HighGold Mining Intersects 21.7 g/t Gold over 11.9 Meters at DC Prospect, Johnson Tract Project, Alaska

HighGold Mining announced promising results from the Difficult Creek Prospect in Alaska, with drill hole DC22-043 revealing 11.9m at 21.68 g/t Au and including a high-grade subinterval of 3.9m at 54.2 g/t Au. The ongoing drilling program aims to explore the newly identified Ellis Zone, which has shown multi-ounce grade mineralization. The company has completed 3,017 meters in 25 holes so far in 2022 and continues to refine targets for future drilling while aiming for an overall completion of 10,000 to 11,000 meters this season.

- High-grade drill results from the Difficult Creek Prospect, with significant intersections including 3.9m at 54.2 g/t Au.

- Discovery of the new Ellis Zone, indicating potential for a significant mineralized system.

- Planned extensive follow-up drilling to further explore and expand the mineralization.

- Potential reduction in total meterage to be drilled this season, estimated at 10,000 to 11,000 meters, due to late start from snowpack.

Including 54.2 g/t Gold, 71 g/t Silver,

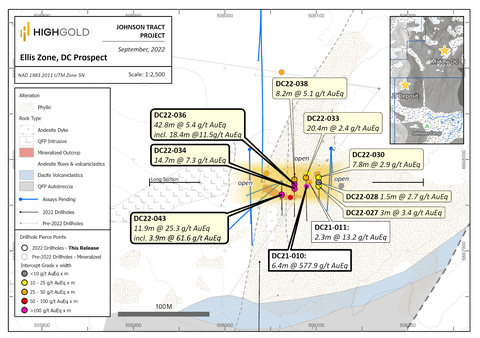

Figure 1.

Initial diamond drilling in 2022 has focused on the

Drill Highlights of the

-

11.9m @ 21.68 g/t Au, 30 g/t Ag,

0.61% Cu,4.20% Zn (25.3 g/t AuEq), in hole DC22-043, including-

3.9m @ 54.20 g/t Au, 71 g/t Ag,

1.26% Cu,8.29% Zn (61.6 g/t AuEq), including -

1.4m @ 92.75 g/t Au, 138 g/t Ag,

2.22% Cu,19.80% Zn (109 g/t AuEq)

-

3.9m @ 54.20 g/t Au, 71 g/t Ag,

-

42.8m @ 3.4 g/t Au, 23 g/t Ag,

0.21% Cu,2.06% Zn (5.4 g/t AuEq), in hole DC22-036, including-

18.4m @ 7.29 g/t Au, 50 g/t Ag,

0.44% Cu,3.92% Zn (11.2 g/t AuEq) including -

3.7m @ 18.00 g/t Au, 87 g/t Ag,

0.91% Cu,4.05% Zn (22.9 g/t AuEq)

-

18.4m @ 7.29 g/t Au, 50 g/t Ag,

-

14.7m @ 4.0 g/t Au, 18 g/t Ag,

0.27% Cu,4.18% Zn (7.3 g/t AuEq), in hole DC22-034, including-

5.6m @ 7.8 g/t Au, 36 g/t Ag,

0.49% Cu,9.17% Zn (14.6 g/t AuEq)

-

5.6m @ 7.8 g/t Au, 36 g/t Ag,

“A priority of our 2022 drill program was to follow up on last year’s late season discovery at the DC Prospect to determine if the mineralization continued to depth and laterally along strike. This has been confirmed in our initial step-outs which have returned multiple intersections of high-grade mineralization, including subintervals of multi-ounce grade,” commented

Discussion of DC Prospect and Ellis Zone Drill Results

The DC Prospect is located four (4) kilometers northeast of the JT Deposit and is characterized by a series of large gossan alteration zones similar in style to the +1Moz AuEq JT Deposit that collectively extend over a 1.5 km x 3.0 km area in a broad northeasterly trend. Gold mineralization and pervasive clay/anhydrite alteration are preferentially developed within dacitic to rhyolitic fragmental rocks that are capped by a shallowly-dipping sequence of lesser altered andesite volcanics that are host to a gold- and silver-rich epithermal vein field at higher elevations. The widespread extent of mineralization exposed in erosional windows through the capping andesite supports potential for a large and partially blind mineralized system linking the various DC Prospect zones together over a strike length of 3 km.

Drilling in late 2021 resulted in the discovery of near-surface bonanza-grade mineralization, which returned 577.9 g/t Au and 2,023 g/t Ag over 6.40 meters in hole DC21-010. Subsequent geological modeling during the off-season inferred an east-west striking, steeply north-dipping trend to the mineralization that became the focus for the initial 2022 drill program at what is now referred to as the 'Ellis Zone’.

Two (2) drill rigs have been targeting the

Details of the locations of 2022 drill holes completed to date can be found in Figures 1 and 2 with key assay intersections displayed in Table 1.

Next Steps for the DC Prospect

The bonanza-grade gold and silver assays from the DC Prospect remain a very important driver for the Company and a second round of drilling is planned for September/October to continue chasing the newly defined mineralization at depth and along strike. One drill rig will remain dedicated to continuing to expand the

2022 Summer Exploration Activities

Two (2) diamond drill rigs are currently operating on the Project along with regional geological mapping, geochemical sampling, airborne drone-magnetic geophysical surveying, and preliminary environmental and engineering baseline studies. Approximately

To

For information on

Table 1.

Drill Hole |

From |

To |

Length |

Au |

Ag |

Cu |

Pb |

Zn |

AuEq |

(meters) |

(meters) |

(meters) |

(g/t) |

(g/t) |

% |

% |

% |

(g/t) |

|

DC22-027 |

35.7 |

38.7 |

3.0 |

1.33 |

20.6 |

0.14 |

0.53 |

2.60 |

3.4 |

DC22-028 |

33.8 |

35.3 |

1.5 |

1.15 |

19.2 |

0.25 |

0.68 |

1.38 |

2.7 |

And |

48.9 |

50.2 |

1.3 |

1.00 |

7.7 |

0.18 |

0.59 |

2.13 |

2.7 |

DC22-030 |

54.2 |

62.0 |

7.8 |

2.1 |

11.2 |

0.07 |

0.18 |

0.93 |

2.9 |

Incl |

54.2 |

55.3 |

1.1 |

9.9 |

32.3 |

0.09 |

0.08 |

0.50 |

10.7 |

DC22-033 |

62.0 |

82.4 |

20.4 |

1.26 |

8.1 |

0.15 |

0.28 |

1.24 |

2.4 |

Incl |

70.9 |

76.4 |

5.5 |

2.87 |

6.7 |

0.11 |

0.15 |

0.79 |

3.6 |

DC22-034 |

34.8 |

49.5 |

14.7 |

4.04 |

17.7 |

0.27 |

0.75 |

4.18 |

7.3 |

Incl |

41.4 |

47.0 |

5.6 |

7.77 |

36.0 |

0.49 |

1.45 |

9.17 |

14.6 |

DC22-036 |

41.0 |

83.8 |

42.8 |

3.44 |

23.3 |

0.21 |

0.83 |

2.06 |

5.4 |

Incl |

42.0 |

60.4 |

18.4 |

7.29 |

49.9 |

0.44 |

1.78 |

3.92 |

11.2 |

Incl |

47.0 |

50.7 |

3.7 |

18.00 |

86.8 |

0.91 |

1.62 |

4.05 |

22.9 |

DC22-038 |

74.6 |

82.8 |

8.2 |

4.39 |

8.7 |

0.34 |

0.03 |

0.28 |

5.1 |

Incl |

74.6 |

80.1 |

5.5 |

5.95 |

11.9 |

0.50 |

0.01 |

0.21 |

6.8 |

DC22-043 |

37.1 |

49.0 |

11.9 |

21.68 |

30.1 |

0.61 |

0.38 |

4.20 |

25.3 |

Incl |

37.1 |

43.7 |

6.6 |

38.31 |

48.8 |

0.89 |

0.37 |

5.48 |

43.3 |

Incl |

37.1 |

41.0 |

3.9 |

54.20 |

71.1 |

1.26 |

0.48 |

8.29 |

61.6 |

Incl |

37.1 |

38.5 |

1.4 |

92.75 |

138.1 |

2.22 |

0.95 |

19.80 |

108.9 |

True thickness for the reported intersections estimated at

About the

Johnson Tract is a polymetallic (gold, copper, zinc, silver, lead) project located near tidewater, 125 miles (200 kilometers) southwest of

Mineralization at Johnson Tract occurs in Jurassic intermediate volcaniclastic rocks and is characterized as epithermal-type with submarine volcanogenic attributes. The JT Deposit is a thick, steeply dipping silicified body averaging 40m true thickness that contains a stockwork of quartz-sulphide veinlets and brecciation, cutting through and surrounded by a widespread zone of anhydrite alteration.

The JT Deposit hosts an Indicated Resource of 3.489 Mt grading 9.39 g/t gold equivalent (“AuEq”) comprised of 5.33 g/t Au, 6.0 g/t Ag,

Prior to HighGold, the Project was last explored in the mid-1990s by a mid-tier mining company that evaluated direct shipping material from Johnson to the

About HighGold

HighGold is a mineral exploration company focused on high-grade gold projects located in

On Behalf of

“

President & CEO

Additional Notes :

Starting azimuth, dip and final length (Azimuth/-Dip/Length) for the eight drill holes reported today are noted as follows: DC22-027 (180/69/86.7m), DC22-028 (180/78/101.5m), DC22-030 (180/84/104.8m), DC22-033 (180/84/98.4m), DC22-034 (180/68/73.9m), DC22-036 (180/78/104.0m), DC22-038 (180/85/113.0m), and DC22-043 (180/72/100.2m).

Samples of drill core were cut by a diamond blade rock saw, with half of the cut core placed in individual sealed polyurethane bags and the remaining half of the cut core placed back in the original core box for permanent storage, on site. Sample lengths range from a minimum 0.5-meter to a maximum 2.0-meter interval, with an average sample length of 1.0 to 1.5 meter.

The half-cut core samples are then dried for 1-2 days at 50-60 degrees Celsius, crushed to 2mm (>

Gold is determined by fire-assay fusion of a 50-gram sub-sample with atomic absorption spectroscopy (AAS). Samples that return values >10 ppm gold from fire assay and AAS are determined by using fire assay and a gravimetric finish. Various metals including silver, gold, copper, lead and zinc are analyzed by inductively-coupled plasma (ICP) atomic emission spectroscopy, following multi-acid digestion. The elements copper, lead and zinc are determined by ore grade assay for samples that return values >10,000 ppm by ICP analysis. Silver is determined by ore grade assay for samples that return >100 ppm. ALS Geochemistry meets all requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015. ALS Global operates according to the guidelines set out in ISO/IEC Guide 25.

The Company maintains a robust QAQC program that includes the collection and analysis of duplicate samples and the insertion of blanks and standards (certified reference material). The Company’s database and QAQC data have been audited by two independent, external experts,

Neither

Forward looking statements: This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively “forward looking statements”). Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company’s further 2022 drill plans and future results at the

View source version on businesswire.com: https://www.businesswire.com/news/home/20220912005393/en/

For further information, please visit the

Phone: 1-604-629-1165 or North American toll-free 1-855-629-1165

Email: information@highgoldmining.com.

Website: www.highgoldmining.com

Twitter : @HighgoldMining

Source:

FAQ

What were the highlights of HighGold Mining's drill results at Difficult Creek Prospect?

What is the significance of the Ellis Zone for HighGold Mining?

How much drilling has been completed by HighGold Mining in 2022?

What impact does snowpack have on HighGold Mining's drilling program?