HighGold Mining Discovers New Regional Gold-Bearing Structure at the Johnson Tract Project Defining a Multi-kilometer Prospective Target Corridor, Alaska, USA

HighGold Mining Inc. (OTCQX: HGGOF) announced promising results from its Johnson Tract project in Alaska, highlighting significant discoveries across multiple prospects including Milkbone and Difficult Creek. The company reported bonanza-grade intercepts, notably 577.9 g/t Au and 2,023 g/t Ag from a drill hole at DC. With around $23M in treasury, HighGold plans to drill new targets and update mineral resource estimates within three months. The Milkbone and Easy Creek prospects show strong surface geochemistry, supporting ongoing exploration efforts for high-grade mineralization.

- Promising assay results from multiple prospects, including 577.9 g/t Au and 2,023 g/t Ag at DC.

- Approximately $23M in treasury funding future exploration and drilling activities.

- HighGold ranked in global top 10 for drill holes in 2021, indicating strong exploration potential.

- None.

- Surface Exploration Outlines Multiple Priority Targets for 2022

- Difficult Creek Bonanza Grade Intersection Recognized as a Global Top 10 Drillhole of 2021

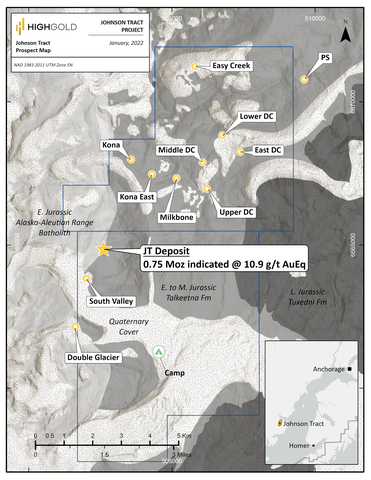

Figure 1 -

“We are seeing encouraging results across the length and breadth of the property and believe that systematic exploration will continue to generate new discoveries at Johnson Tract,” commented President and CEO

“With approximately

* Note - Opaxe Review Annual Drillhole Ranking. Opaxe is an independent Australian mining database company that compiles the best drill intersections reported around the world and then ranks them based on gold equivalent grams per tonne using prevailing metal prices (www.opaxe.com).

New Regional Target Discovery Highlights

HighGold completed geological mapping, geochemical sampling and geophysical surveys in 2021 concurrent with the resource expansion drill program with the objective of assessing the potential for new zones of high-grade mineralization across the district-scale property. The work successfully outlined multiple priority target areas for future drilling related to the prospective 6-km long regional Milkbone Fault system while also advancing the geological knowledge base for the Project. An initial phase of scout drilling at

The Milkbone prospect and the +1 km corridor between it and the bonanza-grade drill hole DC21-010 intercept at the Middle DC prospect to the northeast has emerged as a priority target area for the Company with strong supporting surface geochemistry, including soils up to 8.3 g/t Au and rock samples up to 184 g/t Au (representing the highest-grade soil and rock samples within the entire

The Milkbone fault is also associated with gold mineralization at the

Key sampling highlights can be found below and in Table 1 and Figure 2.

Milkbone Prospect Highlights

- 7.85 g/t Au and 599 g/t Ag in quartz vein breccia (rock grab sample**)

- 8.38 g/t and 4.4 g/t Au-in-soil sample; near the 184 g/t Au rock float sample returned in 2020

-

14.30 g/t Au,

6.1% Zn,4.4% Pb,0.5% Cu in quartz-sulphide vein (rock grab sample) - 11.10 g/t Au and 68.7 g/t Ag in low sulphidation quartz vein (rock grab sample)

-

4.53 g/t Au, 38.6 g/t Ag,

18.60% Pb,4.36% Zn,1.40% Cu in quartz-sulphide vein (rock grab sample) -

5.0% Cu in quartz-sulphide vein (1m rock chip sample) -

3.8% Cu and 34.3 g/t Ag in quartz-sulphide vein (rock float sample) -

Quartz-carbonate-sulphide fault breccia zone (rock grab samples) including:

-

10.1% Zn,7.6% Pb and1.4% Cu -

8.6% Zn,6.6% Pb and1.1% Cu, and -

7.2% Zn,5.5% Pb,1.6% Cu

-

Upper DC Prospect Highlights

- 3,480 g/t Ag and 0.61 g/t Au in low sulphidation quartz vein (rock float sample)

- 1,450 g/t Ag and 7.98 g/t Au in low sulphidation quartz vein (1m rock chip sample)

EC Prospect Highlights

- 29.3 g/t Au in oxidized gossanous boulder (rock float sample)

- >1 g/t Au in 5 soil samples near the Milkbone Fault

**Note - grab samples are by their nature are selective and not necessarily representative of the mineralization hosted on the Property.

Discussion of Surface and Geophysical Results

Geological mapping and rock and soil geochemical sampling focused primarily on underexplored regional prospects including the Milkbone, greater

Milkbone Prospect

The Milkbone prospect is located 3.2 kilometers northeast of the JT Deposit and is named for the regional Milkbone Fault which strikes north-south for approximately 6 km and lies west of the Middle DC prospect. Mineralization occurs at the surface as epithermal-style quartz-sulphide (± carbonate) extensional and fault-fill veins related to faults and splays and as meter-scale base metal and sulphide-rich quartz-carbonate breccias within faults. In 2020, rock sampling by the Company returned anomalous gold (up to 184 g/t in float) and zinc values (up to

Rock sampling by the Company in 2021 returned up to 7.85 g/t Au and 599 g/t Ag in quartz vein breccia along with high base metals to

These results for the Milkbone represent both the highest-grade soil sample (8.38 g/t Au) and the highest-grade rock sample (184 g/t Au) within the entire

DC Prospect (Middle and Upper)

Drilling by the Company in 2021 returned exceptional grades of 577.9 g/t Au and 2,023 g/t Ag over a 6.4m width in hole DC21-010 at the Middle DC prospect at shallow depths (

Rock sampling carried out in 2021 by the Company from Middle DC to Upper DC in an area cut by northeast-trending and northwest-trending faults and/or splays related to the Milkbone Fault system returned 3,480 g/t Ag and 0.61 g/t Au (float sample), 1,450 g/t Ag and 7.98 g/t Au over 1m (chip sample), and 11.10 g/t Au and 69 g/t Ag (grab sample); all in epithermal-style quartz veins. Rock sampling of quartz-sulphide veins returned highs of 4.30 g/t Au,

EC Prospect

In 2019 and 2020, limited rock sampling returned gold values up to 1.3 g/t Au. Soil samples returned anomalous values ranging up to 1.6 g/t Au and up to

Rock sampling by the Company in 2021 discovered a strongly oxidized boulder along the trace of the Milkbone Fault system which returned 29.10 g/t Au. The Drone Mag survey identified a ‘bullseye’ magnetic high associated with the quartz diorite plug, ringed by DCIP chargeability and resistivity anomalies and Au-Cu soil anomalies. This target will be drill tested in 2022.

Kona Prospect

The Kona prospect is located 2.5 kilometers north of the JT Deposit and is characterized by large (0.5 x 1.0 km) zone of sericite-pyrite (± quartz) alteration that is cored by a large quartz-pyrophyllite alteration zone. Mapped alteration closely correlates with a strong IP chargeability high with a smaller, circular magnetic high on its eastern margin. The chargeability anomaly at Kona was tested with two drill holes during the 2021 program which intersected intense disseminated pyrite and local vuggy silica type alteration (assay results are pending).

Discussion of Upper DC Drill Results

New results are reported for ten (10) scout drill holes (DC21-017 to DC2-026) that tested the Central Fault (3 holes) and Upper DC vein field (7 holes), which represent separate targets located 300 to 1000 meters away from the previously reported high-grade mineralization discovered at the Middle DC target (

Central Fault drill holes tested below clay-anhydrite alteration at surface that is associated with a topographic lineament. These holes intersected broad intervals (10s of meters) of alteration associated with elevated to anomalous gold values (50 ppb to 600 ppb Au) around a large fault structure (Central Fault). Upper DC drill holes tested beneath Ag-rich epithermal-style veins sampled during the 2020 field season. These drill holes intersected numerous 15 cm to 1.5 m wide epithermal-style veins within andesite volcanics and quartz-feldspar porphyry intrusives; however, were generally unable to replicate the high silver grades obtained from 2020 surface sampling in the area.

Significant new drill intersections include:

- 127 g/t Ag over 1.5m in hole DC21-017 (92.6m to 94.1m)

-

4.53 g/t Au, 11.5 g/t Ag and

1.94% Zn over 0.5m in hole DC21-021 (290.5m to 291.0m) - 1.75 g/t Au and 42.2 g/t Ag over 0.6m in hole DC21-021 (246.9m to 247.5m)

- 0.29 g/t Au and 15.7 g/t Ag over 4.0m in hole DC21-022 (176.5m to 180.5m)

- 40.3 g/t Ag over 1.5m in hole DC21-023 (290.5 to 291.0m)

Data collected during the 2021 surface exploration and scout drill program within the greater DC and Milkbone prospect areas indicates that precious metal mineralization is best developed at deeper stratigraphic levels than the Upper DC target, most notably at or near to the upper contact of the dacite volcaniclastic unit and appears to favor proximity to the Milkbone fault and related fault splays. This knowledge is critical to vectoring and prioritizing targets as the Company prepares its drill plans for 2022.

About the

The JT Deposit hosts an Indicated Resource of 2.14 Mt grading 10.93 g/t gold equivalent (“AuEq”) comprised of 6.07 g/t Au, 5.8 g/t Ag,

Prior to HighGold, the Project was last explored in the mid-1990s by a mid-tier mining company that evaluated direct shipping material from Johnson to the

About HighGold

HighGold is a mineral exploration company focused on high-grade gold projects located in

On Behalf of

“

President & CEO

For further information, please visit the

Additional notes:

True widths of new reported drill intersections are unknown.

Gold Equivalent (“AuEq”) is based on assumed metal prices and

Rock and drill core samples are shipped by air and transport truck in sealed woven plastic bags to the ALS Global –

Soil samples are shipped by air and transport truck in sealed woven plastic bags to the ALS Global –

The Company has a robust QAQC program that includes the insertion of blanks, standards and duplicates.

Neither

Forward looking statements: This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively “forward looking statements”). Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company’s currently ongoing drill program and pending assays are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company’s expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220125005727/en/

Phone: 1-604-629-1165 or North American toll-free 1-855-629-1165

Email: information@highgoldmining.com.

Website: www.highgoldmining.com

Twitter: @HighgoldMining

Source:

FAQ

What are the recent exploration results for HighGold Mining Inc. (HGGOF) in 2022?

How much funding does HighGold Mining Inc. have for its exploration activities?

What notable drill results did HighGold Mining Inc. achieve recently?

What are the main target areas for HighGold Mining Inc. in 2022?