GOLD ROYALTY ANNOUNCES ACQUISITION OF ROYALTY OVER CAPSTONE';S PRODUCING COPPER-SILVER COZAMIN MINE

- The acquisition of the Cozamin royalty brings immediate cash flow and complement the company's revenue growth rate.

- The Royalty generated revenue of over US$1.0 million over the last year and is expected to add meaningful cash flow to Gold Royalty going forward.

- The Royalty covers two concessions over the Calicanto vein at Cozamin. Gold Royalty has the option to acquire additional royalties on five contiguous concessions to the south of the Royalty.

- The company expects to be generating positive free cash flow in 2024 with the addition of Cozamin and the Côté Gold Project.

- The company intends to fund the transaction through its existing cash and cash equivalents.

- The board of directors will suspend dividends to focus on growing cash flow and net asset value per share through accretive acquisitions.

Insights

Analyzing...

DESIGNATED NEWS RELEASE

The Company also announces that it expects that, with the completion of the proposed acquisition, its board of directors will suspend dividends under its previously announced dividend program to focus capital on executing its strategic priority of growing cash flow and net asset value per share through accretive acquisitions.

David Garofalo, Chairman and CEO of Gold Royalty commented, "The acquisition of the Cozamin royalty brings immediate cash flow, complementing our peer-leading revenue growth rate from our portfolio of high-quality, long-life North American assets. Capstone is an experienced and proven operator and we are excited to see them continue to deliver strong operating and exploration results at Cozamin for years to come. We currently expect to be generating positive free cash flow in 2024 with, among other things, the addition of Cozamin, the Côté Gold Project on track to enter production early next year, and corporate overhead costs continuing to decrease."

- Cozamin is an established, low-cost operating copper-silver mine which has been in production since 2006 and has a history of exploration success and mine life extensions;

- The Royalty generated revenue of over

US over the last year and is expected to add meaningful cash flow to Gold Royalty going forward, along with leverage to increasing copper and silver prices during the life of mine;$1.0 million - Capstone published an updated National Instrument I 43-101 ("NI 43-101") technical report for Cozamin in May 2023 which outlined a life of mine plan extending to 2030 based only on mineral reserves1;

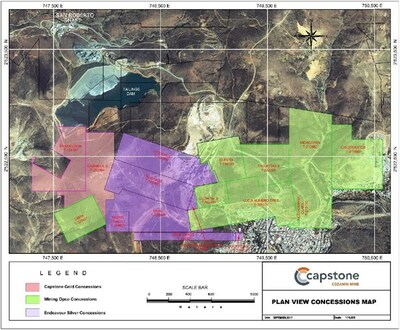

- The Royalty covers two concessions over the Calicanto vein at Cozamin. As part of the transaction, Gold Royalty has been granted the option to acquire additional royalties on five contiguous concessions to the south of the Royalty for consideration of up to

US .$500,000 - The Company intends to fund the transaction through its existing cash and cash equivalents.

______________________________ |

1 Based on the NI 43-101 Technical Report titled "NI 43-101 Technical Report on the Cozamin Mine, |

Cozamin is a copper-silver underground mine with a surface milling facility, located 3.6 km north-northwest of

Cozamin has been continuously operated by Capstone since late 2006, when it commenced commercial production at a rate of 1,000 tonnes per day. At the time, it had a three-year mine life based upon then existing mineral reserves. Since then, successful exploration has extended the expected life of the mine to 2030 based on existing mineral reserves1.

From 2023 to 2030, average annual production is currently forecasted by Capstone at 20,000 tonnes of copper and 1.3 million ounces of silver at average C1 costs of

Capstone announced on February 1, 2023 that it plans to update its mine plan in 2024 to introduce cut-and-fill mining, which it expects will allow it to convert additional resources to reserves and provide a pathway to increase production at the mine to better utilize the installed mill capacity of 4,400 tonnes per day.

The Royalty was created under a 2017 concession division agreement between Endeavour and Capstone, under which, among other things, if Capstone outlined a primarily base metals mineral resource estimate (defined as >

The acquisition of the Royalty is subject to customary closing conditions and is currently expected to be completed in August 2023.

Gold Royalty Corp. is a gold-focused royalty company offering creative financing solutions to the metals and mining industry. Its mission is to invest in high-quality, sustainable, and responsible mining operations to build a diversified portfolio of precious metals royalty and streaming interests that generate superior long-term returns for our shareholders. Gold Royalty's diversified portfolio currently consists primarily of net smelter return royalties on gold properties located in the

Alastair Still, P.Geo., Director of Technical Services of the Company, is a qualified person as such term is defined under NI 43-101 and has reviewed and approved the technical information disclosed in this news release.

Except where otherwise stated, the disclosure in this news release relating to Cozamin has been derived from the Cozamin Report and other public information disclosed by the operator and has not been independently verified by the Company. Specifically, the Company has limited, if any, access to the property subject to the Royalty. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. The Royalty does not cover the entire project area of Cozamin, or the entirety of the areas covered by existing mineral reserve and resource and estimates. Please refer to the Cozamin Report for further information regarding the mineral reserve.

Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this news release, including any references to mineral resources or mineral reserves, was prepared by the project operator in accordance with NI 43-101, which differs significantly from the requirements of the

Certain of the information contained in this news release constitutes 'forward-looking information' and 'forward-looking statements' within the meaning of applicable Canadian and

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/gold-royalty-announces-acquisition-of-royalty-over-capstones-producing-copper-silver-cozamin-mine-301888897.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/gold-royalty-announces-acquisition-of-royalty-over-capstones-producing-copper-silver-cozamin-mine-301888897.html

SOURCE Gold Royalty Corp.