HazardHub Winter Weather Data Helps Insurers and Homeowners Prepare for Top Seasonal Risks

HazardHub identifies top winter perils and areas of vulnerability

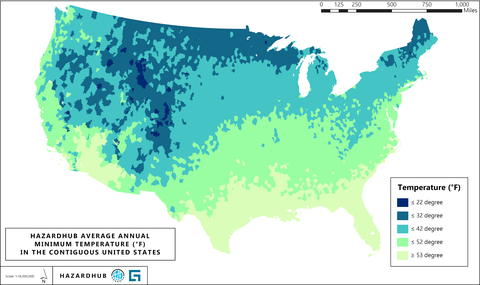

HazardHub map of average annual minimum temperatures for the contiguous

HazardHub risk data and maps detail extreme cold and winter weather risks at the national, state, and local levels, right down to the specific property address level. HazardHub offers more than 1,000 data points and risk scores for climate risks and extreme weather events.

Freezing Temperatures Across the

According to Guidewire HazardHub data, 31.4 million housing units in the

The primary factors contributing to the coldest regions are latitude, elevation, and geography. The states on the northern border, in the Rockies, or with higher elevations, as well as

Top States with Freezing Temperatures

According to Guidewire HazardHub data, the top five states with the lowest average annual winter temperatures are:

1.

2.

3.

4.

5.

6.

Top Winter Weather Perils

According to an analysis of Guidewire HazardHub data, the most perilous Winter Weather Risks, based on the potential for claims loss, extent of damage, and frequency, are:

Frozen Pipes

Freezing temperatures cause water inside pipes to expand, leading to cracks and bursts that result in extensive water damage to flooring, drywall, and home contents. This peril leads to one of the most frequent winter insurance claims. Mitigation steps include insulating pipes, maintaining indoor heat, allowing faucets to drip during cold snaps, and draining water lines in vacant properties.

Top Five States for Frozen Pipe Risk

1.

2.

3.

4.

5.

These states have the highest percentage of homes and structures rated as an ‘F’ grade according to the HazardHub Frozen Pipe Risk score. According to HazardHub data,

Snow Load (Roof Collapse)

Accumulated snow and ice place significant stress on roofs, risking structural damage or collapse, particularly for older buildings or those with flat roofs. States like

Top Five States for Snow Load Risk (Danger of Roof Collapse)

1.

2.

3.

4.

5.

These states have the highest percentage of homes and structures rated as at risk for snow load according to the HazardHub Snow Load Risk Score. More than

Ice Dams

Heat escaping through a poorly insulated roof can melt snow, which refreezes at the roof’s edge, forming ice dams that block proper drainage. This leads to leaks and roof damage, lifting shingles, and causing water damage inside the home. According to HazardHub data, approximately

Other major winter weather risks to homes and businesses include power outages from fallen trees and damaged lines, high winds that cause structural damage, flooding from rapid snowmelt overwhelming drainage systems, and house fires due to unsafe heating practices. Over the past two decades, weather-related events have caused

Harnessing Data for Better Protection

“The cold, hard fact is that extreme winter weather caused

HazardHub’s detailed winter risk data and maps are available through Guidewire PolicyCenter and Guidewire InsuranceNow solutions, as well as via the HazardHub API. Insurers can utilize this data to improve risk assessment and underwriting accuracy, while property owners can better prepare for the winter season.

Consumers interested in assessing their home’s winter risk can visit freehomerisk.com.

About Guidewire Software

Guidewire is the platform P&C insurers trust to engage, innovate, and grow efficiently. More than 570 insurers in 42 countries, from new ventures to the largest and most complex in the world, rely on Guidewire products. With core systems leveraging data and analytics, digital, and artificial intelligence, Guidewire defines cloud platform excellence for P&C insurers.

We are proud of our unparalleled implementation record, with 1,700+ successful projects supported by the industry’s largest R&D team and SI partner ecosystem. Our marketplace represents the largest solution partner community in P&C, where customers can access hundreds of applications to accelerate integration, localization, and innovation.

For more information, please visit www.guidewire.com and follow us on X (formerly known as Twitter) and LinkedIn.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250121971687/en/

Melissa

Director, Public Relations

Guidewire Software, Inc.

+1.650.464.1177

mcobb@guidewire.com

Source: Guidewire Software