Gerald O’Shaughnessy Issues Letter to GeoPark Shareholders

Gerald O’Shaughnessy, co-founder and second largest shareholder of GeoPark Limited (GPRK), has issued a letter urging shareholders to vote against four incumbent board members at the upcoming Annual General Meeting. He criticizes the board for failing to address strategic issues and for allowing CEO Jim Park to operate without proper oversight. O’Shaughnessy highlights concerns over high leverage, declining book value, and the lack of transparency in governance. He argues that voting against these directors is crucial for improving shareholder value and ensuring better corporate governance.

- None.

- High leverage limits GeoPark's growth potential.

- Book value has declined by over $400 million since 2012.

- Long-term share performance has decreased from $13.84 in 2011 to $12.14 in 2021, underperforming the S&P 500.

- Concerns over lack of transparency and inadequate strategic planning.

Insights

Analyzing...

Gerald O’Shaughnessy, the co-founder, former Chairman and second largest shareholder of GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK) today issued the following letter to the Company’s shareholders.

Image 1 (Photo: Business Wire)

July 8, 2021

Dear Fellow Shareholders,

You face an important decision at the upcoming GeoPark Annual General Meeting (“the Meeting”). How you vote will determine whether the current GeoPark Board seriously considers options to improve the value of your investment, or whether the incumbent directors simply continue with the status quo that has resulted in suboptimal economic results compared to our closest peer and our partner in Llanos 34, Parex Resources. Put simply, voting against four of the Company’s director nominees sends a message that GeoPark must be run in the best interests of all shareholders, not just to benefit CEO Jim Park.

As the Company’s second largest shareholder, my interests are wholly aligned with yours. Unlike you, I unfortunately have had to witness the dysfunction in GeoPark’s boardroom and the extreme deference of most directors to Mr. Park. What has occurred at the Company is a classic failure of corporate governance – Mr. Park has been allowed to operate without real oversight from the Board. That is why I strongly urge you to vote against directors most responsible – Jim Park, Constantin Papadimitriou, Robert Bedingfield and Pedro Aylwin.

Please consider the following points:

The Board Has Failed to Address the Critical Strategic Issues Facing GeoPark

GeoPark’s conduct during this campaign has been highly telling. Despite its voluminous public materials, the GeoPark Board has not addressed many of the urgent issues I have raised – instead, and perhaps unwittingly, since Jim Park has undoubtedly dictated the Company’s response to my points, it has sought to distract shareholders from what really matters.

For example, the Board has still not unequivocally stated that it will consider potential strategic combinations or partnerships to enhance shareholder value where Mr. Park and his team would not occupy leadership roles in any resulting entity. These issues are core to GeoPark’s future, and the Board cannot leave shareholders in the dark on these matters.

In terms of the economic case, the facts on the surface mask a deeper issue. GeoPark’s performance in the last five years has been good, largely as a result of discovering one asset – Llanos 34 in Colombia – that has been a game changer for two companies sharing the same asset. This good fortune has been weakened, however, by the Company’s money-losing non-Colombian assets.

GeoPark also has not sufficiently addressed its debt situation and continues to be one of the most leveraged companies among its peer group. This means that the majority of its cash flows are being used to service debt in addition to maintenance capital expenditures and a modest exploration program. High leverage severely limits GeoPark’s ability to invest in growth. Further, GeoPark has had to hedge its production, thereby limiting its upside when oil and gas prices rise.

Fact versus Fiction

Given GeoPark’s public statements on recent events, it is also vitally important to separate fact from fiction so that shareholders know the truth. GeoPark has made many untrue statements, but here are the key instances:

First, the Company initially tried to portray my removal as Chairman as an orderly transition. The reality is that it was anything but orderly. On June 4, a week after the call described in the paragraph below, I received a written ultimatum that either I resign as Chair within the next 24 hours, or I would be removed at a board meeting to be held on June 6. Upon receiving the June 4 ultimatum, I asked for an additional 24 hours to respond, which was denied. I was removed on June 6 and told I would not be nominated at the upcoming annual meeting of shareholders. This timing was clearly related to the next point.

Second, let me unequivocally state that any discussions I had with potential third parties about possible business transactions in my role as Chairman were at the request of my fellow directors. In these instances, I was approached on an entirely unsolicited basis by these parties, and I immediately reported that to the Board. The Board then asked me to speak alone with the third parties, whose input I immediately reported back. In these conversations, it became clear that the biggest obstacle to a transaction was Mr. Park’s lack of transparency in negotiations and his insistence on leading any resulting entity. When I relayed this information back to certain directors, the meeting where I was scheduled to report this to a larger group of directors was abruptly cancelled, and I received a call from two Board members, requesting that I resign, in which they said my successor as Chair was undetermined at that point.

Third, in April of 2021 I agreed to apply the Board’s newly proposed share pledge policy to my share pledges, which stemmed from my family’s

Fourth, the share pledging was never mentioned by the Board in their ultimatum that I resign as Chair and my eventual removal as a director. The claim that my pledging of shares was part of the rationale for my removal is a blatant attempt to rewrite history and distract from the real issues at hand that I have raised, as the Board well knows given our correspondence. Regardless, if reinstated to the Board, I have committed to have my pledges released and paid off in full within a year – I am happy to simply remove the distraction put forward by the GeoPark Board.

In fact, I was told that my “disruptive,” and “non-collaborative” approach was why I was being kicked off the Board. The fact is that these descriptions mischaracterize my conduct, which was the result of my expressed concerns about inadequacies, lack of independence and poor governance practices exhibited by the Board.

- Yes, I was critical of the Chairman of the Nominating and Corporate Governance Committee (Robert Bedingfield) for delaying the corporate governance review and reform for six months and later for his delay of an additional five months in adopting best practices in the director selection processes that I proposed (particularly with respect to the determination of the needed skill sets for directors) and for then ignoring these practices despite Board recognition of their merits. However, such criticism was respectful and appropriate under the circumstances.

- Yes, I have also complained to the Chairman of the Compensation Committee (Constantin Papadimitriou) for his failure to provide information or feedback on executive compensation and overall salaries and benefits.

- On several occasions, I acknowledge correcting inaccurate draft minutes of meetings prepared by the corporate secretary and director Pedro Aylwin, which I believe is what a director is supposed to do.

What this all boils down to is that I was pushed out for simply carrying out my responsibilities as Chairman of the Board. My removal is direct evidence of Mr. Park’s tight grip on the Board and the Company, his resistance to true corporate governance reform and his unwillingness to explore pathways for shareholder value creation.

Jim Park’s History of Dodging the Truth

Mr. Park is extremely opaque in the conduct of both his professional and personal lives, benefitting from a Board lax in its oversight of substantial perquisites from the Company and all too willing to be kept in the dark on significant matters, allowing him to escape scrutiny in instances where other executives would have been censured.

All this has contributed to a general perception in the marketplace that Mr. Park’s lack of transparency and insistence on control are substantial impediments to strategic discussions.

At this point, shareholders should be asking the following questions:

-

What does the Company have to show under Mr. Park’s stewardship beyond a single big discovery in Llanos 34 in Columbia, which was a windfall for GeoPark?

-

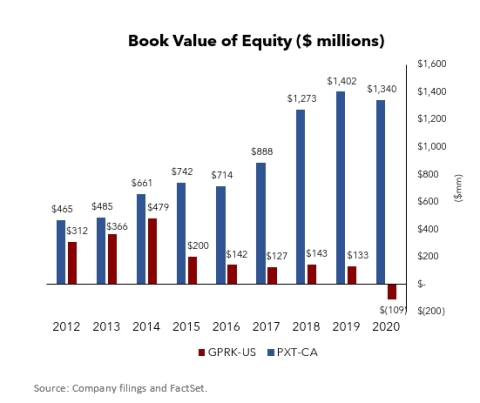

GeoPark’s mantra is “Creating Value and Giving Back.” Looking back, GeoPark’s book value has declined by more than

$400 million since 2012 – despite the Llanos 34 bonanza in Columbia – while our partner in the same block, Parex Resources, has substantially improved its balance sheet by nearly$1 billion . (See Image 1)

-

Additionally, GeoPark’s long-term share performance is mediocre at best: its share price has decreased from

$13.84 on January 3, 2011, to$12.14 on July 7, 2021. During the same period, the S&P 500 increased roughly240% . (See Image 2)

-

GeoPark’s mantra is “Creating Value and Giving Back.” Looking back, GeoPark’s book value has declined by more than

-

Looking forward, how and when will GeoPark return value to shareholders?

-

My concern is that GeoPark will attempt to improve its balance sheet through equity issuances that will dilute shareholders in an effort to fund future acquisitions and achieve scale, while maintaining Mr. Park’s objective of retaining control.

- With Mr. Park and the current Board in control of the Company, it is doubtful that GeoPark will achieve the scale to be the LATAM winner in the next three to five years in transactions which are accretive to shareholders, which is the time when major players will be divesting attractive assets.

-

My concern is that GeoPark will attempt to improve its balance sheet through equity issuances that will dilute shareholders in an effort to fund future acquisitions and achieve scale, while maintaining Mr. Park’s objective of retaining control.

-

What damage has been done in the past to the realization of shareholder value by Mr. Park’s opaqueness and overall lack of transparency?

- Based upon Mr. Park’s mediocre track record in long term value creation and his lack of transparency and need for control, it is difficult to see how shareholders can trust him to pursue all options to create shareholder value.

-

Why does GeoPark have only one director with public company board experience and why have Mr. Park and other directors been so vehemently against adding experienced and independent directors with public company board experience to the Board?

-

Over the past two years, I have proposed highly qualified, independent director candidates to enhance our Board’s oversight. These candidates were rejected.

- It is certainly problematic that Mr. Bedingfield (who serves on only one other public company board) is the model for the rest of the directors in terms of how to behave on a public company board – which I believe has caused the Board to fail to carry out its fiduciary duties appropriately.

-

Over the past two years, I have proposed highly qualified, independent director candidates to enhance our Board’s oversight. These candidates were rejected.

-

Why did members of the Compensation Committee not receive compensation information for the top officers other than the CEO or for the permanent consultants to the Company? Why does the Compensation Committee not receive information on Mr. Park’s perquisites?

- This is a failure of governance at the most basic level and must be rectified.

-

Why were independent directors not given access to compensation information for C-suite and permanent consultants?

- I asked for it and it was withheld.

-

If “it is categorically false that the Company maintains four houses for Mr. Park,"1as the Company claims, how many residences (including apartments) has the Company provided financial assistance for with respect to Mr. Park in the past few years?

- The Company’s response was characteristically evasive by using the word “houses” when they knew some of these residences were apartments.

-

Who bears responsibility for advancing these falsehoods and tactics aimed at avoiding the real issues?

- Mr. Park.

It is beyond time for a truly independent Board at GeoPark, one with the industry knowledge and the strength to rein in and oversee management and to provide input into the Company’s strategy.

In order to protect and enhance shareholder value, I urge you to join me in opposing the election to the Board of Jim Park, Constantin Papadimitriou, Robert Bedingfield and Pedro Aylwin.

Sincerely,

Gerald E. O’Shaughnessy

A vote AGAINST four incumbent directors is a vote to send a message that change is needed on the Board at GeoPark to benefit all of the Company’s shareholders. You can vote AGAINST these directors either by voting on GeoPark’s proxy card, or by voting on the BLUE proxy card included in these materials.

VOTE AGAINST FOUR GEOPARK DIRECTOR NOMINEES TO SIGNAL THAT YOU DEMAND CHANGE IN ORDER TO PROTECT YOUR INVESTMENT

1 GeoPark Investor Presentation: Consistent Performance and Value Delivery, Page 28.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210708005489/en/