Grounded Lithium Announces Development Plan to Support Upcoming Preliminary Economic Assessment

Grounded Lithium Corp. (OTCQB: GRDAF) announced its field development plan for the Kindersley Lithium Project (KLP), targeting an initial production of 10,000 metric tons per year. The plan involves 24 producing wells and 5 disposal wells, supported by 70 kilometers of pipelines to minimize surface disturbance. This project is expected to significantly reduce operating costs as it's free of hydrocarbons and H2S, eliminating the need for pre-treatment. The preliminary economic assessment (PEA) is anticipated for Q2 2023, with production expected to commence by 2026. The company also granted stock options and RSUs to employees and insiders.

- Initial phase of production targets 10,000 metric tons/year of lithium.

- Cost-effective development due to absence of contaminants: hydrocarbons and H2S.

- Only 24 producing wells required, indicating strong reservoir quality.

- Infrastructure needs limited to 70 kilometers of buried pipelines, minimizing surface disturbance.

- Expecting to complete the Preliminary Economic Assessment (PEA) in Q2 2023.

- None.

- Producing wells - only 24 additional producing wells planned given strong grade and deliverability characteristics of the reservoir;

- Disposal wells - 5 injector wells;

- Pipelines - given strong reservoir characteristics resulting in a relatively small number of wells, only 70 kilometers of buried brine capable pipelines should be required, significantly limiting surface disturbance; and

- Central processing facility ("CPF") – an appropriately sized CPF will take advantage of economies of scale during construction. Our CPF avoids incremental capital often associated with removal of contaminants in the brine, such as trace hydrocarbons and/or H2S gases, as these are not expected to be present in GLC's intended drill horizon.

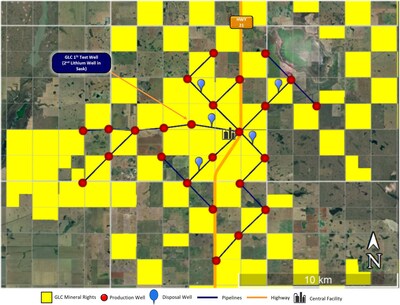

This proposed development plan is best depicted by the following graphic, which can also be found in our latest corporate presentation on our website. (www.groundedlithium.com)

"From our outset, we singularly focused on building the Company and its associated projects to generate cash flow and provide economic returns as quickly as possible," stated

Field work completed over the last year confirmed our geologic view that our intended production zone is free of hydrocarbons and H2S, which materially reduces the cost of a full commercial plant since pre-treatment facilities will not be required to process these contaminants. With an initial project size of 10,000 metric tons/yr of battery grade lithium salt, our initial processing facility maintains a smaller footprint and is expected to be located near key infrastructure such as paved highways, key power sources and a number of operational services given our proximity to

From an operational perspective, positive results from our field work evidencing grade and more importantly for this type of operation, deliverability, results in a field development plan calling for only 22 producing wells, with five disposal wells. Aside from our initial test well, we will drill two additional producing wells to provide operational flexibility and redundancy in order to maintain consistent annual production rates. Our field work further refined our 3-dimensional dynamic model, enabling a more precise inter-well spacing and depletion plan through time. Additional capital savings are expected from the shallow depth to our intended horizon, which materially reduces capital expenditures associated with drilling and ancillary services. The infrastructure to connect our wells to the facility requires only approximately 70 kilometers (43 miles) of buried pipeline for both production and disposal. Taken as a whole, our program requires similar total wells to produce sufficient volumes for a 10,000 metric ton/yr project but at approximately half the depth and with reduced facility requirements for brine prefiltering, we believe the KLP has the potential to be one of the lowest cost structure projects in the lithium from brine industry in Western Canada.

From a land tenure perspective, the location and selection of our drill program will earn or validate mineral permits which are leased from either the Crown (government) or freehold landowners. We note that this development plan has an average inter-well distance between 1 mile to 1.5 miles whereby we can develop our individual sections in a checker-board manner. This model provides for infill development, that we can use for future growth or production maintenance if necessary.

Several factors may impact our timing of the development plan, however the Company anticipates production commencement in the 2026 timeframe. Lithium from brine projects have the potential to reach commercial production far quicker than current global sources of lithium, which can often exceed a decade from concept to commissioning.

As has been communicated in the past, we plan to deploy direct lithium extraction technology to deliver a very economic project. We have been making steady progress in our analysis and efforts with

The Company also announces that it granted 1,474,000 stock options to certain officers, employees, directors and consultants of the Company at a strike price of

In addition, as part of the 2022 incentive compensation program to insiders and 2022 Board compensation, 1,018,000 RSU's were granted to certain employees, officers and directors as applicable. RSU's vest

The Company also encourages readers to visit our website at www.groundedlithium.com to view a number of virtual interviews and webcasts that senior leadership of the Company recently participated in, including

GLC is a publicly traded lithium brine exploration and development company that controls approximately 3.7 million metric tons of lithium carbonate equivalent of inferred resource over our focused land holdings in

Scientific and technical information contained in this press release has been prepared under the supervision of

This press release may contain forward-looking statements and forward-looking information within the meaning of applicable Canadian securities laws. The opinions, forecasts, projections and statements about future events of results, are forward looking information, forward-looking statements or financial outlooks (collectively, "forward-looking statements") under the meaning of applicable Canadian securities laws. These statements are made as of the date of this press release and the fact that this press release remains available does not constitute a representation by GLC that the Company believes these forward-looking statements continue to be true as of any subsequent date. Although GLC believes that the assumptions underlying, and expectations reflected in, these forward-looking statements are reasonable, it can give no assurance that these assumptions and expectations will prove to be correct. Such statements include, but are not limited to, statements regarding the completion of the PEA and timing thereof; the Company's project development plan; the completion of lab pilot work and associated technology selection; commencing construction of a field demonstration plant and the timing thereof; reservoir deliverability; the project size of the Company's initial processing facility; the location of the Company's initial processing facility; the number of 10,000 metric tons/yr phases and expectation that operational and financial risks will be minimized as a result, which will drive incremental shareholder and stakeholder value; the Company's expectation that it will drill additional producing wells to provide operational flexibility and redundancy in order to maintain consistent annual production rates; anticipated capital savings stemming from shallow depth to intended horizon; the cost structure associated with the KLP; earning and validating mineral permits which are leased from either the Crown or freehold landowners; infill development being used for future growth or production maintenance; the timing of the Company commencing production; deploying DLE technology to deliver an economic project and GLC's vision of becoming a best-in-class, environmentally responsible, Canadian lithium producer supporting the global energy transition.

Among the important factors, risks, uncertainties and assumptions that could cause actual results to differ materially from those indicated by such forward-looking statements are: GLC's expectation that our operations will be in

This news release shall not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction.

Neither the

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/grounded-lithium-announces-development-plan-to-support-upcoming-preliminary-economic-assessment-301741567.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/grounded-lithium-announces-development-plan-to-support-upcoming-preliminary-economic-assessment-301741567.html

SOURCE

FAQ

What is Grounded Lithium Corp's recent development plan?

What is the estimated timeline for the Kindersley Lithium Project?

How many wells are planned for the Kindersley Lithium Project?

What are the environmental impacts of the development plan?