HighGold Announces Positive Metallurgical Test Results from JT Deposit Alaska, USA

HighGold Mining has announced positive metallurgical test results for its Johnson Tract project in Alaska, revealing recoveries of 97.2% gold, 92.3% zinc, and 84.5% copper from high-quality concentrates. The project features a 0.75 million oz gold equivalent indicated resource at 10.9 g/t AuEq. These results enhance the potential economics of the JT Project, aiding future studies. The US$9 million summer exploration program will include 13,000 meters of drilling and further evaluations of mineralization styles. Updated resource estimates are expected in Q2 2022.

- Gold recovery of 97.2%, zinc recovery of 92.3%, and copper recovery of 84.5% from metallurgical tests.

- High-quality concentrates produced with low impurities and no expected penalties.

- Upcoming resource estimation for JT Project expected by Q2 2022.

- US$9 million summer exploration program planned, including 13,000 meters of diamond drilling.

- None.

Recoveries of

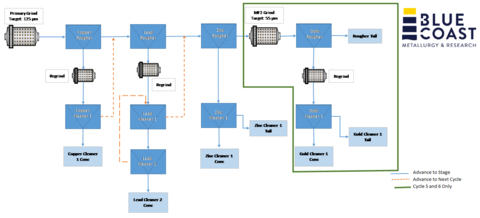

Figure 1 – JT Deposit - LCT-1 Flowsheet (Graphic: Business Wire)

Highlights of Metallurgical Test Results

The polymetallic (Au-Zn-Cu-Pb-Ag) JT Deposit exhibits an excellent response using conventional metallurgical techniques. Locked cycle flotation tests yielded very high-quality copper, zinc, lead and gold concentrates produced at a coarse primary grind with very good metal recoveries, low impurities and negligible penalty elements. Highlights include:

-

Gold recovery of

97.2% combined total of payable gold to concentrates and leaching of tails -

Zinc recovery of

92.3% to a concentrate grading52.6% zinc -

Copper recovery of

84.5% to a concentrate grading30.6% copper -

Lead recovery of

72.4% to a concentrate grading62.1% lead - Gold pyrite concentrate grading 64.3 g/t gold

- Coarse primary grind size of 125 microns

“We are very pleased with these metallurgical results, which demonstrate excellent metal recoveries to highly-quality concentrate products,” commented President and CEO

Test Program Details

The metallurgical test program (the “Program”) was completed by

The Program included mineralogical analysis, comminution testwork, flotation optimization testwork, locked cycle testwork, cyanidation of rougher tails and cleaner concentrates for global gold recovery, and follow-up mineralogical analysis of concentrates and tailings for deleterious elements.

Discussion of Test Program Results

Mineralogy and Comminution

Mineralogical analysis of the Master Composite showed that primary sulphide minerals are sphalerite, pyrite, chalcopyrite and galena. Pyrite, sphalerite and chalcopyrite all show very good liberation, with galena showing moderate liberation. Comminution testwork conducted on the Master Composite yielded the following results:

- Bond Ball Work Index of 16.6 kWh/tonne indicating the sample is hard

- Bond Abrasion index testing results indicated the sample is moderately abrasive

- SMC testwork showed that this sample was soft with respect to impact

Flotation

Flotation optimization was conducted on the Master Composite through a series of batch rougher and cleaner tests under a variety of conditions followed by a single locked cycle flotation test. The parameters explored included: i) primary grind size; ii) lead and zinc depressants; iii) lead regrind; iv) gold/pyrite circuit; and v) an MF2 (Mill-Float x 2) flowsheet. The best flotation conditions were then applied to the locked cycle test.

The locked cycle test was conducted as a standard six-cycle test; the flowsheet is presented in Figure 1. The copper, lead and zinc circuits were conducted on all six cycles, and the gold circuit was added to cycle 6. A coarse primary grind of 125 microns was utilized, with flotation of a copper rougher concentrate reground and cleaned once, followed by flotation of a lead rougher concentrate reground and cleaned twice. The zinc rougher concentrate was cleaned once with no regrind. The gold circuit consisted of a secondary grind of the zinc rougher tails (MF2 flowsheet), followed by gold rougher, concentrate regrind, and gold cleaner float. Table 1 shows the projected metallurgy for the locked cycle test.

All concentrates met target grades for the metal of interest and recoveries were overall very good. Gold concentration is at payable levels for all concentrate products, including the zinc concentrate, with a majority reporting to the copper, lead and pyrite concentrates where pay-ability is highest. Low levels of deleterious elements and impurities were detected in the final concentrates and no penalties are expected for any of the concentrate products based on current smelter contract standards (Table 2).

Leach Tests

Separate cyanidation leach tests were performed to evaluate different processing scenarios, including a) cyanidation of rougher tails in the absence of floating a gold concentrate, b) cyanidation of rougher tails generated after producing a gold concentrate, and c) cyanidation of the gold concentrate itself. Gold recovery results for the three tests are presented in Table 3.

Total Payable Gold Recovery

Estimated total payable gold recovery is

Table 1: LCT-1 Projected Metallurgy |

||||||||||||

Product |

Assays |

% Distribution |

||||||||||

Au (g/t) |

Ag (g/t) |

Cu (%) |

Pb (%) |

Zn (%) |

S (%) |

Au |

Ag |

Cu |

Pb |

Zn |

S |

|

Cu Concentrate |

276 |

71 |

30.6 |

2.11 |

3.94 |

33.4 |

32.7 |

15.3 |

84.5 |

2.4 |

1.1 |

8.7 |

Pb Concentrate |

220 |

95 |

1.42 |

62.1 |

15.1 |

18.1 |

26.9 |

21.1 |

4.0 |

72.4 |

4.3 |

4.9 |

Zn Concentrate |

10.4 |

26 |

0.31 |

2.85 |

52.6 |

31.9 |

7.8 |

35.5 |

5.5 |

20.4 |

92.3 |

52.7 |

Zn Cleaner Tail |

7.64 |

7 |

0.21 |

0.35 |

0.77 |

9.15 |

1.6 |

2.5 |

1.1 |

0.7 |

0.4 |

4.3 |

Au Concentrate |

64.3 |

24 |

0.38 |

0.70 |

1.52 |

33.3 |

18.5 |

12.4 |

2.6 |

1.9 |

1.0 |

21.1 |

Au Cleaner Tail |

2.17 |

2 |

0.04 |

0.08 |

0.10 |

1.49 |

1.4 |

2.2 |

0.6 |

0.5 |

0.1 |

2.1 |

Rougher Tail |

1.85 |

1 |

0.01 |

0.03 |

0.05 |

0.48 |

11.0 |

11.0 |

1.8 |

1.7 |

0.7 |

6.2 |

Calc. Head |

12.4 |

7 |

0.53 |

1.30 |

5.29 |

5.62 |

100 |

100 |

100 |

100 |

100 |

100 |

Table 2: LCT-1 Concentrate Deleterious Element Content |

|||||||

Product |

As |

Bi |

Cd |

Hg |

Mn |

Sb |

Se |

|

(ppm) |

(ppm) |

(pm) |

(ppm) |

(ppm) |

(ppm) |

(ppm) |

Cu Concentrate |

63 |

<2 |

162 |

0.28 |

71 |

13 |

228 |

Zn Concentrate |

133 |

<2 |

2218 |

0.99 |

411 |

39 |

93 |

Pb Concentrate |

27 |

<2 |

611 |

0.49 |

64 |

51 |

134 |

Au Concentrate |

903 |

<2 |

47 |

0.31 |

1029 |

73 |

82 |

Concentrates are considered ‘clean’ by industry standard with deleterious elements well below smelter penalty levels |

|||||||

Table 3: Cyanidation Leach Test Results |

||

Product |

Au Recovery (48hrs) |

Ag Recovery (48hrs) |

Rougher Tails absent production of a gold concentrate |

|

|

Rougher Tails generated from gold concentrate |

|

NA |

Gold Concentrate |

|

|

Table 4: Total Payable Gold Recovery |

||

Product |

Au (g/t) |

Distribution (%) |

Cu Concentrate |

276 |

32.7 |

Pb Concentrate |

220 |

26.9 |

Zn Concentrate |

10.4 |

7.8 |

Au Concentrate |

64.3 |

18.5 |

Combined Rougher and Cleaner Tails (CN |

1.85 to 7.64 |

11.3 |

TOTAL GOLD RECOVERY |

|

|

Additional Test Work and Opportunities

Additional metallurgical test work is ongoing to assess JT Deposit variability including the evaluation of other mineralization styles such as the footwall copper zone. Several opportunities for further optimization and flowsheet refinement exist and will be evaluated in future studies.

2022 Exploration Program

The Company recently announced plans for a

About the

Johnson Tract is a poly-metallic (gold, copper, zinc, silver, lead) project located near tidewater, 125 miles (200 kilometers) southwest of

Mineralization at Johnson Tract occurs in Jurassic-age intermediate volcaniclastic rocks and is characterized as epithermal-type with submarine volcanogenic attributes. The JT Deposit is a thick, steeply dipping silicified body (20m to 50m average true thickness) that contains a stockwork of quartz-sulphide veinlets and brecciation, cutting through and surrounded by a widespread zone of anhydrite alteration.

The JT Deposit hosts an Indicated Resource of 2.14 Mt grading 10.93 g/t AuEq comprised of 6.07 g/t Au, 5.8 g/t Ag,

Prior to HighGold, the Project was last explored in the mid-1990s by a mid-tier mining company that evaluated direct shipping material from Johnson to the

About HighGold

HighGold is a well-funded mineral exploration company focused on high-grade gold projects located in

Qualified Person and Quality Assurance

On Behalf of

“

President & CEO

For further information, please visit the

The Company has a robust QAQC program that includes the insertion of blanks, standards and duplicates.

Neither

Forward looking statements: This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively “forward looking statements”). Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company’s 2022 exploration plans and potential future engineering studies are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company’s expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220622005381/en/

Phone: 1-604-629-1165 or North American toll-free 1-855-629-1165

Email: information@highgoldmining.com.

Website: www.highgoldmining.com

Twitter: @HighgoldMining

Source:

FAQ

What are the metallurgical test results for HGGOF's Johnson Tract project?

What is the indicated resource for HighGold Mining's Johnson Tract project?

When will the updated resource estimation for Johnson Tract be released?

What is the planned exploration budget for HighGold Mining's summer program?