Greenridge Exploration Inc. Stakes the Raven Uranium Project in the Athabasca Basin Region, Northern Saskatchewan, Canada

- Strategic acquisition near Cameco's McArthur River Uranium Mine, one of the world's largest uranium operations

- Cost-effective expansion through staking rather than expensive acquisition

- 100% ownership with no underlying royalties, maximizing potential future returns

- Significant land package of 6,269 hectares in the prolific Athabasca Basin region

- Early-stage project with no proven resources or reserves yet

- Will require significant exploration investment to determine economic viability

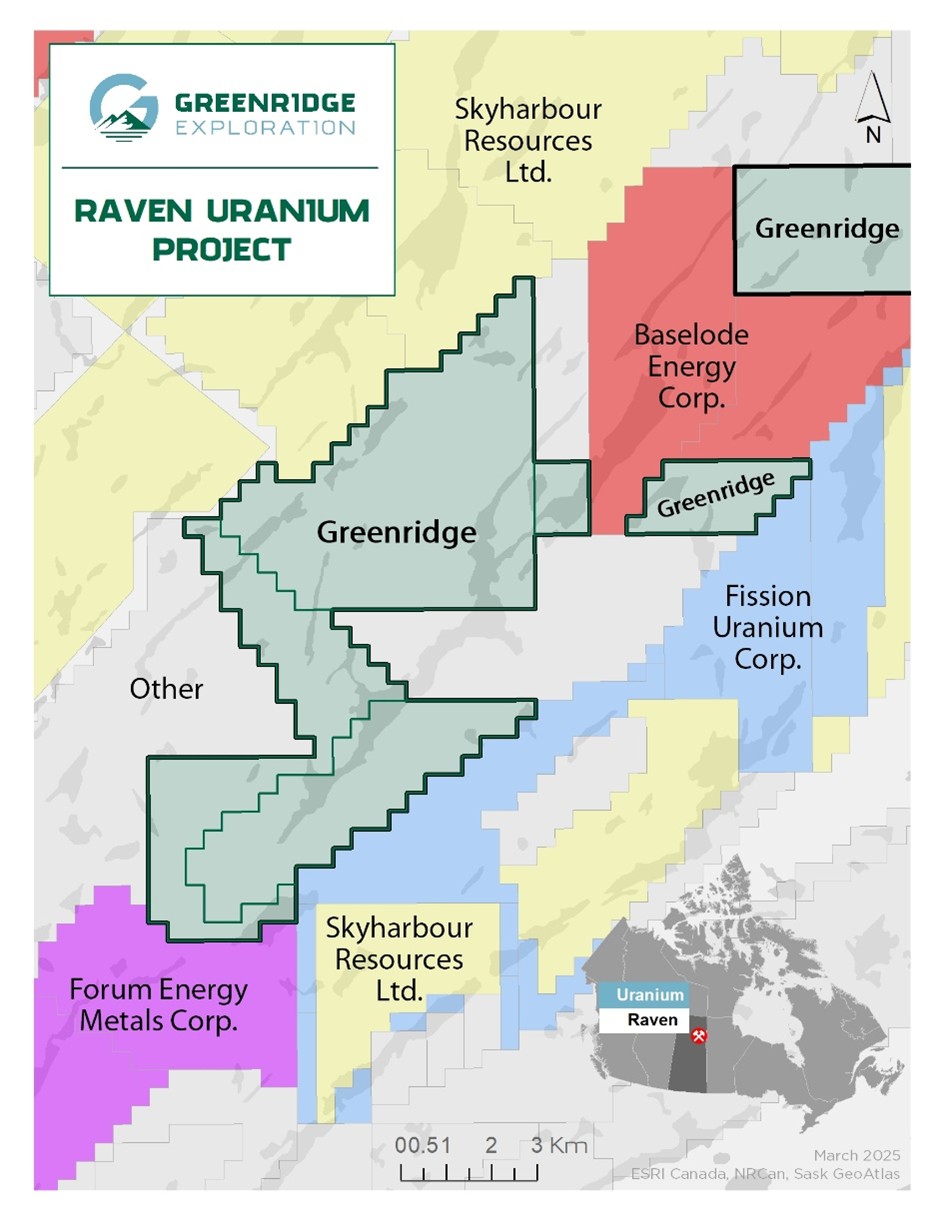

VANCOUVER, British Columbia, June 03, 2025 (GLOBE NEWSWIRE) -- Greenridge Exploration Inc. (“Greenridge” or the “Company”) (CSE: GXP | FRA: HW3 | OTCQB: GXPLF), is pleased to announce that it has acquired the Raven Uranium Project (“Raven”, or the “Property”) in northern Saskatchewan, Canada via low-cost staking. Raven consists of four mineral claims encompassing 6,269 hectares (15,491 acres), located near the eastern margin of the Athabasca Basin about 65 kilometres (40 miles) southeast of Cameco Corporation’s McArthur River Uranium Mine. The Raven claims are

Greenridge acquired the new claims that are contiguous to a single claim already owned by the Company (Please see Figure 1 below).

Figure 1 - Location of the Raven Uranium Project

About Raven

Raven is located outside of the eastern margin of the Athabasca Basin within the central parts of the Wollaston Domain basement rocks, which host prolific uranium mines such as Key Lake, McArthur River, Cigar Lake, and Rabbit Lake, amongst others. Basement-hosted uranium deposits are actively explored for outside the current Athabasca Basin margin, with multiple recent major discoveries such as the Triple R deposit (“Triple R”) found in 2012 in the southwestern Athabasca Basin at Patterson Lake. In the past three years, discoveries of high-grade uranium mineralization have been reported in the southeastern region outside the Athabasca Basin margin by exploration companies such as Atha Energy Corp. and Baseload Energy Corp.

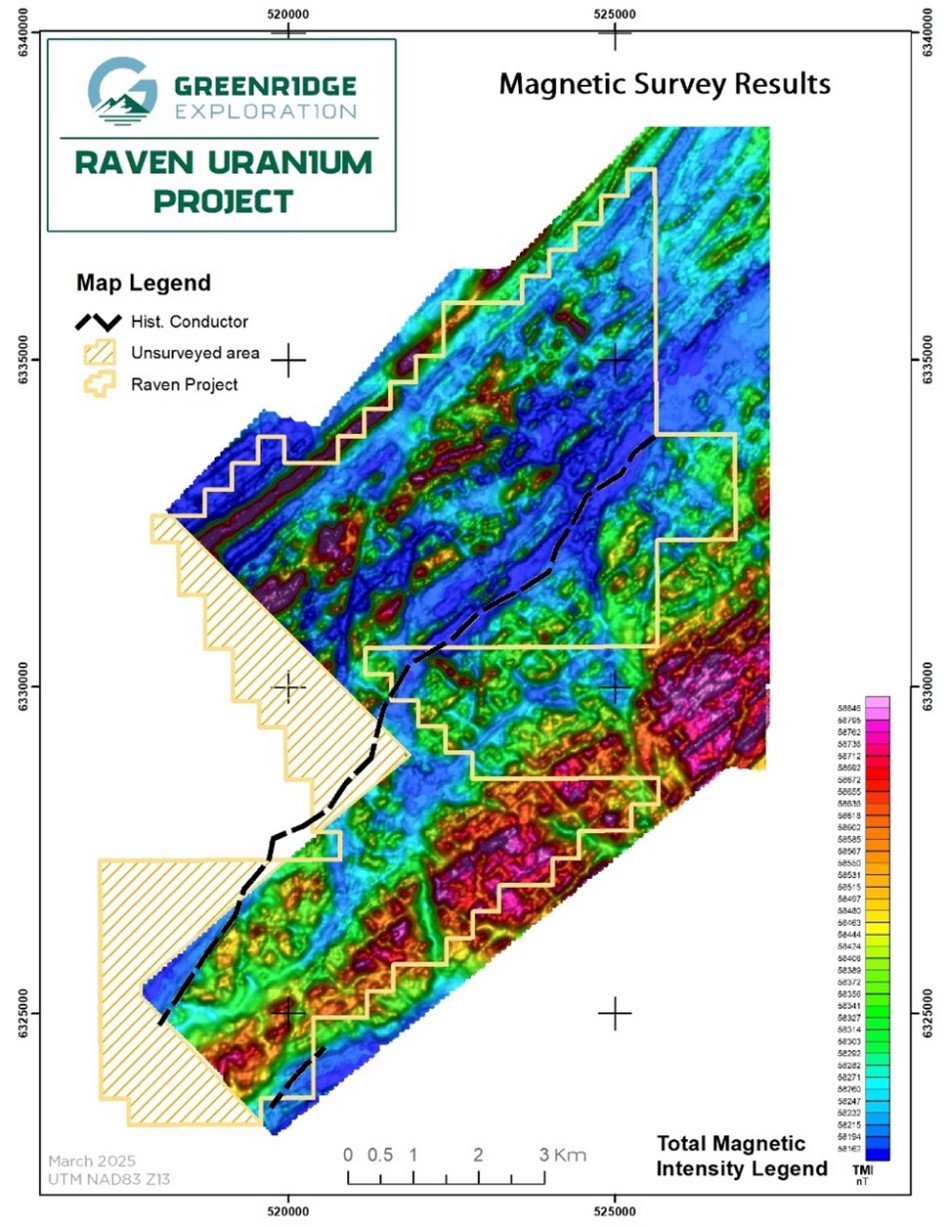

Raven hosts more than nine (9) kilometres of a historical electromagnetic conductor coincident with a prominent northeast-southwest trending magnetic low. Structural trends such as these which are cross-cut by interpreted brittle faults are considered to be a prospective setting for uranium mineralization in the Athabasca Basin region (Please see Figure 2). There are no known historical drill holes on Raven, and Greenridge considers the Property to be underexplored.

Figure 2 - Raven Uranium Project – 2021 Magnetic Survey Results

2025 Exploration Plans

Greenridge owns data from a 2021 high-resolution airborne magnetic and radiometric survey flown over the Property area, which is the same system used to detect buried uranium-bearing boulders at Patterson Lake, Saskatchewan, thereby contributing to the discovery of Triple R in November 2012. Follow-up prospecting from the historical radiometric survey to date has been limited, and further surface work is recommended. The Company may carry out a helicopter-borne airborne electromagnetic survey in 2025 in conjunction with other surveys planned in the area, if logistics permit.

Grant of Stock Options and RSUs

On June 2, 2025, the Company granted a total of 450,000 stock options (the “Options”) to purchase common shares of the Company to certain directors and consultants pursuant to the Company’s equity incentive plan (the “Plan”). Such Options are exercisable into common shares of the Company, at an exercise price of

Statement of Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Sean Hillacre, M.Sc., P. Geo., a geological consultant to the Company and a Qualified Person for Greenridge as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Hillacre has examined information regarding the historical exploration at Raven, which includes a review of the historical sampling, analytical and procedures underlying the information and opinions contained herein.

Management cautions that historical results collected and reported by operators unrelated to Greenridge have not been verified nor confirmed by its Qualified Person; however, the historical results create a scientific basis work at Raven. Management further cautions that historical results, discoveries and published resource estimates on adjacent or nearby mineral properties, or other properties located within the Athabasca Basin, whether in reference to stated current resource estimates or historical resource estimates, are not necessarily indicative of the results that may be achieved on the Property.

About Greenridge Exploration Inc.

Greenridge Exploration Inc. (CSE: GXP | OTCQB: GXPLF | FRA: HW3) is a mineral exploration company dedicated to creating shareholder value through the acquisition, exploration, and development of critical minerals and precious metals projects in Canada. The Company owns or has interests in 29 projects and additional claims covering approximately 393,651 hectares (972,712 acres) with considerable exposure to potential uranium, lithium, nickel, copper and gold discoveries. The Company is led by an experienced management team and board of directors with significant expertise in capital raising and advancing mining projects.

Greenridge has one of the largest uranium property portfolios in Canada consisting of 16 projects and additional prospective claims covering approximately 221,509 hectares (547,349 acres). The Company has opportunities to realize value in a further 13 strategic and critical metals projects which include lithium, nickel, gold, and copper exploration properties totalling approximately 174,142 hectares (425,363 acres). Project highlights include:

- The Black Lake property, located in the NE Athabasca Basin, (

40% Greenridge,50.43% UEC,8.57% Orano) saw a 2004 discovery hole (BL-18) return0.69% U3O8 over 4.4m.1 - The Hook-Carter property (

20% Greenridge,80% Denison) is strategically located in the SW Margin of the Athabasca Basin, sitting ~13km from NexGen Energy Ltd.’s Arrow deposit and ~20 km from Fission Uranium Corp.’s Triple R deposit. - The Gibbons Creek property hosts high-grade boulders located in 2013, with grades of up to

4.28% U3O82, and the McKenzie Lake project saw a 2023 exploration program return three samples which included 844 ppm U-total (0.101% U3O8), 273 ppm U-total, and 259 ppm U-total3. - The Nut Lake property located in the Thelon Basin includes historical drilling which intersected up to 9ft of

0.69% U3O8 including4.90% U3O8 over 1ft from 8ft depth4. In 2024, Greenridge’s prospecting program located a float sample that returned31.13% U3O8, sourced from the Tundra Showing5. - The Firebird Nickel property has seen two drill programs (7 holes totaling 1,339 m), where hole FN20-002 intersected 23.8 m of

0.36% Ni and0.09% Cu, including 10.6 m of0.55% Ni and0.14% Cu.6 - The Electra Nickel project 2022 drill program included results of 2,040 ppm Ni over 1m and 1,260 ppm Ni over 3.5m.7

The Company has strategic partnerships which includes properties being operated and advanced by Denison Mines Corp. and Uranium Energy Corp. The Company’s management team, board of directors, and technical team brings significant expertise in capital raising and advancing mining projects and is poised to attract new investors and raise future capital.

References:

1 – Black Lake: UEX Corporation News Release dated October 12, 2004.

2 – Gibbons Creek: Lakeland Resources Inc. News Release dated January 8, 2014.

3 – McKenzie Lake: ALX Resources Corp. New Release dated November 7, 2023.

4 – Nut Lake: Greenridge Exploration Inc. News Release dated February 19, 2024.

5 – 1979 Assessment Report (number 81075) by Pan Ocean Oil Ltd.

6 – Firebird Nickel: ALX Resources Corp. New Release dated April 15, 2020.

7 – Electra Nickel: ALX Resources Corp. New Release dated July 20, 2022.

On Behalf of the Board of Directors of Greenridge

Russell Starr

Chief Executive Officer, Director

Telephone: +1 (778) 897-3388

Email: info@greenridge-exploration.com

Disclaimer for Forward-Looking Information

Certain statements in this news release are forward-looking statements, including with respect to future plans, and other matters. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as "may", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, business, economic and capital market conditions, the ability to manage operating expenses, and dependence on key personnel. Forward looking statements in this news release include, but are not limited to, statements with respect to the Property and its mineralization potential; the Company’s objectives, goals, or future plans with respect to the Property; and the Company's possible exploration program at the Property. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, anticipated costs, and the ability to achieve goals. Factors that could cause the actual results to differ materially from those in forward-looking statements include, the continued availability of capital and financing, litigation, failure of counterparties to perform their contractual obligations, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information.

The Canadian Securities Exchange (CSE) does not accept responsibility for the adequacy or accuracy of this release.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/693ae946-f34a-48bf-bbca-32ea990a058b

https://www.globenewswire.com/NewsRoom/AttachmentNg/7470543a-33fd-42ea-a6a2-61c0461e122d