Guanajuato Silver Reports 2nd Consecutive Quarter of Positive Mine Operating Income

Rhea-AI Summary

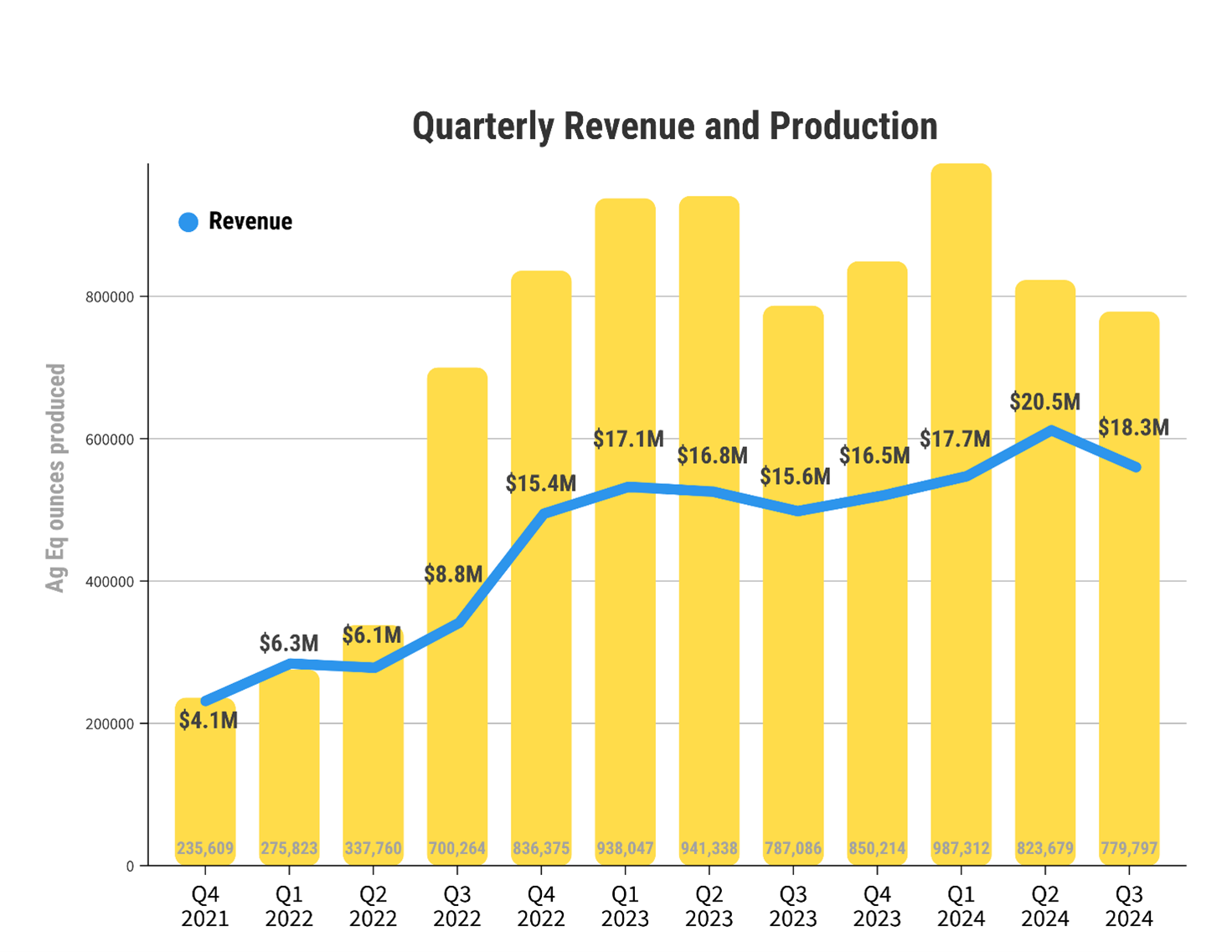

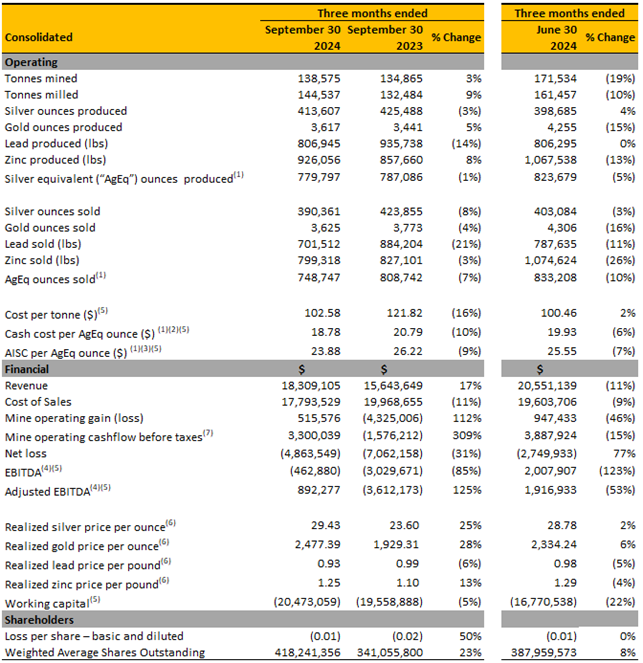

Guanajuato Silver reported positive Q3 2024 results with mine operating income of $515,576, marking the second consecutive quarter of positive performance. The company achieved production of 779,797 AgEq ounces, including 413,607 ounces of silver and 3,617 ounces of gold. Revenue reached $18.3M, a 17% increase over Q3 2023. The company reported positive adjusted EBITDA of $892,277 and improved operational metrics with AISC of $23.88 per AgEq ounce, a 7% improvement over the previous quarter. Notable achievements include the complete repayment of its $7.5M OCIM facility and reaching over 3M AgEq ounces produced at El Cubo since late 2021.

Positive

- Second consecutive quarter of positive mine operating income ($515,576)

- 17% year-over-year revenue increase to $18.3M

- 7% improvement in AISC to $23.88 per AgEq ounce

- Positive adjusted EBITDA of $892,277

- Complete repayment of $7.5M OCIM facility

- 4% increase in silver production over previous quarter

Negative

- 10% decrease in total tonnes milled from previous quarter

- 11% quarter-over-quarter revenue decline

- Net loss of $4.8M for the quarter

- Negative working capital of $20.4M

News Market Reaction

On the day this news was published, GSVRF gained 4.27%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

~ Also 2nd Consecutive Quarter of Positive Adjusted EBITDA of US

VANCOUVER, BC / ACCESSWIRE / November 22, 2024 / Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(OTCQX:GSVRF) is pleased to announce financial and operating results for the three month and nine month periods ending September 30, 2024. All dollar amounts are in US dollars (US$) and prepared in accordance with IFRS Accounting Standards ("IFRS") as issued by the International Accounting Standards Board. This news release should be read in conjunction with the Company's unaudited condensed consolidated interim financial statements for the period ended September 30, 2024 and Management's Discussion & Analysis ("MD&A") thereon, which can be viewed under the Company's profile at www.sedarplus.ca. Production results are from the Company's wholly-owned El Cubo Mines Complex ("El Cubo"), Valenciana Mines Complex ("VMC"), Pinguico project ("Pinguico"), and San Ignacio mine ("San Ignacio") in Guanajuato, Mexico, the Horcon Project ("Horcon") located in Jalisco, Mexico, and the Topia mine ("Topia") located in Durango, Mexico.

Selected Q3 2024 (Three Month Period) Highlights:

Positive mine operating income of

$515,576 ; Q3 represents the second consecutive quarter of positive income from mining operations.All-in Sustaining Cost ("AISC")* of

$23.88 per silver-equivalent ("AgEq") ounce; this represents a7% improvement over the previous quarter.Cash cost per AgEq ounce was

$18.78 ; this was a6% improvement over the previous quarter. Over the past 12-months, GSilver has made significant capex investments designed to improve operational efficiencies at all four of the Company's producing silver mines (Except as otherwise noted, see note to table below for details regarding the Company's AgEq calculations).Production for the quarter of 779,797 AgEq derived from 413,607 ounces of silver, 3,617 ounces of gold, 806,945 pounds of lead and 926,056 pounds of zinc.

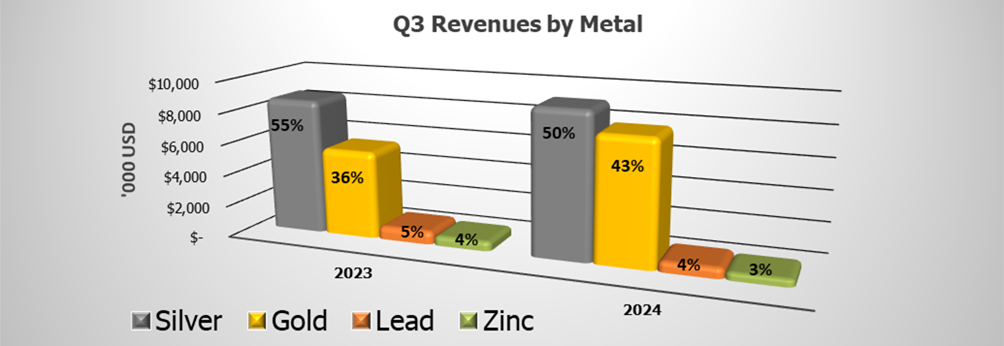

Silver production of 413,607 ounces was an increase of

4% over the previous quarter. Silver production accounted for50% of Q3 revenue;43% of revenue was generated by gold production. Guanajuato Silver is a primary silver and gold producer with over90% of revenues being derived from the sale of precious metals. All lead and zinc production comes exclusively from the Company's Topia mine located in northwest Durango.During the quarter the Company confirmed an important production milestone - over 3,000,000 AgEq ounces had been produced at El Cubo since the restart of operations in late 2021. For this purpose, AgEq has been calculated using an 82.77:1 (Ag/Au) ratio from October 1, 2021, until September 20, 2024.

In the quarter, the Company announced the complete repayment of its US

$7,500,000 silver and gold pre-payment facility to Swiss-based precious metals trading firm, OCIM Metals & Mining S.A. ("OCIM"); this followed the Q2 repayment in full of the US$5,000,000 concentrate pre-payment facility owed to Ocean Partners UK Limited ("Ocean Partners").Total tonnes milled at the Company's three production facilities was 144,537 tonnes, which was a decrease of

10% from the previous quarter. The majority of this decrease is attributable to outstanding fleet and mill maintenance requirements; during the quarter, the Company undertook an enhanced maintenance and repairs program at all operations that is expected to continue into Q4.Revenue for the quarter of

$18.3M represented a17% increaseover Q3 2023, and a decrease of11% over the previous quarter. Consolidated revenue for the quarter was generated by a realized average price of$29.43 per silver ounce,$2,477 per gold ounce,$0.93 per pound of lead, and$1.25 per pound of zinc.Positive adjusted EBITDA* of

$892,277 ; the second consecutive quarter of positive adjusted EBITDA confirms that cash flow from mining operations is improving.Net loss for the quarter of

$4.8M . Non-cash items accounted for nearly40% of this loss; as an example, the non-cash derivative loss related to the Company's gold loan with Ocean Partners was$1.66M . Importantly, as the gold spot price rises, derivative losses are more than off-set by higher revenue from the sale precious metals concentrates.As of September 30, 2024, the Company had cash and cash equivalents of

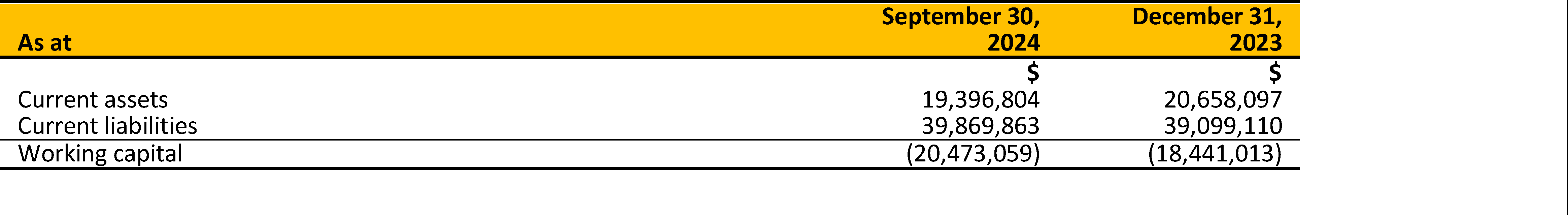

$1.6M and negative working capital of$20.4M ; subsequent to the end of the quarter, the Company closed an equity financing on October 30 for C$8.72M .

*EBITDA, (Earnings Before Interest, Taxes, Depreciation and Amortization) Adjusted EBITDA, AISC and working capital are non-IFRS financial measures with no standardized meaning under IFRS, and therefore they may not be comparable to similar measures presented by other issuers. For further information and detailed reconciliations of Non-IFRS financial measures to the most directly comparable IFRS measures see "Non-IFRS Financial Measures" in this News Release.

OPERATING AND FINANCIAL HIGHLIGHTS

Commercial production at the El Cubo Mines Complex ("CMC") commenced on October 1, 2021. The Valenciana Mines Complex ("VMC"), the San Ignacio mine ("San Ignacio") and the Cata mill facility, and the Topia Mines Complex ("Topia") were acquired on August 4, 2022. Topia had continuous production throughout the acquisition. The San Ignacio mine recommenced production in August 2022 and production at the Valenciana mine also began in August 2022. Recommissioning of the Cata plant began in December 2022 with processing commencing in January 2023.

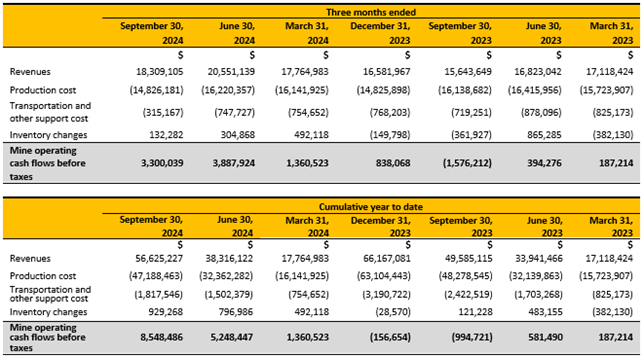

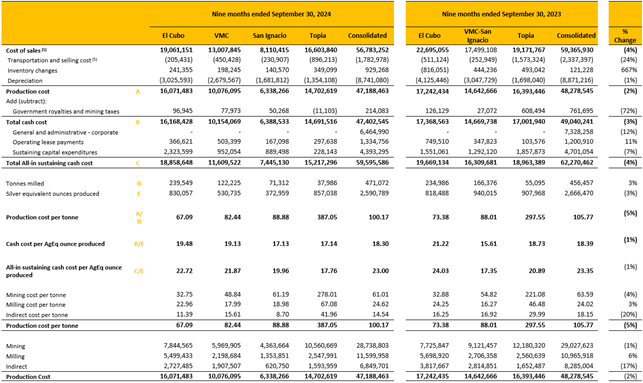

The following table summarizes the Company's consolidated operating and financial results for the three and nine months ended September 30, 2024 and 2023:

Silver equivalents are calculated using 84.04:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.04:1 (Ag/Zn) ratio for Q3 2024; an 81.83:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for Q3 2023; an 84.34:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for YTD 2024; and an 82.21:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for YTD 2023, respectively.

Cash cost per silver equivalent ounce includes mining, processing, and direct overhead. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

AlSC per AgEq oz includes mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

See Reconciliation of earnings before interest, taxes, depreciation, and amortization in the Non-IFRS Financial Measures section of this news release.

Mine Operating Cashflow Before Taxes, Cash cost per silver equivalent, cost per tonne, AISC per AgEq ounce, EBITDA, Adjusted EBITDA and working capital are non-IFRS financial measure with no standardized meaning under IFRS, and therefore they may not be comparable to similar measures presented by other issuers. For further information and detailed reconciliations of non-IFRS financial measures to the most directly comparable IFRS measures see "Non-IFRS Financial Measures" in the Non-IFRS Financial Measures section of this news release.

Based on provisional sales before final price adjustments, before payable metal deductions, treatment, and refining charges.

Mine operating cash flow before taxes is calculated by adding back depreciation, depletion, and inventory write-downs to mine operating loss. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

NON-IFRS FINANCIAL MEASURES

The Company has disclosed certain non-IFRS financial measures and ratios in this MD&A, as discussed below. These non-IFRS financial measures and non-IFRS ratios are widely reported in the mining industry as benchmarks for performance and are used by Management to monitor and evaluate the Company's operating performance and ability to generate cash. The Company believes that, in addition to financial measures and ratios prepared in accordance with IFRS, certain investors use these non-IFRS financial measures and ratios to evaluate the Company's performance. However, the measures do not have a standardized meaning under IFRS and may not be comparable to similar financial measures disclosed by other companies. Accordingly, non-IFRS financial measures and non-IFRS ratios should not be considered in isolation or as a substitute for measures and ratios of the Company's performance prepared in accordance with IFRS.

Non-IFRS financial measures are defined in National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-122") as a financial measure disclosed that (a) depicts the historical or expected future financial performance, financial position or cash flow of an entity, (b) with respect to its composition, excludes an amount that is included in, or includes an amount that is excluded from, the composition of the most directly comparable financial measure disclosed in the primary financial statements of the entity, (c) is not disclosed in the financial statements of the entity, and (d) is not a ratio, fraction, percentage or similar representation.

A non-IFRS ratio is defined by NI 52-112 as a financial measure disclosed that (a) is in the form of a ratio, fraction, percentage, or similar representation, (b) has a non-IFRS financial measure as one or more of its components, and (c) is not disclosed in the financial statements.

WORKING CAPITAL

Working capital is a non-IFRS measure that is a common measure of liquidity but does not have any standardized meaning. The most directly comparable measure prepared in accordance with IFRS is current assets net of current liabilities. Working capital is calculated by deducting current liabilities from current assets. Working capital should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. The measure is intended to assist readers in evaluating the Company's liquidity.

MINE OPERATING CASH FLOW BEFORE TAXES

Mine operating cash flow before taxes is a non-IFRS measure that does not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. Mine operating cash flow is calculated as revenue minus production costs, transportation and selling costs and inventory changes. Mine operating cash flow is used by management to assess the performance of the mine operations, excluding corporate and exploration activities, and is provided to investors as a measure of the Company's operating performance.

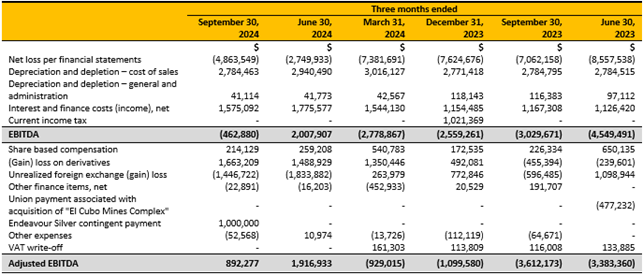

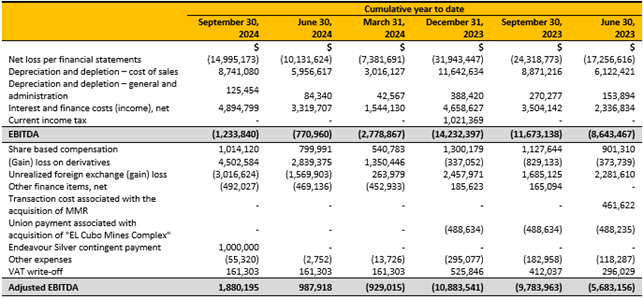

EBITDA

EBITDA is a non-IFRS financial measure, which excludes the following from net earnings:

Income tax expense;

Finance costs;

Amortization and depletion.

Adjusted EBITDA excludes the following additional items from EBITDA:

Share based compensation;

Non-recurring impairments (reversals);

Loss (gain) on derivative;

Significant other non-routine finance items.

Adjusted EBITDA per share is calculated by dividing Adjusted EBITDA by the basic weighted average number of shares outstanding for the period.

Management believes EBITDA is a valuable indicator of the Company's ability to generate liquidity by producing operating cash flow to fund working capital needs, service debt obligations, and fund capital expenditures. Management uses EBITDA for this purpose. EBITDA is also frequently used by investors and analysts for valuation purposes whereby EBITDA is multiplied by a factor or "EBITDA multiple" based on an observed or inferred relationship between EBITDA and market values to determine the approximate total enterprise value of a Company. Management believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results because it is consistent with the indicators management uses internally to measure the Company's performance and is an indicator of the performance of the Company's mining operations.

EBITDA is intended to provide additional information to investors and analysts. It does not have any standardized definition under IFRS and should not be considered in isolation or as a substitute for measures of operating performance prepared in accordance with IFRS. EBITDA excludes the impact of cash costs of financing activities and taxes, and the effects of changes in operating working capital balances, and therefore is not necessarily indicative of operating profit or cash flow from operations as determined by IFRS. Other companies may calculate EBITDA and Adjusted EBITDA differently.

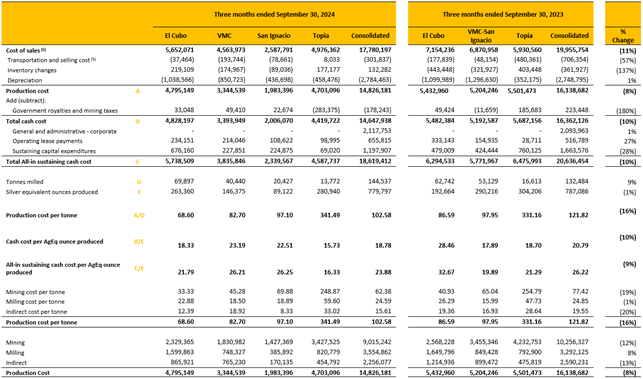

Cash Cost per AgEq Ounce, All-In Sustaining Cost per AgEq Ounce and Production Cost per Tonne

Cash costs per silver equivalent oz and production costs per tonne are measures developed by precious metals companies in an effort to provide a comparable standard; however, there can be no assurance that the Company's reporting of these non-IFRS measures and ratios are similar to those reported by other mining companies. Cash costs per silver equivalent ounce and total production cost per tonne are non-IFRS performance measures used by the Company to manage and evaluate operating performance at its operating mining unit, in conjunction with the related IFRS amounts. They are widely reported in the silver mining industry as a benchmark for performance, but do not have a standardized meaning and are disclosed in addition to IFRS measures. Production costs include mining, milling, and direct overhead at the operation sites. Cash costs include all direct costs plus royalties and special mining duty. Total production costs include all cash costs plus amortization and depletion, changes in amortization and depletion in finished goods inventory and site share-based compensation. Cash costs per silver equivalent ounce is calculated by dividing cash costs and total production costs by the payable silver ounces produced. Production costs per tonne are calculated by dividing production costs by the number of processed tonnes. The following tables provide a detailed reconciliation of these measures to the Company's direct production costs, as reported in its consolidated financial statements.

AISC is a non-IFRS performance measure and was calculated based on guidance provided by the World Gold Council ("WGC"). WGC is not a regulatory industry organization and does not have the authority to develop accounting standards for disclosure requirements. Other mining companies may calculate AISC differently as a result of differences in underlying accounting principles and policies applied, as well as differences in definitions of sustaining capital expenditures. AISC is a more comprehensive measure than cash cost per ounce and is useful for investors and management to assess the Company's operating performance by providing greater visibility, comparability and representation of the total costs associated with producing silver from its current operations, in conjunction with related IFRS amounts. AISC helps investors to assess costs against peers in the industry and help management assess the performance of its mine.

AISC includes total production costs (IFRS measure) incurred at the Company's mining operation, which forms the basis of the Company's total cash costs. Additionally, the Company includes sustaining capital expenditures, corporate general and administrative expense, operating lease payments and reclamation cost accretion. The Company believes this measure represents the total sustainable costs of producing silver and gold concentrate from current operations and provides additional information of the Company's operational performance and ability to generate cash flows. As the measure seeks to reflect the full cost of silver and gold concentrate production from current operations, new projects capital at current operation is not included. Certain other cash expenditures, including share-based payments, tax payments, dividends and financing costs are also not included.

The following tables provide detailed reconciliations of these measures to cost of sales, as reported in notes to the Company's consolidated financial statements.

Silver equivalents are calculated using 84.04:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.04:1 (Ag/Zn) ratio for Q3 2024; an 81.83:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for Q3 2023, respectively.

Cash cost per silver equivalent ounce includes mining, processing, and direct overhead.

AlSC per oz includes mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital.

Production costs include mining, milling, and direct overhead at the operation sites.

Consolidated amount for the three months ended September 30, 2024, excludes

$3,986 in relation to silver bullion transportation and selling cost from cost of sales.

Silver equivalents are calculated using 84.34:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) YTD 2024 and an 82.21:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) YTD 2023, respectively.

Cash cost per silver equivalent ounce includes mining, processing, and direct overhead.

AlSC per oz includes mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital.

Production costs include mining, milling, and direct overhead at the operation sites.

Consolidated amount for the nine months ended September 30, 2024, excludes

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

Qualified Person

William Gehlen, a Director of Guanajuato Silver, is a Certified Professional Geologist with the American Institute of Professional Geologists (No. 10626), and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Mr. Gehlen has reviewed and verified technical data disclosed in this news release and detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to herein. Verified data underlying the disclosed information includes reviewing compiled assay data; QAQC performance of blank samples, duplicates, and certified reference materials; and grade calculation formulas.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson"

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: jjj@Gsilver.com

Gsilver.com

Guanajuato Silver Bullion Store

Please visit our Bullion Store, where Guanajuato Silver coins and bars can be purchased.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, improvements in operational efficiencies; fluctuations in production results and the Company's status as one of the fastest growing silver producers in Mexico.

Such forward-looking statements and information reflect management's current beliefs and expectations and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: our estimates of mineralized material at El Cubo and San Ignacio and the assumptions upon which they are based, including geotechnical and metallurgical characteristics of rock conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to production estimates; the ability of the Company to ramp up processing of mineralized material at its processing plants at the projected rates and source sufficient high grade mineralized material to fill such processing capacity; prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects and to satisfy current liabilities and obligations including debt repayments; capital cost estimates; decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, market conditions, availability of financing, future prices of gold, silver and other metals, currency rate fluctuations, rising inflation and interest rates, actual results of production, exploration and development activities, actual resource grades and recoveries of silver, gold and other metals, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, geopolitical conflicts including wars, environmental risks, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to successfully discover and mine sufficient quantities of high grade mineralized material at El Cubo, VMC, San Ignacio and Topia for processing at its existing mills to increase production, tonnage milled and recoveries rates of gold, silver, and other metals in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver's decision to process mineralized material from El Cubo, VMC, San Ignacio, Topia and its other mines is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company's projected production of silver, gold and other metals will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about the impact of the resurgence of COVID-19, the ongoing war in Ukraine, inflation and rising interest rates and the impact they will have on the Company's operations, supply chains, ability to access mining projects or procure equipment, supplies, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR+ at www.sedarplus.ca including the Company's most recently filed annual information form. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

SOURCE: Guanajuato Silver Company Ltd.

View the original press release on accesswire.com