Cerro de Pasco Resources Announces New Results from Quiulacocha Silver-Zinc-Lead Zone, Revealing Significant Increase in Gallium Levels

Rhea-AI Summary

Cerro de Pasco Resources (GPPRF) has reported assay results from eight additional drill holes at its Quiulacocha Tailings Project in Central Peru. The results reveal significant metal content across 800 meters of the drilled area, with notable intersections in the silver-zinc-lead zone including:

- Consistent silver grades ranging from 39-52 g/t

- Zinc levels between 1.22-1.54%

- Lead content of 0.84-1.17%

- Notably high gallium concentrations of 58-84 g/t

The company highlighted the increasing presence of gallium, particularly in the southern section where grades nearly double the northern averages. This discovery is considered strategically important following China's recent export restrictions, which have caused gallium prices to surge. The drilling program completed 40 holes, with samples being analyzed at Inspectorate Services Lab in Lima.

Positive

- High gallium concentrations discovered (58-84 g/t), offering new revenue potential

- Consistent precious and base metals content across 800m drilling area

- Strategic timing with gallium market disruption due to China export restrictions

- Project requires minimal mining costs due to surface-level material

- Adjacent processing plants available for immediate reprocessing

Negative

- None.

News Market Reaction

On the day this news was published, GPPRF gained 4.27%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

MONTREAL, Jan. 07, 2025 (GLOBE NEWSWIRE) -- Cerro de Pasco Resources Inc. (CSE: CDPR) (OTCQB: GPPRF) (FRA: N8HP) (“CDPR” or the “Company”) is pleased to report assay results for an additional eight drill holes from the Quiulacocha Tailings Project in Central Peru.

Highlights - All intersections are in core lengths from surface and correspond to the predominant silver-zinc-lead zone in the northern section of the Quiulacocha deposit:

- Hole SPT10 intersected 31 meters (“m”) at 47 grams per tonne (“g/t”) silver (“Ag”),

1.30% zinc (“Zn”),0.87% Lead (“Pb”), and 58 g/t gallium (“Ga”)- Including a 5 m intersection at

0.21% copper (“Cu”) and 0.43 g/t gold (“Au”)

- Including a 5 m intersection at

- Hole SPT11 intersected 27 m at 43 g/t Ag,

1.22% Zn,0.84% Pb, and 64 g/t Ga- Including a 3 m intersection at

0.20% Cu and 0.23 g/t Au

- Including a 3 m intersection at

- Hole SPT21 intersected 27 m at 45 g/t Ag,

1.29% Zn,0.81% Pb, and 59 g/t Ga- Including a 2 m intersection at

0.21% Cu and 0.23 g/t Au

- Including a 2 m intersection at

- Hole SPT22 intersected 26 m at 46 g/t Ag,

1.26% Zn,0.98% Pb, and 69 g/t Ga- Including a 2 m intersection at

0.25% Cu and 0.19 g/t Au

- Including a 2 m intersection at

- Hole SPT23 intersected 28 m at 53 g/t Ag,

1.53% Zn,1.12% Pb, and 83 g/t Ga- Including a 5 m intersection at

0.31% Cu and 0.32 g/t Au

- Including a 5 m intersection at

- Hole SPT32 intersected 31 m at 47 g/t Ag,

1.26% Zn,0.89% Pb, and 65 g/t Ga - Hole SPT1_1 intersected 26 m at 52 g/t Ag,

1.54% Zn,1.17% Pb, and 84 g/t Ga- Including a 1 m intersection at

0.31% Cu and 0.12 g/t Au

- Including a 1 m intersection at

- Hole SPT1_2 intersected 16 m at 48 g/t Ag,

1.39% Zn,0.99% Pb, and 65 g/t Ga

"Today’s drillhole results are highly encouraging and exceed our initial expectations," stated Guy Goulet, CEO. "Drillholes intersected Cu-Ag-Au tailings with grades reaching

"The consistent and increasing presence of gallium, a critical metal essential for advanced electronics and renewable energy technologies, adds significant potential to the project’s economics. Gallium’s importance has risen sharply following China's recent export restrictions to the US and other nations, which have caused prices to surge and underscored its strategic value in global supply chains. This geopolitical shift highlights the growing demand for secure and diversified sources of gallium, positioning our findings as particularly timely."

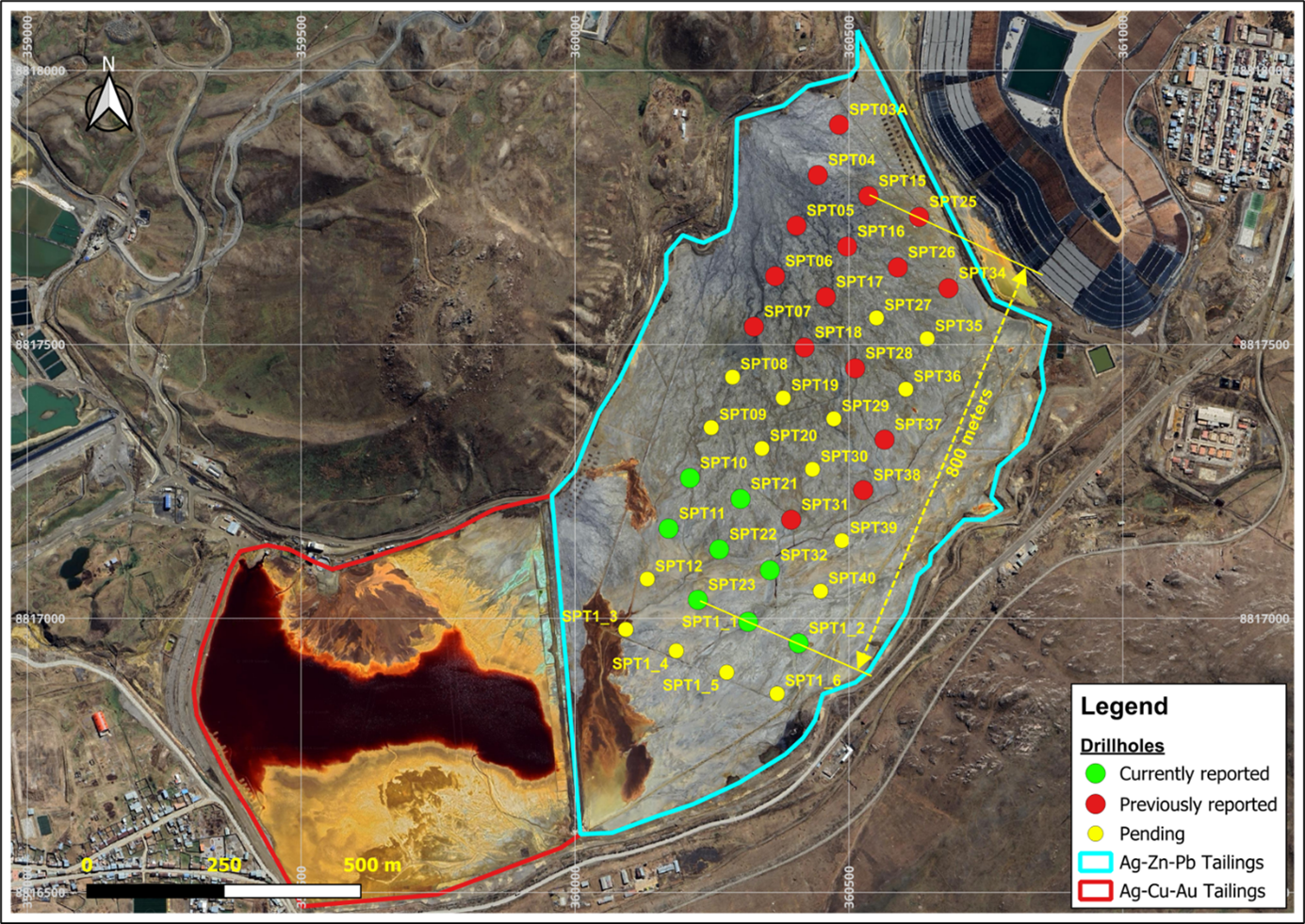

The results demonstrate that the metal content is continuous at depth and laterally across 800 meters of the drilled area (Figure 1). The assay results for each of the eight drill holes are presented in Tables 1 to 8.

The Iron results also indicate a consistent presence of pyrite throughout the deposit. Pyrite (indicatively

Figure 1: 40-hole Quiulacocha Drill Program showing drillholes related to this press release

Table 1. Assay results, Drillhole SPT10

| Drillholes: SPT10 | ||||||||||

| From | To | Ag (oz/t) | Ag (g/t) | % Zn | % Pb | % Cu | Au (g/t) | Ga (g/t) | In (g/t) | % Fe |

| 0 | 1 | 1.63 | 50.70 | 0.51 | 0.65 | 0.05 | 0.04 | 58.76 | 22.68 | 27.04 |

| 1 | 2 | 1.19 | 37.01 | 0.94 | 0.58 | 0.03 | 0.03 | 42.92 | 21.21 | 26.28 |

| 2 | 3 | 1.47 | 45.72 | 1.11 | 0.77 | 0.04 | 0.02 | 75.84 | 7.32 | 25.93 |

| 3 | 4 | 1.22 | 37.95 | 0.83 | 0.54 | 0.03 | 0.02 | 45.12 | 21.33 | 27.42 |

| 4 | 5 | 1.22 | 37.95 | 0.84 | 0.54 | 0.03 | 0.02 | 48.60 | 20.85 | 26.43 |

| 5 | 6 | 1.27 | 39.50 | 0.87 | 0.60 | 0.04 | 0.02 | 47.76 | 22.52 | 27.06 |

| 6 | 7 | 1.42 | 44.17 | 1.01 | 0.64 | 0.05 | 0.03 | 58.96 | 22.97 | 28.60 |

| 7 | 8 | 1.45 | 45.10 | 1.02 | 0.70 | 0.05 | 0.02 | 60.56 | 22.37 | 28.59 |

| 8 | 9 | 1.46 | 45.41 | 1.15 | 0.64 | 0.06 | 0.02 | 70.53 | 22.79 | 26.00 |

| 9 | 10 | 1.48 | 46.03 | 1.25 | 0.75 | 0.07 | 0.03 | 66.88 | 22.21 | 26.21 |

| 10 | 11 | 1.65 | 51.32 | 1.41 | 1.07 | 0.09 | 0.03 | 68.68 | 11.56 | 26.90 |

| 11 | 12 | 1.38 | 42.92 | 1.14 | 0.69 | 0.06 | 0.03 | 58.30 | 19.99 | 26.95 |

| 12 | 13 | 1.73 | 53.81 | 2.02 | 1.95 | 0.10 | 0.03 | 97.38 | 10.24 | 25.84 |

| 13 | 14 | 1.70 | 52.88 | 1.86 | 1.73 | 0.09 | 0.03 | 95.79 | 13.16 | 24.55 |

| 14 | 15 | 1.92 | 59.72 | 2.18 | 2.54 | 0.15 | 0.05 | 105.00 | 15.80 | 24.40 |

| 15 | 16 | 1.52 | 47.28 | 1.48 | 1.11 | 0.10 | 0.05 | 53.80 | 29.86 | 27.14 |

| 16 | 17 | 1.37 | 42.61 | 1.28 | 0.85 | 0.08 | 0.05 | 50.12 | 20.76 | 27.03 |

| 17 | 18 | 1.33 | 41.37 | 1.18 | 0.64 | 0.07 | 0.06 | 41.84 | 18.58 | 27.25 |

| 18 | 19 | 1.28 | 39.81 | 1.29 | 0.63 | 0.09 | 0.09 | 35.51 | 18.88 | 27.26 |

| 19 | 20 | 1.32 | 41.06 | 1.37 | 0.67 | 0.09 | 0.09 | 32.08 | 18.08 | 27.27 |

| 20 | 21 | 1.36 | 42.30 | 1.43 | 0.75 | 0.09 | 0.07 | 42.68 | 19.15 | 27.03 |

| 21 | 22 | 1.52 | 47.28 | 1.43 | 0.68 | 0.16 | 0.18 | 51.61 | 20.32 | 27.24 |

| 22 | 23 | 1.42 | 44.17 | 1.21 | 0.64 | 0.13 | 0.18 | 47.43 | 17.72 | 26.98 |

| 23 | 24 | 1.26 | 39.19 | 1.16 | 0.44 | 0.09 | 0.15 | 19.93 | 15.05 | 28.72 |

| 24 | 25 | 1.40 | 43.54 | 1.15 | 0.57 | 0.13 | 0.20 | 41.14 | 15.46 | 26.35 |

| 25 | 26 | 1.47 | 45.72 | 1.32 | 0.60 | 0.15 | 0.20 | 43.12 | 18.46 | 27.78 |

| 26 | 27 | 1.68 | 52.25 | 1.29 | 0.70 | 0.20 | 0.37 | 60.50 | 18.28 | 26.40 |

| 27 | 28 | 1.98 | 61.58 | 1.74 | 1.30 | 0.24 | 0.45 | 90.24 | 10.28 | 25.98 |

| 28 | 29 | 1.76 | 54.74 | 1.73 | 1.02 | 0.21 | 0.44 | 61.78 | 21.97 | 25.35 |

| 29 | 30 | 1.90 | 59.10 | 1.35 | 0.61 | 0.21 | 0.42 | 41.32 | 16.57 | 33.71 |

| 30 | 31 | 2.19 | 68.12 | 1.65 | 1.37 | 0.27 | 0.44 | 79.02 | 9.24 | 25.39 |

| Mean | 1.51 | 47.11 | 1.30 | 0.87 | 0.10 | 0.12 | 57.85 | 18.25 | 26.94 | |

Table 2. Assay results, Drillhole SPT11

| Drillholes: SPT11 | ||||||||||

| From | To | Ag (oz/t) | Ag (g/t) | % Zn | % Pb | % Cu | Au (g/t) | Ga (g/t) | In (g/t) | % Fe |

| 0 | 1 | 1.29 | 40.12 | 1.25 | 1.37 | 0.05 | 0.04 | 75.01 | 19.92 | 22.83 |

| 1 | 2 | 1.03 | 32.04 | 1.32 | 0.83 | 0.03 | 0.02 | 44.94 | 23.46 | 25.53 |

| 2 | 3 | 1.41 | 43.86 | 1.17 | 1.29 | 0.05 | 0.02 | 111.00 | 19.84 | 22.42 |

| 3 | 4 | 1.29 | 40.12 | 1.03 | 0.80 | 0.05 | 0.03 | 88.79 | 30.66 | 25.68 |

| 4 | 5 | 1.22 | 37.95 | 1.17 | 0.92 | 0.04 | 0.03 | 103.00 | 21.48 | 24.35 |

| 5 | 6 | 1.24 | 38.57 | 0.97 | 0.74 | 0.04 | 0.02 | 89.88 | 20.80 | 26.66 |

| 6 | 7 | 1.14 | 35.46 | 0.92 | 0.67 | 0.05 | 0.03 | 72.91 | 18.48 | 25.70 |

| 7 | 8 | 1.26 | 39.19 | 1.07 | 0.73 | 0.05 | 0.02 | 77.53 | 18.68 | 26.01 |

| 8 | 9 | 1.26 | 39.19 | 1.02 | 0.70 | 0.05 | 0.02 | 71.36 | 19.52 | 25.99 |

| 9 | 10 | 1.53 | 47.59 | 1.19 | 0.86 | 0.06 | 0.02 | 72.74 | 18.32 | 24.88 |

| 10 | 11 | 1.55 | 48.21 | 1.28 | 1.09 | 0.08 | 0.03 | 69.96 | 7.16 | 26.90 |

| 11 | 12 | 1.52 | 47.28 | 0.94 | 0.71 | 0.06 | 0.03 | 42.29 | 21.04 | 28.07 |

| 12 | 13 | 1.55 | 48.21 | 1.25 | 1.07 | 0.06 | 0.03 | 62.16 | 24.88 | 26.59 |

| 13 | 14 | 1.43 | 44.48 | 1.39 | 1.22 | 0.08 | 0.02 | 85.32 | 6.60 | 24.34 |

| 14 | 15 | 1.50 | 46.66 | 1.27 | 0.83 | 0.06 | 0.03 | 70.52 | 7.68 | 26.53 |

| 15 | 16 | 1.47 | 45.72 | 1.52 | 1.64 | 0.16 | 0.07 | 92.00 | 11.96 | 26.17 |

| 16 | 17 | 1.45 | 45.10 | 1.12 | 0.71 | 0.09 | 0.07 | 47.52 | 22.30 | 28.58 |

| 17 | 18 | 1.27 | 39.50 | 1.10 | 0.58 | 0.10 | 0.10 | 35.20 | 21.48 | 28.90 |

| 18 | 19 | 1.35 | 41.99 | 1.43 | 0.60 | 0.10 | 0.08 | 33.44 | 20.52 | 27.42 |

| 19 | 20 | 1.52 | 47.28 | 1.19 | 0.70 | 0.19 | 0.21 | 55.52 | 20.35 | 24.90 |

| 20 | 21 | 1.61 | 50.08 | 1.45 | 0.60 | 0.20 | 0.19 | 43.56 | 21.05 | 28.10 |

| 21 | 22 | 1.58 | 49.14 | 1.03 | 0.77 | 0.22 | 0.29 | 87.64 | 22.46 | 27.54 |

| 22 | 23 | 1.52 | 47.28 | 1.32 | 0.64 | 0.16 | 0.19 | 40.28 | 20.83 | 27.72 |

| 23 | 24 | 1.57 | 48.83 | 1.81 | 0.68 | 0.17 | 0.18 | 36.40 | 23.72 | 28.97 |

| 24 | 25 | 0.93 | 28.93 | 1.05 | 0.65 | 0.03 | 0.02 | 37.84 | 4.92 | 25.78 |

| 25 | 26 | 0.87 | 27.06 | 1.11 | 0.56 | 0.02 | 0.02 | 41.64 | 20.65 | 25.70 |

| 26 | 27 | 1.66 | 51.63 | 1.50 | 0.67 | 0.23 | 0.22 | 49.36 | 21.73 | 26.22 |

| Mean | 1.37 | 42.65 | 1.22 | 0.84 | 0.09 | 0.08 | 64.36 | 18.91 | 26.24 | |

Table 3. Assay results, Drillhole SPT21

| Drillholes: SPT21 | ||||||||||

| From | To | Ag (oz/t) | Ag (g/t) | % Zn | % Pb | % Cu | Au (g/t) | Ga (g/t) | In (g/t) | % Fe |

| 0 | 1 | 1.33 | 41.37 | 0.85 | 1.20 | 0.06 | 0.04 | 73.17 | 10.60 | 25.53 |

| 1 | 2 | 1.23 | 38.26 | 1.35 | 1.16 | 0.05 | 0.04 | 63.54 | 24.31 | 25.87 |

| 2 | 3 | 1.31 | 40.75 | 1.32 | 1.28 | 0.05 | 0.04 | 75.37 | 23.22 | 25.11 |

| 3 | 4 | 1.23 | 38.26 | 1.05 | 0.68 | 0.03 | 0.03 | 46.45 | 22.86 | 27.29 |

| 4 | 5 | 1.19 | 37.01 | 1.06 | 0.66 | 0.03 | 0.03 | 50.95 | 21.00 | 25.98 |

| 5 | 6 | 1.41 | 43.86 | 1.09 | 0.60 | 0.04 | 0.03 | 56.01 | 22.52 | 28.73 |

| 6 | 7 | 1.33 | 41.37 | 1.02 | 0.58 | 0.04 | 0.03 | 62.08 | 21.95 | 27.13 |

| 7 | 8 | 1.16 | 36.08 | 0.86 | 0.47 | 0.03 | 0.03 | 52.49 | 21.04 | 27.22 |

| 8 | 9 | 1.47 | 45.72 | 1.27 | 0.80 | 0.06 | 0.03 | 76.16 | 24.86 | 24.87 |

| 9 | 10 | 1.51 | 46.97 | 1.33 | 1.02 | 0.07 | 0.03 | 76.65 | 24.64 | 26.81 |

| 10 | 11 | 1.46 | 45.41 | 1.14 | 0.71 | 0.06 | 0.02 | 67.28 | 21.31 | 26.85 |

| 11 | 12 | 1.53 | 47.59 | 1.20 | 0.73 | 0.06 | 0.02 | 69.78 | 22.87 | 26.03 |

| 12 | 13 | 1.70 | 52.88 | 1.89 | 2.07 | 0.11 | 0.04 | 107.00 | 13.20 | 24.98 |

| 13 | 14 | 1.72 | 53.50 | 1.27 | 0.73 | 0.07 | 0.02 | 75.42 | 22.74 | 26.18 |

| 14 | 15 | 1.52 | 47.28 | 1.14 | 1.31 | 0.09 | 0.04 | 78.48 | 11.56 | 26.55 |

| 15 | 16 | 1.72 | 53.50 | 1.13 | 0.78 | 0.08 | 0.03 | 71.12 | 23.32 | 28.12 |

| 16 | 17 | 1.34 | 41.68 | 1.10 | 0.68 | 0.06 | 0.04 | 49.04 | 20.43 | 28.53 |

| 17 | 18 | 1.42 | 44.17 | 1.27 | 0.67 | 0.08 | 0.07 | 49.40 | 20.79 | 28.47 |

| 18 | 19 | 1.38 | 42.92 | 1.35 | 0.72 | 0.10 | 0.07 | 43.00 | 21.04 | 28.19 |

| 19 | 20 | 1.42 | 44.17 | 1.65 | 0.87 | 0.10 | 0.08 | 42.60 | 22.06 | 29.85 |

| 20 | 21 | 1.50 | 46.66 | 1.29 | 0.65 | 0.18 | 0.27 | 49.12 | 19.83 | 27.54 |

| 21 | 22 | 1.40 | 43.54 | 1.39 | 0.66 | 0.10 | 0.10 | 42.00 | 18.84 | 27.90 |

| 22 | 23 | 1.45 | 45.10 | 1.36 | 0.64 | 0.11 | 0.11 | 41.44 | 18.47 | 29.22 |

| 23 | 24 | 1.46 | 45.41 | 1.44 | 0.65 | 0.13 | 0.16 | 43.44 | 20.62 | 27.34 |

| 24 | 25 | 1.46 | 45.41 | 1.42 | 0.60 | 0.15 | 0.20 | 40.88 | 18.87 | 27.53 |

| 25 | 26 | 1.46 | 45.41 | 1.85 | 0.52 | 0.22 | 0.20 | 41.56 | 19.39 | 24.49 |

| 26 | 27 | 1.54 | 47.90 | 1.61 | 0.54 | 0.19 | 0.25 | 40.48 | 18.93 | 26.87 |

| Mean | 1.43 | 44.52 | 1.29 | 0.81 | 0.09 | 0.08 | 58.70 | 20.42 | 27.01 | |

Table 4. Assay results, Drillhole SPT22

| Drillholes: SPT22 | ||||||||||

| From | To | Ag (oz/t) | Ag (g/t) | % Zn | % Pb | % Cu | Au (g/t) | Ga (g/t) | In (g/t) | % Fe |

| 0 | 1 | 1.58 | 49.14 | 0.41 | 1.58 | 0.03 | 0.05 | 96.32 | 23.48 | 20.47 |

| 1 | 2 | 1.43 | 44.48 | 1.44 | 1.21 | 0.05 | 0.02 | 120.00 | 13.44 | 24.04 |

| 2 | 3 | 1.34 | 41.68 | 1.25 | 1.08 | 0.05 | 0.02 | 105.00 | 30.55 | 24.59 |

| 3 | 4 | 1.19 | 37.01 | 1.33 | 1.13 | 0.05 | 0.02 | 122.00 | 12.32 | 24.26 |

| 4 | 5 | 1.36 | 42.30 | 1.02 | 0.77 | 0.04 | 0.02 | 79.97 | 25.76 | 27.14 |

| 5 | 6 | 1.32 | 41.06 | 1.03 | 0.63 | 0.04 | 0.02 | 59.72 | 22.06 | 27.73 |

| 6 | 7 | 1.54 | 47.90 | 1.08 | 0.66 | 0.05 | 0.03 | 61.04 | 21.77 | 29.28 |

| 7 | 8 | 1.50 | 46.66 | 1.11 | 0.68 | 0.05 | 0.02 | 64.52 | 21.07 | 29.25 |

| 8 | 9 | 1.40 | 43.54 | 1.24 | 0.85 | 0.06 | 0.02 | 56.12 | 21.43 | 26.22 |

| 9 | 10 | 1.46 | 45.41 | 1.16 | 0.85 | 0.06 | 0.02 | 65.96 | 23.44 | 28.95 |

| 10 | 11 | 1.74 | 54.12 | 1.70 | 1.62 | 0.11 | 0.03 | 91.64 | 13.32 | 26.23 |

| 11 | 12 | 1.58 | 49.14 | 1.62 | 1.59 | 0.08 | 0.03 | 96.92 | 13.68 | 27.30 |

| 12 | 13 | 1.76 | 54.74 | 1.65 | 1.80 | 0.10 | 0.03 | 100.00 | 39.16 | 25.94 |

| 13 | 14 | 1.67 | 51.94 | 1.11 | 0.82 | 0.07 | 0.03 | 74.00 | 25.16 | 27.39 |

| 14 | 15 | 1.59 | 49.45 | 1.20 | 0.95 | 0.08 | 0.03 | 63.05 | 24.18 | 26.87 |

| 15 | 16 | 1.48 | 46.03 | 1.44 | 1.20 | 0.10 | 0.07 | 56.32 | 26.60 | 28.52 |

| 16 | 17 | 1.58 | 49.14 | 1.45 | 1.22 | 0.09 | 0.05 | 57.42 | 23.30 | 28.14 |

| 17 | 18 | 1.43 | 44.48 | 1.20 | 0.78 | 0.08 | 0.06 | 45.85 | 21.96 | 27.39 |

| 18 | 19 | 1.25 | 38.88 | 1.06 | 0.71 | 0.09 | 0.08 | 37.71 | 21.34 | 26.73 |

| 19 | 20 | 1.36 | 42.30 | 1.15 | 0.81 | 0.09 | 0.07 | 53.05 | 24.58 | 27.13 |

| 20 | 21 | 1.51 | 46.97 | 1.37 | 0.73 | 0.11 | 0.08 | 37.97 | 21.90 | 28.88 |

| 21 | 22 | 1.55 | 48.21 | 1.49 | 0.97 | 0.13 | 0.07 | 45.45 | 24.83 | 29.14 |

| 22 | 23 | 1.27 | 39.50 | 1.03 | 0.59 | 0.11 | 0.09 | 31.33 | 18.19 | 27.87 |

| 23 | 24 | 1.45 | 45.10 | 1.38 | 0.63 | 0.13 | 0.08 | 30.23 | 21.66 | 28.75 |

| 24 | 25 | 1.52 | 47.28 | 1.52 | 0.60 | 0.17 | 0.12 | 36.21 | 21.02 | 28.37 |

| 25 | 26 | 1.59 | 49.45 | 1.22 | 1.13 | 0.32 | 0.25 | 96.01 | 31.18 | 25.16 |

| Mean | 1.48 | 46.00 | 1.26 | 0.98 | 0.09 | 0.05 | 68.61 | 22.59 | 26.99 | |

Table 5. Assay results, Drillhole SPT23

| Drillholes: SPT23 | ||||||||||

| From | To | Ag (oz/t) | Ag (g/t) | % Zn | % Pb | % Cu | Au (g/t) | Ga (g/t) | In (g/t) | % Fe |

| 0 | 1 | 2.49 | 77.45 | 2.88 | 1.47 | 0.07 | 0.04 | 102.00 | 10.84 | 22.79 |

| 1 | 2 | 1.91 | 59.41 | 3.15 | 1.71 | 0.07 | 0.04 | 103.00 | 9.76 | 23.68 |

| 2 | 3 | 2.51 | 78.07 | 3.14 | 1.80 | 0.09 | 0.04 | 104.00 | 10.04 | 24.96 |

| 3 | 4 | 1.75 | 54.43 | 2.23 | 1.48 | 0.07 | 0.03 | 136.00 | 9.80 | 24.02 |

| 4 | 5 | 1.55 | 48.21 | 1.40 | 1.17 | 0.06 | 0.02 | 140.00 | 8.84 | 24.10 |

| 5 | 6 | 1.49 | 46.34 | 1.14 | 0.78 | 0.05 | 0.02 | 73.69 | 6.76 | 25.83 |

| 6 | 7 | 1.53 | 47.59 | 1.14 | 0.82 | 0.05 | 0.02 | 87.49 | 6.88 | 26.98 |

| 7 | 8 | 1.77 | 55.05 | 1.42 | 0.82 | 0.07 | 0.03 | 72.06 | 5.68 | 26.71 |

| 8 | 9 | 1.79 | 55.68 | 1.48 | 0.76 | 0.07 | 0.03 | 63.90 | 5.96 | 26.22 |

| 9 | 10 | 1.68 | 52.25 | 1.34 | 0.87 | 0.08 | 0.03 | 83.04 | 6.20 | 26.31 |

| 10 | 11 | 1.69 | 52.56 | 1.29 | 0.72 | 0.07 | 0.03 | 57.51 | 21.39 | 25.49 |

| 11 | 12 | 1.70 | 52.88 | 1.41 | 1.03 | 0.08 | 0.03 | 74.48 | 22.95 | 26.61 |

| 12 | 13 | 1.71 | 53.19 | 1.41 | 1.07 | 0.08 | 0.03 | 77.85 | 15.00 | 26.94 |

| 13 | 14 | 1.91 | 59.41 | 1.77 | 2.00 | 0.13 | 0.04 | 104.00 | 15.84 | 24.95 |

| 14 | 15 | 1.57 | 48.83 | 1.80 | 2.04 | 0.13 | 0.05 | 123.00 | 11.96 | 25.14 |

| 15 | 16 | 1.27 | 39.50 | 1.28 | 1.30 | 0.11 | 0.08 | 59.71 | 22.68 | 26.51 |

| 16 | 17 | 1.38 | 42.92 | 1.11 | 0.93 | 0.11 | 0.09 | 56.41 | 24.31 | 31.36 |

| 17 | 18 | 1.33 | 41.37 | 1.19 | 1.20 | 0.14 | 0.08 | 68.82 | 24.74 | 26.28 |

| 18 | 19 | 1.23 | 38.26 | 1.17 | 0.89 | 0.12 | 0.08 | 50.78 | 22.20 | 25.84 |

| 19 | 20 | 1.24 | 38.57 | 1.14 | 0.86 | 0.14 | 0.09 | 57.55 | 20.99 | 25.79 |

| 20 | 21 | 1.41 | 43.86 | 1.30 | 0.76 | 0.16 | 0.11 | 50.89 | 20.61 | 28.34 |

| 21 | 22 | 1.43 | 44.48 | 1.28 | 0.71 | 0.16 | 0.10 | 49.64 | 20.55 | 28.18 |

| 22 | 23 | 1.39 | 43.23 | 1.25 | 0.68 | 0.16 | 0.14 | 50.93 | 20.37 | 27.47 |

| 23 | 24 | 1.42 | 44.17 | 1.29 | 0.81 | 0.23 | 0.20 | 69.26 | 19.98 | 25.23 |

| 24 | 25 | 1.52 | 47.28 | 1.29 | 0.79 | 0.21 | 0.20 | 76.85 | 22.89 | 27.06 |

| 25 | 26 | 2.12 | 65.94 | 1.29 | 1.62 | 0.30 | 0.41 | 151.00 | 17.64 | 25.45 |

| 26 | 27 | 1.95 | 60.65 | 1.28 | 1.03 | 0.26 | 0.38 | 84.20 | 22.42 | 27.05 |

| 27 | 28 | 3.08 | 95.80 | 1.07 | 1.12 | 0.53 | 0.42 | 99.75 | 20.33 | 28.50 |

| Mean | 1.71 | 53.12 | 1.53 | 1.12 | 0.14 | 0.10 | 83.14 | 15.99 | 26.21 | |

Table 6. Assay results, Drillhole SPT32

| Drillholes: SPT32 | ||||||||||

| From | To | Ag (oz/t) | Ag (g/t) | % Zn | % Pb | % Cu | Au (g/t) | Ga (g/t) | In (g/t) | % Fe |

| 0 | 1 | 1.87 | 58.16 | 1.67 | 2.04 | 0.10 | 0.03 | 118.00 | 36.03 | 22.78 |

| 1 | 2 | 1.84 | 57.23 | 1.43 | 1.50 | 0.07 | 0.03 | 123.00 | 37.46 | 23.16 |

| 2 | 3 | 1.21 | 37.64 | 1.15 | 0.96 | 0.05 | 0.02 | 111.00 | 34.57 | 24.65 |

| 3 | 4 | 1.26 | 39.19 | 1.29 | 1.21 | 0.06 | 0.02 | 133.00 | 41.88 | 24.16 |

| 4 | 5 | 1.25 | 38.88 | 1.01 | 0.66 | 0.04 | 0.02 | 93.50 | 28.79 | 26.92 |

| 5 | 6 | 1.47 | 45.72 | 0.96 | 0.62 | 0.04 | 0.02 | 66.35 | 23.97 | 26.83 |

| 6 | 7 | 1.67 | 51.94 | 1.21 | 0.80 | 0.06 | 0.02 | 82.81 | 28.61 | 27.36 |

| 7 | 8 | 1.79 | 55.68 | 1.18 | 0.68 | 0.07 | 0.03 | 65.08 | 25.52 | 28.21 |

| 8 | 9 | 1.62 | 50.39 | 1.19 | 0.67 | 0.07 | 0.03 | 66.79 | 26.12 | 25.88 |

| 9 | 10 | 1.65 | 51.32 | 1.17 | 0.71 | 0.06 | 0.02 | 55.62 | 22.61 | 26.96 |

| 10 | 11 | 1.61 | 50.08 | 1.25 | 0.94 | 0.08 | 0.03 | 63.67 | 26.12 | 26.11 |

| 11 | 12 | 1.53 | 47.59 | 1.25 | 0.97 | 0.06 | 0.03 | 69.65 | 27.23 | 27.06 |

| 12 | 13 | 1.89 | 58.79 | 1.91 | 2.16 | 0.12 | 0.03 | 133.00 | 43.14 | 25.07 |

| 13 | 14 | 1.67 | 51.94 | 1.73 | 1.71 | 0.11 | 0.05 | 83.69 | 37.40 | 26.40 |

| 14 | 15 | 1.60 | 49.77 | 1.28 | 0.96 | 0.07 | 0.03 | 59.62 | 24.89 | 25.53 |

| 15 | 16 | 1.53 | 47.59 | 1.33 | 1.18 | 0.09 | 0.04 | 67.45 | 28.40 | 26.22 |

| 16 | 17 | 1.48 | 46.03 | 1.21 | 0.99 | 0.10 | 0.06 | 58.93 | 27.39 | 26.95 |

| 17 | 18 | 1.42 | 44.17 | 1.34 | 1.03 | 0.10 | 0.06 | 57.33 | 27.04 | 26.98 |

| 18 | 19 | 1.41 | 43.86 | 1.20 | 1.02 | 0.10 | 0.08 | 53.20 | 24.88 | 26.94 |

| 19 | 20 | 1.53 | 47.59 | 1.64 | 1.62 | 0.11 | 0.06 | 71.85 | 34.97 | 26.80 |

| 20 | 21 | 1.50 | 46.66 | 1.17 | 0.88 | 0.10 | 0.06 | 48.75 | 25.30 | 28.19 |

| 21 | 22 | 1.35 | 41.99 | 1.08 | 0.86 | 0.10 | 0.07 | 40.70 | 22.42 | 28.15 |

| 22 | 23 | 1.35 | 41.99 | 1.06 | 0.76 | 0.10 | 0.07 | 48.43 | 24.44 | 27.13 |

| 23 | 24 | 1.39 | 43.23 | 1.21 | 1.04 | 0.11 | 0.08 | 48.84 | 4.88 | 28.05 |

| 24 | 25 | 1.27 | 39.50 | 0.99 | 0.52 | 0.09 | 0.09 | 23.45 | 17.29 | 29.22 |

| 25 | 26 | 1.50 | 46.66 | 1.34 | 0.62 | 0.10 | 0.07 | 27.59 | 20.74 | 30.85 |

| 26 | 27 | 1.36 | 42.30 | 1.04 | 0.52 | 0.09 | 0.07 | 25.52 | 16.95 | 28.83 |

| 27 | 28 | 1.35 | 41.99 | 1.01 | 0.55 | 0.11 | 0.07 | 35.60 | 17.88 | 28.27 |

| 28 | 29 | 1.36 | 42.30 | 0.92 | 0.54 | 0.09 | 0.07 | 26.53 | 16.81 | 28.96 |

| 29 | 30 | 1.45 | 45.10 | 1.68 | 0.55 | 0.11 | 0.07 | 23.28 | 20.82 | 29.36 |

| 30 | 31 | 1.54 | 47.90 | 1.12 | 0.47 | 0.15 | 0.08 | 25.92 | 16.41 | 28.66 |

| Mean | 1.51 | 46.88 | 1.26 | 0.96 | 0.09 | 0.05 | 64.78 | 26.16 | 26.99 | |

Table 7. Assay results, Drillhole SPT1_1

| Drillholes: SPT1_1 | ||||||||||

| From | To | Ag (oz/t) | Ag (g/t) | % Zn | % Pb | % Cu | Au (g/t) | Ga (g/t) | In (g/t) | % Fe |

| 0 | 1 | 2.15 | 66.87 | 1.90 | 1.09 | 0.08 | 0.04 | 71.84 | 8.52 | 25.07 |

| 1 | 2 | 1.51 | 46.97 | 1.94 | 1.29 | 0.08 | 0.05 | 117.00 | 9.36 | 23.33 |

| 2 | 3 | 1.60 | 49.77 | 1.64 | 1.25 | 0.08 | 0.04 | 142.00 | 10.08 | 24.85 |

| 3 | 4 | 1.41 | 43.86 | 1.51 | 1.16 | 0.07 | 0.03 | 134.00 | 8.64 | 23.67 |

| 4 | 5 | 1.31 | 40.75 | 1.21 | 0.85 | 0.06 | 0.03 | 113.00 | 8.68 | 24.54 |

| 5 | 6 | 1.45 | 45.10 | 1.30 | 0.86 | 0.06 | 0.03 | 101.00 | 7.84 | 25.09 |

| 6 | 7 | 1.88 | 58.47 | 1.63 | 0.88 | 0.07 | 0.02 | 72.81 | 6.28 | 26.22 |

| 7 | 8 | 1.86 | 57.85 | 1.55 | 0.79 | 0.07 | 0.03 | 69.06 | 5.92 | 25.66 |

| 8 | 9 | 1.68 | 52.25 | 1.32 | 0.79 | 0.07 | 0.03 | 68.27 | 23.67 | 25.13 |

| 9 | 10 | 1.81 | 56.30 | 1.34 | 0.89 | 0.07 | 0.03 | 61.17 | 23.11 | 25.01 |

| 10 | 11 | 1.70 | 52.88 | 1.26 | 0.78 | 0.07 | 0.03 | 60.90 | 23.97 | 25.40 |

| 11 | 12 | 1.94 | 60.34 | 1.53 | 1.54 | 0.10 | 0.03 | 77.26 | 6.96 | 25.39 |

| 12 | 13 | 1.89 | 58.79 | 1.64 | 1.54 | 0.10 | 0.03 | 97.68 | 7.64 | 24.92 |

| 13 | 14 | 1.60 | 49.77 | 1.47 | 1.21 | 0.09 | 0.05 | 60.59 | 24.59 | 27.07 |

| 14 | 15 | 1.73 | 53.81 | 1.65 | 1.57 | 0.10 | 0.04 | 93.98 | 6.60 | 25.63 |

| 15 | 16 | 1.57 | 48.83 | 1.65 | 1.67 | 0.12 | 0.05 | 97.06 | 9.44 | 25.81 |

| 16 | 17 | 1.47 | 45.72 | 1.51 | 1.22 | 0.12 | 0.07 | 58.61 | 24.37 | 26.01 |

| 17 | 18 | 1.31 | 40.75 | 1.15 | 0.87 | 0.10 | 0.08 | 54.86 | 5.32 | 26.08 |

| 18 | 19 | 1.42 | 44.17 | 1.50 | 1.32 | 0.10 | 0.06 | 63.20 | 6.48 | 24.97 |

| 19 | 20 | 1.31 | 40.75 | 1.25 | 1.14 | 0.14 | 0.08 | 76.43 | 7.64 | 26.01 |

| 20 | 21 | 1.45 | 45.10 | 1.23 | 1.05 | 0.12 | 0.07 | 64.21 | 5.04 | 26.63 |

| 21 | 22 | 1.88 | 58.47 | 2.12 | 1.60 | 0.06 | 0.04 | 102.00 | 8.40 | 25.67 |

| 22 | 23 | 1.73 | 53.81 | 2.07 | 1.47 | 0.06 | 0.04 | 92.04 | 8.32 | 25.53 |

| 23 | 24 | 2.09 | 65.01 | 2.14 | 1.73 | 0.07 | 0.04 | 113.00 | 8.04 | 26.04 |

| 24 | 25 | 1.37 | 42.61 | 1.19 | 1.00 | 0.11 | 0.07 | 65.22 | 6.00 | 25.50 |

| 25 | 26 | 2.26 | 70.29 | 1.43 | 0.76 | 0.31 | 0.12 | 48.25 | 21.37 | 27.31 |

| Mean | 1.67 | 51.89 | 1.54 | 1.17 | 0.10 | 0.05 | 83.67 | 11.24 | 25.48 | |

Table 8. Assay results, Drillhole SPT1_2

| Drillholes: SPT1_2 | ||||||||||

| From | To | Ag (oz/t) | Ag (g/t) | % Zn | % Pb | % Cu | Au (g/t) | Ga (g/t) | In (g/t) | % Fe |

| 0 | 1 | 1.74 | 54.12 | 1.19 | 0.88 | 0.04 | 0.04 | 54.12 | 24.47 | 27.93 |

| 1 | 2 | 1.39 | 43.23 | 1.33 | 0.71 | 0.07 | 0.08 | 69.65 | 4.20 | 26.93 |

| 2 | 3 | 1.31 | 40.75 | 1.15 | 0.60 | 0.06 | 0.09 | 54.52 | 23.31 | 27.63 |

| 3 | 4 | 1.32 | 41.06 | 1.20 | 0.66 | 0.07 | 0.09 | 67.01 | 23.72 | 27.30 |

| 4 | 5 | 1.33 | 41.37 | 1.20 | 0.62 | 0.07 | 0.10 | 59.97 | 23.90 | 27.07 |

| 5 | 6 | 1.67 | 51.94 | 1.50 | 0.72 | 0.06 | 0.04 | 58.09 | 25.02 | 26.69 |

| 6 | 7 | 1.76 | 54.74 | 1.56 | 0.75 | 0.07 | 0.03 | 55.75 | 4.40 | 27.95 |

| 7 | 8 | 1.80 | 55.99 | 1.52 | 0.72 | 0.06 | 0.03 | 54.21 | 22.48 | 27.19 |

| 8 | 9 | 1.78 | 55.36 | 1.34 | 0.76 | 0.07 | 0.03 | 48.05 | 24.34 | 28.03 |

| 9 | 10 | 1.54 | 47.90 | 1.29 | 0.84 | 0.06 | 0.03 | 46.73 | 21.54 | 26.77 |

| 10 | 11 | 1.76 | 54.74 | 1.97 | 1.97 | 0.10 | 0.03 | 108.00 | 7.76 | 25.70 |

| 11 | 12 | 1.61 | 50.08 | 1.52 | 1.35 | 0.09 | 0.04 | 70.09 | 4.48 | 27.18 |

| 12 | 13 | 1.58 | 49.14 | 1.42 | 1.39 | 0.09 | 0.05 | 77.84 | 5.68 | 26.35 |

| 13 | 14 | 1.50 | 46.66 | 1.64 | 1.58 | 0.13 | 0.06 | 91.92 | 7.36 | 25.80 |

| 14 | 15 | 1.27 | 39.50 | 1.24 | 1.04 | 0.09 | 0.08 | 52.23 | 4.60 | 27.58 |

| 15 | 16 | 1.26 | 39.19 | 1.24 | 1.23 | 0.09 | 0.06 | 69.39 | 5.76 | 24.56 |

| Mean | 1.54 | 47.86 | 1.39 | 0.99 | 0.08 | 0.06 | 64.85 | 14.56 | 26.92 | |

Drill Program

CDPR engaged Ingetrol Comercial S.A.C., a subsidiary of Grupo Ingetrol (Chile), and ConeTec Peru, a subsidiary of the ConeTec Group (Canada). The campaign utilizes percussion and sonic drilling techniques to ensure the most accurate results.

On October 23rd, the Company completed the last of 40 drill holes, ahead of the rainy season, collecting more than 1,000 samples over a significant portion of the Quiulacocha tailings deposit. The samples were safely transported to the laboratory in freezer containers and are currently being analyzed.

Laboratory Testing

All samples are stored and transported to Lima in freezer containers to prevent oxidation and preserve sample integrity.

The samples are dried and tested at the Inspectorate Services Lab (Bureau Veritas) in Lima. Following geochemical and mineralogical testing, representative composites from select samples will be sent for an advanced metallurgical test work program.

The assay results are derived from a combination of multi-element ICP (detecting 60 elements), Atomic Absorption (for determining upper limits of the metals Zn, Pb, and Cu), and Fire Assay for Au.

Quality Assurance (QA) and Quality Control (QC)

The preparation of samples for Geochemical Analyses comprises drying at 100°C and riffle splitting to obtain a representative pulp sample of 250 grams. The sample does not undergo sieving or any other mechanical preparation (crushing or grinding) to preserve the original grain size distribution.

Bureau Veritas performs all sample preparation and analytical programs, supported by the QA/QC program, which is monitored on a sample lot basis. The CDPR QA/QC program consists of inserting twin samples, coarse duplicate samples, pulp duplicate samples, standard reference materials, and coarse blank material and further checking at a second laboratory.

Geophysics

CDPR has successfully completed Phase 1 of its geophysical studies, focusing on the dry areas of the Quiulacocha Tailings. Depth readings, conducted by Geomain Ingenieros S.A.C., ranged from 20 to over 40 meters in various locations.

The Quiulacocha Tailings

CDPR is the titleholder of the concession “El Metalurgista” in Peru, which grants it the right to explore and exploit the Quiulacocha Tailings within its assigned area. The General Mining Bureau of the Peruvian Ministry of Energy and Mines has formally confirmed the enforceability of these rights.

The Quiulacocha Tailings Storage Facility covers approximately 115 hectares and is estimated to hold approximately 75 million tonnes of material processed from the 1920s to 1990s.

Initially, these tailings resulted from the mining of 16+ million tonnes of copper-silver-gold mineralization with reported historical grades of up to

With minimal mining costs due to surface-level material and current reprocessing capacity at adjacent plants, CDPR's Quiulacocha Project stands out as one of Peru's key mining initiatives. This project provides economic benefits and aims to restore the environment and create employment opportunities, aligning with the local community's needs.

Technical Information

Mr. Alfonso Palacio Castilla, MIMMM/Chartered Engineer (CEng) and Project Superintendent for CDPR, has reviewed and approved the scientific and technical information contained in this news release. Mr. Palacio is a Qualified Person for the purposes of reporting in compliance with NI 43-101.

Cerro de Pasco Resources

Cerro de Pasco Resources Inc. is focused on the development of its principal

Forward-Looking Statements and Disclaimer

Certain information contained herein may constitute “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified using forward-looking terminology such as “plans”, “seeks”, “expects”, “estimates”, “intends”, “anticipates”, “believes”, “could”, “might”, “likely” or variations of such words, or statements that certain actions, events or results “may”, “will”, “could”, “would”, “might”, “will be taken”, “occur”, “be achieved” or other similar expressions.

Forward-looking statements, including the expectations of CDPR’s management regarding the realization, timing and scope of its drilling program, the completion of a resource report as well as the business and the expansion and growth of CDPR’s operations, are based on CDPR’s estimates and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of CDPR to be materially different from those expressed or implied by such forward-looking statements or forward-looking information.

Forward-looking statements are subject to business and economic factors and uncertainties and other factors, that could cause actual results to differ materially from these forward-looking statements, including the relevant assumptions and risks factors set out in CDPR’s public documents, available on SEDAR+ at www.sedarplus.ca. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Although CDPR believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements and forward-looking information. Except where required by applicable law, CDPR disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Further Information

Guy Goulet, CEO

Telephone: +1-579-476-7000

Mobile: +1-514-294-7000

ggoulet@pascoresources.com

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/37a5d01d-97d4-4899-bc9b-f2e8837d2eff