Hannan Extends Mineralization by 3 Kilometres Strike at San Martin, Peru Channel Samples 0.4 Metres @ 10.8% Copper and 124 g/t Silver

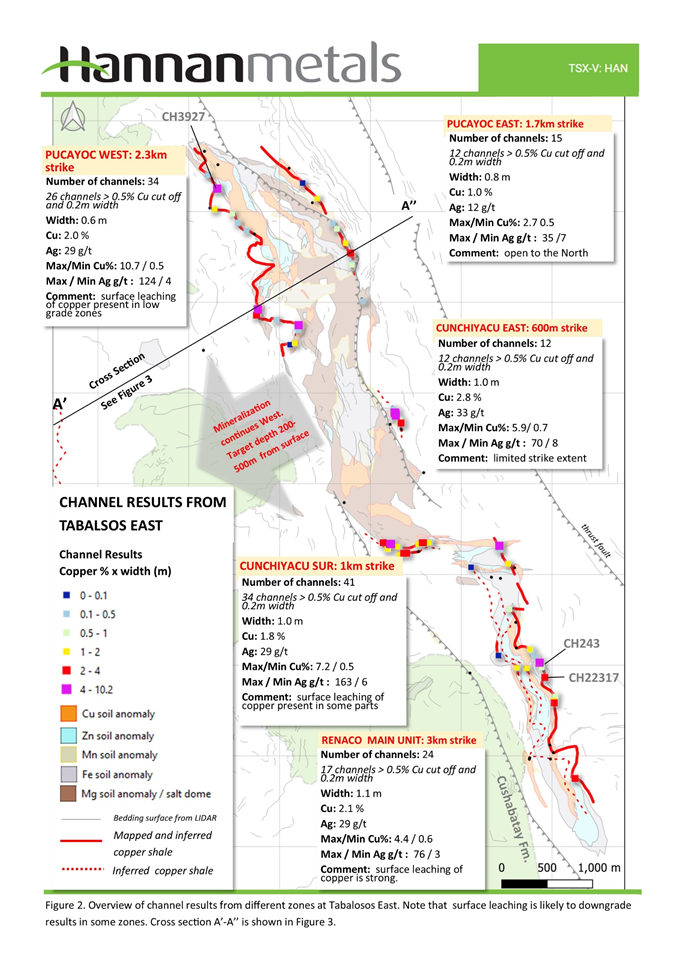

Hannan Metals Limited (HANNF) announced significant advancements in copper-silver exploration at the Tabalosos East prospect in Peru, part of the San Martin Joint Venture. The company has doubled systematic channel samples, revealing high grades and continuity. Notable findings include a new mineralization zone at Renaco, extending 3 kilometers south, with an average of 1.1 meters at 2.1% copper and 29 g/t silver. Upcoming geophysical surveys aim to map mineralization at depth, with plans for a maiden drill program by mid-year.

- Doubling of systematic channel samples indicates robust exploration activity.

- Discovery of a new mineralization zone at Renaco with high-grade results, including 0.4 meters at 10.8% copper and 124 g/t silver.

- Geophysical trials planned, enhancing exploration depth understanding.

- None.

Insights

Analyzing...

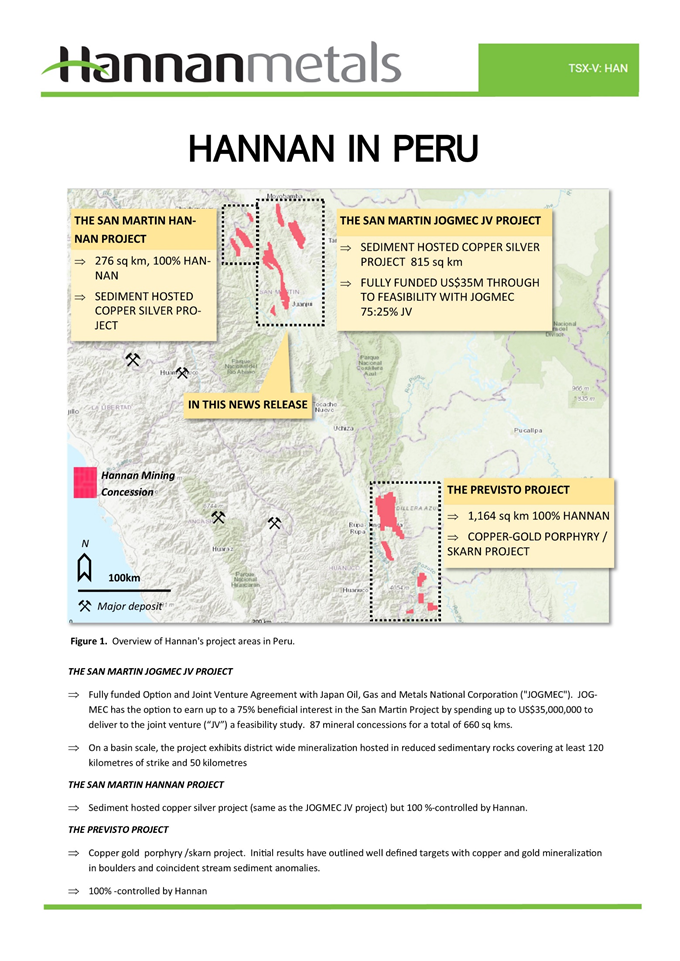

VANCOUVER, BC / ACCESSWIRE / January 25, 2022 / Hannan Metals Limited ("Hannan" or the "Company") (TSXV:HAN)(OTC PINK:HANNF) is pleased to report Hannan has doubled the number of systematic channel samples collected at the Tabalosos East prospect within the San Martin JOGMEC Joint Venture ("JV") sediment-hosted copper-silver project in Peru (Figure 1). Results continue to demonstrate high grades with continuity.

Highlights:

|

Michael Hudson, CEO, states "Comprehensive channel sampling provides further excitement, with average widths and grades continuing to show context with drill numbers found during the discovery of the vast Kupferschiefer copper-silver deposits. We have also extended mineralization via channel sampling a further 3 kilometres south into the Renaco area with some of the highest grades we have seen on the project to date including channeling 0.4 metres @

At San Martin outcrop is extremely poor with <

Copper mineralization is located at the base of a transition between the Sarayaquillo Formation and the Cushabatay Formation. This transition has previously been recognized in the district in academic literature, but is not well documented. The mineralized zone is located in the transition between fluvial-aeolian sediments and the onset of marine sedimentation. Copper mineralization is hosted in well-sorted sediments with the main reductant consisting of carbonized plant fragments varying in size from silt to several decimetres, at the top of a red-bed unit. Furthermore, initial observations suggest that the mineralization is mineralogically very simple with the dominant hypogene copper minerals being chalcocite and minor cuprite. Overall, the mineralization is extremely sulfur poor and very little sulfides can be observed in hand specimens. Leaching of the copper mineralization by supergene processes has been observed by Hannan geologists in some zones of Tabalosos and it is possible that the mineralization will show higher grades at depth due to the absence of surface leaching.

Context with the discovery of the Kupferschiefer

Sediment-hosted stratiform copper-silver deposits are among the two most important copper sources in the world, the other being copper porphyries. They are also a major producer of silver. KGHM Polska Miedz's ("KGHM") three copper-silver sediment-hosted mines in Poland (the "Kupferschiefer") were the leading silver producer in the world and seventh largest global copper miner in 2020. Quoted resources in 2019 for KGHM were 1,518 Mt @

To provide context, Hannan's widths and grade (0.9 metre @ 1.9 % copper and 27 g/t silver) from 105 channel surface samples reported here at San Martin (lower cut

- In 1957 the discovery drillhole (Sieroszowice IG 1) intersected 2.0 metres @

1.5% copper at the depth of 657 metres. - In 1959 the Lubin-Sieroszowice deposit, based on the results from 24 drillholes contained 1,365 Mt @

1.4% copper and 26 g/t silver in indicated resources, with a thickness ranging between 0.2-13.1 metres in an area about 28 kilometres long and 6 kilometres wide between 400 metres and 1,000 metres depth.

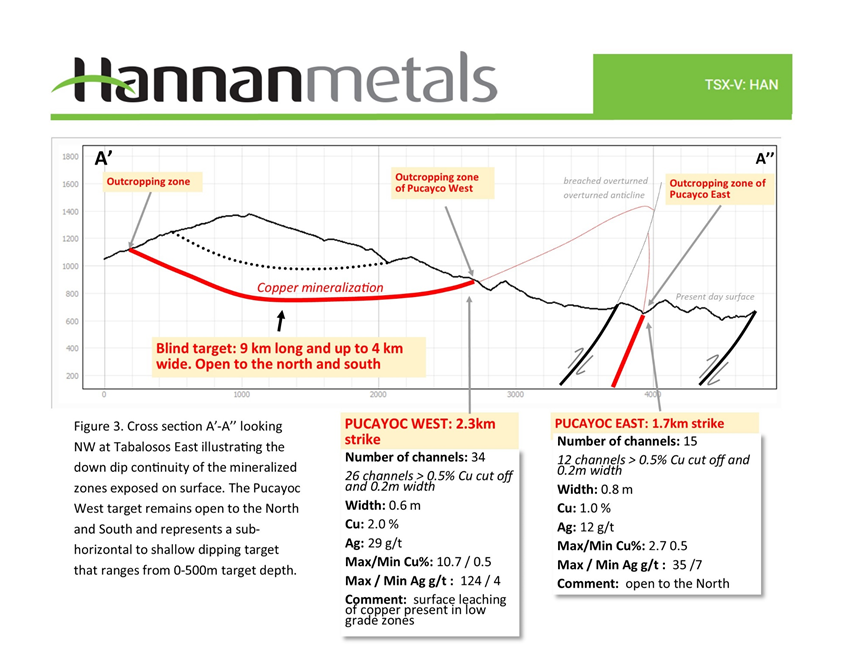

Hannan's sampling, to date, has been confined to surface channel sampling, although mineralization at Tabalosos East is interpreted to extend with shallow dips to the west for between 2-4 kilometres, with a target depth ranging from surface to 500 metres (Figure 3).

Technical Background

All samples were collected by Hannan geologists. Rock and sediment samples were transported to ALS in Lima via third party services using traceable parcels. At the laboratory, rock samples were prepared and analyzed by standard methods. The sample preparation involved crushing

Channel samples are considered representative of the in-situ mineralization samples and sample widths quoted approximate the true width of mineralization, while grab samples are selective by nature and are unlikely to represent average grades on the property.

About Hannan Metals Limited (TSXV:HAN) (OTCPK: HANNF)

Hannan Metals Limited is a natural resources and exploration company developing sustainable resources of metal needed to meet the transition to a low carbon economy. Over the last decade, the team behind Hannan has forged a long and successful record of discovering, financing, and advancing mineral projects in Europe and Peru. Hannan is a top ten in-country explorer by tenured area in Peru.

Mr. Michael Hudson FAusIMM, Hannan's Chairman and CEO, a Qualified Person as defined in National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

On behalf of the Board, "Michael Hudson" | Further Information |

Forward Looking Statements. Certain disclosure contained in this news release may constitute forward-looking information or forward-looking statements, within the meaning of Canadian securities laws. These statements may relate to this news release and other matters identified in the Company's public filings. In making the forward-looking statements the Company has applied certain factors and assumptions that are based on the Company's current beliefs as well as assumptions made by and information currently available to the Company. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. These risks and uncertainties include but are not limited to: the political environment in which the Company operates continuing to support the development and operation of mining projects; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; risks related to negative publicity with respect to the Company or the mining industry in general; planned work programs; permitting; and community relations. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news.

Table 1: Results from 91 channel samples from Tabalosos East reported through August 2021 to current date. Lower cut >0.5 % copper over 0.2 metres. Channel samples average of 1.0 metres @

| Hole | UTME | UTMN | From (m) | To (m) | Width (m) | Cu% | Ag ppm | Reported date |

| CH4321 | 315191 | 9291943 | 1.1 | 4.1 | 3.0 | 3.4 | 36 | here |

| CH23760 | 313990 | 9291964 | 0.0 | 2.0 | 2.0 | 4.9 | 62 | 9-Aug-21 |

| CH3860 | 312531 | 9294550 | 0.0 | 2.8 | 2.8 | 3.3 | 49 | 20-Sep-21 |

| CH22330 | 314051 | 9293379 | 0.0 | 1.4 | 1.4 | 5.5 | 68 | here |

| CH243 | 315635 | 9290654 | 0.7 | 3.2 | 2.5 | 2.7 | 61 | here |

| CH23999 | 314038 | 9293412 | 0.0 | 1.2 | 1.2 | 5.4 | 62 | 9-Aug-21 |

| CH3917 | 312980 | 9294375 | 0.2 | 3.0 | 2.8 | 1.9 | 34 | here |

| CH207 | 313998 | 9291961 | 1.2 | 2.1 | 0.9 | 5.6 | 51 | here |

| CH3891 | 314038 | 9293411 | 0.0 | 1.6 | 1.6 | 3.0 | 34 | 30-Nov-21 |

| CH3927 | 312083 | 9295880 | 0.8 | 1.2 | 0.4 | 10.8 | 124 | here |

| CH3803 | 314047 | 9293404 | 0.0 | 0.7 | 0.7 | 5.9 | 70 | 9-Aug-21 |

| CH22317 | 315691 | 9290491 | 2.5 | 3.4 | 0.9 | 4.4 | 76 | here |

| CH211 | 313994 | 9291957 | 4.1 | 5.3 | 1.2 | 3.3 | 34 | here |

| CH22309 | 316025 | 9289377 | 0.0 | 1.5 | 1.5 | 2.6 | 29 | here |

| CH3824 | 313911 | 9291977 | 0.0 | 0.6 | 0.6 | 5.0 | 139 | 9-Aug-21 |

| CH23764 | 314341 | 9291977 | 0.0 | 0.4 | 0.4 | 7.2 | 163 | 9-Aug-21 |

| CH4520 | 315795 | 9290211 | 0.0 | 2.3 | 2.3 | 1.2 | 14 | here |

| CH49 | 313984 | 9291968 | 0.5 | 1.5 | 1.0 | 2.8 | 45 | here |

| CH23763 | 314355 | 9291977 | 0.0 | 0.4 | 0.4 | 6.3 | 152 | 9-Aug-21 |

| CH101 | 313553 | 9295172 | 0.0 | 3.1 | 3.1 | 0.8 | 10 | 20-Sep-21 |

| CH23640 | 312515 | 9294485 | 0.0 | 2.7 | 2.7 | 0.9 | 17 | here |

| CH4310 | 314136 | 9291859 | 0.5 | 1.4 | 0.9 | 2.7 | 39 | 30-Nov-21 |

| CH22331 | 314108 | 9293297 | 0.7 | 1.9 | 1.2 | 2.1 | 24 | here |

| CH22301 | 313979 | 9291959 | 1.5 | 4.7 | 3.2 | 0.7 | 11 | here |

| CH3862 | 312531 | 9294540 | 0.0 | 2.0 | 2.0 | 1.1 | 14 | 20-Sep-21 |

| CH62 | 314169 | 9291861 | 0.7 | 2.1 | 1.4 | 1.5 | 30 | here |

| CH43 | 313967 | 9291968 | 1.0 | 2.5 | 1.5 | 1.4 | 21 | here |

| CH23992 | 313967 | 9291967 | 0.0 | 2.0 | 2.0 | 1.0 | 19 | 9-Mar-21 |

| CH4313 | 314296 | 9291961 | 3.5 | 5.2 | 1.7 | 1.2 | 27 | 30-Nov-21 |

| CH226 | 315493 | 9290591 | 0.7 | 2.0 | 1.3 | 1.6 | 20 | here |

| CH3888 | 315286 | 9291745 | 0.0 | 0.8 | 0.8 | 2.3 | 24 | 30-Nov-21 |

| CH3818 | 313955 | 9291907 | 0.0 | 1.1 | 1.1 | 1.6 | 28 | 9-Aug-21 |

| CH3896 | 314034 | 9293427 | 1.8 | 2.8 | 1.0 | 1.7 | 19 | 30-Nov-21 |

| CH4336 | 315384 | 9290598 | 0.2 | 1.3 | 1.1 | 1.5 | 27 | here |

| CH215 | 314070 | 9291932 | 2.6 | 4.2 | 1.6 | 1.0 | 17 | here |

| CH3823 | 313910 | 9291978 | 0.0 | 0.7 | 0.7 | 2.3 | 40 | 9-Aug-21 |

| CH23758 | 313984 | 9291966 | 0.0 | 1.3 | 1.3 | 1.2 | 18 | 9-Aug-21 |

| CH23778 | 312936 | 9294177 | 1.4 | 1.6 | 0.2 | 6.9 | 89 | 20-Sep-21 |

| CH4309 | 314126 | 9291862 | 0.0 | 0.4 | 0.4 | 3.4 | 30 | 30-Nov-21 |

| CH58 | 314092 | 9291845 | 1.1 | 2.7 | 1.6 | 0.8 | 17 | here |

| CH114 | 312053 | 9295650 | 0.5 | 1.1 | 0.6 | 2.2 | 43 | 30-Nov-21 |

| CH15 | 315794 | 9290237 | 2.0 | 2.8 | 0.8 | 1.7 | 19 | here |

| CH3821 | 313970 | 9291966 | 0.0 | 1.8 | 1.8 | 0.7 | 12 | 9-Aug-21 |

| CH14 | 314414 | 9291977 | 0.0 | 0.3 | 0.3 | 4.3 | 56 | 20-Sep-21 |

| CH23781 | 312937 | 9294175 | 0.0 | 0.2 | 0.2 | 6.0 | 63 | 20-Sep-21 |

| CH201 | 313987 | 9291952 | 0.7 | 2.6 | 1.9 | 0.6 | 7 | here |

| CH237 | 315525 | 9290801 | 0.6 | 2.5 | 1.9 | 0.6 | 16 | here |

| CH3903 | 313184 | 9295770 | 1.5 | 1.9 | 0.4 | 2.7 | 35 | here |

| CH23784 | 313497 | 9295279 | 0.0 | 0.6 | 0.6 | 1.8 | 30 | 30-Nov-21 |

| CH23993 | 313968 | 9291903 | 0.0 | 0.5 | 0.5 | 2.0 | 35 | 9-Mar-21 |

| CH24 | 315808 | 9290283 | 0.8 | 1.3 | 0.5 | 1.9 | 10 | here |

| CH23787 | 312982 | 9294376 | 0.0 | 0.7 | 0.7 | 1.3 | 13 | 30-Nov-21 |

| CH3908 | 313566 | 9295040 | 1.0 | 2.5 | 1.5 | 0.6 | 6 | here |

| CH3806 | 314093 | 9293333 | 0.0 | 1.0 | 1.0 | 0.9 | 9 | 9-Aug-21 |

| CH22321 | 315657 | 9290599 | 3.0 | 4.3 | 1.3 | 0.7 | 12 | here |

| CH3846 | 313402 | 9295437 | 0.0 | 1.0 | 1.0 | 0.9 | 10 | 20-Sep-21 |

| CH4507 | 315796 | 9290245 | 0.0 | 0.4 | 0.4 | 2.1 | 29 | 30-Nov-21 |

| CH3803 | 314047 | 9293404 | 1.6 | 2.2 | 0.6 | 1.4 | 18 | 9-Aug-21 |

| CH222 | 314346 | 9291976 | 0.7 | 1.8 | 1.1 | 0.8 | 23 | here |

| CH4326 | 315289 | 9291745 | 1.9 | 2.3 | 0.5 | 1.8 | 20 | here |

| CH109 | 312250 | 9295604 | 0.6 | 0.8 | 0.2 | 4.0 | 36 | 30-Nov-21 |

| CH3891 | 314038 | 9293411 | 2.5 | 3.4 | 0.9 | 0.9 | 10 | 30-Nov-21 |

| CH75 | 315304 | 9291243 | 0.3 | 0.9 | 0.6 | 1.2 | 15 | here |

| CH23998 | 314033 | 9293426 | 0.0 | 0.7 | 0.7 | 1.0 | 11 | 9-Aug-21 |

| CH49 | 313984 | 9291968 | 2.0 | 3.0 | 1.1 | 0.6 | 9 | here |

| CH23991 | 313966 | 9291966 | 0.0 | 1.2 | 1.2 | 0.5 | 7 | 9-Mar-21 |

| CH229 | 315533 | 9290795 | 0.8 | 1.1 | 0.3 | 1.9 | 30 | here |

| CH3814 | 314335 | 9291976 | 0.0 | 0.8 | 0.8 | 0.7 | 16 | 9-Aug-21 |

| CH22326 | 314019 | 9293454 | 0.7 | 1.4 | 0.7 | 0.7 | 8 | here |

| CH4508 | 314415 | 9291978 | 0.0 | 0.5 | 0.5 | 1.0 | 10 | 30-Nov-21 |

| CH23791 | 312307 | 9295506 | 2.4 | 2.6 | 0.2 | 2.3 | 21 | 30-Nov-21 |

| CH3858 | 312937 | 9294178 | 0.0 | 0.2 | 0.2 | 2.2 | 27 | 20-Sep-21 |

| CH23775 | 312531 | 9294540 | 0.0 | 0.3 | 0.3 | 1.5 | 20 | 20-Sep-21 |

| CH3814 | 314335 | 9291976 | 2.0 | 2.4 | 0.4 | 1.1 | 16 | 9-Aug-21 |

| CH233 | 315548 | 9290777 | 0.6 | 1.0 | 0.4 | 1.1 | 12 | here |

| CH23786 | 313355 | 9295498 | 0.0 | 0.5 | 0.5 | 0.8 | 9 | 30-Nov-21 |

| CH23790 | 312310 | 9295500 | 2.2 | 2.8 | 0.7 | 0.5 | 4 | 30-Nov-21 |

| CH4333 | 315204 | 9291896 | 0.0 | 0.5 | 0.5 | 0.7 | 3 | here |

| CH23776 | 312940 | 9294179 | 0.0 | 0.5 | 0.5 | 0.6 | 8 | 20-Sep-21 |

| CH2 | 313354 | 9295495 | 2.9 | 3.4 | 0.5 | 0.6 | 8 | 20-Sep-21 |

| CH123 | 312737 | 9294437 | 3.2 | 3.5 | 0.3 | 0.9 | 11 | here |

| CH252 | 315586 | 9290719 | 1.0 | 1.3 | 0.3 | 0.9 | 13 | here |

| CH23778 | 312936 | 9294177 | 0.0 | 0.2 | 0.2 | 1.2 | 12 | 20-Sep-21 |

| CH23762 | 314415 | 9291976 | 0.0 | 0.4 | 0.4 | 0.6 | 7 | 9-Aug-21 |

| CH3853 | 315387 | 9290592 | 0.0 | 0.4 | 0.4 | 0.5 | 8 | 20-Sep-21 |

| CH4542 | 313401 | 9295438 | 0.3 | 0.7 | 0.4 | 0.5 | 7 | here |

| CH129 | 311979 | 9296031 | 0.5 | 0.7 | 0.2 | 1.0 | 8 | here |

| CH22312 | 314432 | 9291983 | 0.5 | 0.7 | 0.3 | 0.8 | 11 | here |

| CH219 | 314092 | 9291926 | 1.0 | 1.2 | 0.2 | 0.9 | 6 | here |

| CH123 | 312737 | 9294437 | 1.9 | 2.2 | 0.3 | 0.5 | 6 | here |

| CH106 | 312988 | 9294371 | 0.0 | 0.2 | 0.2 | 0.8 | 18 | 20-Sep-21 |

SOURCE: Hannan Metals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/685317/Hannan-Extends-Mineralization-by-3-Kilometres-Strike-at-San-Martin-Peru-Channel-Samples-04-Metres-108-Copper-and-124-gt-Silver