the Johnson Tract Deposit?

What are the grades for the Indicated and Inferred resources at Johnson Tract?

What is the planned exploration activity for HighGold Mining in 2022?