Golden Valley Bancshares Reports First Quarter 2025 Results (Unaudited); Announces Dividends & Stock Repurchase Plan

Golden Valley Bancshares (OTC PINK:GVYB) has reported strong Q1 2025 results, announcing special and annual cash dividends along with a new stock repurchase plan. The company declared a special dividend of $1.00 per share and an annual dividend of $0.40 per share, both payable in May 2025.

Key financial highlights for Q1 2025 vs Q1 2024 include:

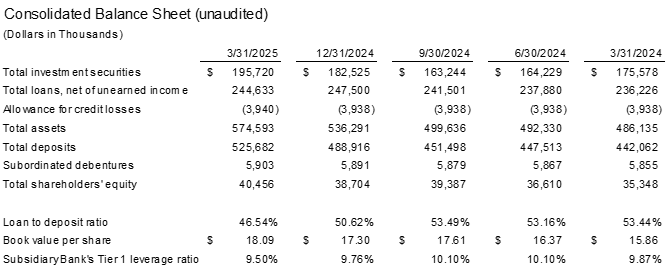

- Assets up 18.2% to $574.6 million

- Deposits increased 18.9% to $525.7 million

- Loans grew 3.6% to $244.6 million

- Equity rose 14.5% to $40.5 million

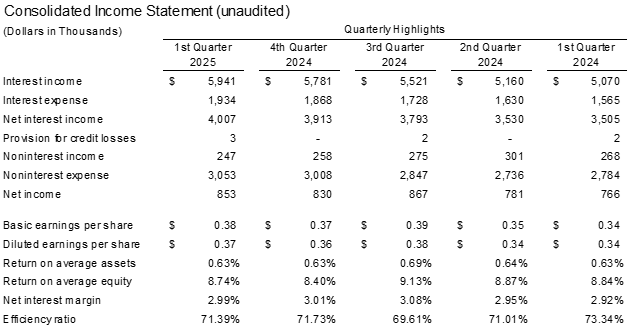

The company reported Q1 2025 net profit of $853,000, up from $766,000 in Q1 2024. Interest income increased to $5.94 million, while interest expense rose to $1.93 million. The Board approved a $1 million stock repurchase program effective May 1, 2025 through December 31, 2025. Asset quality remains exceptional with no loans over 30 days past due.

Golden Valley Bancshares (OTC PINK:GVYB) ha riportato risultati solidi per il primo trimestre del 2025, annunciando dividendi speciali e annuali in contante insieme a un nuovo piano di riacquisto di azioni. L'azienda ha dichiarato un dividendo speciale di $1,00 per azione e un dividendo annuale di $0,40 per azione, entrambi pagabili a maggio 2025.

I principali punti finanziari per il primo trimestre del 2025 rispetto al primo trimestre del 2024 includono:

- Attività aumentate del 18,2% a $574,6 milioni

- Depositi aumentati del 18,9% a $525,7 milioni

- Prestiti cresciuti del 3,6% a $244,6 milioni

- Patrimonio netto aumentato del 14,5% a $40,5 milioni

L'azienda ha riportato un utile netto per il primo trimestre del 2025 di $853.000, in aumento rispetto ai $766.000 del primo trimestre del 2024. Il reddito da interessi è aumentato a $5,94 milioni, mentre la spesa per interessi è salita a $1,93 milioni. Il Consiglio ha approvato un programma di riacquisto di azioni da $1 milione, valido dal 1 maggio 2025 al 31 dicembre 2025. La qualità degli attivi rimane eccezionale, senza prestiti scaduti oltre i 30 giorni.

Golden Valley Bancshares (OTC PINK:GVYB) ha reportado resultados sólidos para el primer trimestre de 2025, anunciando dividendos especiales y anuales en efectivo junto con un nuevo plan de recompra de acciones. La compañía declaró un dividendo especial de $1.00 por acción y un dividendo anual de $0.40 por acción, ambos pagaderos en mayo de 2025.

Los principales aspectos financieros del primer trimestre de 2025 en comparación con el primer trimestre de 2024 incluyen:

- Activos aumentados un 18.2% a $574.6 millones

- Depósitos incrementados un 18.9% a $525.7 millones

- Préstamos crecieron un 3.6% a $244.6 millones

- Capital aumentó un 14.5% a $40.5 millones

La compañía reportó una utilidad neta de $853,000 para el primer trimestre de 2025, en comparación con $766,000 en el primer trimestre de 2024. Los ingresos por intereses aumentaron a $5.94 millones, mientras que los gastos por intereses subieron a $1.93 millones. La Junta aprobó un programa de recompra de acciones de $1 millón, efectivo del 1 de mayo de 2025 al 31 de diciembre de 2025. La calidad de los activos sigue siendo excepcional, sin préstamos con más de 30 días de atraso.

골든 밸리 뱅크쉐어스 (OTC PINK:GVYB)는 2025년 1분기 강력한 실적을 보고하며 특별 및 연간 현금 배당금과 새로운 자사주 매입 계획을 발표했습니다. 회사는 주당 $1.00의 특별 배당금과 주당 $0.40의 연간 배당금을 선언했으며, 두 배당금 모두 2025년 5월에 지급될 예정입니다.

2025년 1분기와 2024년 1분기를 비교한 주요 재무 하이라이트는 다음과 같습니다:

- 자산 18.2% 증가하여 $574.6 백만

- 예금 18.9% 증가하여 $525.7 백만

- 대출 3.6% 증가하여 $244.6 백만

- 자본 14.5% 증가하여 $40.5 백만

회사는 2025년 1분기 순이익이 $853,000으로 2024년 1분기의 $766,000에서 증가했다고 보고했습니다. 이자 수익은 $5.94 백만으로 증가했으며, 이자 비용은 $1.93 백만으로 상승했습니다. 이사회는 2025년 5월 1일부터 2025년 12월 31일까지 유효한 $1 백만 규모의 자사주 매입 프로그램을 승인했습니다. 자산 품질은 뛰어나며 30일 이상 연체된 대출이 없습니다.

Golden Valley Bancshares (OTC PINK:GVYB) a annoncé de solides résultats pour le premier trimestre 2025, en déclarant des dividendes spéciaux et annuels en espèces ainsi qu'un nouveau plan de rachat d'actions. L'entreprise a déclaré un dividende spécial de 1,00 $ par action et un dividende annuel de 0,40 $ par action, tous deux payables en mai 2025.

Les principaux points financiers pour le premier trimestre 2025 par rapport au premier trimestre 2024 incluent :

- Actifs en hausse de 18,2 % à 574,6 millions de dollars

- Dépôts en augmentation de 18,9 % à 525,7 millions de dollars

- Prêts en hausse de 3,6 % à 244,6 millions de dollars

- Capitaux propres en hausse de 14,5 % à 40,5 millions de dollars

L'entreprise a rapporté un bénéfice net de 853 000 $ pour le premier trimestre 2025, contre 766 000 $ pour le premier trimestre 2024. Les revenus d'intérêts ont augmenté à 5,94 millions de dollars, tandis que les charges d'intérêts ont augmenté à 1,93 million de dollars. Le conseil d'administration a approuvé un programme de rachat d'actions de 1 million de dollars, valable du 1er mai 2025 au 31 décembre 2025. La qualité des actifs reste exceptionnelle, sans prêts en retard de plus de 30 jours.

Golden Valley Bancshares (OTC PINK:GVYB) hat starke Ergebnisse für das erste Quartal 2025 gemeldet und dabei besondere und jährliche Bardividenden sowie einen neuen Aktienrückkaufplan angekündigt. Das Unternehmen erklärte eine Sonderdividende von $1,00 pro Aktie und eine jährliche Dividende von $0,40 pro Aktie, die beide im Mai 2025 zahlbar sind.

Wichtige finanzielle Highlights für Q1 2025 im Vergleich zu Q1 2024 umfassen:

- Vermögenswerte stiegen um 18,2% auf $574,6 Millionen

- Einlagen erhöhten sich um 18,9% auf $525,7 Millionen

- Darlehen wuchsen um 3,6% auf $244,6 Millionen

- Eigenkapital stieg um 14,5% auf $40,5 Millionen

Das Unternehmen berichtete für das erste Quartal 2025 einen Nettogewinn von $853.000, ein Anstieg von $766.000 im ersten Quartal 2024. Die Zinserträge stiegen auf $5,94 Millionen, während die Zinsaufwendungen auf $1,93 Millionen anstiegen. Der Vorstand genehmigte ein Aktienrückkaufprogramm über $1 Million, das vom 1. Mai 2025 bis zum 31. Dezember 2025 gültig ist. Die Vermögensqualität bleibt außergewöhnlich, ohne Darlehen, die mehr als 30 Tage überfällig sind.

- None.

- None.

CHICO, CA / ACCESS Newswire / April 10, 2025 / Golden Valley Bancshares (OTC PINK:GVYB), with its wholly owned subsidiary, Golden Valley Bank headquartered in Chico, California today reported first quarter 2025 financial results, cash dividends and stock repurchase plan.

Golden Valley Bancshares announced today that the Board of Directors declared a special cash dividend on Golden Valley Bancshares common stock of

On March 11, 2025, the Board of Directors authorized a new stock repurchase plan for up to

First quarter 2025 financial highlights compared to the first quarter of 2024 include:

Assets increased

$88.5 million or18.2% to$574.6 million Loans increased

$8.4 million or3.6% to$244.6 million Deposits increased

$83.6 million or18.9% $525.7 million Equity increased

$5.1 million or14.5% to$40.5 million

The company ended the quarter with all-time highs in both assets and deposits. The exceptional deposit growth experienced in 2024 continued throughout the first three months of 2025 as deposits increased

While enduring a stagnant loan market, the Company was able to grow the loan portfolio by

Asset quality continued to be exceptional with no loans over 30 days past due at quarter end. It's been over a decade since the Bank had a charge off in our loan portfolio. Chief Credit Officer, Quinn Velasquez stated "The Bank is lending to qualified businesses and individuals as a result of our deep knowledge and understanding of our local markets."

The continued momentum created by our strong asset growth positions us well to make significant strides in each of our markets - Chico, Redding and Oroville - in 2025.

Net profit for the quarter ending March 31, 2025, totaled

Interest income increased to

The Bank continues to be a well-capitalized bank and far exceeds minimum regulatory requirements. For additional financial information, please visit the Investors Relations page at goldenvalley.bank/Investor-Relations.

Golden Valley Bancshares, a bank holding company with its wholly owned subsidiary, Golden Valley Bank is a locally owned and operated commercial bank serving the needs of individuals and businesses in northern California. The Bank has full service offices in Chico, Redding and Oroville, California. For more information regarding the bank please call at (530) 894-1000 or visit goldenvalley.bank.

Contact:

Mark Francis

President & CEO

530-894-4920

mfrancis@goldenvalley.bank

Forward-Looking Statements

Statements concerning future performance, developments or events, expectations for growth and income forecasts, and any other guidance on future periods, constitute forward-looking statements that are subject to a number of risks and uncertainties. Actual results are pre-fiscal year-end audit and may differ materially from stated expectations. Specific factors include, but are not limited to, loan production, balance sheet management, expanded net interest margin, the ability to control costs and expenses, interest rate changes, technological factors (including external fraud and cybersecurity threats), natural disasters, pandemics such as COVID-19 and financial policies of the United States government and general economic conditions. Golden Valley Bancshares disclaims any obligation to update any such factors.

SOURCE: Golden Valley Bancshares

View the original press release on ACCESS Newswire