HighGold Mining Intersects 18.7 g/t Au over 56.6 Meters at JT Deposit, Alaska

HighGold Mining Inc. (TSX-V:HIGH, OTCQX:HGGOF) has announced promising assay results from its Johnson Tract Gold Project in Alaska, including significant intersections of high-grade gold. Notably, hole JT21-125 revealed 18.69 g/t Au over 56.6 meters, with standout segments of 114.37 g/t Au over 4.9 meters and 64.74 g/t Au over 5.0 meters. The Company aims to advance its Phase I metallurgical testing program using drill core samples. HighGold plans to update its resource estimates early in 2022, following an extensive ongoing drill program with over 30,000 meters drilled since its maiden resource.

- High assay results from hole JT21-125, including 18.69 g/t Au over 56.6 m.

- High grades identified, including 114.37 g/t Au over 4.9 m and 64.74 g/t Au over 5.0 m.

- Upcoming Phase I metallurgical test program aims to improve historic results and support future process design.

- Ongoing drilling with three rigs, showing commitment to resource expansion.

- None.

Includes 114.4 g/t Au over 4.9 meters and 64.7 g/t Au over 5.0 meters

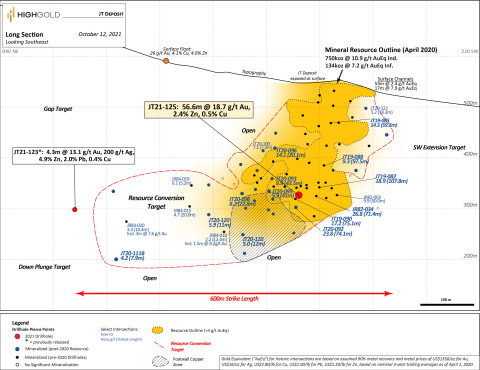

Figure 1.

Hole JT21-125 is an infill hole designed with the dual purpose of collecting material to support a Phase I metallurgical testing program and to provide better definition of the deeper, higher-grade portion of the JT Deposit (Figure 1). The hole successfully intersected a long interval of gold-dominant mineralization with significantly higher gold grade than the average of the JT Deposit resource. True thickness of the JT Deposit typically ranges from 20 to 50 meters and in the JT21-125 intersection is over 35 meters.

Drill Highlights Hole JT21-125

-

18.69 g/t Au,

2.43% Zn,0.47% Cu over 56.6m, including-

31.69 g/t Au,

1.82% Zn,0.58% Cu over 32.9m, including two high-grade intervals of -

64.74 g/t Au,

1.49% Zn,0.53% Cu over 5.0m and -

114.37 g/t Au,

3.51% Zn,0.33% Cu over 4.9m

-

31.69 g/t Au,

“We are very pleased to report this new intercept from the deeper reaches of the JT Deposit that confirms the strength of the mineralizing system,” commented President and CEO

Discussion of JT Deposit Infill Results

Assay results reported today include an intersection from infill drilling at the JT Deposit from hole JT21-125. The hole was designed as a dual-purpose infill and metallurgical test hole to gather sample material through the JT Deposit for the 2021 Phase I Metallurgical Testing Program. The hole successfully intersected typical ‘JT-style’ mineralization in silicified, veined and brecciated dacite tuff over 56.6 meters from 236.7-293.3m in the deeper portion of the JT Deposit. The drill hole was collared on the northwest side of the deposit at an azimuth/dip of 130/-46 degrees, oriented to cut across the mineralized zone in the opposite direction to most previous holes with the objective of better defining the continuity and orientation of high-grade gold mineralization. Details on the metallurgical test work program are presented below.

The location of infill hole JT21-125 in relation to the JT Deposit is presented on a longitudinal section in Figure 1 with details on assay composites presented in Table 1. The Au-Cu-Zn-Ag-Pb mineralization associated with the JT Deposit has been defined over a total strike length of 600 meters and remains open along strike to the northeast and southwest, and at depth.

Table 1. |

||||||||

|

|

|

|

|

|

|

|

|

Drill Hole |

From (m) |

To (m) |

Width (m) |

Au (g/t) |

Ag (g/t) |

Zn (%) |

Cu (%) |

Pb (%) |

JT21-125 |

236.7 |

293.3 |

56.6 |

18.69 |

3.9 |

2.43 |

0.47 |

0.36 |

Including |

260.4 |

293.3 |

32.9 |

31.69 |

5.1 |

1.82 |

0.58 |

0.47 |

Including |

273.4 |

278.4 |

5.0 |

64.74 |

7.4 |

1.49 |

0.53 |

0.88 |

And Incl. |

288.4 |

293.3 |

4.9 |

114.37 |

10.5 |

3.51 |

0.33 |

<0.01 |

True thickness for the intersection in hole JT21-125 is estimated at

2021 Phase I Metallurgical Testing Program

Blue Coast Metallurgy & Research has been engaged to carry out a Phase I metallurgical testwork program on the JT Deposit using selected drill core from the 2021 drill program. The Program will: a) complete test work to confirm historic metallurgical results reported by previous operators and identify possible opportunities for improvement; and b) advance the metallurgy to support potential future PEA-level process design. The Program will include QEMSCAN mineralogical studies, identification of potential geometallurgical domains, grindability/gravity/flotation test work, and the development of a flowsheet for recovery of pay metals to marketable end products. Two (2) composites are currently being considered from the upper and lower JT Deposit domains, and potentially a third composite from the

Current Exploration Activities

Three (3) diamond drill rigs are currently operating on the Project in concert with a regional geological mapping and geochemical sampling program, air and ground-based geophysical surveying, and a Phase I metallurgical sampling program. The current phase of drilling is scheduled to conclude on or before month end. Assays results will be released on an ongoing basis pending review and meeting Company quality assurance-quality control protocols. An updated mineral resource estimate is planned for the JT Deposit in early 2022, following the completion and receipt of all assays from the 2021 drill program. The new resource estimate will incorporate new drilling completed in 2020 and 2021. Over 30,000 meters have been drilled on the Project since the maiden resource.

About the

Johnson Tract is a poly-metallic (gold, copper, zinc, silver, lead) project located near tidewater, 125 miles (200 kilometers) southwest of

Mineralization at Johnson Tract occurs in Jurassic-age intermediate volcaniclastic rocks and is characterized as epithermal-type with submarine volcanogenic attributes. The JT Deposit is a thick, steeply dipping silicified body (20m to 50m average true thickness) that contains a stockwork of quartz-sulphide veinlets and brecciation, cutting through and surrounded by a widespread zone of anhydrite alteration.

The JT Deposit hosts an Indicated Resource of 2.14 Mt grading 10.93 g/t gold equivalent (“AuEq”) comprised of 6.07 g/t Au, 5.8 g/t Ag,

Prior to HighGold, the Project was last explored in the mid-1990s by a mid-tier mining company that evaluated direct shipping material from Johnson to the

About HighGold

HighGold is a mineral exploration company focused on high-grade gold projects located in

On Behalf of

“

President & CEO

For further information, please visit the

Additional notes:

The starting azimuth and dip (Azimuth/-Dip) for drillhole JT21-125 is 130/-46 degrees. Samples of drill core were cut by a diamond blade rock saw, with half of the cut core placed in individual sealed polyurethane bags and half placed back in the original core box for permanent storage. Sample lengths typically vary from a minimum 0.5 meter interval to a maximum 2.0 meter interval, with an average 1.0 to 1.5 meter sample length. Drill core samples are shipped by air and transport truck in sealed woven plastic bags to ALS Minerals sample preparation facility in

The Company has a robust QAQC program that includes the insertion of blanks, standards and duplicates.

Neither

Forward looking statements: This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively “forward looking statements”). Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company’s currently ongoing drill program and pending assays are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company’s expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211013005427/en/

Phone: 1-604-629-1165 or North American toll-free 1-855-629-1165

Email: information@highgoldmining.com.

Website: www.highgoldmining.com

Twitter: @HighgoldMining

Source:

FAQ

What are the latest assay results from HighGold Mining Inc.'s Johnson Tract (HGGOF)?

How will the assay results impact HighGold Mining Inc.'s stock (HGGOF)?

What is HighGold Mining Inc.'s plan for metallurgical testing (HGGOF)?

When will HighGold Mining update its resource estimates (HGGOF)?