Guanajuato Silver Provides Updated PEA for the El Cubo Mines Complex

VANCOUVER, BC / ACCESSWIRE / June 26, 2023 / Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(AQUIS:GSVR)(OTCQX:GSVRF) announces that as part of a scheduled program to update GSilver's NI 43-101 technical reports and resource estimates for all of its producing mines in Mexico, the Company is presenting positive results from its new "preliminary economic assessment" of GSilver's

James Anderson, Chairman and CEO, said, "Guanajuato Silver has grown significantly over the past two years through a strategy of acquiring older mines in the Guanajuato Mining Camp and the State of Durango, and bringing them efficiently back into production. Because of the nature and swiftness of these acquisitions, most of the mineralized material at these mines were categorized as historical resource estimates. As previously announced, we have initiated a program to upgrade our existing resources and historical estimates to current resources (see Guanajuato Silver news release dated February 23, 2023 -"Guanajuato Silver Drills 6,981 g/t AgEq at San Ignacio and Prepares to Expand Production"); appropriately, the El Cubo Mines Complex is the first to be updated. We anticipate a current resource estimate for our San Ignacio mine to be completed later this year. The 2023 PEA replaces Behre Dolbear's previous preliminary economic assessment report issued on May 6, 2021, with an effective date of January 31, 2021."

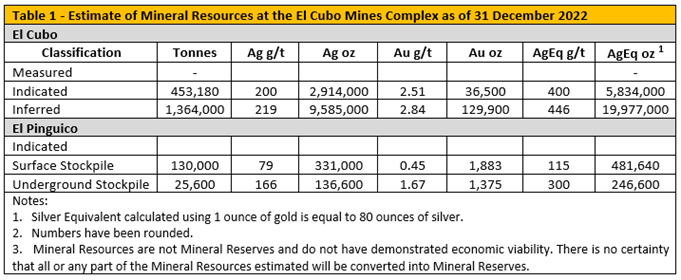

Mineral Resource Estimate

The upgraded mineral resource for the El Cubo Mines Complex as extracted from the 2023 PEA is presented in Table 1 below:

1 The silver equivalent ("AgEq") ounces shown in this column are not included in the 2023 PEA and have been estimated and added directly by GSilver for ease of reference and comparison purposes based on a ratio of 1 ounce of gold is equal to 80 ounces of silver, (one troy ounce converted to the metric system equals 31.1035 grams).

Mr. Anderson added, "This updated PEA envisions a six-year mine life; however, El Cubo has already demonstrated a production history that has extended well over 100-years. Our goal is to continually increase mineral resources through in-fill and exploration drilling to end each year with

The mineral resource estimate used as the basis for the 2023 PEA was developed by Behre Dolbear using the December 31, 2016 mineral resource estimate and computer models developed for El Cubo by Endeavour Silver Corp. ("Endeavour"), El Cubo's previous owner, and GSilver's February 28, 2017 resource estimate for the El Pinguico property.2,3 Behre Dolbear has extensively reviewed and audited the primary drilling data, computer models, wireframes, estimation methods, and the previous estimates and the El Cubo mill production in 2021 and 2022 to help develop the estimate of the current mineral resources at the El Cubo Mines Complex.

Although Endeavour and GSilver significantly increased the drilling and sampling data at El Cubo beyond the data in the 2016 database which has been used for the El Cubo 2023 PEA mineral resource estimate, such drilling was primarily exploration drilling on parallel vein structures and requires additional infill drilling to achieve a drill spacing adequate for an inferred mineral resource estimate. Accordingly, the results from such subsequent drilling by Endeavour and GSilver have not been used in the calculation of the mineral resource estimate for El Cubo as of December 31, 2022 in the 2023 PEA. The 2023 PEA includes a recommendation that targeted drilling should be completed to increase the mineral resource tonnage, classification, and mine life prior to a pre-feasibility study (see Section 14.0 Mineral Resource Estimate and Section 26.0 Recommendations in the 2023 PEA).4

The remaining mineral resources at El Cubo, as of December 31, 2022, total approximately 0.45 million tonnes of indicated resources and 1.36 million tonnes of inferred resources. There is no certainty that all or any part of the mineral resources estimated will be converted into mineral reserves. Mineral reserves have not been identified for El Cubo or El Pinguico.

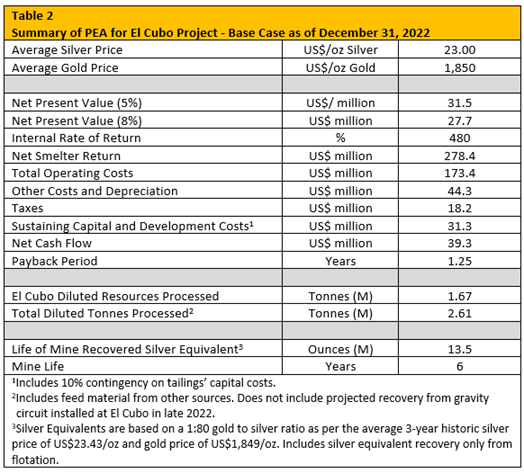

Preliminary Economic Assessment

Behre Dolbear also prepared a discounted cash flow model for the El Cubo Mines Complex excluding El Pinguico ("El Cubo")5, to determine the Net Present Value (NPV), Internal Rate of Return (IRR), and payback period.

Key parameters integral to Behre Dolbear's preparation of the cash flow model and determination of NPV include:

- All results are expressed in US Dollars (US$).

- The analysis is based on a

100% equity basis. Specific business considerations, such as debt or equity financing and detailed tax strategies, have purposely not been included or analyzed in detail. - All cash flows are determined on an after-tax basis.

- Net Present Values (NPV) are determined, assuming end-of-year cash flows.

- All costs and revenues reflect "real" or constant 2023 dollars without escalation.

- The measures used in the PEA are metric except where, by convention, gold and silver content, production, and sales are stated in troy ounces.

A summary of the updated preliminary economic assessment for El Cubo as at December 31, 2022 as extracted from the 2023 PEA is set out in Table 2 below.6

The following is a summary of certain cash flow model inputs reflected in the 2023 PEA. Readers should refer to the 2023 PEA directly for a complete discussion of these and other inputs.

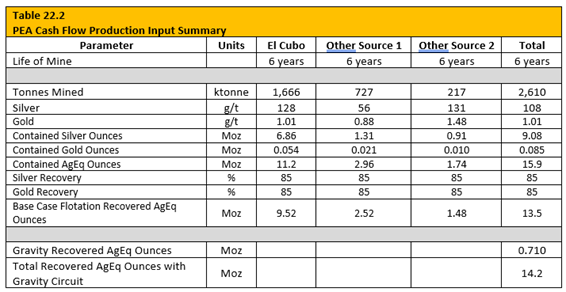

● Life of Mine and Production Forecasts. The cash flow model incorporates a 6-year operating and development period prepared on the basis of the diluted tonnages summarized in Table 22.2 below. At steady state, the average monthly targeted production rate is 36,250 tonnes per month for an average annual total of 435,000 tonnes per year mined and processed. The overall projected base case production is summarized in Table 22.2. Also shown in Table 22.2 is the projected silver equivalent recovery with the addition of the gravity circuit at El Cubo at the end of 2022.

● Commodity Prices and Net Smelter Return. The use of historical metal prices is a generally accepted methodology for modeling long-term commodity prices. For the 2023 PEA, Behre Dolbear used base case silver and gold prices of US

The net smelter return (NSR) was determined on the basis of, inter alia, revenues of

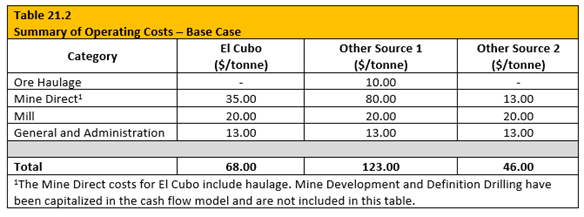

● Operating Costs. Average mining, processing and administration costs for six years of operations based on current experience at El Cubo are presented in Table 21.2 below:

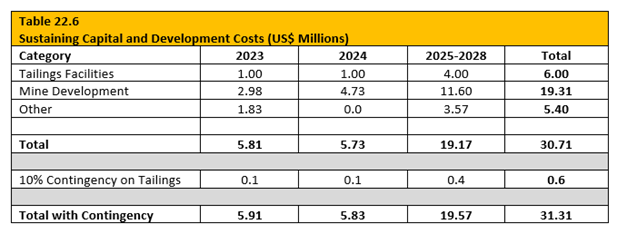

● Development and Capital Costs. The development and capital costs associated with mine development and equipment, new tailings facility, and facility improvements for the remaining mine life at El Cubo are shown in Table 22.6 below. Included in the sustaining capital costs is the construction of additional capacity in the Tailings Storage Facility 3-B. The construction is scheduled to begin in 2023 and will be completed by 2026 at an estimated capital cost of US

● Other Costs and Taxes. Other costs include:

Mining Rights Tax.......................................................

Government Fee on Precious Metals...........................

Workers Profit Share................................................

These costs are based on the requirements of the Mexican government. Depreciation was determined on a straight-line basis for 8 years as per Mexican tax laws. The income tax rate is projected at

● Sensitivity Analysis

To determine the effect of changes in several of the base case assumptions, a sensitivity analysis was prepared for each operating scenario. Certain factors, such as commodity prices, operating costs, and capital costs, could have a significant effect on the financial performance of El Cubo. The objective of the sensitivity analyses is to determine the effect of several varying key parameters, as a point of comparison to the base line results. The following parameters were evaluated.

- Discount rates ranging from

0% to10% were applied to determine the effect on NPV. - Commodity prices generally have the greatest effect on mining project economics. The sensitivity to changes in commodity prices was determined on the basis of a constant gold-to-silver price ratio of 1:80, which is consistent with historical data.

- The cash variable operating costs were varied to determine the effect on NPV.

- Both the initial and sustaining capital costs were varied.

In each case, the particular parameter was changed for each year during the life of the mine (LOM) review. In reality, it is unlikely that each of the varied parameters would experience the same increases or decreases over the entire LOM. As such, these sensitivity analyses present the best or the worst-case scenarios in the ranges evaluated. The purpose of the sensitivity analysis is to provide an indication of the relative effect that a specific operating parameter can have on the overall project economics.

Of the sensitivity factors reviewed, the discounted cash flow was significantly affected by variations in both the commodity prices and operating costs.

At the 3-year historical average silver price of US

Based on the results of the sensitivity analysis, the average NPV(5) breakeven price is approximately US

● Feed Material from Other Sources

The base case cash flow model includes feed material from other sources as per GSilver's plan of operation including GSilver's San Ignacio mine and VMC in Guanajuato, Mexico. If the additional material is not fed to the El Cubo mill, the base case NPV(5) is reduced by

● Footnotes

2 National 43-101 Technical Report: Updated Mineral Resource and Reserve Estimates for the El Cubo Project, Guanajuato State, Mexico for Endeavour Silver by Hard Rock Consulting, LLC. Effective Date, December 31, 2016, Report Date: March 3, 2017. Downloaded from SEDAR.

3 NI 43-101 Technical Report for the El Pinguico Project, Guanajuato Mining District Mexico for VanGold Mining, authored by Carlos Cham Dominguez of FINDORE S.A. DE C.V., effective date February 28, 2017. Downloaded from SEDAR.

4 See the 2023 PEA for further details of the key assumptions, parameters and methods used to estimate the current mineral resources at El Cubo and El Pinguico.

5 GSilver's current mine plan does not include production from El Pinguico's existing stockpiles as GSilver suspended processing of mineral resources from such stockpiles in July 2022 to focus on processing higher grade material from El Cubo and its subsequently acquired San Ignacio mine and Valenciana Mines Complex ("VMC") in Guanajuato, Mexico.

6 The cash flow model includes indicated and inferred resources for El Cubo and material from other sources not included in the El Cubo mineral resources including mineralized material from GSilver's nearby

Cautionary Statement:

The above economic analysis is preliminary in nature and includes inferred mineral resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Mineral resources that are not Mineral Reserves do not have demonstrated economic viability. Further, there has been insufficient exploration to allow for the classification of the inferred mineral resources as an indicated or measured mineral resource; however, it is reasonably expected that the majority of the inferred mineral resources could be upgraded to indicated or measured mineral resources with continued exploration. There is no guarantee that any part of the mineral resources disclosed herein will be converted into a mineral reserve in the future or that the 2023 PEA will be realized.

Shares for Debt

GSilver also announces that it has closed its previously announced shares-for-debt transaction totaling C

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine Complex, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

Technical Information

Reynaldo Rivera, VP of Exploration of GSilver, has approved the scientific and technical information contained in this news release. Mr. Rivera is a member of the Australasian Institute of Mining and Metallurgy (AusIMM - Registration Number 220979) and a "qualified person" as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson"

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: jjj@GSilver.com

Gsilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, estimates of mineral resources; the opportunities for exploration, development and expansion of El Cubo; estimates of capital expenditures and operating costs related to and estimated future financial or operational performance at El Cubo; the ability of the Company to continually increase mineral resources at El Cubo each year through in-fill and exploration drilling to extend the life-of-mine at El Cubo beyond the six year mine life set out in the 2023 PEA for decades to come; the estimates of NPV, IRR and life of mine projections for El Cubo; the ability of the Company to source, process and expand other sources of mineralized material for processing at the El Cubo mill; the timing for completion of updated NI 43-101 technical reports and current resource estimates for the Company's mining projects including San Ignacio; and the Company's status as one of the fastest growing silver producers in Mexico.

Such forward-looking statements and information reflect management's current beliefs and expectations and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: our estimates of mineral resources and other mineralized material at El Cubo and the Company's other mining projects in Guanajuato, Mexico and the assumptions upon which they are based, including geotechnical and metallurgical characteristics of rock conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to the 2023 PEA; the ability of the Company to ramp up processing of mineral resources and material at El Cubo at the projected rates and source sufficient high grade mineralized material to fill such processing capacity; prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects and to satisfy current liabilities and obligations including debt repayments; capital cost estimates; operating costs; decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, market conditions, availability of financing, future prices of gold, silver and other metals, currency rate fluctuations, high inflation and interest rates, actual results of production, exploration and development activities, actual resource grades and recoveries of silver, gold and other metals, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, geopolitical conflicts including wars, environmental risks, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to successfully discover and mine sufficient quantities of high grade mineral resources or other material at El Cubo, VMC, San Ignacio and Topia for processing at its existing mills to increase production, tonnage milled and recovery rates of gold, silver, and other metals in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver's decision to process mineral resources and other material from El Cubo, VMC, San Ignacio and Topia is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not mineral reserves do not have demonstrated economic viability, are considered too speculative geologically to have economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company's projected production of silver, gold and other metals or the 2023 PEA will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about the continued spread and severity of COVID-19, the ongoing war in Ukraine and high inflation and interest rates and the impact they will have on the Company's operations, supply chains, ability to access mining projects or procure equipment, supplies, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com including the Company's most recently filed annual information form. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

Cautionary Note for U.S. Investors regarding Reserve and Resource Estimates

Canadian public disclosure standards, including National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") developed by the Canadian Securities Administrators, differ from the requirements of the Securities and Exchange Commission in the United States (the "SEC"). In particular, the terms "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" in this news release are defined in accordance with NI 43-101 under the guidelines set out in the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Mineral Reserves 2014 ("CIM Definition Standards"). The SEC has recently modernized and amended its mineral property disclosure requirements for issuers whose securities are registered with the SEC under the United States Securities Act of 1934 and now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" which are substantially similar to the corresponding CIM Definition Standards. However, U.S. investors are cautioned that while the foregoing terms adopted by the SEC are "substantially similar" to corresponding definitions under CIM Definition Standards, there are differences. As such, there is no assurance any mineral resources that the Company may report as "measured mineral resources", "indicated mineral resources" or "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted by the SEC. United States investors are also cautioned that while the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", they should not assume that all or any part of the mineral deposits in these categories would ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described by these terms has a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any "measured mineral resources", "indicated mineral resources", or "inferred mineral resources" that the Company reports are or will ever be converted into mineral reserves or economically or legally mineable. Further under Canadian securities laws, estimates of "inferred mineral resources" cannot form the basis of feasibility, pre-feasibility or other economic studies, except in rare cases, although it is reasonably expected that the majority of "inferred resources" could be upgraded to "indicated resources" with continued exploration. Nonetheless, investors are cautioned not to assume that all or any part of an "inferred mineral resource" exists or is economically or legally mineable. Also, disclosure of "contained ounces" in a mineral resource is permitted disclosure under Canadian securities laws; however, historically the SEC only permits issuers to report mineralization that does not constitute "mineral reserves" as in place tonnage and grade, without reference to unit measures. Accordingly, information concerning mineral deposits set forth in this news release may not be comparable with information made public by companies that report in accordance with U.S. securities laws.

SOURCE: Guanajuato Silver Company Ltd.

View source version on accesswire.com:

https://www.accesswire.com/763620/Guanajuato-Silver-Provides-Updated-PEA-for-the-El-Cubo-Mines-Complex