Great Panther Announces Open Pit and Regional Exploration Results for the Tucano Gold Mine in Brazil

Great Panther Mining Limited (TSX: GPR | NYSE American: GPL) announced findings from its 2021 resource replacement and expansion drilling program at the Tucano Gold Mine in Brazil. The Phase 2 results from TAP C suggest strong continuity of mineralization, paving the way for an extended open pit mine life with a planned return to production in 2022. The company is also advancing regional exploration within a 20 km radius, identifying new gold trends. Significant drilling highlights include intersections of up to 13.7g/t gold, demonstrating promising potential for resource estimation updates later this year.

- Strong drilling results from TAP C, including intersections up to 13.7g/t gold.

- Plans to return TAP C to production in 2022, extending the open pit mine life.

- Ongoing regional exploration identifies potential gold trends within a 20 km radius.

- None.

Insights

Analyzing...

Drilling on the TAP C open pit further defines continuity of mineralization for resource expansion and regional exploration identifies gold trend within 20 km radius of Tucano mine

TSX: GPR | NYSE American: GPL

VANCOUVER, BC, Sept. 7, 2021 /PRNewswire/ - Great Panther Mining Limited (TSX: GPR) (NYSE-A: GPL) ("Great Panther" or the "Company"), a growing gold and silver producer focused on the Americas, announces results from Phase 2 of the 2021 resource replacement and expansion drilling program and regional exploration results from the Company's wholly-owned Tucano Gold Mine ("Tucano") in Brazil. Tucano comprises a 7-kilometre-long trend of gold deposits hosted within a large tenement package controlled by Great Panther covering approximately 2,000 km2 of the Vila Nova Greenstone Belt.

"One of the primary objectives of our exploration program at Tucano this year is to extend the open pit mine life, and I am pleased to report that our intention is to bring TAP C back into production in 2022 as the drilling has demonstrated continuity of mineralization at depth below the current pit floor," commented Rob Henderson, Great Panther's President & CEO.

"The other main objectives at Tucano this year include extending the high-grade zones underground and defining the regional potential of our district-scale land package," continued Mr. Henderson. "Initial results from our regional exploration program are very promising as they confirm the potential surrounding Tucano and our ability to generate new quality targets through focused, systematic exploration. Drilling of new targets is planned for the fourth quarter of this year. Our immediate focus is making new discoveries within a 20 km radius of the mine. However, we believe that the greenstone belt has significant exploration upside, and our long-term objective is to make a major new discovery within our extensive tenement package."

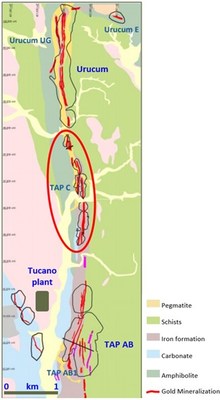

Resource Replacement and Expansion Drilling

The Company continues to focus on resource definition along the 7-kilometer-long mine sequence. Last year the focus was on the Taperaba ("TAP AB") pit where the Company successfully upgraded inferred resources to Measured & Indicated ("M&I") status and, as a result, significantly increased the open pit reserves at TAP AB. This year the focus has been on TAP C, situated between the TAP AB and Urucum pits that are the current focus of production at Tucano. The definition of new resources at TAP C will give Tucano additional operational flexibility with new production fronts from shallow pits close to the plant (see Figure 1).

Highlights and significant intersections from drilling at TAP C are summarized below and are expected to be applied to an updated Mineral Reserve and Mineral Resource ("MRMR") estimation for Tucano later this year.

Highlights from the 2021 TAP C drill program1 2:

- 21TACDD001: 4m @ 13.7g/t from 130m

- 21TACDD002: 6.3m @ 4.0g/t from 145.7m

- 21TACDD003: 11.95m @ 1.4g/t from 104.25m

- 21TACDD023: 8.55m @ 4.9g/t from 25.95m

- 21TACDD028: 12.7m @ 2.9g/t from 186.3m

- 21TACDD029: 24.6m @ 1.6g/t from 100m

- 21TACDD029: 38m @ 2.5g/t from 167m

- including: 3m @ 8.7g/t from 167m

- 21TACDD030: 9m @ 7.8g/t from 45m

_______________________ |

1 Widths are drillhole intercept widths. |

2 Drill holes 21TACDD001-21TACDD007 announced in a news release dated April 7, 2021. Note: Minor differences reflect a change in open pit cut-off being employed to 0.3 g/t gold compared to 0.4 g/t in April. |

The drilling focused on defining M&I resources down to 70 m below the pit surface. Wireframes for the mineralization have been prepared and block models are being generated for resource estimation and categorization.

Table 1: Significant gold assay results for 2021 TAP C drilling | |||||

Drill hole | Interval | From | To | Est. true width | Grade |

21TACDD001 | 10.4 | 83.0 | 93.4 | 5.2 | 0.60 |

21TACDD001 | 6.8 | 99.0 | 105.8 | 3.4 | 0.99 |

21TACDD001 | 4.0 | 130.0 | 134.0 | 2.0 | 13.65 |

21TACDD002 | 9.3 | 79.3 | 88.6 | 5.0 | 0.55 |

21TACDD002 | 6.9 | 129.6 | 136.5 | 3.7 | 1.20 |

21TACDD002 | 6.3 | 145.7 | 152.0 | 3.3 | 3.99 |

including | 1.0 | 150.0 | 151.0 | 0.5 | 19.21 |

21TACDD003 | 12.0 | 104.3 | 116.2 | 6.9 | 1.39 |

including | 2.0 | 111.0 | 113.0 | 1.1 | 4.61 |

21TACDD004 | 5.6 | 199.5 | 205.0 | 3.2 | 0.93 |

21TACDD006 | 6.0 | 18.0 | 24.0 | 3.4 | 0.76 |

21TACDD006 | 5.0 | 101.0 | 106.0 | 2.9 | 1.30 |

including | 1.0 | 104.0 | 105.0 | 0.6 | 4.67 |

21TACDD006 | 4.0 | 168.0 | 172.0 | 2.3 | 0.87 |

21TACDD007 | 8.0 | 75.0 | 83.0 | 4.4 | 1.03 |

21TACDD008 | 3.1 | 38.0 | 41.1 | 1.8 | 2.60 |

21TACDD010 | 2.3 | 136.0 | 138.3 | 1.3 | 2.55 |

21TACDD011 | 7.1 | 185.1 | 192.2 | 4.0 | 1.45 |

21TACDD012 | 10.0 | 117.0 | 127.0 | 5.7 | 1.20 |

21TACDD013 | 4.5 | 70.0 | 74.5 | 2.6 | 1.65 |

21TACDD022 | 6.6 | 124.0 | 130.6 | 3.8 | 2.77 |

including | 1.2 | 125.2 | 126.4 | 0.7 | 8.90 |

21TACDD023 | 8.6 | 26.0 | 34.5 | 4.3 | 4.93 |

including | 1.7 | 29.4 | 31.1 | 0.8 | 13.93 |

21TACDD027 | 6.0 | 0.0 | 6.0 | 2.7 | 0.78 |

21TACDD028 | 12.7 | 186.3 | 199.0 | 5.4 | 2.85 |

including | 4.0 | 190.0 | 194.0 | 1.7 | 5.36 |

21TACDD029 | 15.0 | 52.0 | 67.0 | 3.9 | 0.51 |

21TACDD029 | 8.0 | 88.0 | 96.0 | 2.1 | 0.89 |

21TACDD029 | 24.6 | 100.0 | 124.6 | 6.4 | 1.64 |

21TACDD029 | 38.0 | 167.0 | 205.0 | 9.8 | 2.48 |

including | 3.0 | 167.0 | 170.0 | 0.8 | 8.74 |

including | 21.0 | 167.0 | 188.0 | 5.4 | 4.05 |

21TACDD030 | 4.0 | 36.0 | 40.0 | 1.8 | 2.18 |

21TACDD030 | 9.0 | 45.0 | 54.0 | 4.1 | 7.78 |

including | 1.0 | 51.0 | 52.0 | 0.5 | 63.19 |

Notes:

| |||||

The full table of drill results can be found at https://www.greatpanther.com/_resources/pdf/20210907-GPR-News-Release-Full-Table-of-Results.pdf.

Regional Exploration

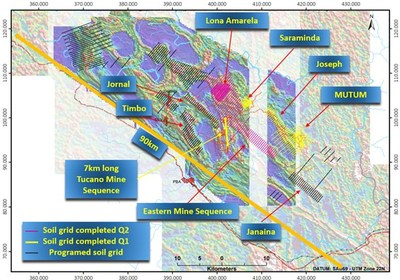

This year the Company initiated an extensive regional soil sampling and mapping program over high priority exploration corridors defined last year. The regional exploration program ties into the current resource definition drilling along the mine sequence by focusing on the identification and fast-tracking of gold targets within a 20 km radius of the mine that may be exploited by open pit mining and processed by the Tucano plant. The Company's goal is to define new resources that may be mined to complement the current ore reserves along the mine sequence. This ambitious program includes over 500-line-kilometres of soil sampling followed by drill testing starting in the fourth quarter of 2021 ("Q4 2021").

Multi-element soil geochemistry received for the first regional grid, Mutum, indicates a continuous 3.8-kilometre-long elevated gold trend. The structural and lithologic setting together with indications of intrusive activity, interpreted from the multi-element geochemistry and aerogeophysics, increase the priority of this trend. They reflect positive features commonly found associated with gold deposits. The Mutum trend is the first of eight high-priority exploration corridors being evaluated with multi-element soil geochemistry this year and is situated just 15 km northeast of the Tucano mine (see Figure 2). The gold trend is being mapped in detail and will be covered by ground magnetics and prioritized for drilling in Q4 2021.

To date, in addition to Mutum, the following prospective, regional exploration corridors have been covered by regional multi-element soil sampling grids: Mutum-Joseph, Lona Amarela, Eastern Mine Sequence, Janaina, Timbo and Jornal. Sampling has been initiated on the Village Antonio grid. Sample results from these grids will be received over the next four to six months. Results will be integrated and anomalies prioritized for inclusion in the regional fast-track drilling budget for 2022.

Technical Disclosure and Qualified Persons

On behalf of Great Panther, Nicholas Winer, Fellow AusIMM and Vice President of Exploration supervised the preparation of data for inclusion in this news release and approved this news release. Mr. Winer is a non-independent Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Mr. Winer reviewed the Tucano QA/QC program. The QA/QC program for drill core includes the regular insertion of blanks, standards, and duplicates into sample batches, diligent monitoring of assay results, and necessary remedial actions. Resource drilling samples are first assayed at the Tucano onsite laboratory. All intervals with anomalous gold are submitted and re-analyzed by the Certified SGS Geosol laboratory in Belo Horizonte by 50 g fire-assay. All SGS Geosol assays, after diligent monitoring of QA/QC and necessary remedial actions, supersede the Tucano assay results in the database for MRMR grade estimation. QA/QC monitoring of the SGS laboratory also includes inter-laboratory checks on five percent of samples with the Certified, ALS laboratory in Belo Horizonte. In addition to the data verification methodology described above, personal inspections of the Tucano property have also been completed.

ABOUT GREAT PANTHER

Great Panther is a growing gold and silver producer focused on the Americas. The Company owns a diversified portfolio of assets in Brazil, Mexico and Peru that includes three operating gold and silver mines, four exploration projects, and an advanced development project. Great Panther is actively exploring large land packages in highly prospective districts and is pursuing acquisition opportunities to complement its existing portfolio. Great Panther trades on the Toronto Stock Exchange trading under the symbol GPR, and on the NYSE American under the symbol GPL.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of Canadian securities laws (together, "forward-looking statements"). Such forward-looking statements may include, but are not limited to, statements regarding: (i) continuity of mineralization of the TAP C deposit to approximately 50 m - 70 m below the current pit floor; (ii) initial results of the re-modelling of the TAP C deposit which define the structural framework that has affected the mineralization and explain mineralization discontinuities; (iii) plans to complete infill drilling of TAP C to target definition of an Inferred and Indicated Mineral Resource; (iv) belief that the interpretation of results of the drilling programs at TAP C are indicative and may be extended over all of the TAP C deposits; (v) confidence in and belief that the Company will be able to include TAP C in the next MRMR statement for Tucano providing additional confidence in the geometry of the ore body is determined; and (vi) confidence that the results of an economic evaluation of the results from TAP C will permit mining to be initiated

These forward-looking statements and information reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: continued operations and exploration work, including plans to complete infill drilling at Tucano, in 2021 occur without significant interruption due to COVID-19 or any other reason; the accuracy of the Company's geological modeling at Tucano and the assumptions upon which they are based, including initial results of the re-modelling of the TAP C deposit which define the structural framework that has affected the mineralization and explain mineralization discontinuities; the results of the phase 1 and phase 2 drilling programs at TAP C are indicative and may be extended over all of the TAP C deposits; planned infill drilling will provide confidence sufficient to define Mineral Resource estimates for the TAP C deposits; geometry of the orebody; ore grades and recoveries; prices for gold, silver, and base metals remaining as estimated; currency exchange rates remaining as estimated; prices for energy inputs, labour, materials, supplies and services (including transportation); all necessary permits, licenses and regulatory approvals for the Company's operations and exploration work are received in a timely manner on favourable terms, Tucano will be able to continue to use cyanide in its operations; the Company will not be required to further impair Tucano as the current open pit mineral reserves are depleted through mining; the ability to procure equipment and operating supplies without interruption and that there are no material unanticipated variations in the cost of energy or supplies; operations not being disrupted by issues such as pit-wall failures or instability, mechanical failures, labour disturbances and workforce shortages, illegal occupations or mining, seismic events, and adverse weather conditions; and the Company's ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements expressed or implied by such forward-looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to: the impact of COVID-19 on the Company's ability to operate and conduct exploration work, including drilling plans, as anticipated, and the risk of an unplanned partial or full shutdown of the Company's mines and processing plants, whether voluntary or imposed, which would adversely impact the Company's revenues, financial condition and ability to meet its production and cost guidance and fund its capital programs and repay its indebtedness; the inherent risk that estimates of Mineral Reserves and Resources may not be accurate and accordingly that mine production will not be as estimated or predicted; planned exploration activities, including plans for further infill drilling at TAP C, may not result in the discovery of new Mineral Resources/definition of Mineral Resources and readers are cautioned that Mineral Resources that are not Mineral Reserves have no defined economic viability; there is no certainty that the Company will be able to define a mineral resource for the TAP C deposits and the Company is not treating the AMC historical estimate as a current mineral resource estimate; open pit mining operations at Tucano have a limited established mine life and the Company may not be able to extend the mine life for Tucano open pit operations beyond 2023 as anticipated; gold, silver and base metal prices may decline or may be less than forecasted; fluctuations in currency exchange rates (including the U.S. dollar to Brazilian real exchange rate) may increase costs of operations; operational and physical risks inherent in mining operations (including pit wall collapses, tailings storage facility failures, environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather) may result in unforeseen costs, shut downs, delays in production and drilling and exposure to liability; potential political and social risks involving Great Panther's operations in a foreign jurisdiction; the potential for unexpected costs and expenses or overruns; shortages in the ability to procure equipment and operating supplies without interruption; employee and contractor relations; relationships with, and claims by, local communities; the Company's ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner on favourable terms; changes in laws, regulations and government practices in the jurisdictions in which the Company operates; legal restrictions related to mining; diminishing quantities or grades of mineral reserves as properties are mined operating or technical difficulties in mineral exploration, changes in project parameters as plans continue to be refined; the Company's inability to meet its production forecasts or to generate the anticipated cash flows from operations could result in the Company's inability to meet its scheduled debt payments when due or to meet financial covenants to which the Company is subject or to fund its exploration programs as planned; ability to maintain and renew agreements with local communities to support continued operations; there is no assurance that the Company will be able to identify or complete acquisition opportunities of, if completed, that such acquisitions will be accretive to the Company; and other risks and uncertainties, including those described in respect of Great Panther, in its most recent annual information form and material change reports filed with the Canadian Securities Administrators available at www.sedar.com and reports on Form 40-F and Form 6-K filed with the Securities and Exchange Commission and available at www.sec.gov.

There is no assurance that these forward-looking statements will prove accurate or that actual results will not vary materially from these forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described, or intended. Accordingly, readers are cautioned not to place undue reliance on forward looking statements. Forward-looking statements and information are designed to help readers understand management's current views of our near- and longer-term prospects and may not be appropriate for other purposes. The Company does not intend, nor does it assume any obligation to update or revise forward-looking statements or information, whether as a result of new information, changes in assumptions, future events or otherwise, except to the extent required by applicable law.

CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES

The Company prepares its disclosure in accordance with the requirements of securities laws in effect in Canada , which differ from the requirements of U.S. securities laws. Terms relating to mineral resources in this news release are defined in accordance with NI 43-101 under the guidelines set out in the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Mineral Reserves 2014 ("CIM Definition Standards").

The United States Securities and Exchange Commission (the "SEC") has adopted amendments effective February 25, 2019 (the "SEC Modernization Rules") to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the United States Securities Exchange Act of 1934. The SEC Modernization Rules have replaced SEC Industry Guide 7, which have been rescinded.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "Measured mineral resources", "Indicated Mineral Resources" and "Inferred Mineral Resources", which are defined in substantially similar terms to the corresponding CIM Definition Standards. In addition, the SEC has amended its definitions of "Proven Mineral Reserves" and "Probable Mineral Reserves" to be substantially similar to the corresponding CIM Definition Standards.

United States investors are cautioned that while the foregoing terms are "substantially similar" to corresponding definitions under the CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any Mineral Resources that the Company may report as "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources" under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

United States investors are also cautioned that while the SEC will now recognize "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources", investors should not assume that any part or all of the mineral deposits in these categories would ever be converted into a higher category of Mineral Resources or into Mineral Reserves. Mineralization described by these terms has a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any "Measured Mineral Resources", "Indicated Mineral Resources", or "Inferred Mineral Resources" that the Company reports are or will be economically or legally mineable.

Further, "Inferred Mineral Resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the Inferred resources exist. In accordance with Canadian securities laws, estimates of "Inferred Mineral Resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

In addition, disclosure of "contained ounces" is permitted disclosure under Canadian regulations; however, the SEC has historically only permitted issuers to report mineralization as in place tonnage and grade without reference to unit measures.

Figure 1: Tap C location and current operating areas of TAP AB and Urucum with Tucano plant.

Figure 2: Location of regional soil grids relative to the Tucano mine sequence.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/great-panther-announces-open-pit-and-regional-exploration-results-for-the-tucano-gold-mine-in-brazil-301369903.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/great-panther-announces-open-pit-and-regional-exploration-results-for-the-tucano-gold-mine-in-brazil-301369903.html

SOURCE Great Panther Mining Limited