HighGold Consolidates Ownership of Yukon Gold Properties in Emerging Reduced Intrusive Related Gold District, Selwyn Basin

HighGold Mining Inc. has completed an agreement to acquire the remaining 50% interest in its Yukon mineral properties, raising its ownership to 100%. The acquisition includes four properties totaling 1023 claims and 21,000 hectares, with the King Tut property identified as a significant gold anomaly. The deal involves a cash payment of C$75,000 and the issuance of 200,000 shares. CEO Darwin Green expressed optimism about the potential for these assets, especially following recent discoveries in the Selwyn Basin.

- Acquisition of remaining 50% interest in Yukon properties increases ownership to 100%.

- King Tut property shows multi-kilometer long gold-in-soil anomalies.

- Recent significant discoveries in the Selwyn Basin enhance prospects for the properties.

- C$75,000 cash payment and issuance of 200,000 shares may dilute existing shareholder value.

- 0.5% net smelter returns royalty on acquired properties could reduce future profits.

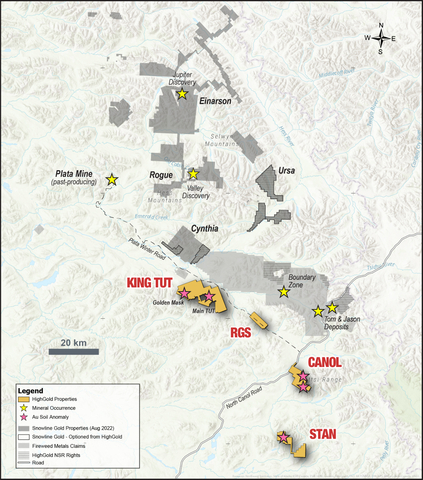

Figure 1 – Location of HighGold’s

“Following the recent and very significant new gold discoveries in Yukon’s Selwyn Basin, it was time to pull our portfolio of Yukon gold properties off the back burner,” commented CEO

Please CLICK HERE to hear additional commentary by CEO

Background on the

The Properties were first staked between 2010 and 2011 as part of a major gold-focused grassroots exploration program in Yukon’s Selwyn Basin carried out under a 50:50 Joint Venture between Constantine Metal Resources (“Constantine”) and Carlin Gold Corporation (“Carlin”). The original staking focused on areas with regional geochemical stream silt anomalies with elevated gold and pathfinder element anomalies with subsequent work including the collection of over 12,000 soil, stream sediment and rock samples across the greater land package.

HighGold acquired its initial

Agreement Terms

HighGold, through its wholly-owned subsidiary, entered into an agreement of purchase and sale (the “Agreement”) with Carlin Gold Corp. (the “Vendor”) to acquire the Properties. In consideration of the acquisition and subject to

In addition to the agreement with Carlin, HighGold has also entered into an agreement of purchase and sale with

About HighGold

HighGold is a well-funded mineral exploration company focused on high-grade gold projects located in

Qualified Person and Quality Assurance

On Behalf of

“

President & CEO

For further information, please visit the

Readers are cautioned that the Company has no interest in or right to acquire any interest in adjacent properties and they are not indicative of mineral deposits on the Company’s properties or any potential exploration thereof.

Readers are cautioned that the Company has no interest in or right to acquire any interest in any of the neighboring mines or deposits, and that mineral deposits, and the results of any mining thereof, on adjacent or similar properties are not indicative of mineral deposits on the Company's properties or any potential exploitation thereof.

Neither

Forward looking statements: This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively “forward looking statements”). Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the potential of the King Tut and other Yukon gold properties are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company’s expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220913005570/en/

Phone: 1-604-629-1165 or North American toll-free 1-855-629-1165

Email: information@highgoldmining.com.

Website: www.highgoldmining.com

Twitter: @HighgoldMining

Source:

FAQ

What recent agreement did HighGold Mining Inc. make regarding its Yukon properties?

What is the significance of the King Tut property in HighGold's acquisition?

How much did HighGold Mining agree to pay for the Yukon properties?

What is the stock symbol for HighGold Mining Inc.?