U.S. Global Investors Reports $11 Million Revenue in Fiscal 2024, Repurchasing Over $2 Million in Shares While Generating a Strong Shareholder Yield of 9.41%

Rhea-AI Summary

U.S. Global Investors (NASDAQ: GROW) reported $11 million in revenue for fiscal year 2024, with net income of $1.3 million, down from $3.1 million the previous year. The company's average assets under management (AUM) stood at $1.9 billion, with total AUM of $1.6 billion as of June 30, 2024. Despite challenges in the airline industry, the company remains optimistic, particularly following the reversal of the yield curve. U.S. Global Investors achieved a strong shareholder yield of 9.41%, repurchasing 767,651 shares at a cost of $2.2 million. The company maintains a healthy liquidity position with $27.4 million in cash and cash equivalents. U.S. Global Investors continues to expand globally, listing a new ETF in Colombia and merging its JETS UCITS ETF with the Travel UCITS ETF (TRIP).

Positive

- Net investment income surged 578% to $2.1 million

- Strong shareholder yield of 9.41%, exceeding Treasury yields

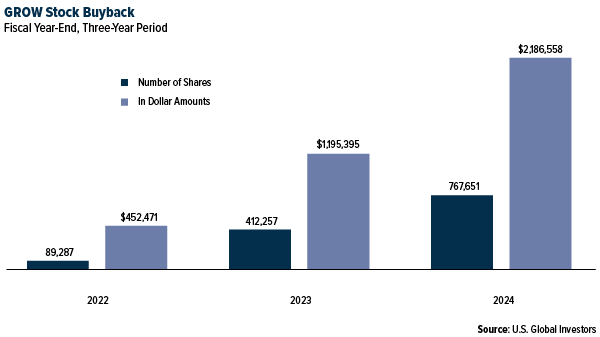

- Repurchased 767,651 shares at a cost of $2.2 million, an 86% increase from the previous year

- Healthy liquidity with $27.4 million in cash and cash equivalents

- Expanded global presence with new ETF listing in Colombia

- Merged JETS UCITS ETF with Travel UCITS ETF (TRIP), diversifying offerings

Negative

- Revenue decreased from $15.1 million to $11 million year-over-year

- Net income fell from $3.1 million to $1.3 million

- Assets under management declined from $2.4 billion to $1.6 billion

- Operating loss of $480,000 compared to operating income of $3.5 million in the previous year

News Market Reaction

On the day this news was published, GROW declined 1.17%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

SAN ANTONIO, Sept. 10, 2024 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm with deep expertise in global markets and specialized sectors from gold mining to airlines, today announced operating revenues of approximately

For fiscal year 2024, average AUM stood at

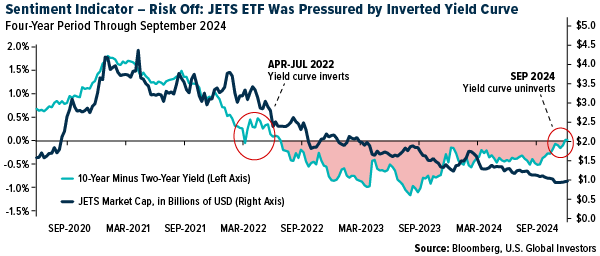

Despite the challenging macroeconomic environment, marked by a prolonged yield curve inversion—where the two-year Treasury yield exceeded the 10-year yield—investor sentiment toward the airline industry has weakened. This inversion, a historical recession signal, lasted for a record-breaking 783 days before reversing.1 The uncertainty surrounding the inversion led many investors to reduce exposure to industries like airlines, which are typically sensitive to economic slowdowns. Despite this, the airline industry’s fundamentals—marked by robust growth in passengers, revenue and cash flow—remained strong, although macroeconomic concerns kept many investors on the sidelines.

Now that the yield curve has normalized, the Company expects a potential shift in market sentiment, as the reversal could signal renewed confidence in future economic stability.

“We can’t control external factors like geopolitics, interest rates, taxes or regulations. However, we do have control over our internal processes, including robust governance, compliance and our smart beta 2.0 approach to developing thematic ETF products, which combines quantitative and fundamental analysis,” says Frank Holmes, CEO of U.S. Global Investors. “While we cannot directly influence investor sentiment, we remain optimistic, particularly following the reversal of the yield curve in September after its historic 783-day inversion. As illustrated in the chart, the correlation between the inverted yield curve and redemptions in the U.S. Global Jets ETF (NYSE: JETS) has been significant.”

Confidence in the Long-Term Outlook for the Airline Industry

The Company continues to express confidence in the long-term growth of the airline industry, driven by strong demand for air travel, lower borrowing costs and a return to pre-pandemic levels of consumer travel spending. Two years ago, the U.S. Transportation Security Administration (TSA) was consistently clearing around 2.0 million passengers per day, even surpassing pre-pandemic figures. In July 2024, the TSA set a new record by screening 3 million passengers in a single day.2

Additionally, the Company continues to expand its global presence with a new ETF listing in Colombia this month. Many countries in Latin America are pursuing robust strategies to expand tourism, creating jobs and attracting foreign capital. This strategic move aligns with the Company’s approach to tapping into high-growth markets, where tourism plays a critical role in driving economic development.

Leading U.S. airlines, including American Airlines, Delta Air Lines, United Airlines, and Southwest Airlines, experienced an average revenue growth of

Review the top holdings in JETS by clicking here.

As of the most recent reporting period, the Company’s shareholder yield—a valuation metric popularized by Cambria Funds founder Mebane Faber3—was

Share Repurchases and Monthly Dividends

Indeed, the Company is committed to returning value to shareholders. During the fiscal year ended June 30, 2024, the Company repurchased a total of 767,651 of its own shares at a net cost of approximately

As of June 30, 2024, the Board of Directors has authorized a monthly dividend of

Healthy Liquidity and Capital Resources

As of June 30, 2024, the Company had net working capital of approximately

Gold Investors Anticipating Rate Cuts

The price of gold hit a new all-time high price on August 20 of this year,5 yet investment in gold-backed ETFs has remained muted as high interest rates in the U.S. deterred some investors from putting money in a non-interest-bearing asset. However, rates are widely expected to be lowered starting at the Federal Open Markets Committee (FOMC) meeting on September 17, a move that should lower bond yields, weaken the U.S. dollar and potentially boost demand for gold and gold mining stocks.

Against this background, the Company is happy to see that AUM in U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU) remained stable between August 2023 and August 2024. We consider GOAU a smart beta 2.0 ETF, meaning we believe it combines the benefits of passive investing and active investing. GOAU provides investors access to companies engaged in the production of precious metals either through active (mining or production) or passive (owning royalties or streams) means.

“De-dollarization, geopolitical tension and concerns over U.S. debt sustainability continue to drive interest in gold,” says Mr. Holmes. “With limited alternatives in other major currencies, central banks have increased their gold reserves, a trend that could continue given expectations of gold continuing to hit new all-time highs.”

JETS UCITS ETF Merged with TRIP

The Company continues to strengthen the global brand of its U.S. Global Jets ETF (NYSE: JETS), which trades not just in New York but also on the Mexican Stock Exchange, the Lima Stock Exchange in Peru and, effective August 29, 2024, the Colombia Securities Exchange.

In April, the U.S. Global Jets UCITS ETF merged with the Travel UCITS ETF (TRIP) after the Company acquired the fund from HANetf, Europe’s first and only independent, full-service provider of UCITS ETFs.

Whereas JETS invests mostly in the airlines industry, TRIP includes other sectors of the travel industry, such as hotels and cruise line operators. All combined, the global tourism market is expected to generate a massive

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time on September 11, 2024, to discuss the Company’s key financial results for the fiscal year. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, marketing and public relations manager. Click here to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

| 12 months ended | |||||

| 6/30/2024 | 6/30/2023 | ||||

| Operating Revenues | $ | 10,984 | $ | 15,074 | |

| Operating Expenses | 11,464 | 11,549 | |||

| Operating Income (Loss) | (480 | ) | 3,525 | ||

| Total Other Income | 2,395 | 558 | |||

| Income Before Income Taxes | 1,915 | 4,083 | |||

| Income Tax Expense | 582 | 934 | |||

| Net Income | $ | 1,333 | $ | 3,149 | |

| Net Income Per Share (Basic and Diluted) | $ | 0.09 | $ | 0.22 | |

| Avg. Common Shares Outstanding (Basic) | 14,182,300 | 14,638,833 | |||

| Avg. Common Shares Outstanding (Diluted) | 14,182,353 | 14,639,069 | |||

| Avg. Assets Under Management (Billions) | $ | 1.9 | $ | 2.5 | |

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides investment management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS here, GOAU here and for SEA here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, a regional ETFs returns and share price may be more volatile than those of a less concentrated portfolio.

Cash flow multiples, also known as valuation multiples, measure the relationship between a company's cash flow and its market value.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS, GOAU and SEA.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS, GOAU and SEA.

1 Bilello, C. (2024, September 5). The longest inversion in history is over - chart of the day (9/4/24). Charlie Bilello’s Blog. https://bilello.blog/2024/the-longest-inversion-in-history-is-over-chart-of-the-day-9-4-24#

2 Statement from Secretary Mayorkas on Record Three Million Screenings by TSA | Transportation Security Administration. (2024, July 8). https://www.tsa.gov/news/press/releases/2024/07/08/statement-secretary-mayorkas-record-three-million-screenings-tsa

3 Meb Faber - Shareholder Yield Investing Strategy and Portfolio. Meb Faber Portfolio | Shareholder Yield. https://www.validea.com/meb-faber#

4 The Company calculates shareholder yield by adding the percentage of change in shares outstanding to the dividend yield for the 12 months ending June 30, 2024. The Company did not have debt; therefore, no debt reduction was included.

5 Gold extends record rally on dollar weakness, rate-cut bets | Reuters. https://www.reuters.com/markets/commodities/gold-steady-near-record-high-investors-seek-more-fed-cues-2024-08-20

6 Global tourism - market size, industry analysis, trends and forecasts (2024-2029). IBISWorld Industry Reports. https://www.ibisworld.com/global/market-research-reports/global-tourism-industry/#CompetitiveForces

7 GDP (current US$). World Bank Open Data. https://data.worldbank.org/indicator/NY.GDP.MKTP.CD

Contact:

Holly Schoenfeldt

Director of Marketing

210.308.1268

hschoenfeldt@usfunds.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/82111e5e-bcef-4f2d-998c-6c67be695c66

https://www.globenewswire.com/NewsRoom/AttachmentNg/f21bbaf8-dee6-4f76-a511-00bca75e82c3