GeoPark Announces Fourth Quarter 2023 Operational Update

- 10% increase in quarterly production

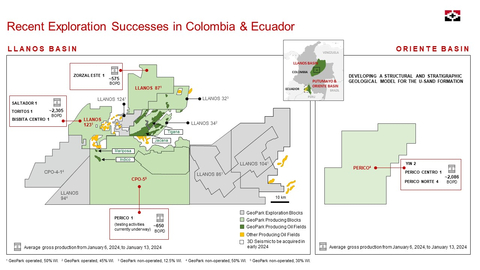

- Successful exploration drilling in Colombia and Ecuador

- Exceeded shareholder return targets

- Renewed share buyback program for up to 10% of shares outstanding

- Cash and cash equivalents increased to $133 million as of December 31, 2023

- Decrease in production in Chile and Brazil

- Divesting non-core operations in Chile

Insights

The operational update from GeoPark Limited indicates a significant 10% increase in quarterly production compared to the previous quarter, signaling robust operational performance and successful exploration initiatives. This uptick in production, particularly in the Colombian and Ecuadorian markets, demonstrates the company's effective resource management and exploration strategy. The impact of this performance is likely to be viewed positively by investors, as it suggests the potential for increased revenue and profitability.

Furthermore, the company's strong balance sheet and shareholder return strategy, which exceeded full-year targets with a notable capital return yield, reflect a shareholder-friendly approach, potentially making the stock more attractive to income-focused investors. The renewal of the share buyback program also signals confidence in the company's valuation and future prospects. Such financial maneuvers are essential for maintaining investor confidence and can impact the company's stock performance.

The reported Adjusted EBITDA and free cash flow projections for 2024, based on an $80-90 Brent crude price, are critical figures for assessing the company's financial health and operational efficiency. Adjusted EBITDA is a measure often used to evaluate a company's operating performance without the need to factor in financing decisions, accounting decisions, or tax environments. GeoPark's projection of generating substantial free cash flow also suggests that it could maintain or increase its capital return to shareholders, which is a crucial consideration for dividend investors.

GeoPark's divestment of non-core assets in Chile can be seen as a strategic move to streamline operations and focus on more profitable ventures. This is a common strategy for energy companies aiming to optimize their portfolio and concentrate on areas with higher netbacks, which is the revenue from selling a barrel of oil after production costs and royalties. The divestment may also reduce operational complexities and enhance overall corporate efficiency.

GeoPark's exploration success, especially in the strategic Llanos 34 Block and CPO-5 Block, is notable for its potential to add reserves and production capacity. The success rate of drilled wells and the opening of new drilling opportunities are key indicators of a company's future production potential. The successful horizontal drilling campaign is particularly relevant, as horizontal drilling is a technique that allows for increased exposure to the resource and can lead to higher production rates compared to traditional vertical wells.

Meanwhile, the focus on delineating new plays and the upcoming independent reserves certification are pivotal for the long-term sustainability of production. The certification can validate the company's reported reserves, which is a vital factor in assessing the company's asset value and growth trajectory. The emphasis on conventional, short-cycle development projects aligns with industry trends favoring projects with quicker returns on investment, especially in a volatile oil price environment.

Quarterly Production up

Shareholder Returns Exceeded Full-year Targets

Recent Exploration Successes in

Oil and Gas Production and Operations

-

Quarterly average oil and gas production of 38,315 boepd, up

10% vs 3Q2023, due to recent exploration successes and the resumption of shut-in production in the CPO-5 Block (GeoPark non-operated,30% WI) - Annual average oil and gas production of 36,563 boepd

- 2023 exit production of 38,361 boepd

- 11 rigs in operation in December 2023 (5 drilling rigs and 6 workover rigs)

-

48 gross wells1 drilled in 2023 with a

75% success rate2

2023 Exploration Drilling Added 5,500+ bopd Gross and Opened New Drilling Opportunities

-

Four successful exploration wells in the Llanos 123 and Llanos 87 blocks (GeoPark operated,

50% WI), added 2,880 bopd gross and included Toritos, a new stratigraphic play in the Paleocene -

Three successful wells in the new combined structural/stratigraphic U-sand play in the Perico Block (GeoPark non-operated,

50% WI) inEcuador added 2,086 bopd gross in aggregate - Two successful exploration wells in the CPO-5 Block with the Perico 1 well currently testing 650 bopd gross and the Halcon 1 well to resume testing in late January 2024, both targeting the stratigraphic Paleocene play and trend in the northern part of the block

- GeoPark’s 2024 drilling campaign will continue delineating the new plays opened in 2023

Successful Horizontal Well Drilling Campaign in the Llanos 34 Block (GeoPark operated,

- Two horizontal wells drilled and put on production in 4Q2023

- Five horizontal wells drilled and put on production in 2023 currently producing 10,060 bopd gross3 in aggregate

- Targeting to drill 2-3 additional horizontal wells in 1Q2024

Exceeded Shareholder Return Targets and Maintained a Strong Balance Sheet

-

Returned

$61.2 million 13% capital return yield4, significantly exceeding the 40-50% free cash flow return target -

Shareholder returns included

$30.0 million 6% dividend yield5, and$31.2 million 5.5% of total shares outstanding) -

Renewed share buyback program for up to

10% of shares outstanding to December 2024 -

Cash and cash equivalents of

$133 million $106 million

Portfolio Management

-

Divesting non-core and low-netback operations in

Chile , expected to close in 1Q20247

2024 Work Program: Growing Production, Delineating New Plays and Returning Value

-

2024 production guidance of 37,000-40,000 boepd8 (assuming no production from the exploration drilling program), 1

-9% production growth9 versus full-year 2023 -

Self-funded 2024 capital expenditure program of

$150 -200 million -

GeoPark expects to generate Adjusted EBITDA10 of

$420 -550 million$90 -160 million$80 -90 -

Targeting to return approximately 40

-50% of free cash flow after taxes to shareholders

Upcoming Catalysts

- Drilling and testing 12-14 gross wells in 1Q2024, targeting attractive conventional, short-cycle development, appraisal and exploration projects

-

Key projects include:

- Llanos 34 Block: Drilling 2-3 additional horizontal wells

- CPO-5 Block: Testing the Halcon 1 exploration well and drilling the Indico 3 development well

- Perico Block: Drilling the Perico Norte 5 appraisal well

- New independent reserves certification expected to be released in early February 2024

Breakdown of Quarterly Production by Country

The following table shows production figures for 4Q2023, as compared to 4Q2022:

|

4Q2023 |

4Q2022 |

||||

Total

|

Oil

|

Gas

|

Total

|

% Chg. |

||

|

34,154 |

34,061 |

557 |

33,749 |

|

|

|

1,419 |

1,419 |

- |

1,259 |

|

|

|

1,641 |

345 |

7,774 |

2,291 |

- |

|

|

1,101 |

16 |

6,510 |

1,134 |

- |

|

Total |

38,315 |

35,842 |

14,841 |

38,433 |

- |

|

|

||||||

a) |

Includes royalties and other economic rights paid in kind in |

Quarterly Production

| (boepd) | 4Q2023 |

3Q2023 |

2Q2023 |

1Q2023 |

4Q2022 |

|

34,154 |

31,780 |

33,045 |

32,580 |

33,749 |

||

1,419 |

659 |

634 |

990 |

1,259 |

||

1,641 |

1,565 |

1,690 |

1,988 |

2,291 |

||

1,101 |

774 |

1,212 |

1,020 |

1,134 |

||

| Total a | 38,315 |

34,778 |

36,581 |

36,578 |

38,433 |

|

| Oil | 35,842 |

32,510 |

33,672 |

33,801 |

35,451 |

|

| Gas | 2,473 |

2,268 |

2,909 |

2,777 |

2,982 |

|

a) |

In |

Oil and Gas Production Update

Consolidated:

Average net oil and gas production in 4Q2023 was 38,315 boepd, flat compared to 4Q2022, due to higher production in

Compared to 3Q2023, consolidated oil and gas production increased

Average net oil and gas production in

Oil and gas production in GeoPark’s main blocks in

-

Llanos 34 Block net average production decreased by

2% to 24,147 bopd (or 53,660 bopd gross) in 4Q2023 compared to 4Q2022, mainly due to the natural decline of the fields, partially offset by development drilling activities including the successful horizontal well drilling campaign -

CPO-5 Block net average production increased by

12% to 6,820 bopd (or 22,734 bopd gross) in 4Q2023 compared to 4Q2022, mainly due to the reopening of the Indico 6 and Indico 7 wells in late September 2023 -

Platanillo Block average production decreased by

28% to 1,658 bopd in 4Q2023 compared to 4Q2022, due to the natural decline of the fields and to a lesser extent a damaged injector well - Llanos 123 Block net average production was 1,083 bopd (or 2,166 bopd gross) in 4Q2023, reflecting production from the Saltador 1 exploration well and partial production from the Toritos 1 and Bisbita Centro 1 exploration wells that were put on production during 4Q2023

Recent Activity in the Llanos Basin

Llanos 34 Block

- Two horizontal wells were drilled and put on production during 4Q2023 and a total of five horizontal wells were put on production in full-year 2023 and are currently producing approximately 10,060 bopd gross11 in aggregate

- GeoPark plans to drill 2-3 additional horizontal wells in 1Q2024

CPO-5 Block

- The Halcon 1 exploration well reached total depth in late October 2023 with preliminary logging information indicating hydrocarbon potential in the Paleocene (Guadalupe) formation. Initial production tests showed intermittent flow rates. A build-up test indicated potential well damage which could be affecting well productivity. A workover is planned to repair damage and resume testing activities in late January 2024

-

The Perico 1 exploration well reached total depth in December 2023 with preliminary logging information indicating hydrocarbon potential in the Barco (Guadalupe) formation. Testing activities started on January 10th, 2024 and the well is currently producing 650 bopd of 14 degrees API with a water cut of

8% - Preliminary activities are currently ongoing to acquire 230 square kilometers of 3D seismic in the northeastern part of the block which is expected to add more prospects to GeoPark’s organic exploration inventory

Llanos 123 Block

-

The Bisbita Centro 1 exploration well reached total depth in November 2023 with logging information indicating hydrocarbon potential in the Paleocene (Guadalupe) formation. Testing activities started in late November 2023 and the well is currently producing approximately 750 bopd of 19 degrees API with a water cut of less than

1% - The Bisbita Centro 1 well is the third successful exploration well drilled by GeoPark in the Llanos 123 Block in 2023, following the Saltador 1 and the Toritos 1 exploration wells that initiated testing in July and October 2023, respectively

Llanos 87 Block

-

The Zorzal Este 1 exploration well reached total depth in November 2023 with logging information indicating hydrocarbon potential in the Paleocene (Guadalupe) formation. Testing activities started in late November 2023 and the well is currently producing approximately 575 bopd of 33 degrees API with a water cut of

1%

Llanos 86 and Llanos 104 blocks (GeoPark operated,

- The Llanos 86 and Llanos 104 blocks are adjacent to the eastern side of the CPO-5 Block

- Initial activities have been carried out to acquire over 650 square kilometers of 3D seismic

-

Once executed, this project would be one of the three biggest onshore seismic acquisition projects in

Colombia and is expected to add further prospects to GeoPark’s organic exploration inventory

Average net oil production in

The Government’s production share varies with oil prices and is approximately 30

Average net production in

The production mix was

Average net production in the Manati field (GeoPark non-operated,

The production mix was

Other News

Divesting Non-Core Operations in

In December 2023, GeoPark signed an agreement with Servicom Chile SPA to divest its non-core and low-netback operations in

In 2023, GeoPark’s operations in

GeoPark’s 2024 consolidated average production guidance of 37,000-40,000 boepd does not consider the

1 |

Including operated and non-operated wells. |

2 |

Including development, appraisal and exploration wells. Does not include injector wells and wells that are currently under evaluation. |

3 |

Average production from December 1, 2023, to December 31, 2023. |

4 |

Based on GeoPark’s average market capitalization from December 1 to December 29, 2023. |

5 |

Based on GeoPark’s average market capitalization from December 1 to December 29, 2023. |

6 |

Unaudited. |

7 |

GeoPark will no longer report production from |

8 |

GeoPark’s 2024 consolidated production guidance includes 1,000-1,300 boepd of production in |

9 |

Calculated using GeoPark’s actual average production in 2023 and for 2024, the consolidated production guidance, the latter of which includes production in |

10 |

The Company is unable to present a quantitative reconciliation of the 2024 Adjusted EBITDA which is a forward-looking non-GAAP measure, because the Company cannot reliably predict certain of the necessary components, such as write-off of unsuccessful exploration efforts or impairment loss on non-financial assets, etc. Since free cash flow is calculated based on Adjusted EBITDA, for similar reasons, the Company does not provide a quantitative reconciliation of the 2024 free cash flow forecast. |

|

|

11 |

Average production from December 1, 2023, to December 31, 2023. |

NOTICE

Additional information about GeoPark can be found in the “Invest with Us” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts and percentages included in this press release have been rounded for ease of presentation. Percentages included in this press release have not in all cases been calculated on the basis of such rounded amounts, but on the basis of such amounts prior to rounding. For this reason, certain percentages in this press release may vary from those obtained by performing the same calculations on the basis of the amounts in the financial statements. Similarly, certain other amounts included in this press release may not sum due to rounding.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this press release can be identified by the use of forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations, regarding various matters, including, drilling campaign, production guidance, shareholder returns, Adjusted EBITDA, capital expenditures and free cash flow. Forward-looking statements are based on management’s beliefs and assumptions, and on information currently available to the management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors.

Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to reflect the occurrence of unanticipated events. For a discussion of the risks facing the Company which could affect whether these forward-looking statements are realized, see filings with the

Oil and gas production figures included in this release are stated before the effect of royalties paid in kind, consumption and losses. Annual production per day is obtained by dividing total production by 365 days.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240116601367/en/

For further information, please contact:

INVESTORS:

Stacy Steimel ssteimel@geo-park.com

Shareholder Value Director

T: +562 2242 9600

Miguel Bello mbello@geo-park.com

Market Access Director

T: +562 2242 9600

Diego Gully dgully@geo-park.com

Capital Markets Director

T: +55 21 99636 9658

MEDIA:

Communications Department communications@geo-park.com

Source: GeoPark Limited

FAQ

What is the ticker symbol for GeoPark Limited?

What was the percentage increase in quarterly production for GeoPark Limited?

What was the cash and cash equivalents for GeoPark Limited as of December 31, 2023?

What is the 2024 production guidance for GeoPark Limited?