Galaxy Entertainment Group Q2 & Interim Results 2022

Continue Working Closely With

Well Prepared to Submit Macau Gaming Concession Tender by 14 September

Q2 2022 Group Adjusted EBITDA of

Continue Effectively Controlling Costs & Remains Financially Healthy

Continue Investing in Macau’s Future with Cotai Phases 3 & 4

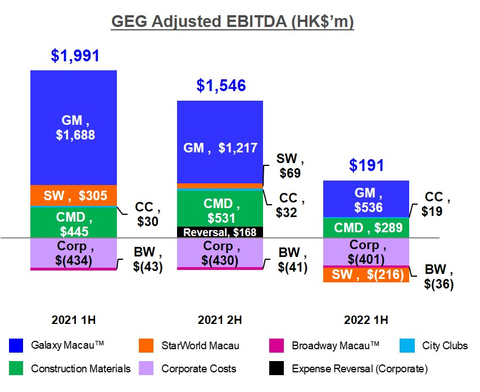

Graph of GEG 1H 2022 Adjusted EBITDA (Photo: Business Wire)

LETTER FROM THE CHAIRMAN OF GALAXY ENTERTAINMENT GROUP

I appreciate the opportunity to update you on GEG’s most recent activities and financial results for the second quarter and first half of 2022. We continue to support the Macau Government by providing hotels for quarantine and medical personnel. We would also like to acknowledge and thank our staff for participating in our various voluntary community programs.

We are pleased to report that we successfully applied for and was granted an extension of our

A number of cities across

Our balance sheet remains liquid and healthy. As of

During the quarter, we optimized our

Moving on to our development update, we continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests. We also continue to invest in

Going forward in the medium to longer term, we remain confident in the future of

Dr.

GBM, MBE, JP, LLD, DSSc, DBA

Chairman

Q2 & Interim 2022 RESULTS HIGHLIGHTS |

GEG: Continues to be Impacted by COVID-19 and Travel Restrictions

Galaxy

StarWorld Macau: Continues to be Impacted by COVID-19 and Travel Restrictions

Broadway Macau™: Continues to be Impacted by COVID-19 and Travel Restrictions

Balance Sheet: Maintain a Healthy and Liquid Balance Sheet

Development Update: Continue Making Progress on Cotai Phases 3 & 4

|

Macau Market Overview

The performance of tourism and gaming industries were adversely impacted by travel restrictions and a COVID-19 outbreak in

In Q2 2022, due to increased cases of COVID-19 and the associated travel restrictions and quarantine rules, visitor arrivals to

Group Financial Results

1H 2022

The Group’s 1H 2022 results posted Net Revenue of

In 1H 2022, GEG experienced good luck in its gaming operation, which increased its Adjusted EBITDA by approximately

The Group’s total GGR on a management basis1 in 1H 2022 was

| Group Key Financial Data |

|

|

||

|

|

|

||

(HK$'m) |

1H 2021 |

1H 2022 |

||

Revenues: |

|

|

||

|

7,841 |

4,130 |

||

Non-gaming |

1,389 |

1,079 |

||

Construction Materials |

1,431 |

1,315 |

||

Total Net Revenue |

10,661 |

6,524 |

||

Adjusted EBITDA |

1,991 |

191 |

||

|

|

|

||

Gaming Statistics2 |

|

|

||

(HK$'m) |

1H 2021 |

1H 2022 |

||

Rolling Chip Volume |

99,9713 |

21,5604 |

||

|

|

|

||

Win |

3,506 |

719 |

||

|

|

|||

Mass Table Drop5 |

24,465 |

14,073 |

||

|

|

|

||

Win |

5,910 |

3,817 |

||

|

|

|||

Electronic Gaming Volume |

8,996 |

7,019 |

||

|

|

|

||

Win |

333 |

238 |

||

|

|

|

||

Total GGR Win6 |

9,749 |

4,774 |

Q2 2022

In Q2 2022, the Group posted Net Revenue of

Latest twelve months Adjusted EBITDA was

In Q2 2022, GEG experienced good luck in its gaming operations which increased Adjusted EBITDA by approximately

Summary Table of GEG Q2 & 1H 2022 Adjusted EBITDA and Adjustments: |

|||||||||||||

in HK$'m |

Q2

|

Q1

|

Q2

|

1H

|

1H

|

|

|||||||

Adjusted EBITDA |

1,132 |

575 |

(384 |

) |

1,991 |

191 |

|

||||||

Luck7 |

81 |

3 |

24 |

|

189 |

27 |

|

||||||

Normalized Adjusted EBITDA |

1,051 |

572 |

(408 |

) |

1,802 |

164 |

|

||||||

The Group’s total GGR on a management basis8 in Q2 2022 was

| Group Key Financial Data |

|

|

|

|

|

||||||||||||||||

(HK$'m) |

|

|

|

|

|

||||||||||||||||

Q2 2021 |

Q1 2022 |

Q2 2022 |

1H 2021 |

1H 2022 |

|

||||||||||||||||

Revenues: |

|

|

|

|

|

||||||||||||||||

|

3,984 |

|

2,902 |

|

1,228 |

|

7,841 |

|

4,130 |

|

|||||||||||

Non-gaming |

791 |

|

623 |

|

456 |

|

1,389 |

|

1,079 |

|

|||||||||||

Construction Materials |

790 |

|

575 |

|

740 |

|

1,431 |

|

1,315 |

|

|||||||||||

Total Net Revenue |

5,565 |

|

4,100 |

|

2,424 |

|

10,661 |

|

6,524 |

|

|||||||||||

Adjusted EBITDA |

1,132 |

|

575 |

|

(384 |

) |

1,991 |

|

191 |

|

|||||||||||

Gaming Statistics1 |

|

|

|

|

|||||||||||||||||

(HK$'m) |

|

|

|

|

|||||||||||||||||

Q2 2021 |

Q1 2022 |

|

Q2 2022 |

1H 2021 |

1H 2022 |

|

|||||||||||||||

Rolling Chip Volume |

44,6372 |

17,9143 |

|

|

|

3,64611 |

|

99,97110 |

21,56011 |

|

|||||||||||

|

3.8 |

% | 3.2 |

% |

|

|

4.2 |

% |

3.5 |

% |

3.3 |

% |

|||||||||

Win |

1,694 |

566 |

|

|

|

153 |

|

3,506 |

719 |

|

|||||||||||

Mass Table Drop4 |

12,880 |

9,463 |

|

|

|

4,610 |

|

24,465 |

14,073 |

|

|||||||||||

|

23.8 |

% | 28.0 |

% |

|

|

25.3 |

% |

24.2 |

% |

27.1 |

% |

|||||||||

Win |

3,061 |

2,652 |

|

|

|

1,165 |

|

5,910 |

3,817 |

|

|||||||||||

Electronic Gaming Volume |

4,801 |

4,380 |

|

|

|

2,639 |

|

8,996 |

7,019 |

|

|||||||||||

|

4.2 |

% | 3.7 |

% |

|

|

2.9 |

% |

3.7 |

% |

3.4 |

% |

|||||||||

Win |

203 |

162 |

|

|

|

76 |

|

333 |

238 |

|

|||||||||||

Total GGR Win5 |

4,958 |

3,380 |

|

|

|

1,394 |

|

9,749 |

4,774 |

|

|||||||||||

Balance Sheet and Dividend

Due to our conservative financial management, our balance sheet continues to remain strong. As of

Galaxy Macau™

Galaxy Macau™ is the primary contributor to the Group’s revenue and earnings. Net Revenue in 1H 2022 was

In Q2 2022, Galaxy Macau™’s Adjusted EBITDA was

The combined five hotels occupancy rate was

Galaxy Macau™ Key Financial Data |

|||||||||||||||

(HK$'m) |

Q2 2021 |

Q1 2022 |

Q2 2022 |

1H 2021 |

1H 2022 |

||||||||||

Revenues: |

|

|

|

|

|||||||||||

|

3,079 |

|

2,503 |

|

1,016 |

|

5,954 |

|

3,519 |

|

|||||

Hotel / F&B / Others |

307 |

|

228 |

|

175 |

|

557 |

|

403 |

|

|||||

Mall |

423 |

|

346 |

|

244 |

|

715 |

|

590 |

|

|||||

Total Net Revenue |

3,809 |

|

3,077 |

|

1,435 |

|

7,226 |

|

4,512 |

|

|||||

Adjusted EBITDA |

924 |

|

724 |

|

(188 |

) |

1,688 |

|

536 |

|

|||||

Adjusted EBITDA Margin |

24 |

% |

24 |

% |

NEG14 |

23 |

% |

12 |

% |

||||||

|

|

|

|

|

|

||||||||||

Gaming Statistics15 |

|

|

|

|

|

||||||||||

(HK$'m) |

Q2 2021 |

Q1 2022 |

Q2 2022 |

1H 2021 |

1H 2022 |

||||||||||

Rolling Chip Volume |

32,51116 |

|

17,91417 |

|

3,64617 |

|

73,22216 |

|

21,56017 |

|

|||||

|

4.1 |

% |

3.2 |

% |

4.2 |

% |

3.6 |

% |

3.3 |

% |

|||||

Win |

1,331 |

|

566 |

|

153 |

|

2,632 |

|

719 |

|

|||||

|

|

|

|

|

|||||||||||

Mass Table Drop18 |

7,972 |

|

6,627 |

|

3,317 |

|

15,100 |

|

9,944 |

|

|||||

|

27.8 |

% |

32.0 |

% |

27.6 |

% |

28.1 |

% |

30.5 |

% |

|||||

Win |

2,219 |

|

2,121 |

|

915 |

|

4,238 |

|

3,036 |

|

|||||

|

|

|

|

|

|||||||||||

Electronic Gaming Volume |

3,513 |

|

3,021 |

|

1,589 |

|

6,680 |

|

4,610 |

|

|||||

|

4.9 |

% |

4.5 |

% |

3.4 |

% |

4.1 |

% |

4.1 |

% |

|||||

Win |

174 |

|

136 |

|

54 |

|

276 |

|

190 |

|

|||||

|

|

|

|

|

|

||||||||||

Total GGR Win |

3,724 |

|

2,823 |

|

1,122 |

|

7,146 |

|

3,945 |

|

|||||

StarWorld Macau

StarWorld Macau’s Net Revenue was

In Q2 2022, StarWorld Macau’s Adjusted EBITDA was

Hotel occupancy was

StarWorld Macau Key Financial Data |

|||||||||||||||

|

|||||||||||||||

(HK$’m) |

Q2 2021 |

Q1 2022 |

Q2 2022 |

1H 2021 |

1H 2022 |

||||||||||

Revenues: |

|

|

|

||||||||||||

|

885 |

|

391 |

|

198 |

|

1,857 |

|

589 |

|

|||||

Hotel / F&B / Others |

40 |

|

27 |

|

17 |

|

74 |

|

44 |

|

|||||

Mall |

7 |

|

6 |

|

5 |

|

14 |

|

11 |

|

|||||

Total Net Revenue |

932 |

|

424 |

|

220 |

|

1,945 |

|

644 |

|

|||||

Adjusted EBITDA |

135 |

|

(58 |

) |

(158 |

) |

305 |

|

(216 |

) |

|||||

Adjusted EBITDA Margin |

14 |

% |

NEG19 |

NEG19 |

16 |

% |

NEG19 |

||||||||

|

|

|

|

|

|

||||||||||

Gaming Statistics20 |

|

|

|

|

|

||||||||||

(HK$'m) |

Q2 2021 |

Q1 2022 |

Q2 2022 |

1H 2021 |

1H 2022 |

||||||||||

Rolling Chip Volume21 |

12,126 |

|

0 |

|

0 |

|

25,809 |

|

0 |

|

|||||

|

3.0 |

% |

0 |

|

0 |

|

3.2 |

% |

0 |

|

|||||

Win |

363 |

|

0 |

|

0 |

|

833 |

|

0 |

|

|||||

|

|

|

|

|

|||||||||||

Mass Table Drop22 |

4,064 |

|

2,183 |

|

982 |

|

7,854 |

|

3,165 |

|

|||||

|

17.3 |

% |

18.8 |

% |

20.6 |

% |

18.2 |

% |

19.3 |

% |

|||||

Win |

702 |

|

410 |

|

202 |

|

1,429 |

|

612 |

|

|||||

|

|

|

|

|

|||||||||||

Electronic Gaming Volume |

664 |

|

475 |

|

342 |

|

1,184 |

|

817 |

|

|||||

|

2.5 |

% |

2.2 |

% |

2.4 |

% |

2.9 |

% |

2.3 |

% |

|||||

Win |

16 |

|

10 |

|

9 |

|

34 |

|

19 |

|

|||||

|

|

|

|

|

|

||||||||||

Total GGR Win |

1,081 |

|

420 |

|

211 |

|

2,296 |

|

631 |

|

|||||

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs. Broadway Macau™’s Net Revenue was

In Q2 2022, Broadway Macau™’s Adjusted EBITDA was

Hotel occupancy was

Broadway Macau™ Key Financial Data |

|||||||||||||||

|

|||||||||||||||

(HK$'m) |

Q2 2021 |

Q1 2022 |

Q2 2022 |

1H 2021 |

1H 2022 |

||||||||||

Revenues: |

|

|

|

|

|||||||||||

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

|||||

Hotel / F&B / Others |

7 |

|

9 |

|

10 |

|

16 |

|

19 |

|

|||||

Mall |

7 |

|

7 |

|

5 |

|

13 |

|

12 |

|

|||||

Total Net Revenue |

14 |

|

16 |

|

15 |

|

29 |

|

31 |

|

|||||

Adjusted EBITDA |

(20 |

) |

(17 |

) |

(19 |

) |

(43 |

) |

(36 |

) |

|||||

Adjusted EBITDA Margin |

NEG23 |

NEG23 |

NEG23 |

NEG23 |

NEG23 |

||||||||||

|

|

|

|

|

|

||||||||||

Gaming Statistics24 |

|

|

|

|

|

||||||||||

(HK$'m) |

|

|

|

|

|

||||||||||

Q2 2021 |

Q1 2022 |

Q2 2022 |

1H 2021 |

1H 2022 |

|||||||||||

Electronic Gaming Volume |

3 |

|

3 |

|

1 |

|

16 |

|

4 |

|

|||||

|

6.6 |

% |

9.0 |

% |

2.3 |

% |

4.0 |

% |

6.4 |

% |

|||||

Win |

1 |

|

0 |

|

0 |

|

1 |

|

0 |

|

|||||

|

|

|

|

|

|

||||||||||

Total GGR Win |

1 |

|

0 |

|

0 |

|

1 |

|

0 |

|

|||||

City Clubs Key Financial Data |

|||||||||||||||

|

|||||||||||||||

(HK$'m) |

Q2 2021 |

Q1 2022 |

Q2 2022 |

1H 2021 |

1H 2022 |

||||||||||

Adjusted EBITDA |

20 |

|

8 |

|

11 |

|

30 |

|

19 |

|

|||||

|

|

|

|

|

|

||||||||||

Gaming Statistics25 |

|

|

|

|

|

||||||||||

(HK$'m) |

|

|

|

|

|

||||||||||

|

Q2 2021 |

Q1 2022 |

Q2 2022 |

1H 2021 |

1H 2022 |

||||||||||

Rolling Chip Volume26 |

0 |

|

0 |

|

0 |

|

940 |

|

0 |

|

|||||

|

0 |

|

0 |

|

0 |

|

4.4 |

% |

0 |

|

|||||

Win |

0 |

|

0 |

|

0 |

|

41 |

|

0 |

|

|||||

|

|

|

|

|

|||||||||||

Mass Table Drop27 |

844 |

|

653 |

|

311 |

|

1,511 |

|

964 |

|

|||||

|

16.7 |

% |

18.5 |

% |

15.4 |

% |

16.1 |

% |

17.5 |

% |

|||||

Win |

140 |

|

121 |

|

48 |

|

243 |

|

169 |

|

|||||

|

|

|

|

|

|||||||||||

Electronic Gaming Volume |

621 |

|

881 |

|

707 |

|

1,116 |

|

1,588 |

|

|||||

|

1.9 |

% |

1.8 |

% |

1.9 |

% |

2.0 |

% |

1.8 |

% |

|||||

Win |

12 |

|

16 |

|

13 |

|

22 |

|

29 |

|

|||||

|

|

|

|

|

|

||||||||||

Total GGR Win |

152 |

|

137 |

|

61 |

|

306 |

|

198 |

|

|||||

Construction Materials Division

Construction Materials Division (“CMD”) contributed Adjusted EBITDA of

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests.

Cotai –

GEG is uniquely positioned for long term growth. Phase 3 is effectively completed and we look forward to welcoming the iconic Raffles at Galaxy Macau through an exclusive 450 all-suite tower. We will align the opening with prevailing market conditions. We intend to follow this with the opening of the GICC and Andaz Macau in anticipation of the recovery of the MICE and entertainment markets.

We are now firmly focused on the development of Phase 4, which is already well under way. We see the premium market evolving with this segment preferring higher quality and more spacious rooms. We continue to proceed with the construction of Cotai Phase 4, our next generation integrated resort, which will complete our ecosystem in Cotai.

Phases 3 & 4 combined will have approximately 3,000 high end and family rooms and villas, 400,000 square feet of MICE space, a 500,000 square feet 16,000-seat multi-purpose arena, F&B, retail and casinos, among others. As you can see, we remain highly confident about the future of

Selected Major Awards in 2022 |

|

AWARD |

PRESENTER |

GEG |

|

|

International Gaming Awards 2022 |

GALAXY |

|

|

|

EarthCheck Certified 2022

|

EarthCheck |

|

Michelin Guide Hong Kong and |

|

Forbes Travel Guide |

|

|

Traveler’s Choice Awards – Best of the Best – The Ritz-Carlton,

|

Tripadvisor Traveler’s Choice Awards |

Reader’s Choice Awards 2022 Top 10 Best Hotels in - Banyan Tree Macau (Silver) - Galaxy Hotel™ (Bronze) |

DestinAsian |

|

|

LEED V4 Gold Certificate – Galaxy Macau Phase 3 (MICE) |

|

STARWORLD |

|

|

Michelin Guide Hong Kong and |

|

|

BROADWAY |

|

|

|

Construction Materials Division |

|

Caring Company Logo 2021/22 – 20 Years Plus Caring

|

|

Outlook

Despite the recent challenging experience in

We continue to support the Macau Government’s COVID-19 prevention efforts, by providing hotels for quarantine and medical personnel. We continue to support the community and local employment including the reopening of our casinos on

Our balance sheet continues to remain healthy and solid with net cash of

We continue to support the economic development of

We are pleased that our

APPENDIX |

Recent selected examples of Galaxy Entertainment Group’s CSR efforts with a particular focus on supporting the Macau Government’s efforts to control COVID-19.

Together we fight the epidemic

GEG has been complying with the

-

Provided

Broadway Hotel as self-health management hotel for persons with yellow health codes and then upgraded to a medical observation hotel for persons with red health codes; -

Provided 130 mobile beds and mattresses to the

Community Treatment Center of the Macau East Asian Games Dome for the support of Macau Government’s anti-epidemic work; -

Accommodated over 600 Mainland medical personnel in our

Hotel Okura Macau ; -

Hosted Dr.

Carolina Ung , PhD in Biomedical Sciences at theUniversity of Macau to Banyan Tree Macau and StarWorld Macau respectively, for the hosting of two Vaccine Information Seminars to help our team members understand the importance of vaccination among children and the elderly; - Launched the Family Vaccine Leave to allow team members to accompany their children under the age of 18 or parents aged 70 or above to get vaccinated on their appointment date; and

-

Supported the Macau Government in boosting the vaccination rate among the elderly and people with disabilities by arranging more than 50 GEG volunteers to assist at the mobile vaccination vehicle at

Iao Hon Market Park twice in April.

With the reoccurrence of COVID-19 in

Fighting the pandemic together – GEG supports mobile vaccination vehicle

More than 50 members of GEG Volunteer Team supported the mobile vaccination vehicle program arranged by the

About

GEG is one of the three original concessionaires in

GEG operates three flagship destinations in

The Group has the largest undeveloped landbank of any concessionaire in

In

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates. For more information about the Group, please visit www.galaxyentertainment.com

1 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of

2 Gaming statistics are presented before deducting commission and incentives.

3 Represents sum of junket VIP and inhouse premium direct.

4 Represents inhouse premium direct.

5 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

6 Total GGR win includes gaming win from

7 Reflects luck associated with our rolling chip program.

8 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of

9 Gaming statistics are presented before deducting commission and incentives.

10 Represents sum of junket VIP and inhouse premium direct.

11 Represents inhouse premium direct.

12 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

13 Total GGR win includes gaming win from

14 NEG represents negative margin.

15 Gaming statistics are presented before deducting commission and incentives.

16 Represents sum of junket VIP and inhouse premium direct.

17 Represents inhouse premium direct.

18 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

19 NEG represents negative margin.

20 Gaming statistics are presented before deducting commission and incentives.

21 Represents junket VIP.

22 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

23 NEG represents negative margin.

24 Gaming statistics are presented before deducting commission and incentives.

25 Gaming statistics are presented before deducting commission and incentives.

26 Represents junket VIP.

27 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220817005822/en/

For Media Enquiries:

Mr.

Tel: +852 3150 1111 Email: ir@galaxyentertainment.com

Source: